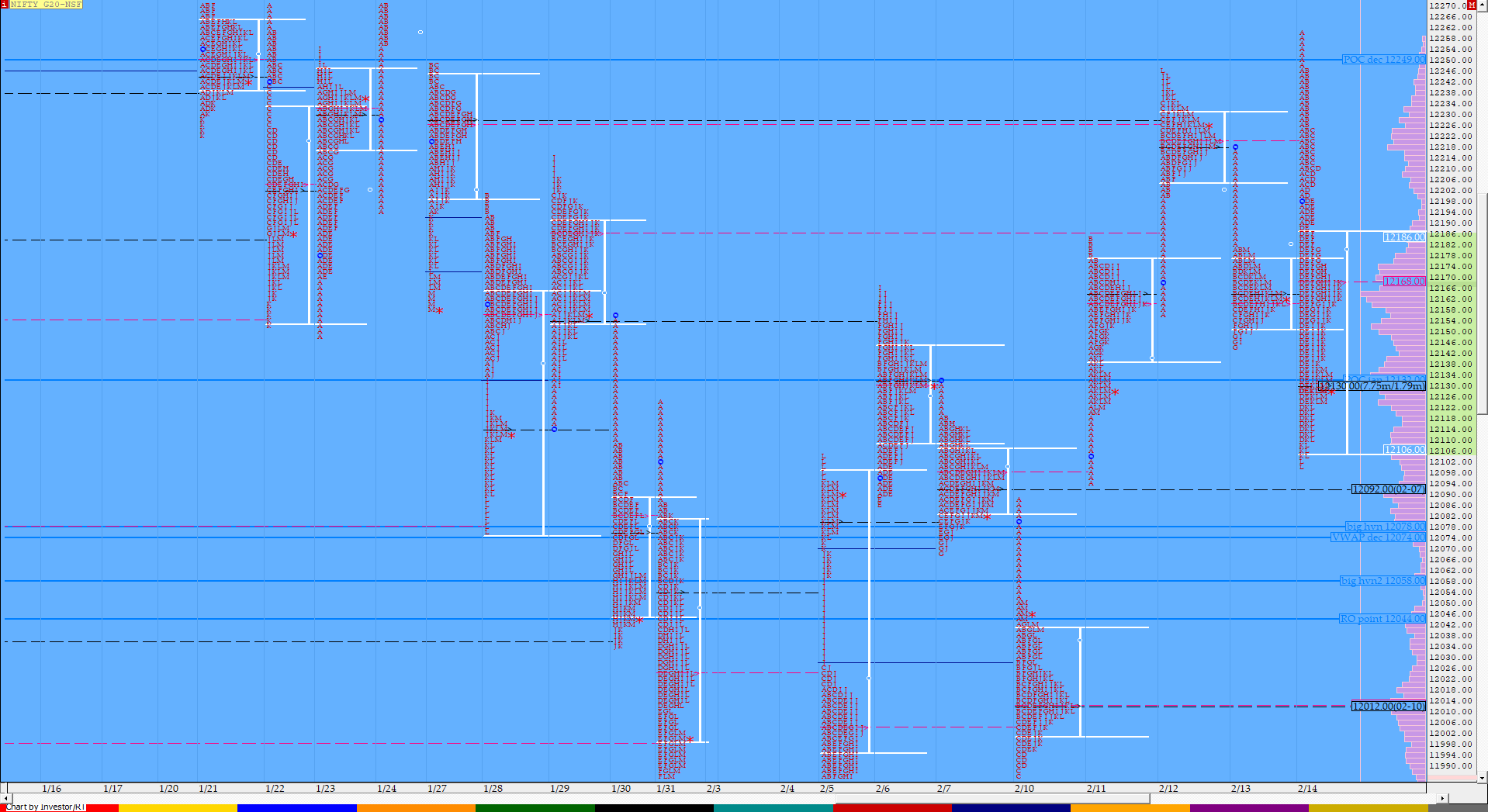

Nifty Feb F: 12129 [ 12260 / 12101 ]

HVNs – 11922 / 11965 / 12012 / 12095 / 12130 / 12165 / 12220

NF opened higher and stayed above the yPOC of the previous day’s ‘b’ shape profile which led to a short covering drive higher in the ‘A’ period as it went on to make new highs for the week at 12260 but as soon as the ‘B’ period started, the auction broke below VWAP which was a sign that supply was coming back and the break of VWAP of a drive open generally leads to the test of the other extreme which happened in the D period as NF not only made a RE (Range Extension) to the downside but also went on to break below PDL (Previous Day Low) as it made lows of 12110 completing the 2 IB objective in the ‘D’ period itself. This imbalance of 150 points then led to a retracement to VWAP in the E period which got rejected indicating that the sellers were still in control after which the auction remained mostly in the 100 point range of the D period (12110 to 12210) for most part of the day building volumes first at 12165 before making a new low of 12101 in the L period as the dPOC for the day shifted to 12130 where it eventually closed leaving a DD (Double Distribution) Trend Day down totally engulfing the previous 2 day’s ‘p’ & ‘b’ profiles. The PLR (Path of Least Resistance) for the coming session would be to the downside if NF gets accepted below 12130 with the 12165-12170 being important supply zone for the next few sessions.

- The NF Open was an Open Drive (Up) (OD) which failed

- The day type was a Double Distribution Trend Day – Down (DD)

- Largest volume was traded at 12130 F

- Vwap of the session was at 12169 with volumes of 100.2 L and range of 159 points as it made a High-Low of 12260-12101

- The 14th Feb VWAP of 12169 will be the immediate reference on any upside.

- The 20th Jan Trend Day VWAP of 12336 remains positional supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12105-12130-12185

Hypos / Estimates for the next session:

a) NF needs to sustain above 12130 for a test of 12145 / 12165-171 / 12192 & 12220-225

b) The auction remains weak below 12120 and could fall to 12105-092* / 12050-044 & 12020-012*

c) Above 12225, NF can probe higher to 12245-260 / 12282* & 12297-309*

d) Below 12012 auction can move lower to 11995-982 / 11960-642 & 11922*

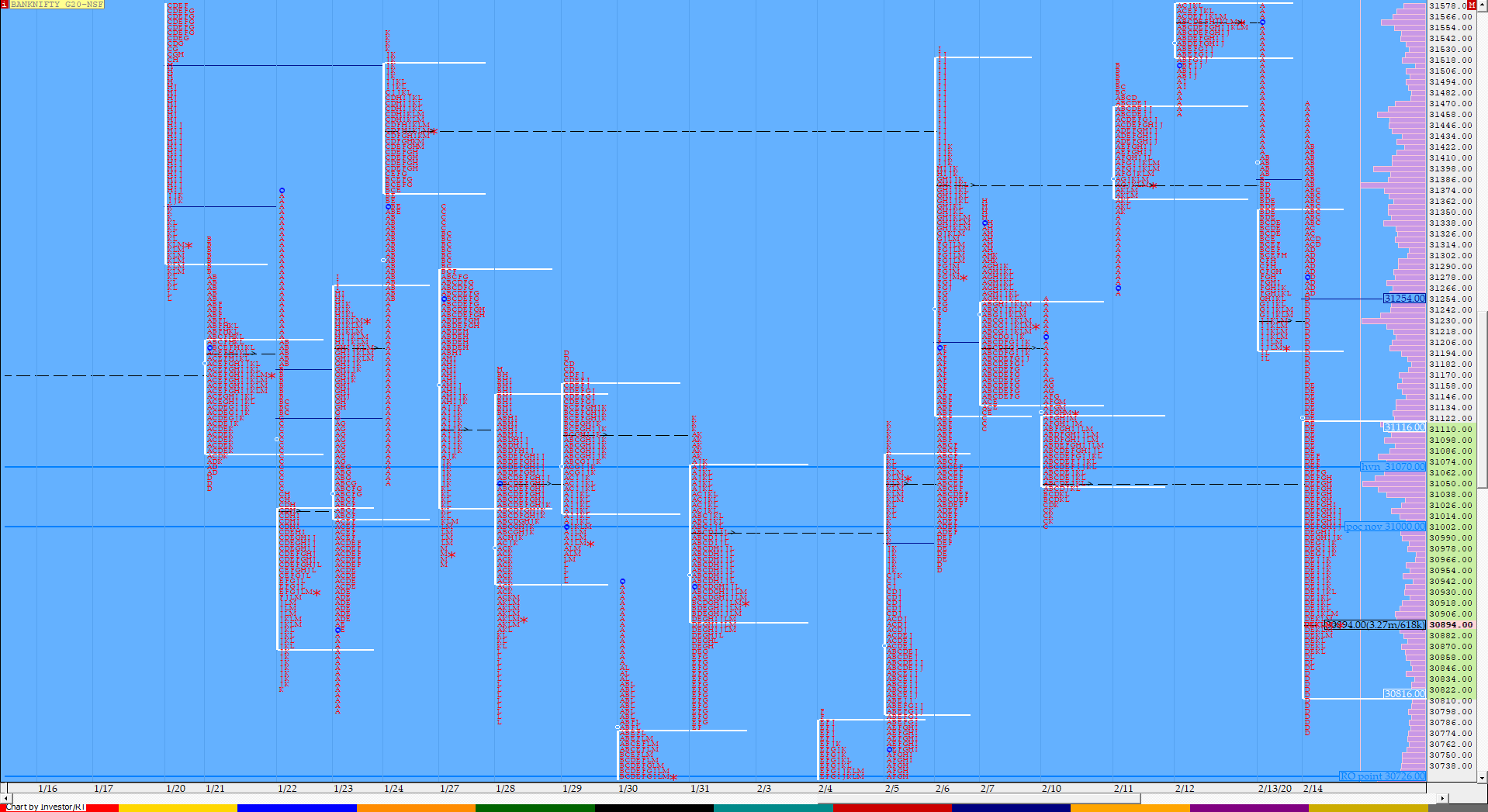

BankNifty Feb F: 30902 [ 31470 / 30774 ]

HVNs – 30355 / 30720 / 30800 / 30900 / 31060 / 31160 / 31200-230 / 31385 / 31460 / 31565

Previous day’s report ended with this ‘On the upside, the PBHs (Pull Back High) of 31266 / 31305 & 31380 would be the levels to watch apart from the big selling tail from 31414 to 31580 and on the downside, BNF would get weaker below 31200 for a test of the next HVN at 31050 & below it the FA of 30956 which is currently on ‘T+6’ Days. ‘

BNF opened higher & was accepted above the PBH of 31266 which led to a short covering move higher in the A period as it made highs of 31470 but broke below VWAP as soon as the ‘B’ period started which was a very bearish sign and a signal that the lows of the day could be tested. The auction then made a big RE to the downside in the D period leaving an extension handle at 31260 and not only did it break below the PDL of 31189 but went on to complete the 3 IB objective of 30839 inside the 30 minutes while making lows of 30774. BNF then made a VWAP test in the E period and was rejected at 31159 after which it made a slow OTF move to the downside for the rest of the day but stayed within the range of the ‘D’ period and closed around the dPOC of 30894 leaving a DD profile for the day with singles at 31159 to 31260 in the middle of the profile which also has a small buying tail from 30850 to 30774 at lows which could act as support in the coming session(s).

- The BNF Open was an Open Drive (Up) (OD) which failed

- The day type was a Double Distribution Trend Day – Down ((DD) )

- Largest volume was traded at 30894 F

- Vwap of the session was at 31067 with volumes of 40.4 L and range of 696 points as it made a High-Low of 31470-30774

- The 14th Feb VWAP of 31067 will be the immediate reference on any upside.

- BNF confirmed a multi-day FA at 31004 on 07/02 and tagged the 1 ATR move of 31487. The 2 ATR objective comes to 31963. This FA got tagged on 14/02 which was the ‘T+4‘ Days.

- BNF confirmed the 4th FA of this series in 6 sessions at 30956 on 06/02 and tagged the 1 ATR objective of 31453 on the same day. The 2 ATR move from this FA comes to 31950. This FA got tagged on 14/02 which was the ‘T+6‘ Days.

- BNF confirmed the third FA of this series in 5 sessions at 30631 on 05/02 and tagged the 2 ATR objective of 31600 on 11/02. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30830-30894-31127

Hypos / Estimates for the next session:

a) BNF needs to sustain above 30932 for a rise to 30992-31010 / 31062-067 / 31126-140 & 31190-233

b) The auction remains below below 30900 and could fall to 30845-800 / 30720 / 30655-645 & 30616-585

c) Above 31233, BNF can probe higher to 31272 / 31321-355 / 31394-424 / 31470-500 & 31565

d) Below 30585, lower levels of 30500-475 / 30410-388 / 30338-313* & 30285-237 could be tagged

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout