Desi MO (McClellans Oscillator for NSE) – 10th APR 2024

MO at 50

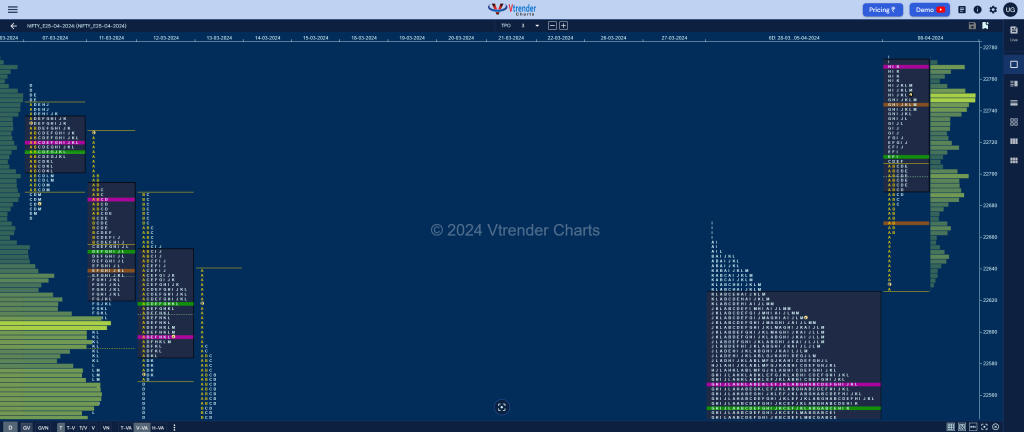

Market Profile Analysis dated 09th April 2024

Nifty Apr F: 22735 [ 22845 / 22702 ] Open Type OA (Open Auction) Volumes of 12,656 contracts Below average Initial Balance 89 points (22840 – 22751) Volumes of 32,362 contracts Below average Day Type Neutral Centre – 143 pts Volumes of 1,14,493 contracts Below average NF opened higher for the second successive session this week […]

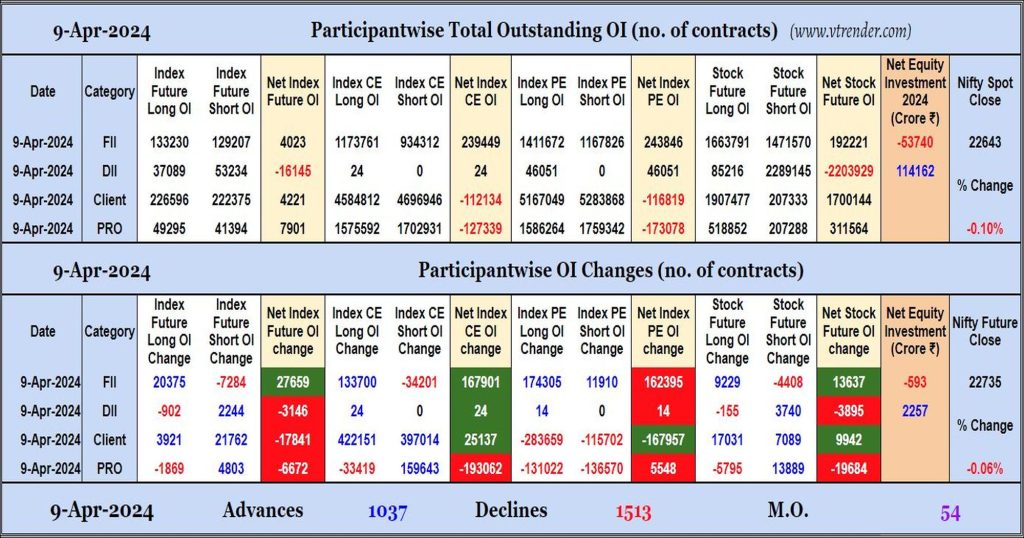

Participantwise Open Interest (Daily changes) – 9th APR 2024

FIIs have added net longs in Index Futures, Stocks Futures and Index Options. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 9th APR 2024

MO at 54

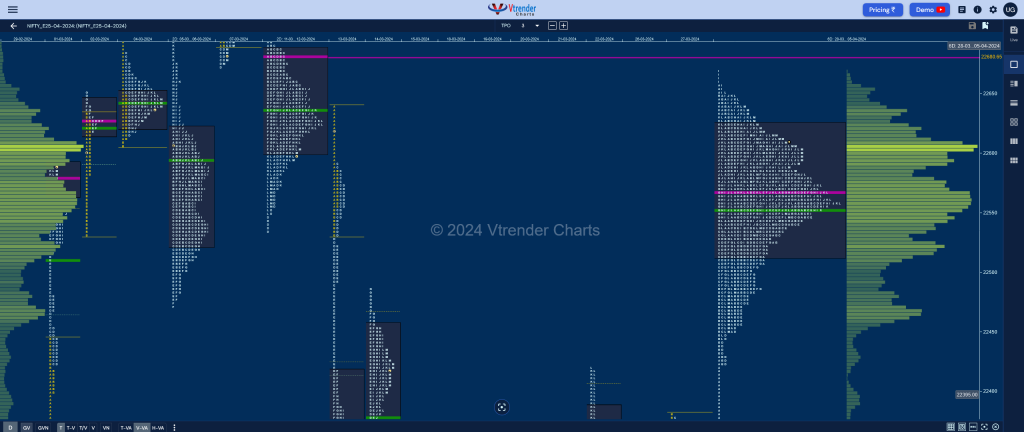

Market Profile Analysis dated 08th April 2024

Nifty Apr F: 22748 [ 22773 / 22625 ] Open Type OAOR (Open Auction Out of Range) Volumes of 16,256 contracts Average Initial Balance 80 points (22705 – 22625) Volumes of 38,572 contracts Below average Day Type NV – 280 pts Volumes of 1,09,833 contracts Range above average & volumes below average NF opened higher and […]

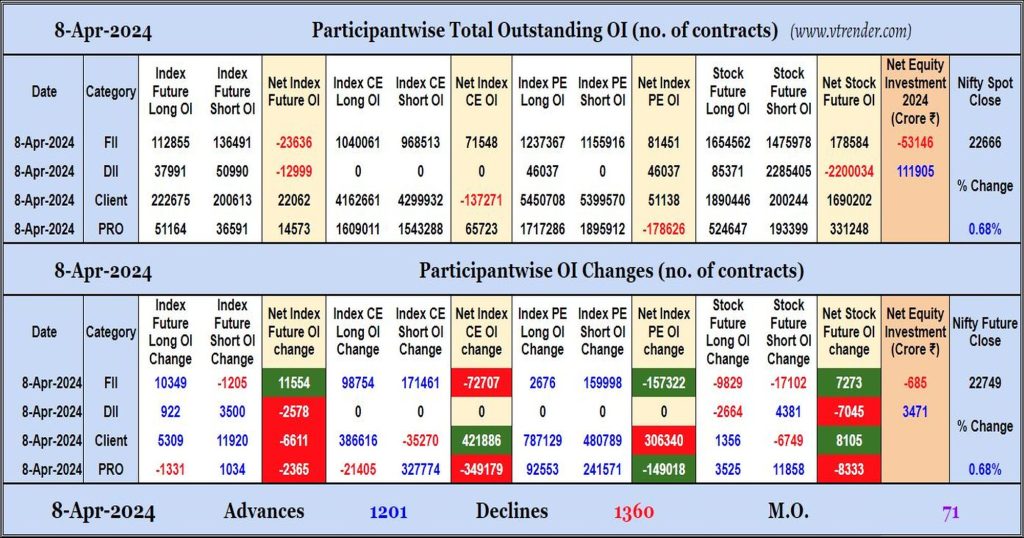

Participantwise Open Interest (Daily changes) – 8th APR 2024

FIIs have added net longs in Index Futures while adding net shorts in Index CE, Index PE and equity segment. They have shed Open Interest in Stocks Futures.

Desi MO (McClellans Oscillator for NSE) – 8th APR 2024

MO at 71

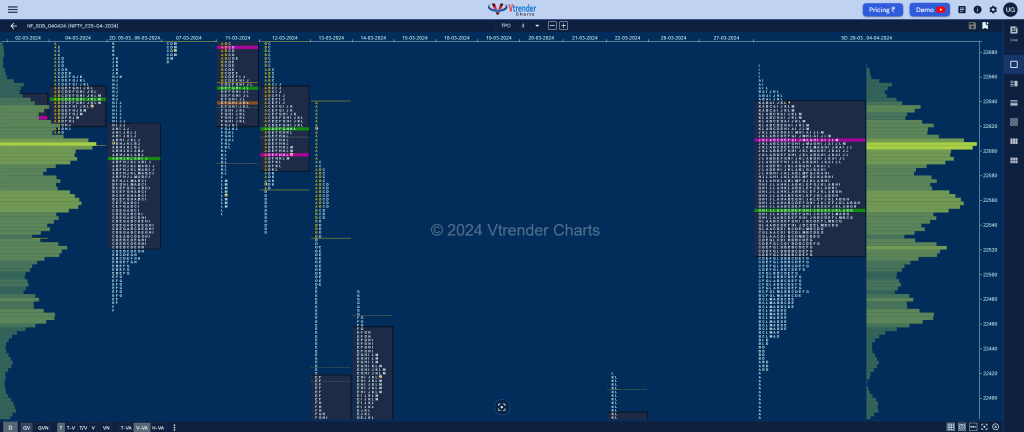

Market Profile Analysis dated 05th April 2024

Nifty Apr F: 22595 [ 22618 / 22505 ] Open Type OAIR (Open Auction In Range) Volumes of 19,210 contracts Above average Initial Balance 68 points (22573 – 22505) Volumes of 45,365 contracts Range below average & volumes above Day Type NV (3-1-3) – 113 pts Volumes of 86,817 contracts Below average NF opened lower making […]

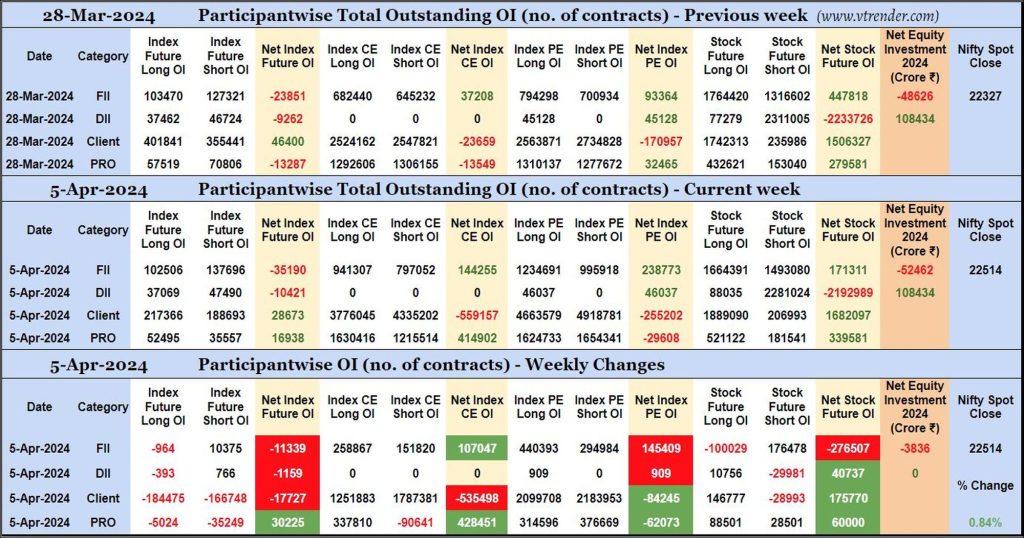

Participantwise Open Interest (Weekly changes) – 5th APR 2024

FIIs have added 10K short Index Futures, net 107K long Index CE, net 145K long Index PE and 176K short Stocks Futures contracts this week while liquidating 100K long Stocks Futures contracts.

FIIs have been net sellers in equity segment for ₹3836 crore during the week.

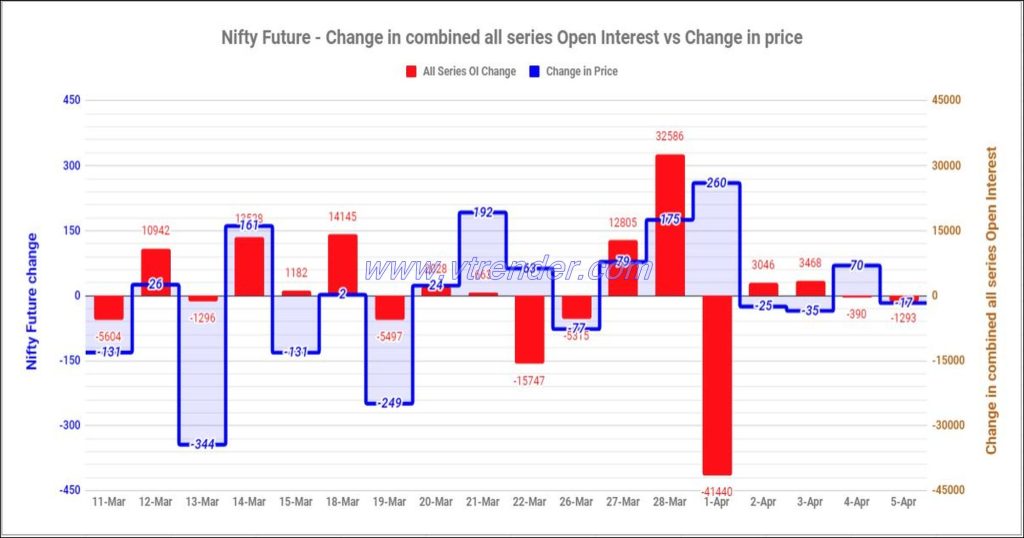

Nifty and Banknifty Futures with all series combined Open Interest – 5th APR 2024

Nifty & Banknifty combined Open Interest across all series & change in OI