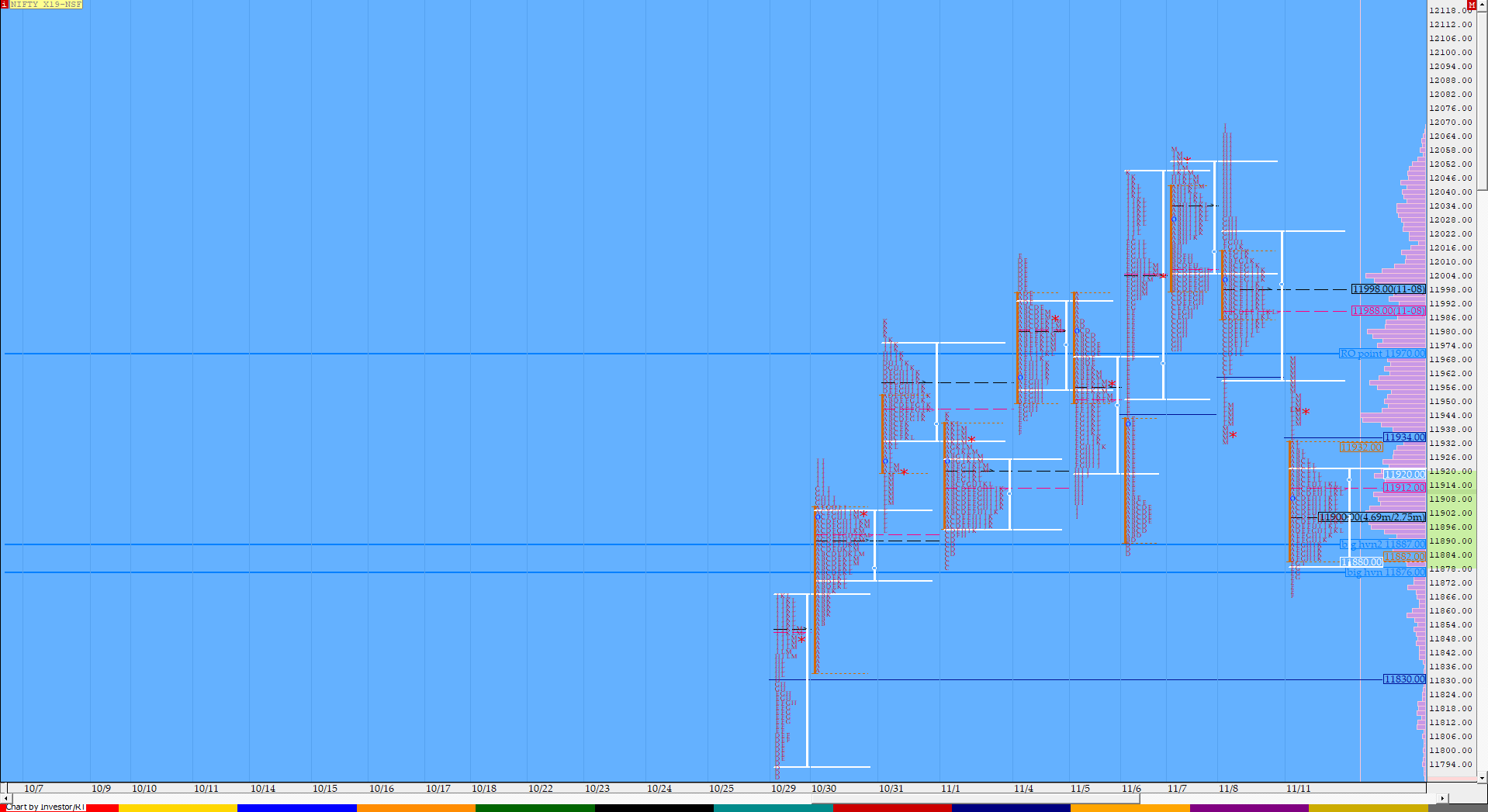

Nifty Nov F: 11944 [ 11968/ 11866 ]

HVNs – 11667 / 11814 / 11860 / 11900 / 11945 / 11980 / 12003

NF got a rare follow up after a Neutral Extreme profile as it opened below PDL (Previous Day Low) and probed lower as it briefly broke below the previous week’s low of 11885 tagging 11881 in the opening minutes but got rejected from there as it reversed the probe to the upside but got resisted just below the PDL as it made a high of 11932 in the ‘A’ period confirming an OAOR start. Typical of the open type, the auction remained in a narrow range of 50 points till the ‘E’ period where it made yet another failed attempt to stay above the 7-day composite VAL of 11919 and this triggered a RE (Range Extension) to the downside in the ‘F’ period as NF made new lows of 11866 but could not complete even the 1.5 IB objective of 11857 in spite of staying below the IBL in the ‘G’ period also which meant the sellers were doing a bad job even after making lower Value as the auction was forming a nice Bell shaped profile for the day till the ‘L period. The last 25 minutes then saw a sharp short covering spike as the stuck sellers were forced to get out as NF got back into the the previous day’s range & tagged the Neutral Extreme high of 11965 while making a high of 11968 to give a hat-trick of Neutral Extreme profiles on the daily. The Neutral Extreme reference for the next session would be 11932 to 11968 and staying above this the PLR would remain up for a tag of the composite POC of 11979 & VAH of 12009.

(Click here to view NF making a failed attempt to move away from the 7-day composite)

- The NF Open was an Open Auction Out of Range (OAOR)

- The day type was a Neutral Extreme Day (Up)

- Largest volume was traded at 11900 F

- Vwap of the session was at 11905 with volumes of 79 L and range of 102 points as it made a High-Low of 11968-11866

- NF confirmed a fresh FA at 11885 on 06/11 and tagged the 1 ATR target of 11999. This FA was revisited on ‘T+3’ Days

- NF confirmed a multi-day FA at 11465 on 16/10 and completed the 2 ATR move up of 11776. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11503 on 17/10 and completed the 2 ATR move up of 11808. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11162 on 09/10 and completed the 2 ATR move up of 11554. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 11810 will be important reference on the downside.

- The settlement day Roll Over point (Nov) is 11970

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11880-11900-11920

Hypos / Estimates for the next session:

a) NF needs to take out immediate supply at 11960-965 for a move to 11982-998 / 12027-50 & 12064-80

b) Immediate support is at 11940-930 below which the auction could test 11905-900 / 11880-865 & 11832-829

c) Above 12080, NF can probe higher to 12112 / 12133-148 & 12166

d) Below 11829, auction becomes weak for 11810-795 / 11771-767 & 11749-734

e) If 12166 is taken out, the auction go up to to 12185-199 / 12226-236 & 11255

f) Break of 11734 can trigger a move lower to 11716-709 / 11689-667 & 11645

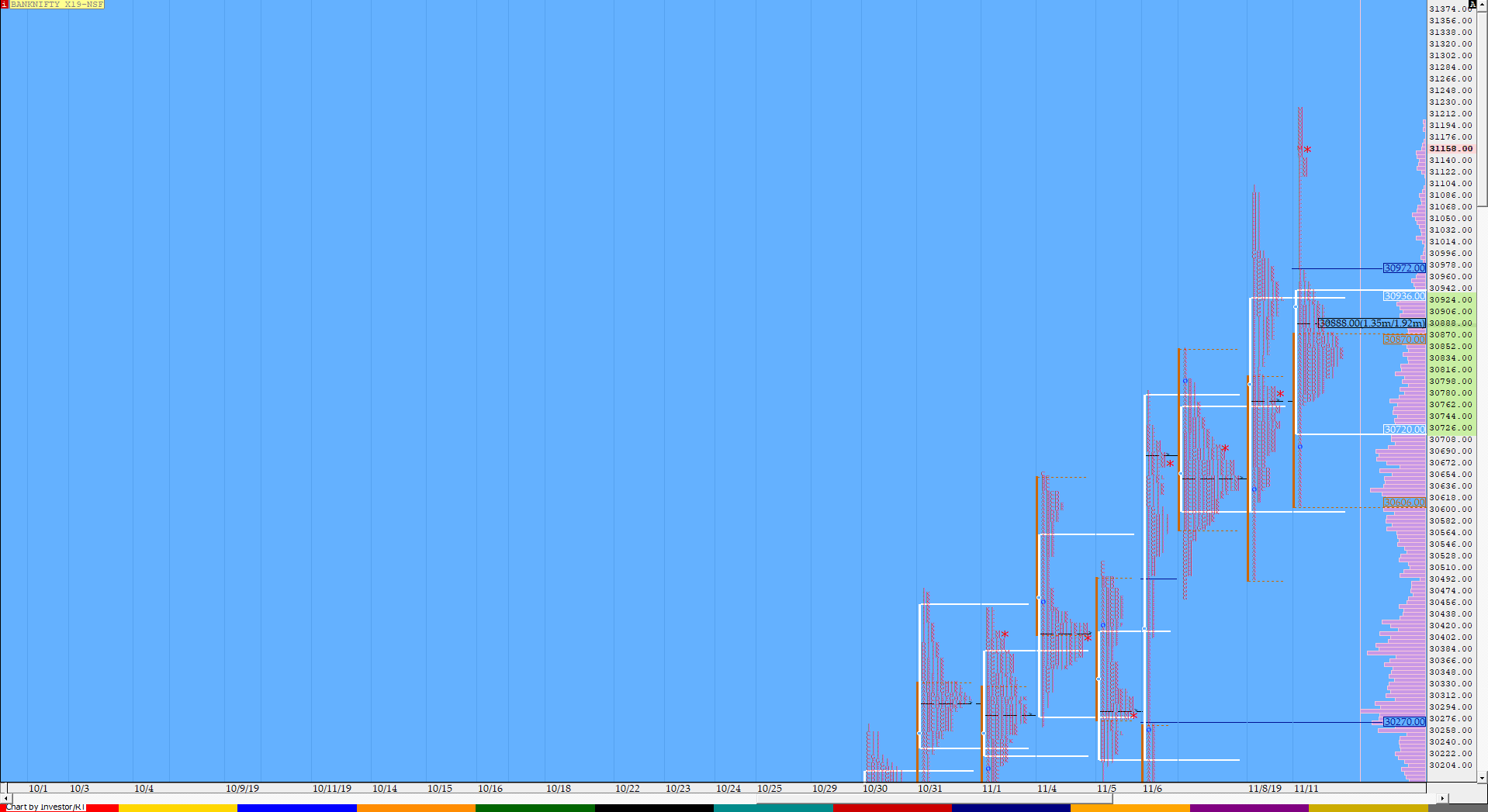

BankNifty Nov F: 31098 [ 31223 / 30610]

HVNs – 30075 / 30150 / 30288 / 30410 / (30530) / 30680 / 30725 / 30815 / 30915 / (31150)

BNF also opened lower but similar to Friday’s action got some good demand at open as it got back above the HVN of 30725 and left a buying tail from 30765 to 30610 and went on to make highs of 30875 in the IB (Initial Balance). The next 2 periods remained inside the IB forming a ‘p’ shape profile and the auction made a RE to the upside in the ‘E’ period making new highs of 30950 but was swiftly rejected from the other HVN of 30925 after which it stayed above VWAP forming a bigger ‘p’ shape profile and similar to NF, BNF also gave a spike into the close but the spike in BNF was of a much bigger magnitude as it made highs of 31223 surpassing previous week’s high. Spike rules will be in play for the next session & the spike reference is from 30968 to 31223.

(Click here to view the 2-day composite 3-1-3 profile in BNF)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (‘p’ profile with a spike)

- Largest volume was traded at 30815 F

- Vwap of the session was at 30859 with volumes of 33.7 L and range of 605 points as it made a High-Low of 31223-30610

- BNF confirmed a fresh FA at 30052 on 06/11 and tagged the 2 ATR target of 31049 on 08/11. This FA is currently on ‘T+4’ Days.

- BNF confirmed a FA at 30658 on 04/11 and the 2 ATR move of 30097 was tagged on 06/11. However, this FA also got negated on the same day and the 1 ATR move on the upside of 31219 was tagged on 11/11.

- BNF confirmed a FA at 27900 on 09/10 and completed the 2 ATR move up of 29779. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 06/11 at 30447 will be important reference on the downside.

- The Trend Day VWAP of 29/10 at 29945 will be important reference on the downside. This was tagged on 30/10 and broken but was swiftly rejected so proves to be support.

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward. BNF closed above this on 11/11 and will be important support now.

- The settlement day Roll Over point (Nov) is 30150

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30745-30815-30946

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31100 for a rise to 31152-200 / 31255 / 30310-326 & 31373-395

b) Staying below 31090, the auction gets weak for 30968-955 / 30859-840 & 30784-760

c) Above 31395, BNF can probe higher to 31417-440 / 31490 & 31560

d) Below 30760, lower levels of 30687-680 / 30630-610 & 30570-560

e) If 31560 is taken out, BNF can give a fresh move up to 31618-640 / 31680 & 31727-740

f) Break of 30560 could trigger a move down 30520 / 30473-445 & 30384

Additional Hypos

g) Above 31740, higher levels of 31784-803 / 31875 & 31929-949 could get tagged

h) If 30384 is broken, BNF could fall to 30310-281 / 30225 & 30150-130

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout