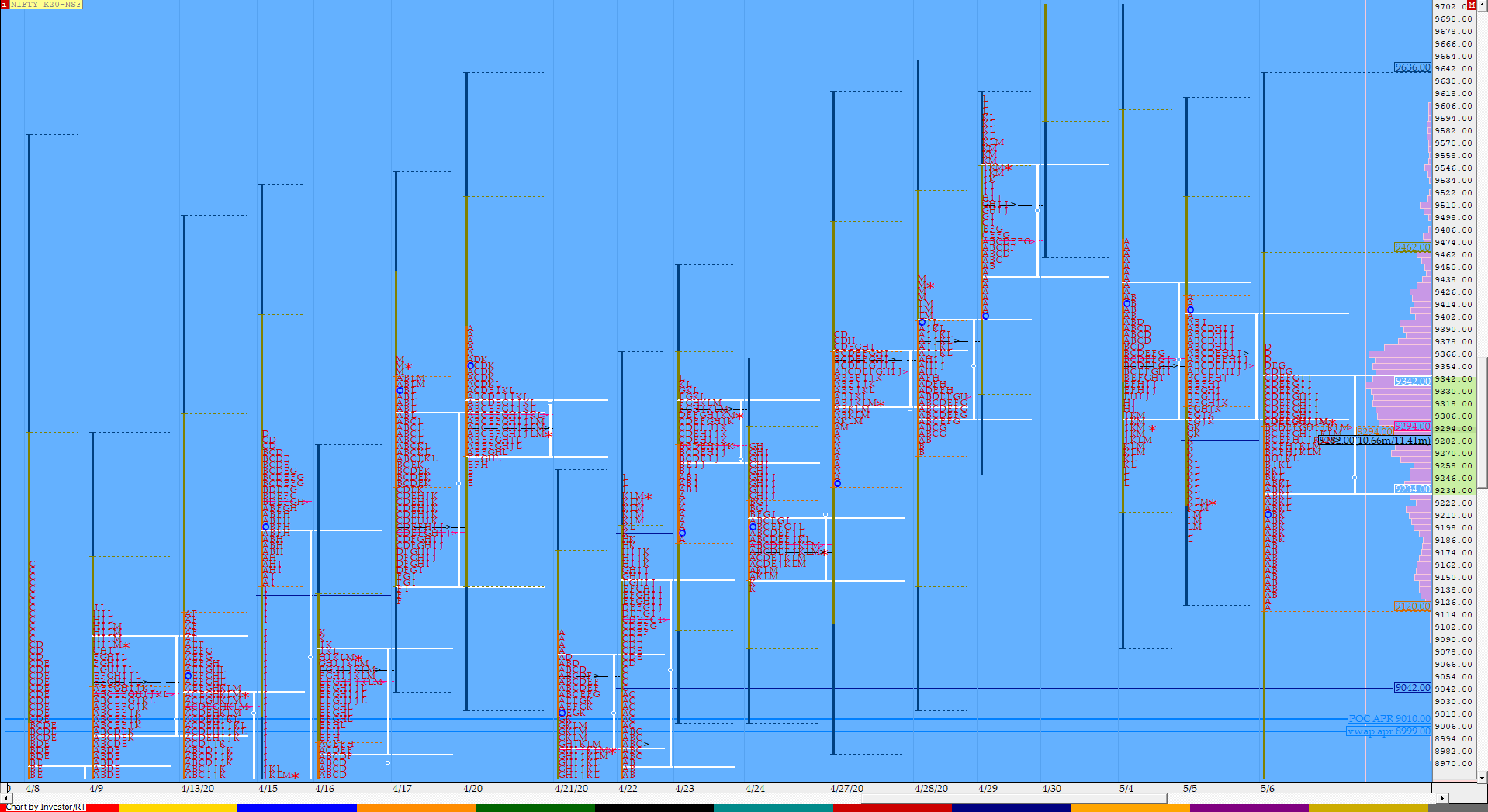

Nifty May F: 9280 [ 9373 / 9125 ]

HVNs – 9285 / 9370 / (9475) / 9800 / 9822-40

NF opened in the spike and seemed to have given an ORR (Open Rejection Reverse) to the downside as it got rejected from 9240 and went on to break below PDL (Previous Day Low) which was also the spike low giving a sharp fall to 9125 in the ‘A’ period but the auction changed character in the ‘B’ period as it got back above VWAP & sustained leading to an equally quick move to the upside breezing through the entire spike zone of 9190 to 9262 as it confirmed an extension handle at 9240 and even went on to tag yesterday’s extension handle of 9290 initiating the 80% Rule in the 2-day composite Value of 9289-9358-9414. NF continued to probe higher in the ‘C’ period as it hit the weekly HVN of 9345 and extended the range further in ‘D’ as it made a high of 9373 but was unable to sustain above the composite POC of 9358 which meant that the supply was coming back in this zone and this also stopped the OTF (One Time Frame) since morning. The auction then made a slow probe towards VWAP over the next few periods and and tagged it in the ‘I’ period as it hit 9258 but was rejected from there & it was also the spike high reference which led to another rotation to the HVN of 9345 where it left poor highs in ‘I’ & ‘J’ indicating exhaustion in the upmove mostly due to the longs booking out. NF then made another probe to VWAP and this time it went on to break below it and get into the spike reference as it replayed the morning move through the low volume zone in a flash but this time on the reverse as it hit lows of 9188 taking support exactly at PDL. The day’s profile completed a perfect ‘p’ shape as the last move for the day was towards the day’s prominent POC of 9294 around where the auction closed to give yet another day of overlapping Value as the auction failed in the attempt to move away resulting in a nice 3-day balance with Value at 9264-9345-9411. (Click here to view the MPLite chart of the composite)

- The NF Open was a Open Rejection Reverse – Down (ORR) which failed

- The day type was a Normal Variation Day (Up) (‘p’ shape profile)

- Largest volume was traded at 9283 F

- Vwap of the session was at 9277 with volumes of 235.1 L and range of 248 points as it made a High-Low of 9373-9125

- NF confirmed a multi-day FA at 9142 on 27/04 and tagged the 2 ATR of 9715 on 30/04. This FA got tagged on 06/05 which was the ‘T+7’ Day.

- NF had confirmed a multi-day FA at 8706 on 09/04 and tagged the 2 ATR objective of 9756 on 30/04. This FA has not been tagged & is now important support.

- The Trend Day VWAP of 8643 would be important support level.

- The settlement day Roll Over point (May) is 9822

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9240-9283-9355

Main Hypos for the next session:

a) NF needs to sustain above 9284 for a rise to 9303-12 / 9336-66 / 9396-9402 / 9420-43 & 9462-75

b) The auction remains weak below 9272-64 and could fall to 9240-13 / 9188-54 / 9125-11 & 9093

Extended Hypos:

c) Above 9475, NF can probe higher to 9513-18 / 9549-74 / 9616-25 & 9653-70

d) Below 9093, the auction can fall further to 9063-40 / 9012-00 / 8975-64 / 8940 & 8900

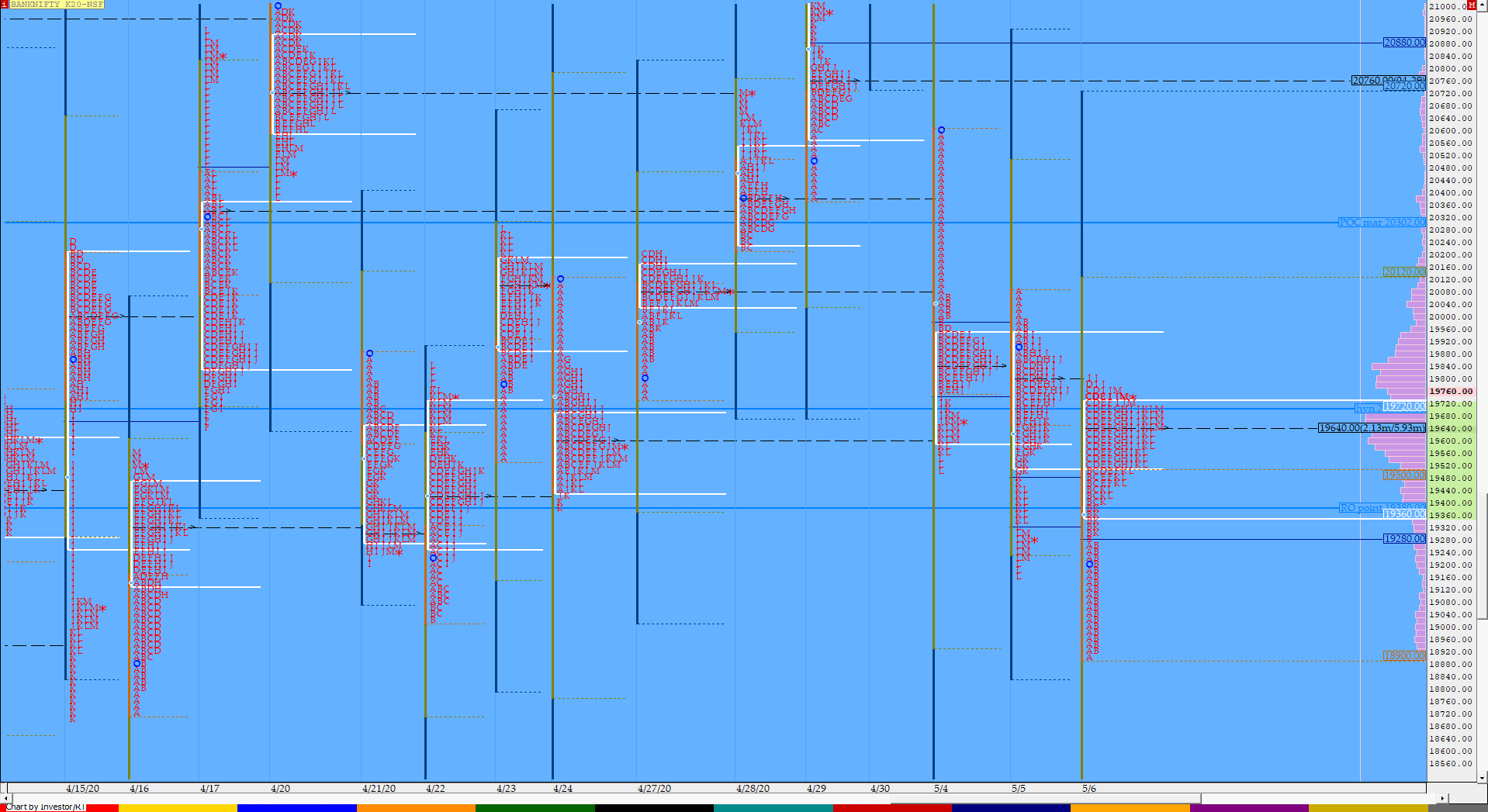

BankNifty May F: 19672 [ 19819 / 18900 ]

HVNs – 19670 / 19830 / 20090 / 20765 / 21600 / (21850)

BNF opened in the lower end of the spike & broke below it leading to a quick fall to 18900 as it extended the imbalance seen from the PBH level of 19952 on the previous day to almost 1000 points but the auction got back above VWAP as early as the start of the ‘B’ period as it made a big move to the upside after leaving an extension handle at 19272 and got back into previous day’s range making a high of 19518 in the B period tagging the extension handle of 19512 it had left in the fall yesterday. BNF continued the probe higher making a big RE in the C period & follower it up with a higher high of 19788 in the ‘D’ period stalling just below the yPOC of 19800. The auction then remained in a narrow range for the next 4 periods before it made a fresh RE in the ‘I’ period as it hit new highs of 19818 but was not able to sustain failing to even tag the 1.5 objective of 19827 which meant that the buyers were losing control and this led to a big dip over the next 3 periods as BNF broke below VWAP for the first time in the day post B period and made a low of 19301 taking support just above the morning reference of 19272. The last 45 minutes then saw a probe back to the HVN of 19700 with a close just above the dPOC of 19640 as the day saw overlapping to lower Value which means this week so far is giving a nicely balanced profile with Value at 19468-19636-19956 (Click here to view the MPLite chart) and it remains to be seen if we move away from this over the last 2 days of the week.

- The BNF Open was a Open Rejection Reverse – Down (ORR) which failed

- The day type was a Normal Variation Day (Up) (‘p’ shape profile)

- Largest volume was traded at 19640 F

- Vwap of the session was at 19521 with volumes of 85.9 L and range of 918 points as it made a High-Low of 19818-18900

- BNF confirmed a FA at 21932 on 30/04 and tagged not just the 1 ATR objective of 21028 but also the 2 ATR target of 20125 on 04/05.

- BNF confirmed a FA at 17977 on 07/04 and tagged the 2 ATR target of 21771 on 30/04. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (May) is 21380

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19394-19640-19726

Main Hypos for the next session:

a) BNF needs to sustain above 19680 for a rise to 19726 / 19782-830 / 19906-965 / 20076-90 / 20160-220 & 20396-430

b) The auction gets weak below 19640 and could test levels of 19575 / 19521-485 / 19420-394 / 19301-272 / 19220-145 & 19049-18970

Extended Hypos:

c) Above 20430, BNF can probe higher to 20535-600 / 20735-755 / 20840 / 20898-914 / 20975-21030 & 21090-116

d) Below 18970, lower levels of 19928-860 / 18777-750 / 18690-608 / 18563 & 18420-300 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout