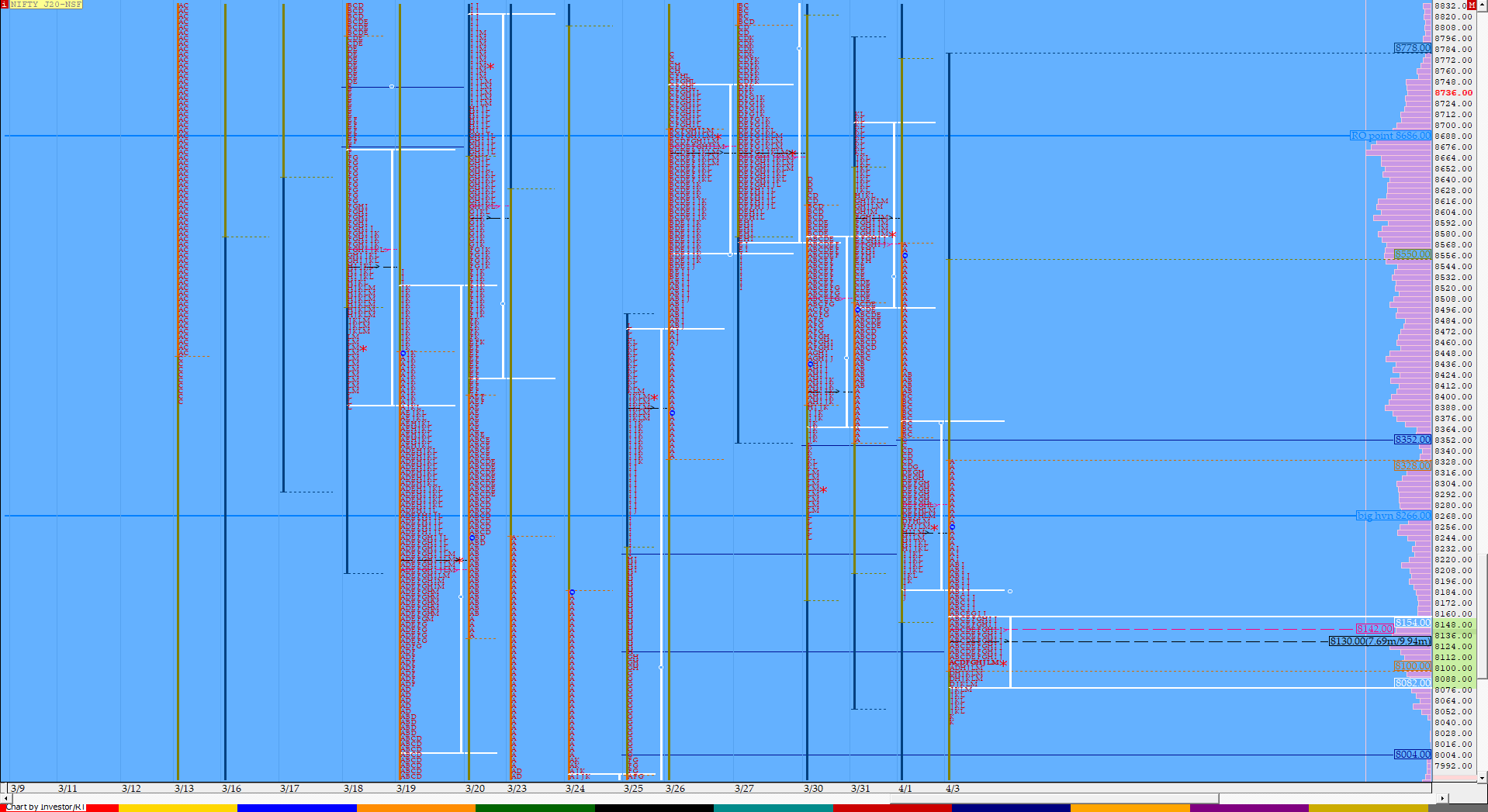

Nifty Apr F: 8084 [ 8330 / 8045 ]

HVNs -7900 / 8130 / (8220) / 8259 / 8304 / 8408 / 8460 / 8540-60 / 8604 / 8670

NF for the second consecutive day gave an initiative move away at open as it moved away from the YPOC of 8250 and went on to make new lows for the week hitting the second extension handle of 8116 as it made lows of 8105 in the IB and in the process had left a selling tail from 8219 to 8330. The auction then started to coil & form a balance with the range also narrowing down with 2 failed attempts to break below IBL in the ‘D’ & ‘H’ periods where it did make new lows of 8085 but was swiftly pushed back into the IB & the second rejection triggered a quick short covering move above VWAP as NF went on to test the morning selling tail where this up move got stalled confirming a PBH of 8234. The auction then made a even faster probe to the downside in the ‘J’ & ‘K’ period as it made fresh REs lower hitting new lows of 8045 before closing the day & week at 8084 forming yet another ‘b’ shape profile on the daily. Value for the day was completely lower with the dPOC at 8130 so staying below this level, the PLR would remain to be on the downside.

- The NF Open was a Open Drive – Down (OD)

- The day type was a Normal Variation Day – Down (‘b’ shape profile)

- Largest volume was traded at 8130 F

- Vwap of the session was at 8127 with volumes of 191.9 L and range of 285 points as it made a High-Low of 8330-8045

- NF confirmed a FA at 7521 on 24/03 and tagged the 2 ATR objective of 8595 on 26/03. This FA has not been tagged and is now positional support.

- NF confirmed a FA at 9384 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point.

- The settlement day Roll Over point (Apr) is 8686

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 8086-8130-8160

Main Hypos for the next session:

a) NF needs to get above 8100 & sustain for a move to 8130 / 8150-59 / 8181-90 / 8204-20 & 8250-59

b) The auction has immediate support at 8060-52 below which it could fall to 8026 / 7999-90 / 7950 & 7896*

Extended Hypos:

c) Above 8259, NF can probe higher to 8290-8304 / 8320-30 / 8363-80 / 8418 & 8445

d) Below 7896, the auction can fall further to 7840 / 7810 / 7791-70 / 7743 & 7710

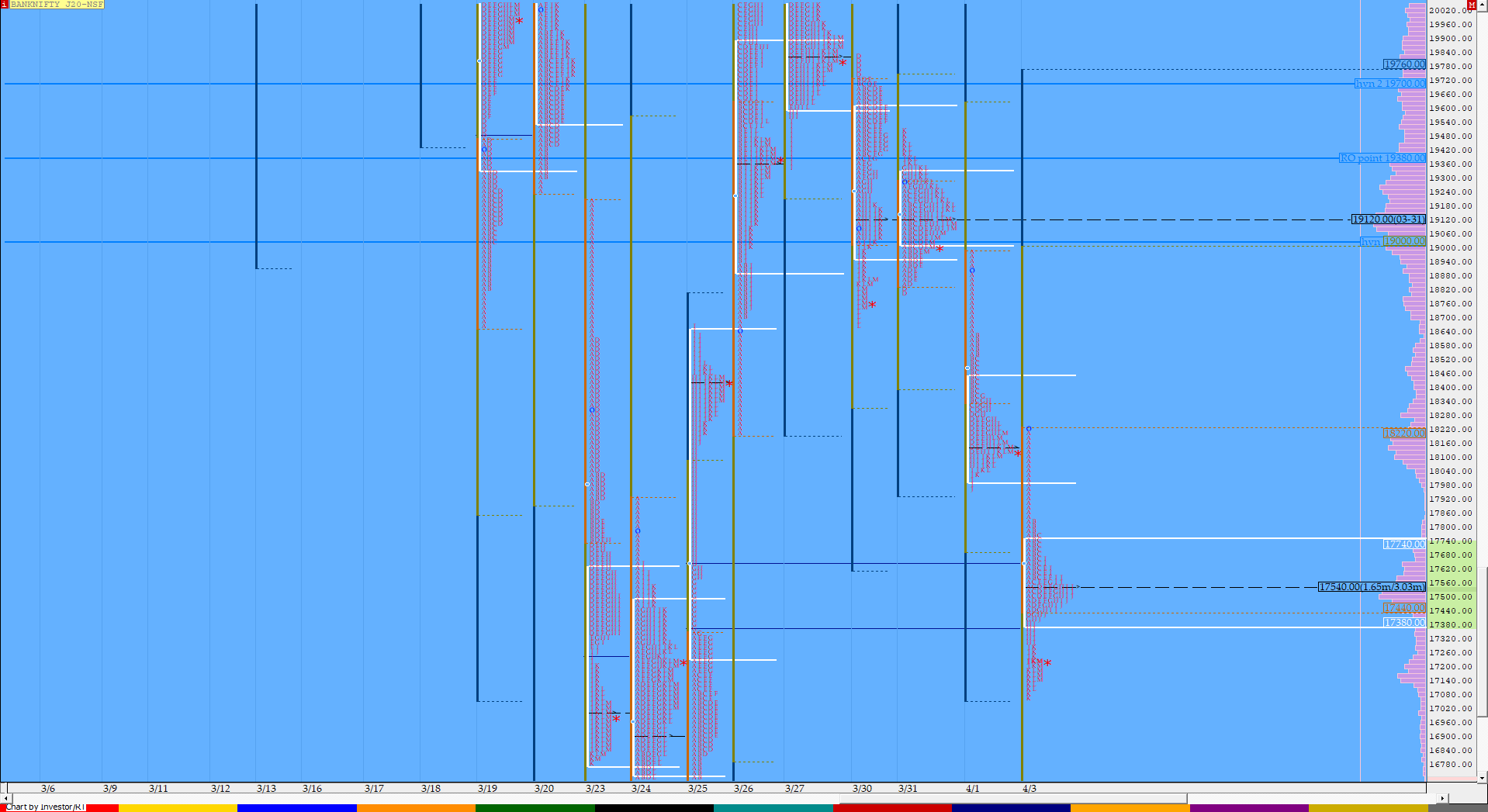

BankNifty Apr F: 17176 [ 18226 / 17075 ]

HVNs – 17540 / 18140-185 / 18790 / 18985 / 19020 / 19125 / 19345 / (19550) / 19700 / 19840

Previous report ended with this ‘Value for the day was completely lower and staying below 18185 in the coming session, the PLR would remain down for a test of 17635 & the extension handle of 17350 below which we have the HVN of 16905‘

BNF started with an OH start at 18226 and gave another drive down breaking below PDL and forming new lows for the week as it made a 775 point drop in the ‘A’ period as it made lows of 17450 leading to a very narrow range in the B period as it confirmed a selling tail from 17829 to 18226 in the IB. The auction then began to form a balance inside the IB with 2 failed attempts to extend the range lower in the ‘D’ & ‘H’ just like it did in NF but BNF being the weaker of the 2 indicies, the bounce was much smaller as the ‘I’ period confirmed a PBH of 17665. BNF then made a fresh leg down and even spiked into the close as it tagged the weekly HVN of 17075 before closing the day at 17176 leaving a ‘b’ shape profile with a spike. The spike reference for the next session would be from 17311 to 17075.

- The BNF Open was a Open Drive – Down (OD)

- The day type was a Normal Variation Day – Down (‘b’ shape profile with a spike close)

- Largest volume was traded at 17540 F

- Vwap of the session was at 17462 with volumes of 50.9 L and range of 1151 points as it made a High-Low of 18226-17075

- BNF confirmed a FA at 19820 on 30/03 and tagged the 1 ATR objective of 17880 on 03/04. The 2 ATR target comes to 15939

- The settlement day Roll Over point (Apr) is 19380

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 17380-17540-17740

Main Hypos for the next session:

a) BNF needs to get above 17225 & sustain for a rise to 17311-376 / 17415 / 17462-490 / 17540 / 17600-665 & 17740-826

b) The auction remains weak below 17160 for a test of 17095-22 / 16970-905* / 16850 / 16800-770 / 16675-600 & 16490

Extended Hypos:

c) Above 17826, BNF can probe higher to 17920-990 / 18072 / 18140-150 / 18225-270 / 18355-415 & 18475-556

d) Below 16490, lower levels of 16360 / 16275 / 16170 / 16110 / 16008 & 15906-855 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout