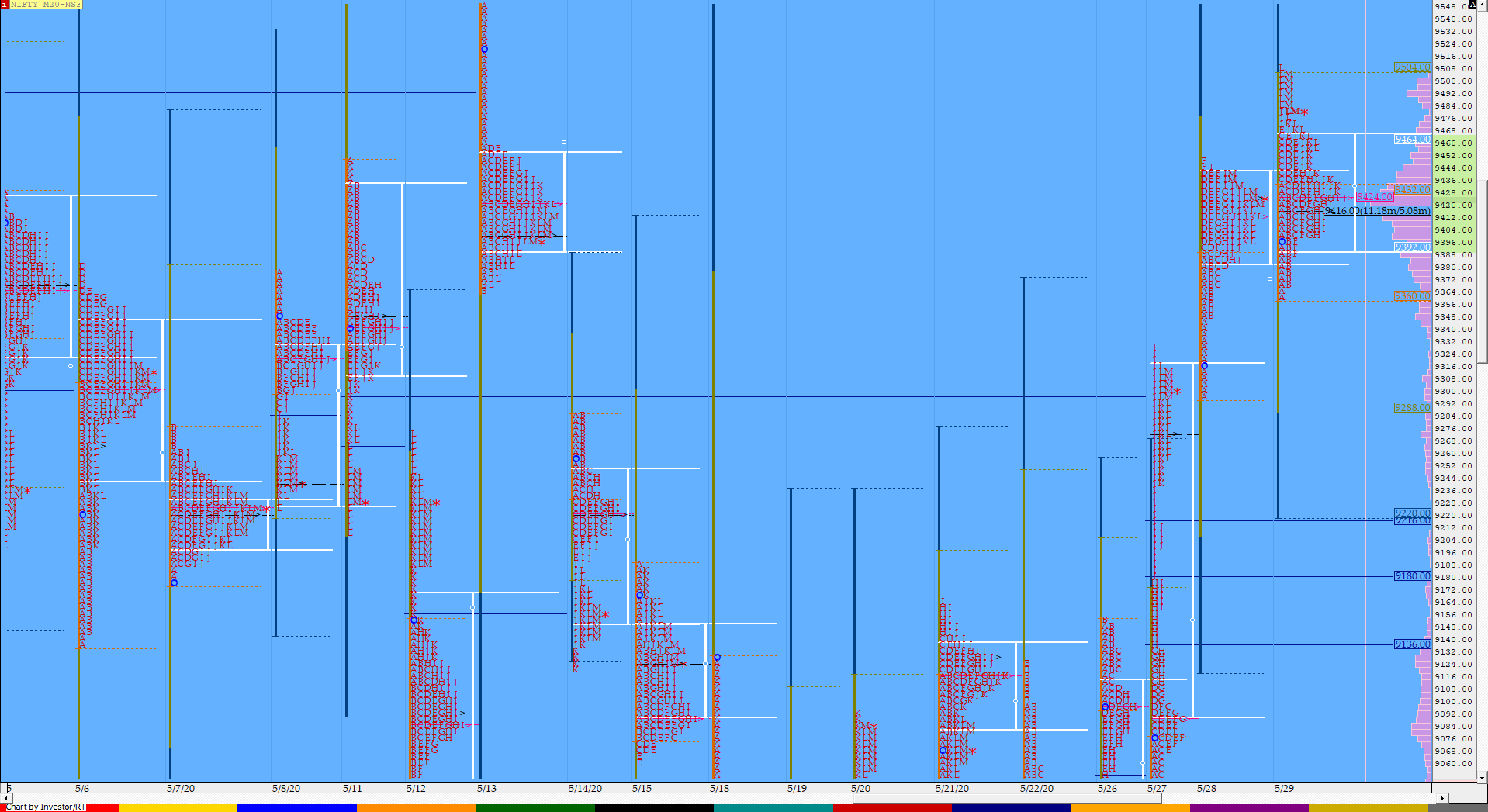

Nifty Jun F: 9791 [ 9911 / 9640 ]

HVNs – 9093 / 9275 / 9433 / 9785

NF opened with a big gap up of 166 points and drove higher on good volumes as it tagged 9800 in the IB and had left a nice 116 point buying tail from 9756 to 9640 which then led to multiple REs (Range Extension) on the upside from the ‘D’ period to the ‘G’ period as the auction completed the 1.5 IB objective and made highs of 9911. The OTF (One Time Frame) probe finally stopped in the ‘H’ period which then led to a test of VWAP which was broken briefly but demand came in as NF left a PBL (Pull Back Low) at 9772 in the ‘J’ period leading to a probed above VWAP as the auction then left a PBH at 9839 confirming a ‘p’ shape profile for the day and closed around the prominent POC of 9785. Value for the day was higher but NF would require to stay above 9785 for the PLR (Path of Least Resistance) to remain Up.

- The NF Open was a Open Auction Out of Range plus Drive Up (OAOR + D)

- The day type was a Normal Variation Day – Up (‘p’ shape profile)

- Largest volume was traded at 9785 F

- Vwap of the session was at 9810 with volumes of 184.7 L and range of 271 points as it made a High-Low of 9911-9640

- The Trend Day VWAP of 9165 would be important support level.

- The settlement day Roll Over point (Jun) is 9426

- The VWAP & POC of May Series is 9183 & 9109 respectively.

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9761-9785-9858

Main Hypos for the next session:

a) NF needs to sustain above 9790 for a rise to 9810 / 9824-39 / 9858-80 / 9905-20 / 9949-60 & 9990-99

b) Staying below 9785, the auction could test 9761-56 / 9740 / 9715-9690 / 9670-56 / 9640-25 & 9594-77

Extended Hypos:

c) Above 9999, NF can probe higher to 10020-47 / 10076-95 / 10125-150 / 10175-183 & 10196-212

d) Below 9577, the auction can fall further to 9555-10 / 9494-80 / 9455-41 / 9400-9395 & 9378-69

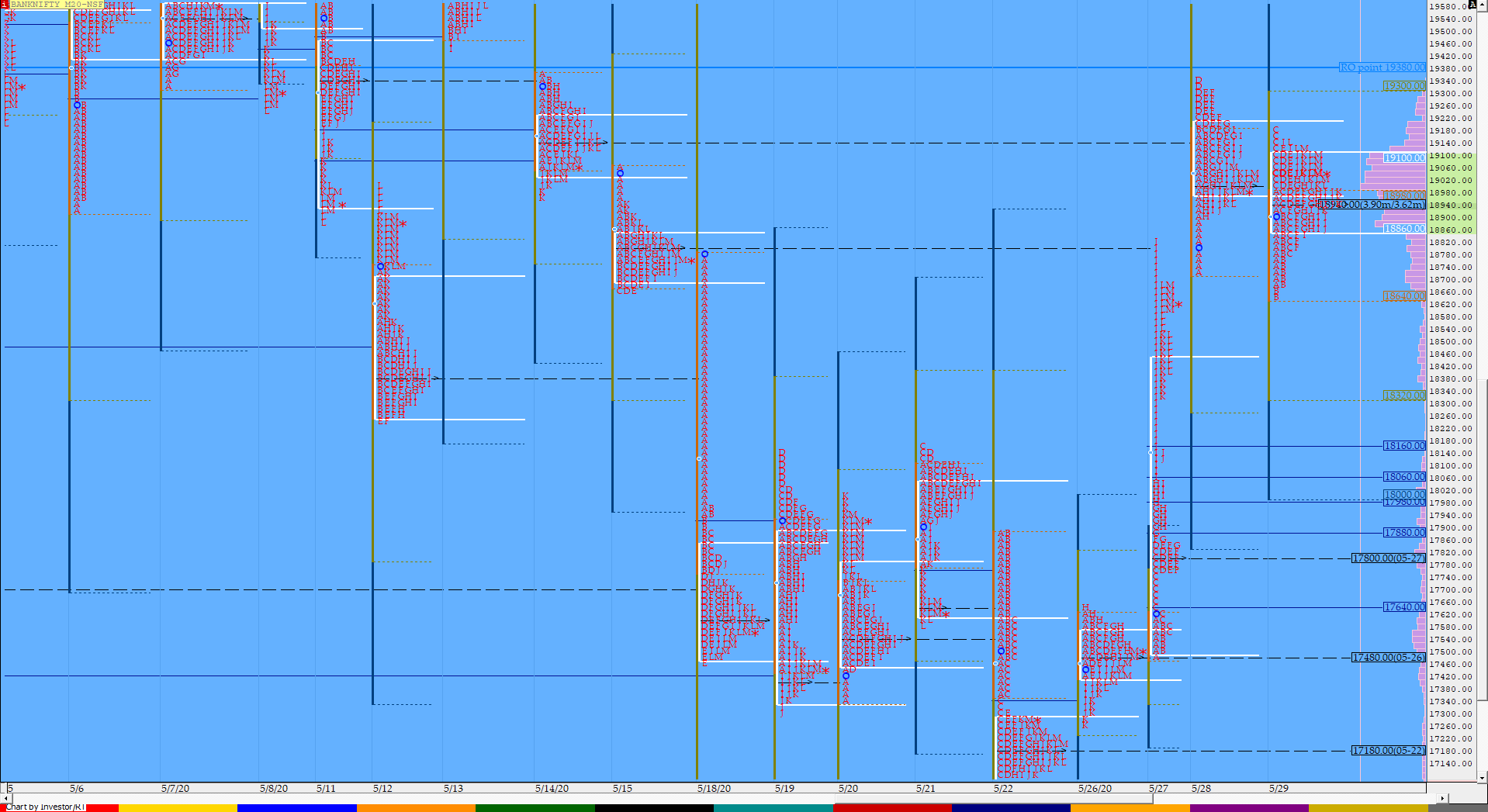

BankNifty Jun F: 19894 [ 20180 / 19450 ]

HVNs – 17800 / 19000 / 19186 / 19980

BNF also opened higher moving away from the 2-day balance it had formed and formed a ‘p’ shape profile for the day with the prominent POC at 19980 which would be the important reference for the next session. On the downside, we have a buying tail from 19707 to 19450 where we can expect demand to come back in case of a probe lower.

- The BNF Open was a Open Auction Out of Range plus Drive Up (OAOR + D)

- The day type was a Normal Day(‘p’ shape profile)

- Largest volume was traded at 19980 F

- Vwap of the session was at 19921 with volumes of 73.2 L and range of 730 points as it made a High-Low of 20180-19450

- The Trend Day VWAP of 18138 would be important support level.

- The settlement day Roll Over point (Jun) is 19035

- The VWAP & POC of May Series is 18767 & 19633 respectively.

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19820-19980-20037

Main Hypos for the next session:

a) BNF has immediate supply at 19935 above which it could rise to 19981 / 20040-74 / 20124-180 / 20220 / 20324-396 / 20430 & 20535-600

b) The auction staying below 19880 could test 19820-764 / 19700-650 / 19575-500 / 19450 / 19349-344 / 19295 & 19186

Extended Hypos:

c) Above 20600, BNF can probe higher to 20735-755 / 20819-840 / 20898-914 / 20975-21030 / 21090-116 & 21175-240

d) Below 19186, lower levels of 19099-015 / 18980-935 / 18870-812 / 18780-720 / 18684-625 & 18535 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout