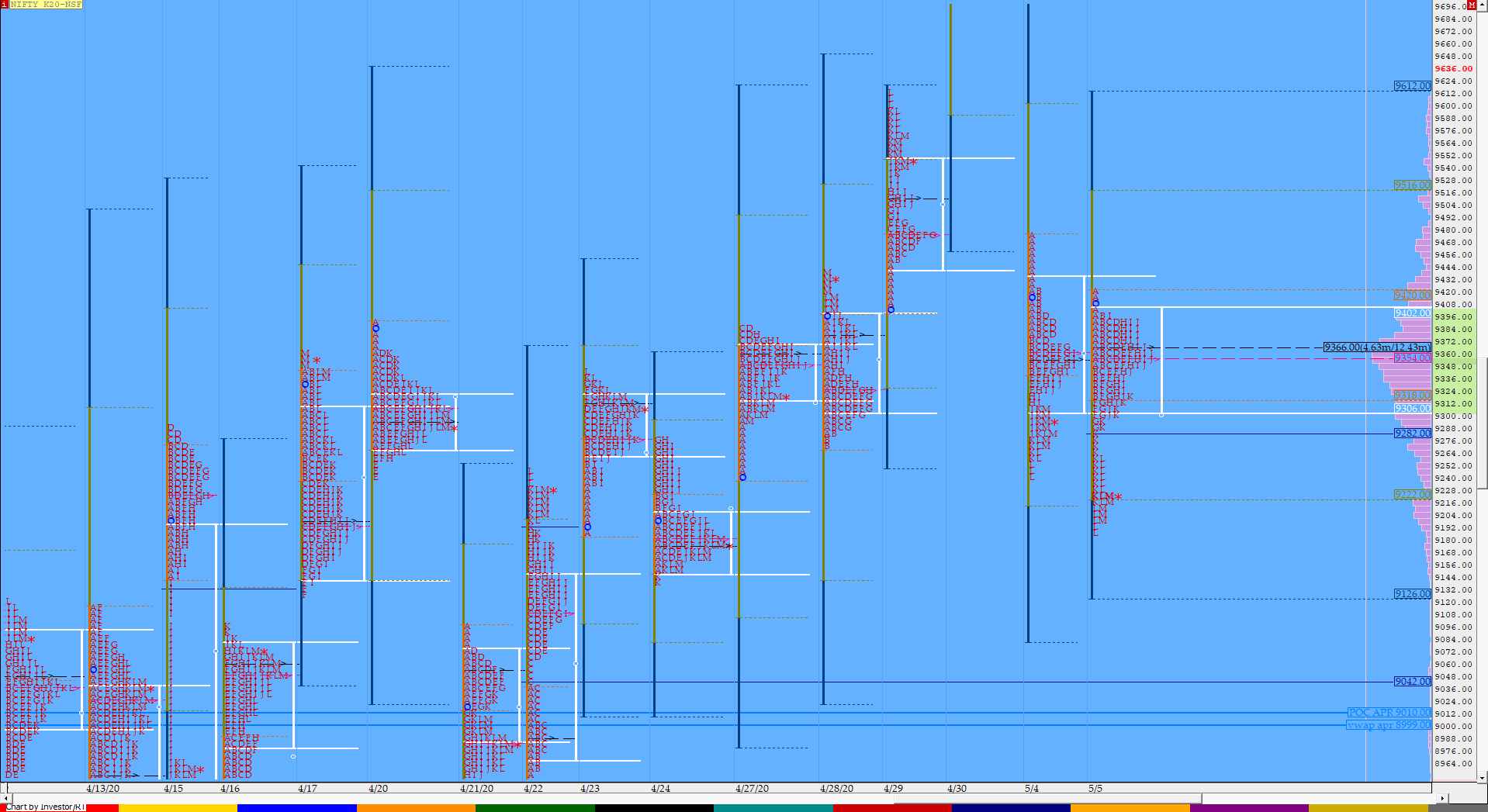

Nifty May F: 9209 [ 9420 / 9190 ]

HVNs – 9370 / (9475) / 9800 / 9822-40

NF opened with a gap up of 125 points but got stalled right below yesterday’s selling tail of 9422 to 9477 as it made a high of 9420 and began a slow probe lower as it went on to tag the yPOC of 9354 while making a low of 9321 in the IB almost completing the 80% Rule in previous Value. The auction then began to form a balance inside the IB range till the ‘F’ period where it made an RE (Range Extension) lower and followed it up with another lower low of 9290 in the ‘G’ period but could not sustain below the IBL which led to a retracement above VWAP as NF tested the ‘B’ period high of 9400 leaving a PBH (Pull Back High) there in the ‘I’ period and as often happens on an OAIR day, the late afternoon break of VWAP led to a spike lower which started in the ‘K’ period in form of an extension handle at 9290 as the auction went on to make lows of 9190 in the ‘L’ period completing the 2 IB objective and stopping just above that weekly VPOC of 9177 before closing at 9208. The Value for the day was almost inside that of the previous day’s and NF has formed a nice 2-day composite ‘b’ shape profile with overlapping POC (Click here to view the MPLite chart) and Value at 9289-9358-9414 and looks good to give a fresh move away from this balance. Spike rules will be in play at open for tomorrow & the reference is 9190 to 9262.

- The NF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day (Down) (with a spike close)

- Largest volume was traded at 9370 F

- Vwap of the session was at 9329 with volumes of 184.1 L and range of 230 points as it made a High-Low of 9420-9190

- NF confirmed a multi-day FA at 9142 on 27/04 and tagged the 2 ATR of 9715 on 30/04. This FA is currently on ‘T+7’ Days.

- NF had confirmed a multi-day FA at 8706 on 09/04 and tagged the 2 ATR objective of 9756 on 30/04. This FA has not been tagged & is now important support.

- The Trend Day VWAP of 8643 would be important support level.

- The settlement day Roll Over point (May) is 9822

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9301-9370-9400

Main Hypos for the next session:

a) NF needs to sustain above 9216-20 for a rise to 9245-65 / 9290-9300 / 9328 / 9345-66 & 9396-9402

b) The auction has immediate support in the zone of 9189-9177 below which it could fall to 9142 / 9111 / 9093 / 9063-40 & 9012-00

Extended Hypos:

c) Above 9402, NF can probe higher to 9420-45 / 9462-75 / 9513-18 / 9549-74 & 9616-25

d) Below 9000, the auction can fall further to 8975-64 / 8940 / 8900 / 8876-45 & 8822-13

BankNifty May F: 19246 [ 20098 / 19164 ]

HVNs – 19830 / 20090 / 20765 / 21600 / (21850)

BNF also opened higher and tested the selling tail of 20078 to 20600 but got rejected at the HVN of 20090 as it made highs of 20098 after which similar to NF, it started to make a slow probe on the downside completing the 80% Rule in yesterday’s Value as it tagged 19660 in the IB. The auction then formed a balance for most part of the day leaving a nice bell shape profile inside previous day’s range as it took support just above PDL (Previous Day Low) in the ‘G’ period where it made a low of 19512. Similar to NF, BNF also made an attempt to probe above VWAP in the ‘I’ period but ended up leaving a PBH at 19958 which triggered a fresh leg to the downside leading to an extension handle at 19512 in the ‘K’ period as the auction spiked lower breaking that FA of 19394 and completed the 2 IB target of 19223 as it hit 19164 in the ‘L’ period before closing the day at 19246. The MPLite chart of the 2-day composite of overlapping Value & POC can be viewed here and the spike reference for the next open would be from 19164 to 19355 with the PLR on the downside.

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day (Down) (with a spike close)

- Largest volume was traded at 19800 F

- Vwap of the session was at 19689 with volumes of 71.5 L and range of 934 points as it made a High-Low of 20098-19164

- BNF confirmed a FA at 21932 on 30/04 and tagged not just the 1 ATR objective of 21028 but also the 2 ATR target of 20125 on 04/05.

- BNF confirmed a multi-day FA at 19394 on 27/04 and tagged the 2 ATR objective of 21406 on 30/04. This FA was tagged on 05/05 which the ‘T+6’ Day.

- BNF confirmed a FA at 17977 on 07/04 and tagged the 2 ATR target of 21771 on 30/04. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (May) is 21380

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19540-19800-19961

Main Hypos for the next session:

a) BNF has immediate supply at 19292 above which it could rise to 19355 / 19440-480 / 19540 / 19635-656 / 19728-760 & 19810-830

b) The auction has support at 19224-185 below which it could test levels of 19125 / 19020 / 18956 / 18860 / 18777-750 & 18690-608

Extended Hypos:

c) Above 19830, BNF can probe higher to 19906-965 / 20076-90 / 20160-220 / 20396-430 & 20535

d) Below 18608, lower levels of 18563 / 18420 / 18300 / 18236-215 / 18170-100 & 18000-17977 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout