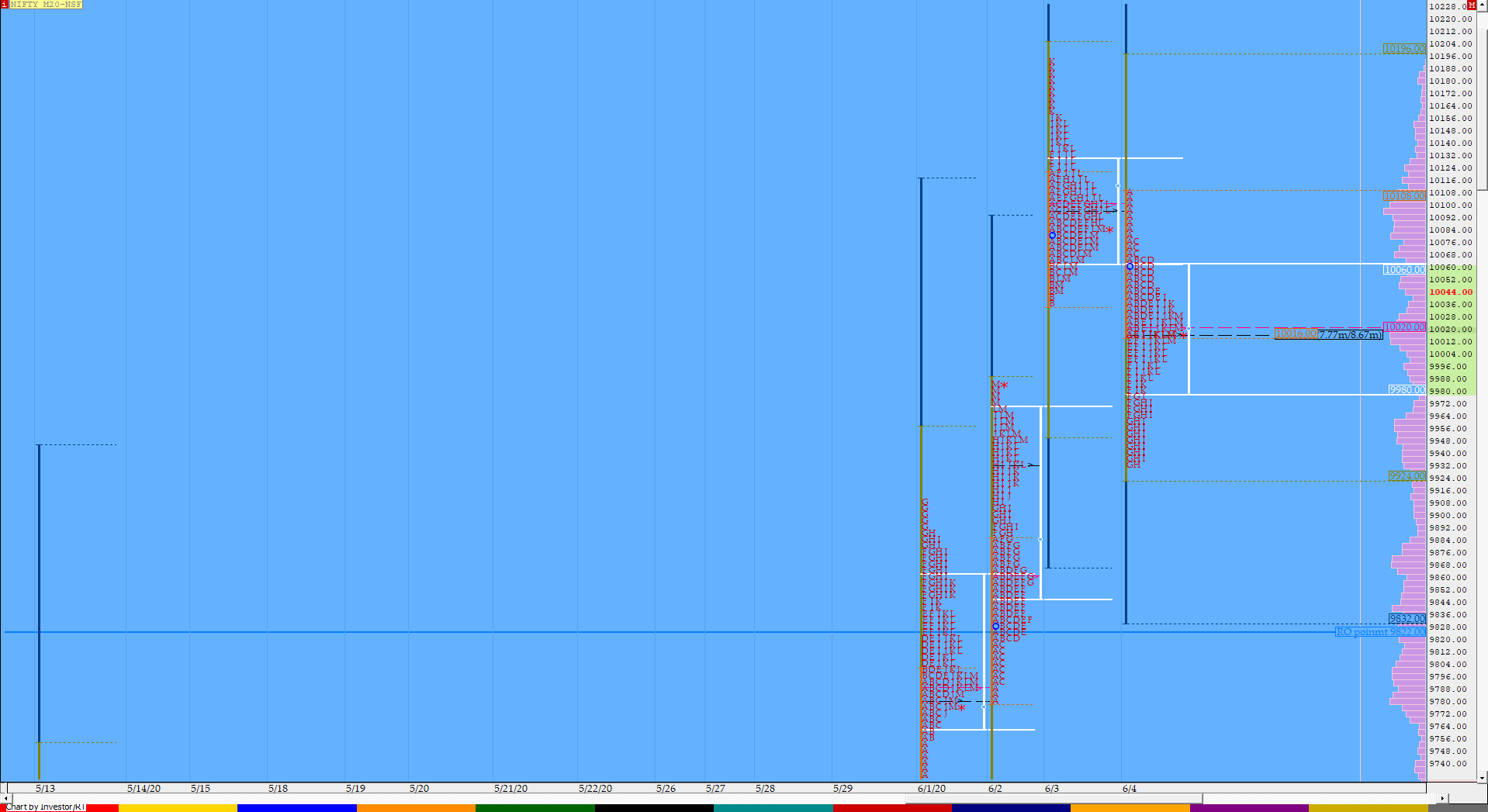

Nifty Jun F: 10017 [ 10110 / 9933 ]

HVNs – 9093 / 9275 / 9433 / 9785 / 9868 / 10020 / 10100

Previous day’s report ended with this ‘Value for the day was higher but the excess at top could mean that the upside probe which started last week has ended and NF could begin to form a balance here or give a retracement to 9933 / 9868 & 9785 in the coming session(s).‘

NF moved away from yesterday’s POC all be it on lower volumes as it left a selling tail from 10110 to 10066 in the IB and probed lower hitting the first target & VPOC of 9933 as it almost completed the 2 IB objective where it formed poor lows indicating exhaution on the downside and completed the day as a nicely balanced ‘b’ shape profile which indicates long liquidation. The auction once again formed a prominent POC at 10020 & closed around it so would be interesting to see if it gives a move away from this POC or starts to form a balance around it in the next session.

- The NF Open was a Open Rejection Reverse – Down (on low volumes)

- The day type was a Normal Variation Day – Down (‘b’ shape long liquidation profile)

- Largest volume was traded at 10020 F

- Vwap of the session was at 10014 with volumes of 175.1 L and range of 177 points as it made a High-Low of 10110-9933

- The Trend Day VWAP of 9165 would be important support level.

- The settlement day Roll Over point (Jun) is 9426

- The VWAP & POC of May Series is 9183 & 9109 respectively.

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9980-10020-10062

Main Hypos for the next session:

a) NF needs to sustain above 10032 for a rise to 10062-68 / 10092-100 / 10122-131 / 10156 / 10180-190 & 10212

b) The auction below 10005 could test 9980 / 9958-32 / 9911-00 / 9868* / 9851-40 & 9814-05

Extended Hypos:

c) Above 10212, NF can probe higher to 10244-266 / 10297-302 / 10335-347 / 10365-375 & 10401-410

d) Below 9805, the auction can fall further to 9785-56 / 9740-15 / 9690 / 9670-56 & 9640-25

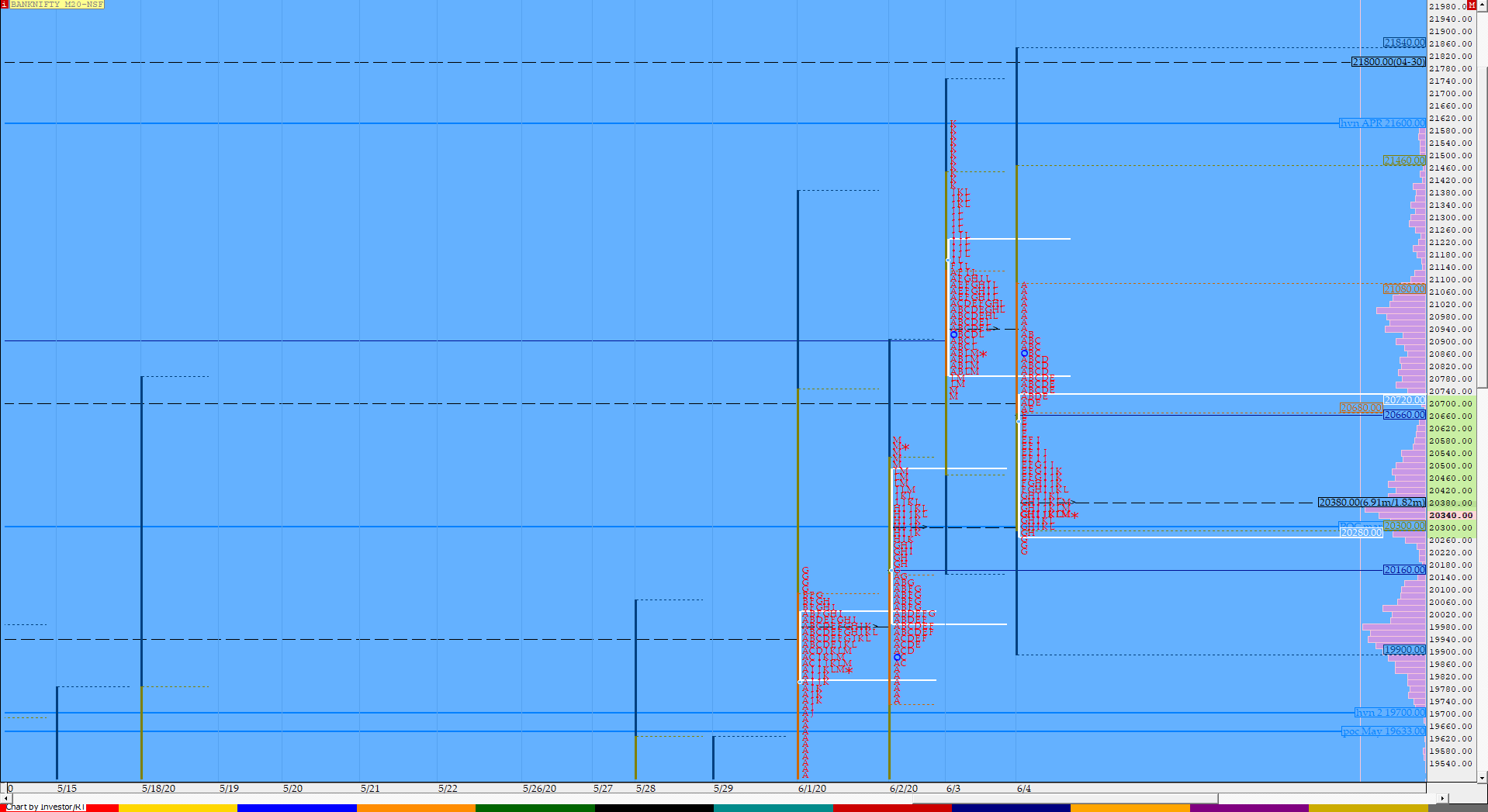

BankNifty Jun F: 20882 [ 21611 / 20739 ]

HVNs – 17800 / 19000 / 19186 / 19980 / 20380 / (20940) / 21000

BNF also moved away from previous day’s POC leaving a selling tail from 20928 to 21080 in the IB after which it formed a small balance before giving a RE (Range Extension) to the downside as it left an extension handle at 20680 and went on to tag the 2 IB objective of 20280 in the ‘G’ period where it made lows of 20233 and in the process tagging the lower VPOC of 20300. However, the auction left a small tail 50 point tail at lows which indicated the end of down move for the time being after which it formed another balance as the day’s POC also shifted to 20380 where it eventually closed to give a Double Distribution profile on the daily. Value for the day was completely lower so staying below 20380, there is good chance that BNF could probe lower towards the extension handle of 20155 & the HVN of 19980 in the coming session.

- The BNF Open was a Open Rejection Reverse – Down (on low volumes)

- The day type was a Double Distribution Trend Day – Down (DD)

- Largest volume was traded at 20380 F

- Vwap of the session was at 20568 with volumes of 93.6 L and range of 847 points as it made a High-Low of 21080-20233

- The Trend Day VWAP of 18138 would be important support level.

- The settlement day Roll Over point (Jun) is 19035

- The VWAP & POC of May Series is 18767 & 19633 respectively.

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 20267-20380-20620

Main Hypos for the next session:

a) BNF needs to sustain above 20390 for a rise to 20460-496 / 20568-620 / 20680 / 20772-862 / 20928-950 & 21000-030

b) Staying below 20380, the auction could test 20310-265 / 20186-124 / 20088-022 / 19980-962 / 19877-820 & 19764-700

Extended Hypos:

c) Above 21030, BNF can probe higher to 21093-140 / 21201-300 / 21399 / 21525-608 / 21662-690 & 21764-785

d) Below 19700, lower levels of 19650 / 19575-500 / 19450-344 / 19295 / 19186-99 & 19015-18980 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://www.explara.com/e/vtrendertradingroomlive