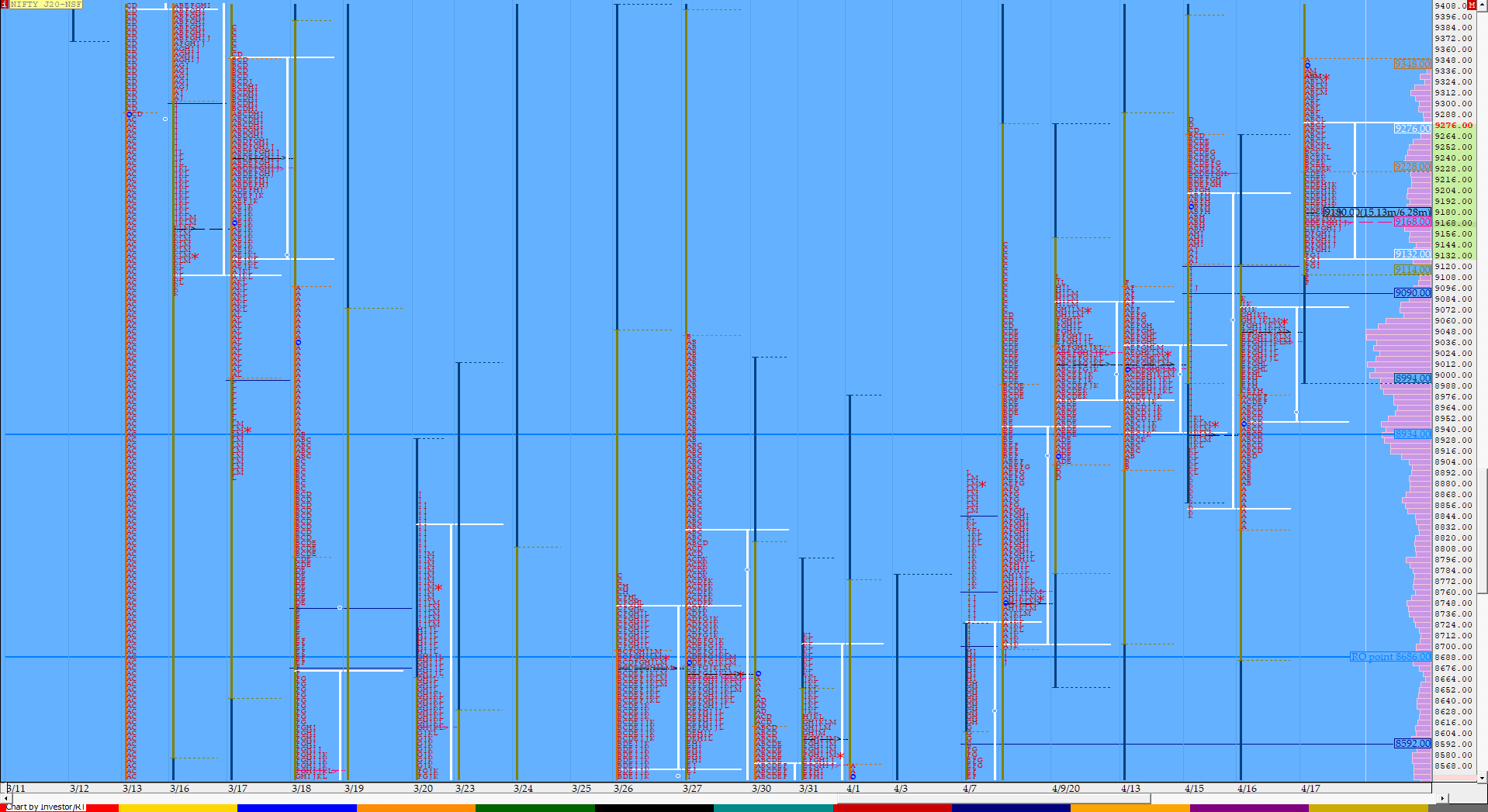

Nifty Apr F: 9311 [ 9350 / 9105 ]

HVNs – 8555 / 8604 / 8670 / 8750 / 8800 / 8937 / 9015 / 9051 / 9180 / 9212 / 9310

NF opened with a big gap up of 310 points as it moved away from the 3-day balance but was also almost an OH (Open=High) start at 9350 just below the positional supply point of 9384 which indicated that the auction got too stretched on the upside and this led to a OTF (One Time Frame) move lower for the first half of the day as NF made multiple REs (Range Extension) as it made lows of 9105 in the ‘F’ period completing the 2 IB objective and taking support just above that important reference of 9095 which it had failed to tag the previous day. The auction then started to form a balance below VWAP for the next 4 periods forming a ‘b’ shape profile for the day but had left a small buying tail at lows & had not closed the gap after which there was a move above VWAP in the ‘K’ period which suggested new initiative demand coming in as NF spiked higher into the close almost tagging the day highs as it hit 9340 before closing the day at 9311. NF is at a crucial zone here & could give a big move away in either direction as we get closer to this month’s expiry. On the upside, the FA of 9384 would be the level to be taken out & sustained to confirm a new leg higher and on the downside, 9270-35 & 9210 would be the important support levels to watch which if broken could get new initiative selling to take NF lower in the coming days.

- The NF Open was a Open Auction Out of Range (OAOR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 9180 F

- Vwap of the session was at 9212 with volumes of 225 L and range of 245 points as it made a High-Low of 9350-9105

- NF confirmed a FA at 9282 on 15/04 and the 1 ATR target comes to 8808. This FA got negated on 17/04 and is no longer a valid reference.

- NF had confirmed a multi-day FA at 8686 on 09/04 and tagged the 1 ATR objective of 9211 on 15/04. The 2 ATR target comes to 9736. This FA is currently on ‘T+6‘ Days.

- NF confirmed a FA at 7521 on 24/03 and tagged the 2 ATR objective of 8595 on 26/03. This FA has not been tagged and is now positional support.

- NF confirmed a FA at 9384 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point.

- The Trend Day VWAP of 8620 would be important support level.

- The settlement day Roll Over point (Apr) is 8686

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9127-9180-9270

Main Hypos for the next session:

a) NF needs to get above 9330 & sustain for a rise to 9358-65 / 9385 / 9412-16 / 9460-80 & 9510

b) Staying below 9310, the auction could test levels of 9290-70 / 9230-12 / 9180-74 / 9127 & 9089

Extended Hypos:

c) Above 9510, NF can probe higher to 9550-70 / 9615 / 9650-80 & 9715-40

d) Below 9089, the auction can fall further to 9035-30 / 9002 / 8985-72 / 8950 / 8920-12 & 8892-75

-Additional Hypos*-

e) Sustaining above 9740* could take NF to 9775-90 / 9850-90 / 9951-60 & 10020-50

f) If 8875* is taken out, NF can start a new leg down to 8840-04 / 8775-45* / 8715-00 & 8667-62

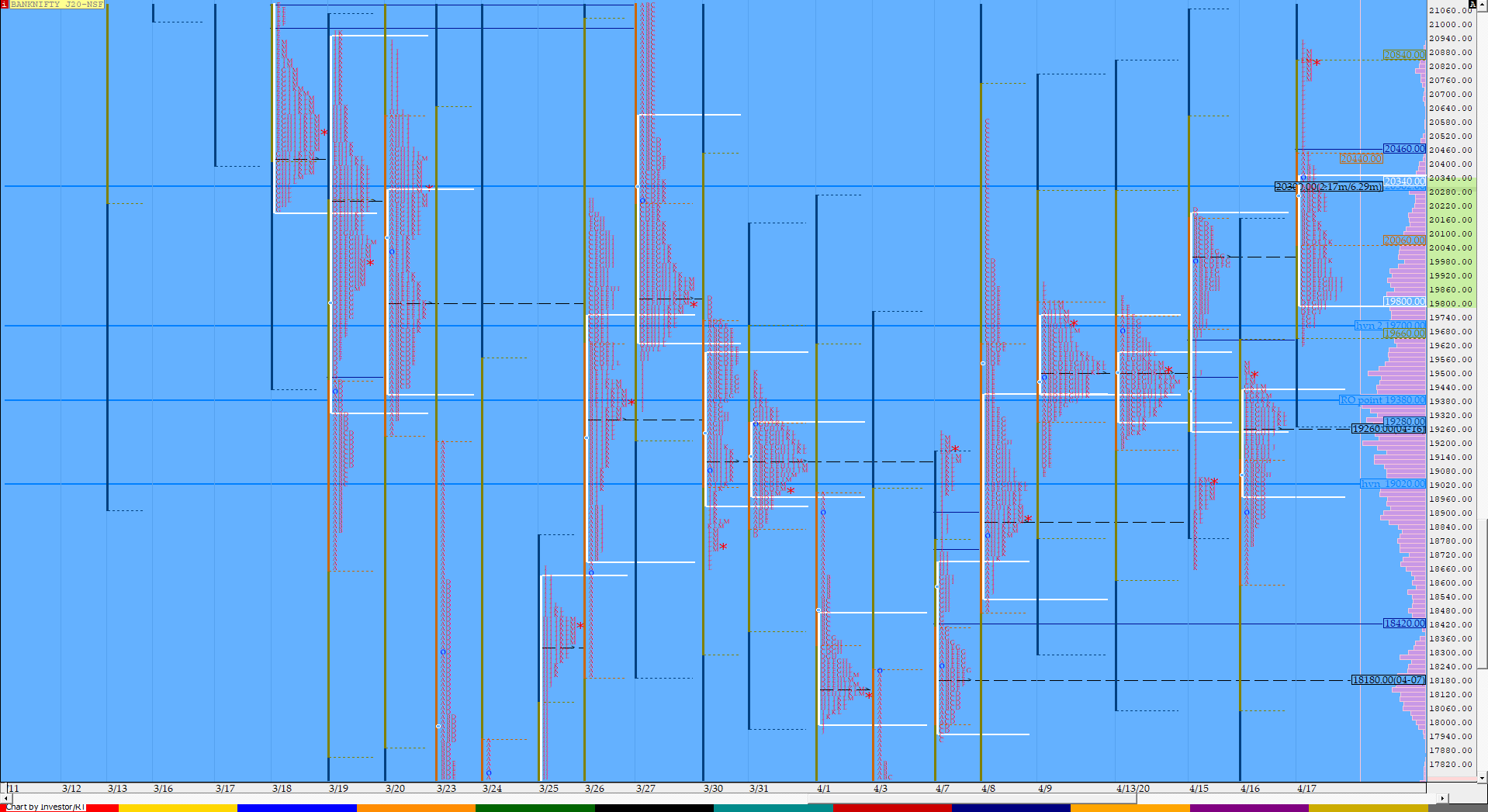

BankNifty Apr F: 20749 [ 20934 / 19624 ]

HVNs – 18790 / 18970 / 19125 / 19270 /19399 / 19500 / 19820 / 19875 / 20000 / 20300

BNF also opened with a big gap up of 926 points negating that FA of 20219 as it made highs of 20452 in the ‘A’ period but similar to NF, started a OTF move lower for the first half of the day as it made lows of 19624 in the ‘F’ period completing the 2 IB objective very soon in the day. The auction then began to form a balance & left a small tail from 19710 to 19624 plus the fact that it remained above PDH (Previous Day High) indicated that there was some demand coming in at the lower levels. BNF then made a move above VWAP in the ‘K’ period and followed it up with a monster spike into the close as it not only made new highs for the day but went on to take out previous week’s high of 20599 to complete a 700 point ‘L’ period as it made highs of 20934 which saw some profit booking coming in as the day closed at 20749 with a Neutral Extreme profile. The reference for the next session would be from 20452 to 20934.

- The BNF Open was a Open Auction Out of Range (OAOR)

- The day type was a Neutral Extreme Day – Up (NeuX)

- Largest volume was traded at 20300 F

- Vwap of the session was at 20055 with volumes of 88.2 L and range of 1310 points as it made a High-Low of 20934-19624

- BNF confirmed a FA at 20219 on 15/04 and completed the 1 ATR objective of 18667 on the same day. The 2 ATR target from this FA comes to 17115. This FA got negated on 17/04 and is no longer a valid reference.

- BNF confirmed a FA at 17921 on 07/04 and tagged the 1 ATR target of 19818 on 08/04. The 2 ATR objective from this FA is at 21715.. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (Apr) is 19380

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19830-20300-20395

Main Hypos for the next session:

a) BNF needs to sustain above 20780 for a rise to 20840-902 / 21000-095 / 21150 / 21250-275 & 21312

b) The auction gets weak below 20700 for a test of 20599 / 20520-452 / 20395-350 / 20300 & 20180-150

Extended Hypos:

c) Above 21312, BNF can probe higher to 21400 / 21460-480 / 21530 / 21600-634 / 21715-750 & 21822-842

d) Below 20150, lower levels of 20055 / 19950 / 19875-830 / 19755-710 & 19555 could come into play

-Additional Hypos*-

e) BNF sustaining above 21842* could start a new leg up to 21910 / 22000-110 / 22200 / 22350-380 & 22423-448

f) If 19555* is taken out, BNF could fall further to 19460 / 19399-375 / 19325-260* / 19185-130 & 19065-028

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout