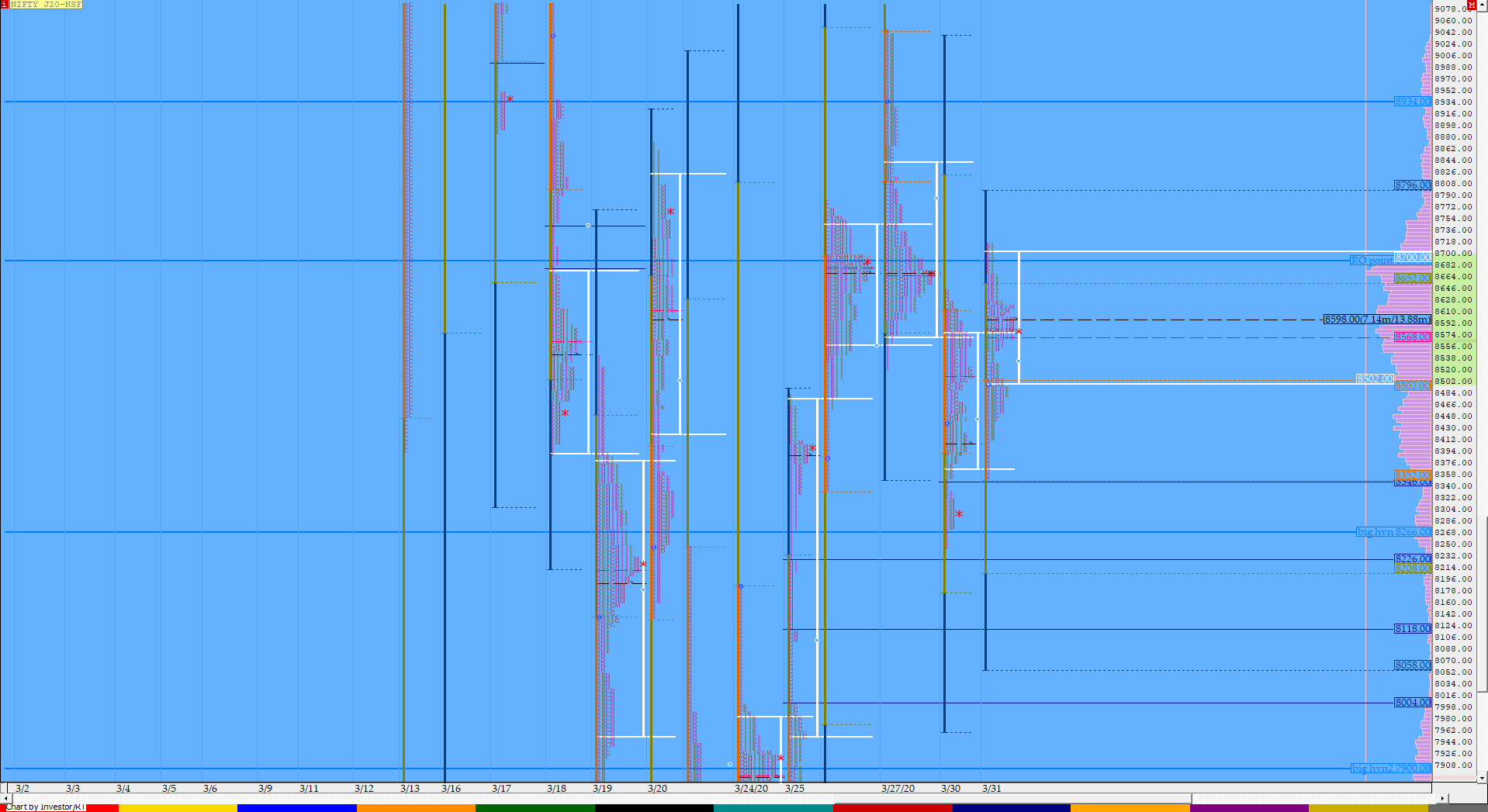

Nifty Apr F: 8257 [ 8569 / 8181 ]

HVNs – 7900 / (8220) / 8259 / 8304 / 8408 / 8460 / 8540-60 / 8604 / 8670

NF opened lower below the YPOC of 8600 & moved away from the 4-day composite Value as it left an initiative tail from 8426 to 8569 in the IB after which it left an extension handle at 8363 in the ‘C’ period to continue trending lower as it tagged the 1.5 IB objective of 8261 in the ‘F’ period. The auction then made a brief retracement in the ‘G’ period but could not even tag VWAP as it left a PBH (Pull Back High) at 8327 indicating that the downside probe is still not over. This led to a fresh leg lower as NF resumed the OTF (One Time Frame) move down making fresh REs for the next 3 periods as it broke below the extension handle of 8222 it had left on 25th March but took support in the buying tail as it made lows of 8181 in the ‘J’ period which marked the end of the OTF lower resulting in a bounce to 8282 in the ‘L’ period before closing the day at 8257 leaving a ‘b’ shape profile with Value completely lower.

Click here to view the MPLite chart of NF moving away from the 4-day balance

- The NF Open was a Open Drive – Down (OD)

- The day type was a Normal Variation Day – Down (‘b’ shape profile)

- Largest volume was traded at 8250 F

- Vwap of the session was at 8311 with volumes of 194.2 L and range of 388 points as it made a High-Low of 8569-8181

- NF confirmed a FA at 7521 on 24/03 and tagged the 2 ATR objective of 8595 on 26/03. This FA has not been tagged and is now positional support.

- NF confirmed a FA at 9384 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point.

- The settlement day Roll Over point (Apr) is 8686

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 8182-8250-8363

Main Hypos for the next session:

a) NF needs to get above 8259 & sustain for a move to 8290-8304 / 8320 / 8363-80 / 8418 & 8445

b) The auction has immediate support at 8250 below which it could fall to 8220-11 / 8181-61 / 8125-16 & 8080-74

Extended Hypos:

c) Above 8445, NF can probe higher to 8470-85 / 8510-40 / 8565-70 / 8604-21 & 8640-76*

d) Below 8074, the auction can fall further to 7999-90 / 7950 / 7896* & 7840-10

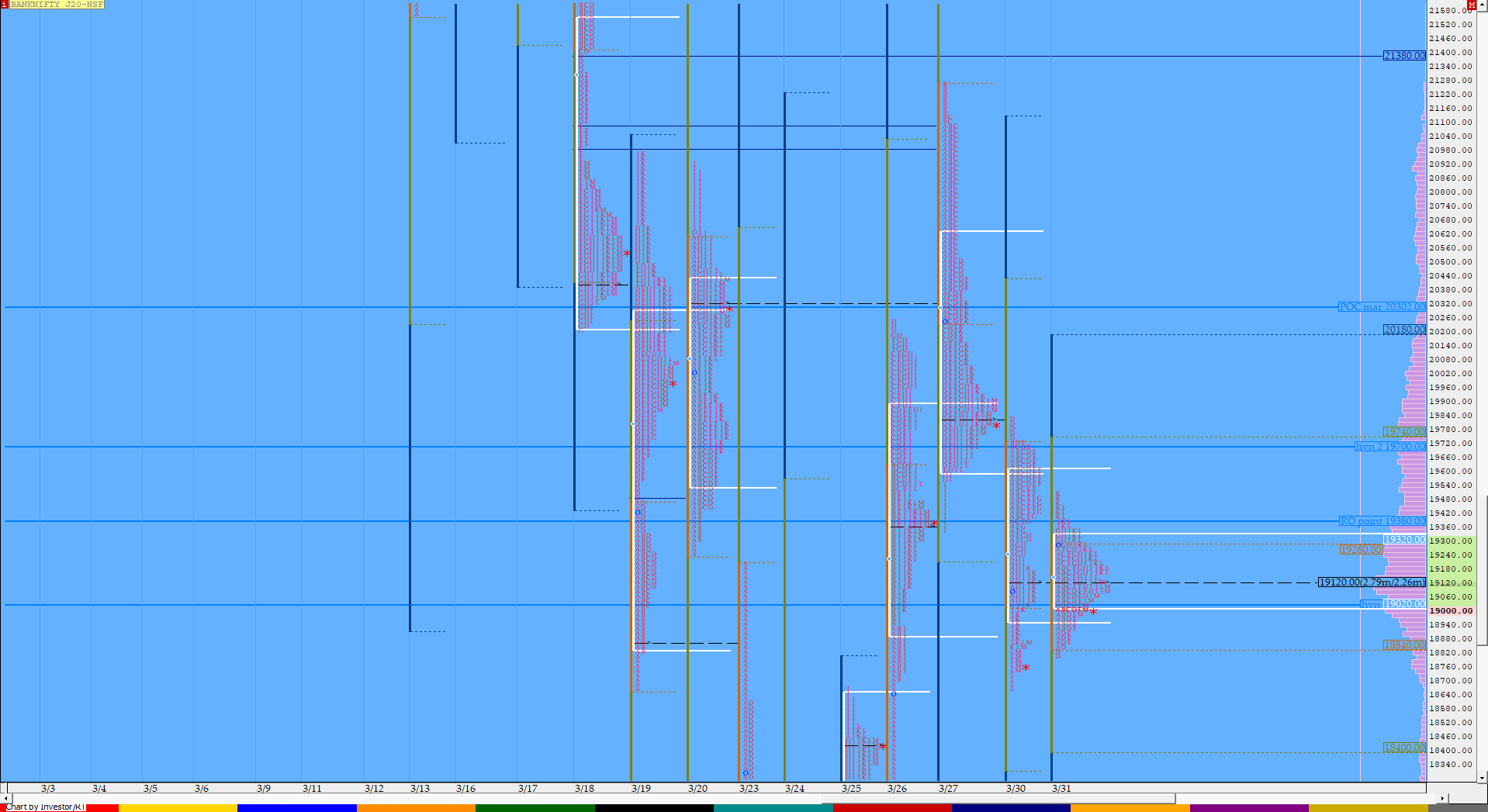

BankNifty Apr F: 18171 [ 18996 / 17962 ]

HVNs – 18140-185 / 18790 / 18985 / 19020 / 19125 / 19345 / (19550) / 19700 / 19840

Previous report ended with this ‘BNF closed the day at 19135 leaving a Neutral Centre profile which was also an inside day with a close around the 2-day overlapping POC so the auction looks set to give a move away from here but needs to take out one of the FAs of 18817 or 19820‘

And rightly so, BNF not only opened lower but like NF, gave a drive down moving from the 2-day overlapping POC of 19135 as well as the 4-day composite Value as it negated the FA of 18817 in the opening 15 minutes itself and went on to leave an extension handle at 18556 after which it made multiple REs to the downside testing the singles of 18163 to 17635 it had left on 25th Mar as it made lows of 17962 in the ‘J’ period before closing around the dPOC leaving a ‘b’ shape profile for the day. Value for the day was completely lower and staying below 18185 in the coming session, the PLR would remain down for a test of 17635 & the extension handle of 17350 below which we have the HVN of 16905.

Click here to view the ‘b’ shape profile of BNF moving away from the 4-day composite

- The BNF Open was a Open Drive – Down (OD)

- The day type was a Normal Variation Day – Down (‘b’ shape profile)

- Largest volume was traded at 18140 F

- Vwap of the session was at 18269 with volumes of 48.3 L and range of 1033 points as it made a High-Low of 18896-17962

- BNF confirmed a FA at 18817 on 31/03 and the 1 ATR move higher comes to 20781. This FA got negated on 01/04 and is no longer a valid reference.

- BNF confirmed a FA at 19820 on 30/03 and the 1 ATR move lower comes to 17880.

- The settlement day Roll Over point (Apr) is 19380

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 17969-18140-18378

Main Hypos for the next session:

a) BNF needs to sustain above 18185 for a rise to 18259-270 / 18370-415 / 18475-556 / 18625 / 18670-710 & 18800-820

b) The auction has immediate support at 18140-100 below which it could test 18040 / 17990-970 / 17920 / 17775-759 / 17710-650 & 17588-544

Extended Hypos:

c) Above 18820, BNF can probe higher to 18890 / 18950-996 / 19104-125* / 19203 / 19274-290 & 19400

d) Below 17544, lower levels of 17490-476 / 17430-345 / 17260 / 17195-150 / 17080-022 & 16970-905* could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout