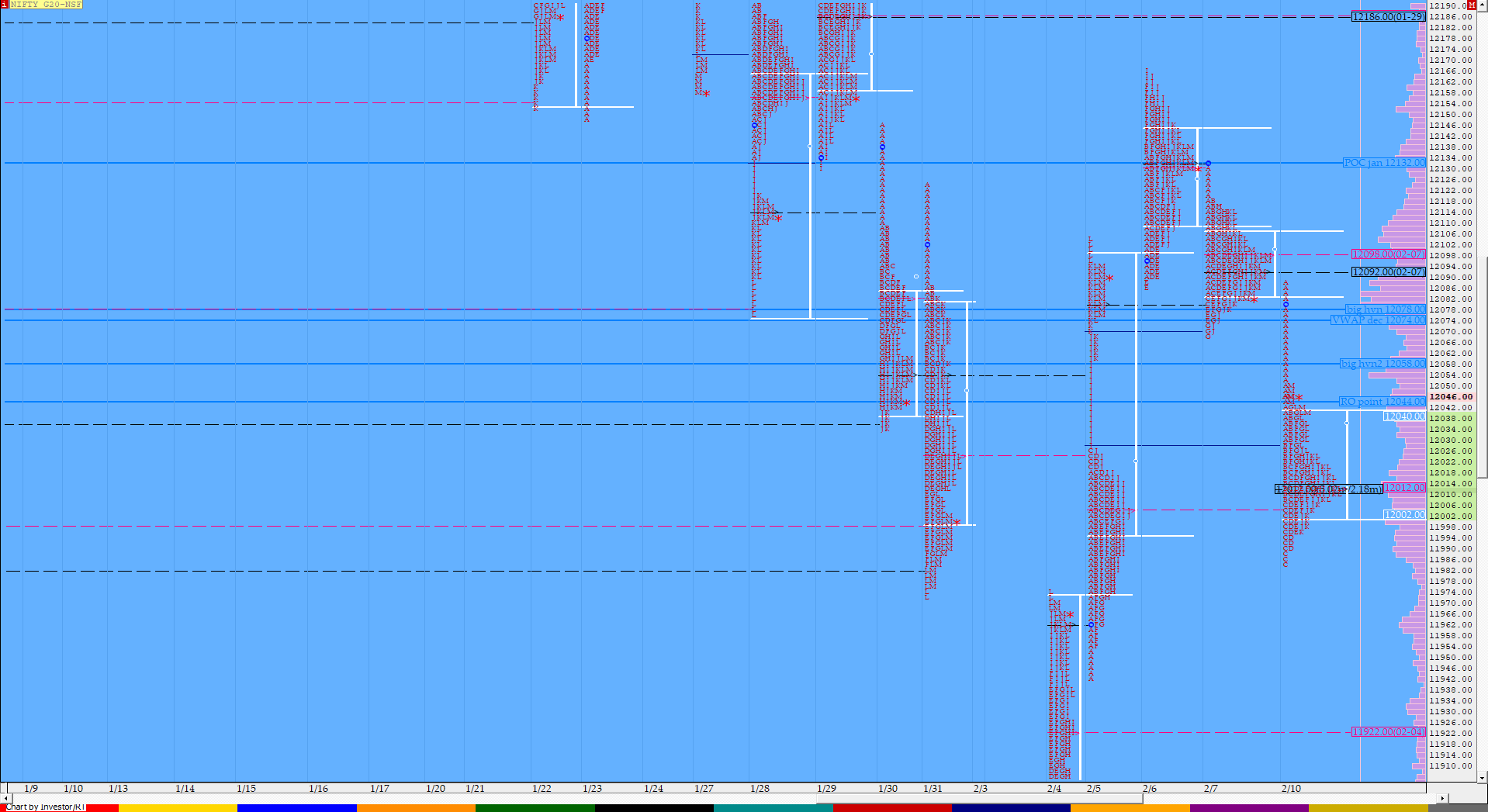

Nifty Feb F: 12040 [ 12089 / 11985 ]

HVNs – 11635 / 11685 / (11803) / 11932 / 11965-978 / 12012-20 / (12046) / 12090-95 / 12132

NF did give a move away from Friday’s balance in form of a OTD (Open Test Drive) down though on low volumes as it made highs of 12089 in the opening minutes almost tagging the yPOC of 12092 and made a swift fall of 81 points in the IB (Initial Balance) breaking below the 5th Feb extension handle of 12049 and hitting the VPOC of 12012 as it made lows of 12008 in the first hour. The auction then made the dreaded ‘C’ side extension as it made new lows for the day at 11985 but could not even complete the 1.5 IB objective of 11968 inspite of getting accepted below the IBL in both the ‘C’ & ‘D’ periods. This coupled with the fact that the D period could not make new lows indicated that either the seller was doing a bad job or that it was only the longs who were booking out with no fresh supply coming in as NF started to form a balance for the rest of the day leaving a ‘b’ shape profile which means long liquidation. Today’s profile has a selling tail from 12050 to 12096 which will be the immediate reference to watch on the upside and on the downside, today’s POC of 12020 would be the important level to the downside.

- The NF Open was an Open Test Drive (Down) (OTD) on low volumes

- The day type was a Normal Day (‘b’ shape profile)

- Largest volume was traded at 12020 F

- Vwap of the session was at 12020 with volumes of 75.7 L and range of 104 points as it made a High-Low of 12089-11985

- The 20th Jan Trend Day VWAP of 12336 remains positional supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12000-12020-12040

Hypos / Estimates for the next session:

a) NF needs to sustain above 12050 for a move higher to 12068-075 & 12092*-096

b) Immediate support is at 12036-030 below which the auction could test 12010 & 11995-982

c) Above 12096, NF can probe higher to 12112-116 & 12132*-145

d) Below 11982 auction gets weak for a test of 11960 & 11942-922*

e) If 12145 is taken out, the auction go up to to 12165-170 / 12189*-193 & 12210-215

f) Break of 11922 can trigger a move lower to 11904 / 11888-881 & 11864

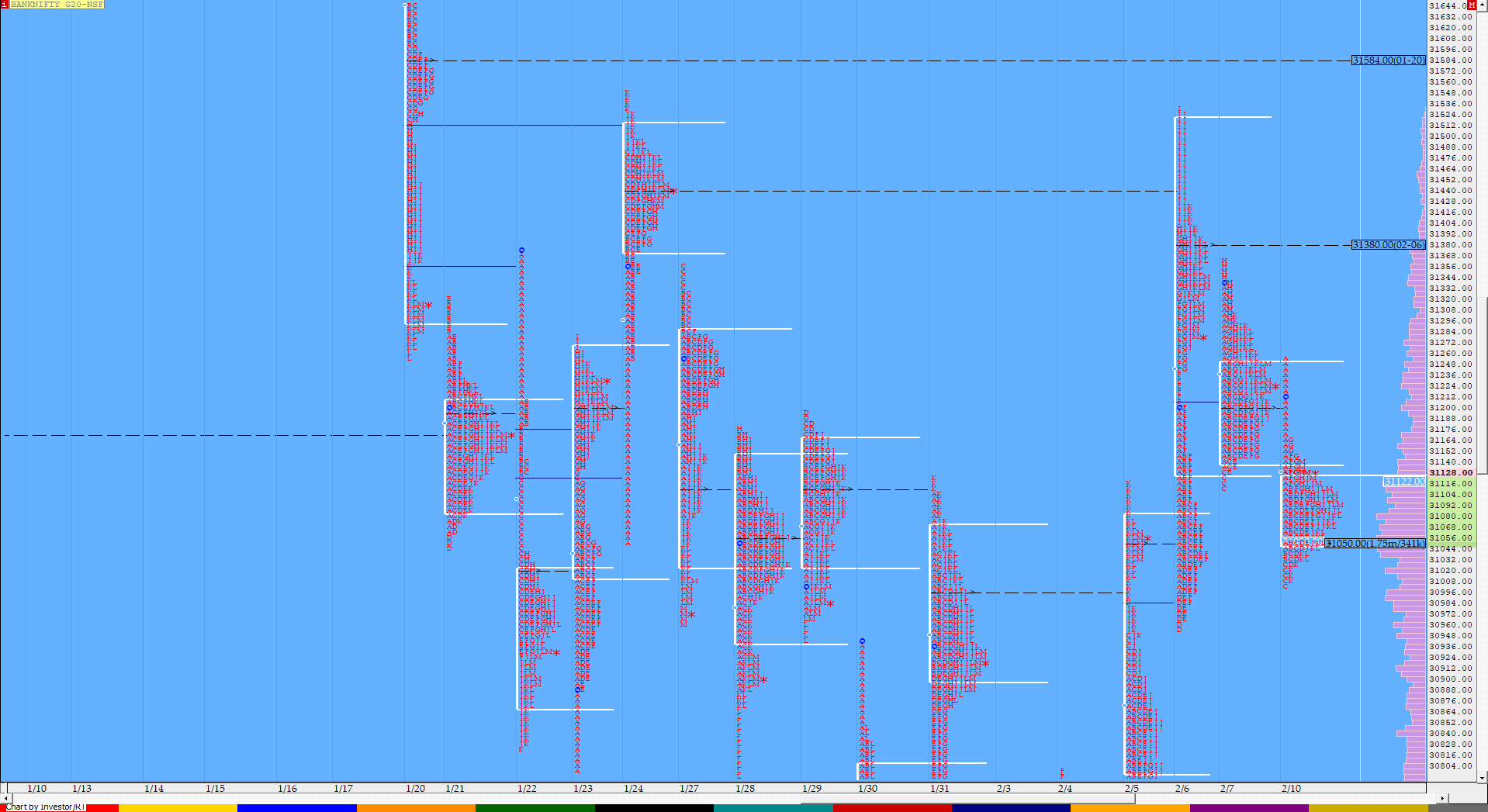

BankNifty Feb F: 31110 [ 31260 / 31004 ]

HVNs – 29900 / (30040) / (30150) / 30355 / 30720 / 30800 / 30870 / 31050 / 31160 / 31200-230 / 31345-380

BNF also gave a OTD down on low volumes as it moved away from the yPOC of 31200 in the IB negating the FA of 31110 as it made lows of 31032 and went on to make that dreaded ‘C’ side RE marking marginal new lows of 31004 but could not extend further leading to a ‘b’ shape profile for the day indicating long liquidation. The auction has a prominent TPO POC at 31090 and can give the next move away from this reference but needs confirming in terms of volumes to validate the transition from balance to an imbalance.

- The BNF Open was an Open Test Drive (Down) (OTD) on low volumes

- The day type was a Normal Day (‘b’ shape profile)

- Largest volume was traded at 31070 F

- Vwap of the session was at 31082 with volumes of 22.5 L and range of 256 points as it made a High-Low of 31260-31004

- BNF confirmed the 5th FA of this series in 7 sessions at 31110 on 07/02 and 2 ATR move from this FA comes to 31623. This FA got negated on 10/02.

- BNF confirmed the 4th FA of this series in 6 sessions at 30956 on 06/02 and tagged the 1 ATR objective of 31453 on the same day. The 2 ATR move from this FA comes to 31950. This FA is currently on ‘T+3‘ Days.

- BNF confirmed the third FA of this series in 5 sessions at 30631 on 05/02 and tagged the 1 ATR objective of 31116 on the same day. The 2 ATR move from this FA comes to 31600. This FA is currently on ‘T+4‘ Days.

- The 20th Jan Trend Day VWAP of 31500 remains positional supply point.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31049-31070-31118

Hypos / Estimates for the next session:

a) BNF has immediate supply in the zone of 31135-152 above which it could rise to 31220 / 31270 & 31328

b) The auction would get weak below 31070 for a test of 31020-002 / 30956 & 30870-855

c) Above 31328, BNF can probe higher to 31380* / 31436 & 31487-530

d) Below 30855, lower levels of 30800 / 30720** & 30675-645 could be tagged

e) If 31530 is taken out, BNF can give a fresh move up to 31584*-600 / 31650-720 & 31775-800

f) Break of 30645 could trigger a move down to 30616-585 / 30500-475 & 30410-388

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout