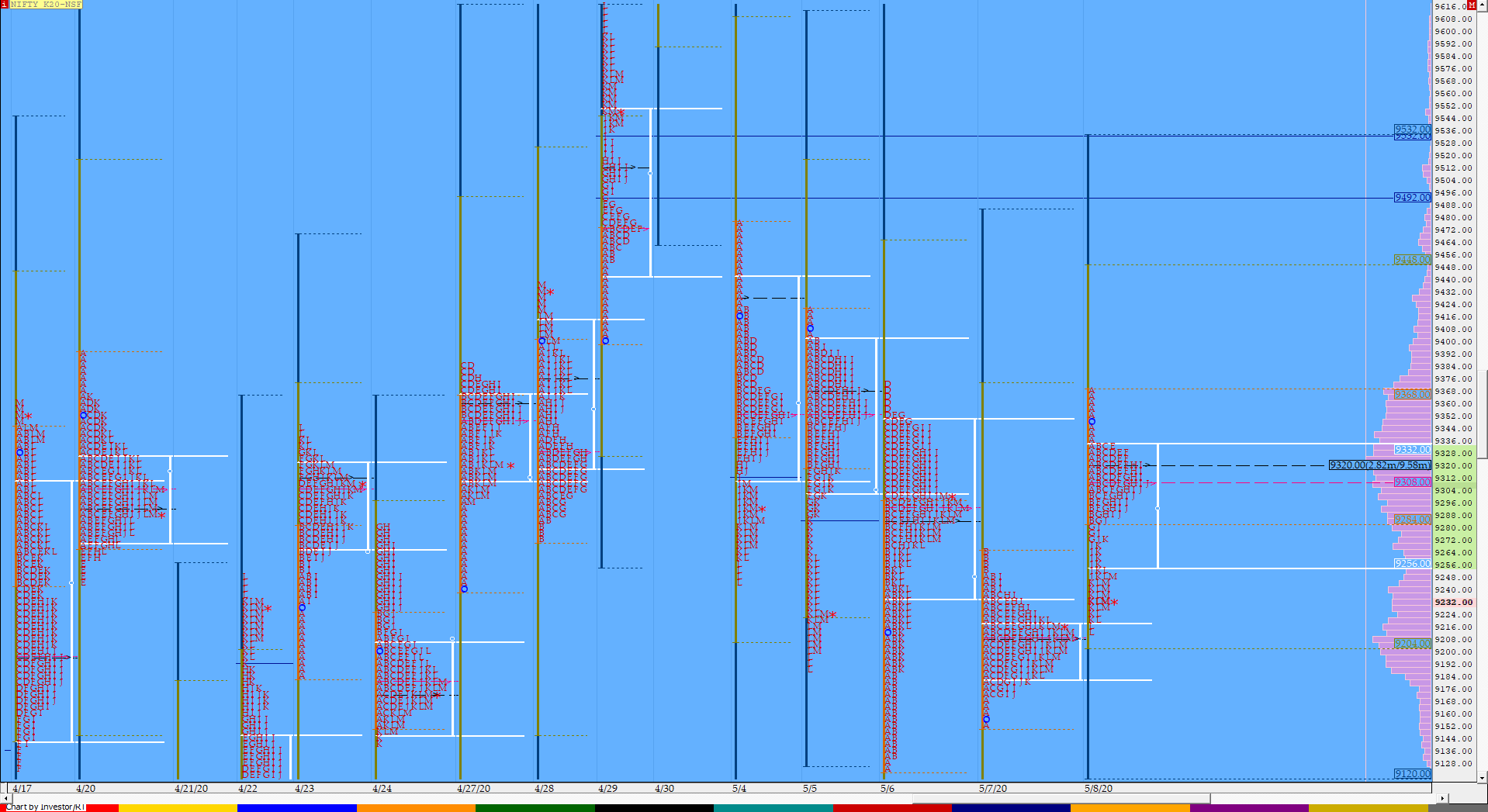

Nifty May F: 9236 [ 9369 / 9215 ]

HVNs – 9204 / (9285) / 9318-24 / 9800 / 9822-40

Previous day’s report ended with this ‘this series POC shifting to 9204 which was also the prominent POC for the day from where we could get a good move away in the next session. The references on the upside would be the VPOC of 9284 & the HVN of 9366 and on the downside below 9180, levels on watch would be 9125-11 & 9012‘.

NF opened with a big gap up of 144 points and hit that HVN of 9366 stalling there as it made a high of 9369 after which it started a slow probe lower in the IB (Initial Balance) and took support exactly at that VPOC of 9285 in the ‘B’ period. The auction then started to form a ‘b’ shape profile as it remained in a narrow range below the selling tail of 9335 to 9369 building volumes at 9320 as it made a failed attempt to break below the IBL forming new low of 9275 in the ‘G’ period but was swiftly rejected back to VWAP as it made similar highs of 9323 in the next 2 periods indicating weakening of demand and this led to a fresh RE (Range Extension) lower in the ‘J’ period as NF left an extension handle at 9275 and almost went on to tag the yPOC of 9204 while it made lows of 9215 in the ‘K’ period before closing the day at 9236. The PLR (Path of Least Resistance) for the next session remains to be on the downside till the auction stays below 9275 & a fresh probe could start once 9204 gets taken out. On the upside, the important references above today’s extension handle would be 9290 & 9320.

- The NF Open was a Open Auction Out of Range (OAOR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 9320 F

- Vwap of the session was at 9295 with volumes of 131.8 L and range of 154 points as it made a High-Low of 9369-9215

- NF had confirmed a multi-day FA at 8706 on 09/04 and tagged the 2 ATR objective of 9756 on 30/04. This FA has not been tagged & is now important support.

- The Trend Day VWAP of 8643 would be important support level.

- The settlement day Roll Over point (May) is 9822

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9266-9320-9346

Main Hypos for the next session:

a) NF needs to sustain above 9240 for a rise to 9261-73 / 9294 / 9312-36 / 9366 / 9396-9402 & 9420-43

b) The auction remains weak below 9232-22 and could fall to 9204* / 9188-80 / 9161-53 / 9125-9093 & 9063-40

Extended Hypos:

c) Above 9443, NF can probe higher to 9462-75 / 9513-18 / 9549-74 & 9616-25

d) Below 9040, the auction can fall further to 9012-00 / 8975-40 / 8900 & 8876-45

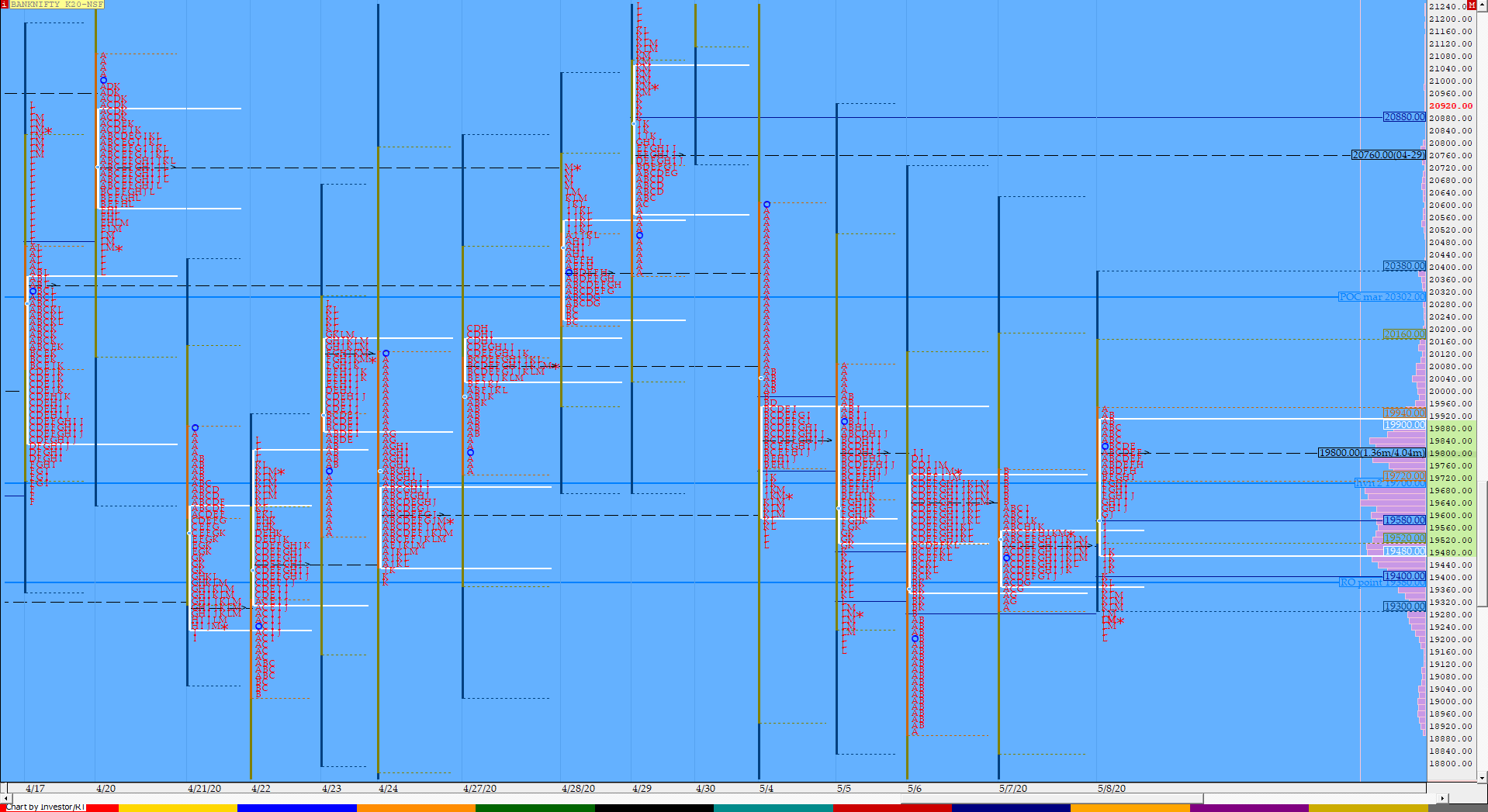

BankNifty May F: 19285 [ 19950 / 19210 ]

HVNs – 19465-510 / 19650 / 19830 / (21600) / (21850)

BNF also opened higher by 320 points and continued to display strength in the ‘A’ period as it hit a high of 19950 but the first signal of the upmove weakening came when it broke below VWAP in the ‘B’ period and went on to make new lows for the day at 19735. The auction then made an attempt to get back above VWAP in the ‘C’ period but left an early PBH (Pull Back High) which gave more confirmation that the supply was now taking over the demand and this in turn led to a Trend Day Down in BNF as it made a OTF (One Time Frame) probe lower all day with the typical afternoon pull back high in the ‘H’ period at 19763 after which it left an extension handle at 19608 and went on to take out the important zone of 19320-19272 as it made lows of 19210 before closing the day at 19285. The first reference zone for the next open would be 19210 to 19426 and BNF continues to remain weak below it. On the upside, today’s extension handle of 19608 & VWAP of 19651 would be the important supply points which if taken out could bring a test of today’s POC of 19800.

- The BNF Open was a Open Auction Out of Range (OAOR)

- The day type was a Trend Day – Down (TD)

- Largest volume was traded at 19800 F

- Vwap of the session was at 19651 with volumes of 58.1 L and range of 740 points as it made a High-Low of 19950-19210

- BNF confirmed a FA at 21932 on 30/04 and tagged not just the 1 ATR objective of 21028 but also the 2 ATR target of 20125 on 04/05. This FA is currently on ‘T+6’ Days.

- BNF confirmed a FA at 17977 on 07/04 and tagged the 2 ATR target of 21771 on 30/04. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (May) is 21380

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19490-19800-19945

Main Hypos for the next session:

a) BNF needs to sustain above 19320 for a rise to 19405-426 / 19494-555 / 19608-656 / 19710-735 / 19800-836 & 19890-945

b) The auction remains weak below 19280 and could test levels of 19220-210 / 19164-145 / 19049-10 / 18970-928 / 18860-777 & 18690-608

Extended Hypos:

c) Above 19945, BNF can probe higher to 20004 / 20076-90 / 20160-220 / 20396-430 / 20535 & 20600

d) Below 18608, lower levels of 18563 / 18420-300 / 18236-215 / 18170-100 & 18000-17977 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout