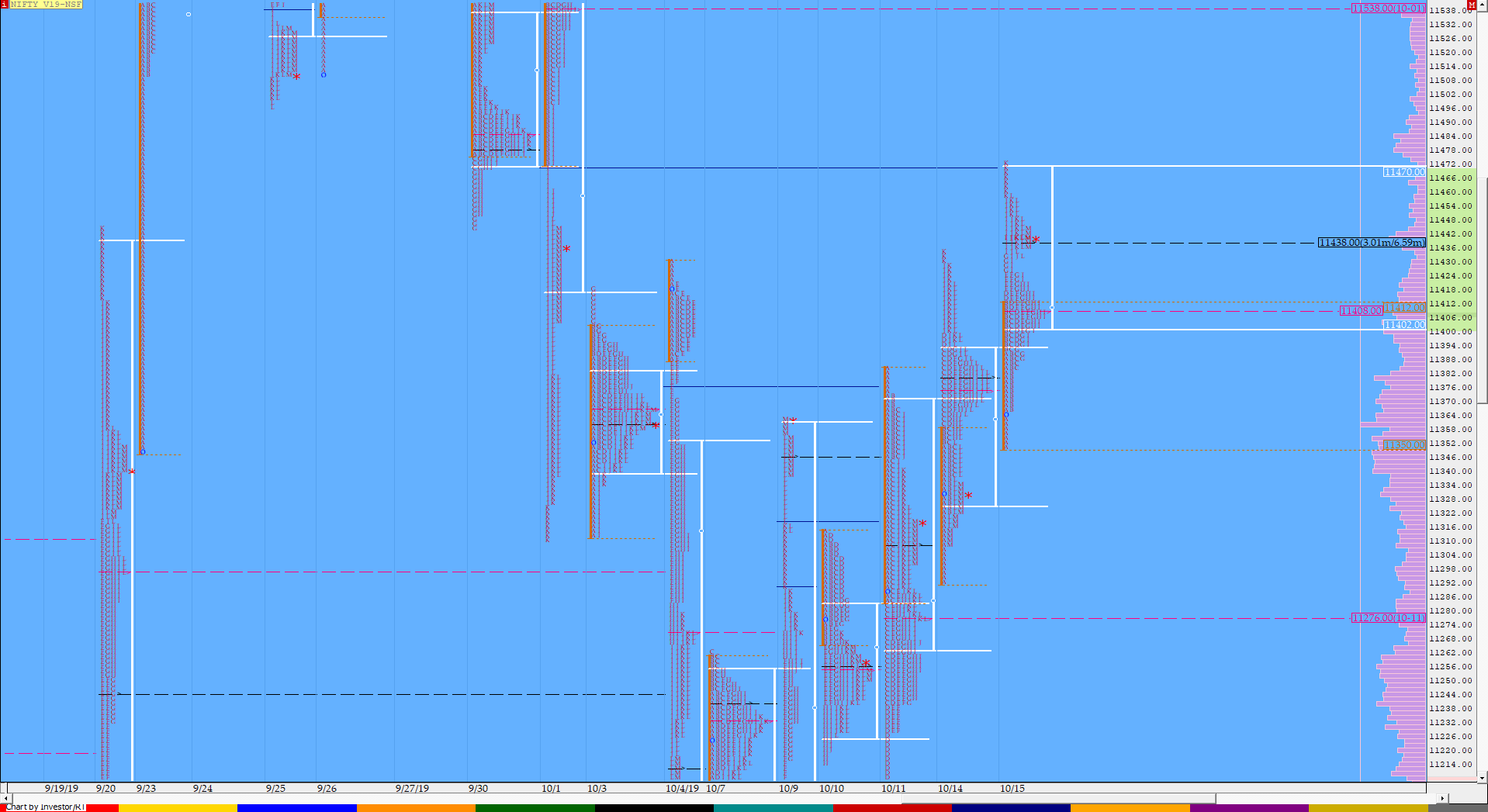

Nifty Oct F: 11439 [ 11474/ 11350 ]

HVNs – 11155 / 11250-253 / (11276) / 11330 / 11380-395 / [11410] / 11440 / 11480 / 11550

NF gave yet another OAIR start but opened with a small gap up & probed higher leaving singles from 11366 to 11336 in the IB to gain acceptance above the important level of 11380 as it made highs of 11413 in the ‘B’ period. The auction continued to make a slow probe higher making multiple REs (Range Extension) till the ‘G’ period but could only extend the range by a mere 20 points as it made new highs of 11433 stalling exactly at the PDH (Previous Day High) after which it gave a dip to VWAP which was defended as NF left a pull back low at 11388 just above the yPOC of 11380 indicating that the PLR is still to the upside. The ‘I’ period then made a fresh RE to the upside followed by highers highs in the next 2 periods as NF tagged new highs of 11473 falling just short of the 2 IB objective. NF then gave a retracement to PDH where it took support to close the day at 11440 which by close had the largest volumes for the day so would be the important reference for the next session. Value for the day was completely higher and for the upside probe to continue, NF will need to stay above 11440 and then take out the higher HVN of 11480 for a move towards the vPOC of 11538. On the downside 11420 would be the immediate support below which 11380 could be tested.

(Click here to view how NF Oct series from start of new series)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (2 IB)

- Largest volume was traded at 11440 F

- Vwap of the session was at 11416 with volumes of 102.4 L and range of 123 points as it made a High-Low of 11473-11350

- NF confirmed a FA at 11113 on 09/10 and completed the 1 ATR move up of 11309. The 2 ATR objective comes to 11505. This FA is currently on ‘T+5’ Days

- The Trend Day VWAP of 09/10 at 11224 will be important support and this held on 10/10 as well as on 11/10

- The higher Trend Day VWAP of 05/07 at 11965 is an important reference higher.

- The settlement day Roll Over point (Oct) is 11630

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11400-11440-11469

Hypos / Estimates for the next session:

a) Sustaining above 11440, NF can probe higher to 11466-480 / 11495-510 & 11529-538*

b) Immeidate support is at 11430-420 below which the auction could test 11395-380 / 11360 & 11340-330

c) Above 11538, NF can probe higher to 11550-565 / 11590 & 11610-615

d) Below 11330, auction becomes weak for 11310 / 11285-267 & 11250*-245

e) If 11615 is taken out, the auction go up to to 11628*-634 / 11660-670 & 11700

f) Break of 11245 can trigger a move lower to 11226-205 / 11185-173 & 11155-150

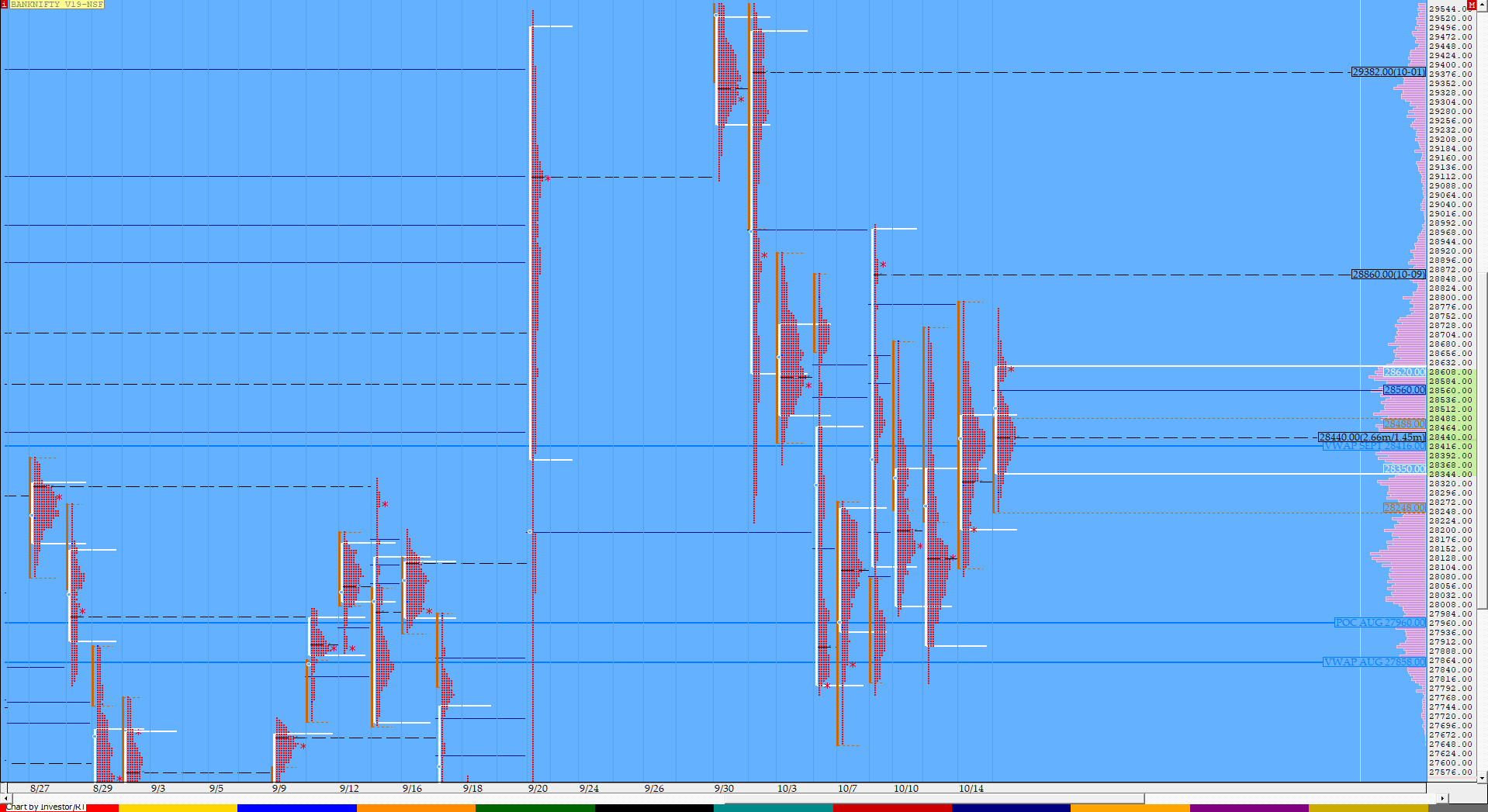

BankNifty Oct F: 28618 [ 28775 / 28251 ]

HVNs – 28025 / 28130 / 28330 / 28430 / 28625 / 28860 / 29350-382

BNF also opened with a small gap up and retained a small buying tail at lows from 28284 to 28210 as it probed above the yPOC of 28410 while making a high of 28490 in the IB. The auction then made multiple REs higher in the ‘D’, ‘E’ & ‘G’ period but could only extend the range by 54 points and the need to look for buyers then brought in a dip to VWAP where BNF left a PBL (Pull Back Low) at 28322 which led to a fresh RE in the ‘I’ period followed by an extension handle at 28555 as BNF trended higher till the ‘K’ period making new highs of 28775 stalling just below previous day’s freak high of 28790 where it was swiftly rejected as it left a selling tail from 28775 to 28689 before closing the day at 28619. Value for the day was higher but on a larger time frame, BNF has been making a composite since the day it moved lower on 1st Oct via a DD Trend Day Down and the 8-day composite can be viewed at the link given below.

(Click here to view the 8-day composite in BNF)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up

- Largest volume was traded at 28450 F

- Vwap of the session was at 28481 with volumes of 42.6 L and range of 524 points as it made a High-Low of 28775-28251

- BNF confirmed a FA at 27774 on 09/10 and completed the 1 ATR move up of 28713. The 2 ATR objective comes to 29653. This FA is currently on ‘T+5’ Days

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Oct) is 30230

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 28290-28450-28602

Hypos / Estimates for the next session:

a) BNF needs to sustain above 28625 for a rise to 28690 / 28740-750 / 28805 & 28875-900

b) Immeidate support is at 28575-555 below which the auction could test 28480-430 / 28370 & 27330-320

c) Above 28900, BNF can probe higher to 28954-990 / 29069 & 29140-167

d) Below 28320, lower levels of 28284-250 / 28190-130 & 28083 could come into play

e) Sustaining above 29167, BNF can give a fresh move up to 29222-283 / 29350-382 & 29445-460

f) Break of 28083 could trigger a move down 28035-25 / 27970 & 27900-880

Additional Hypos

g) Above 29460, higher levels of 29525 / 29653 & 29725-735 could get tagged

h) If 27880 is broken, BNF could fall to 27840 / 27774 & 27675-650

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout