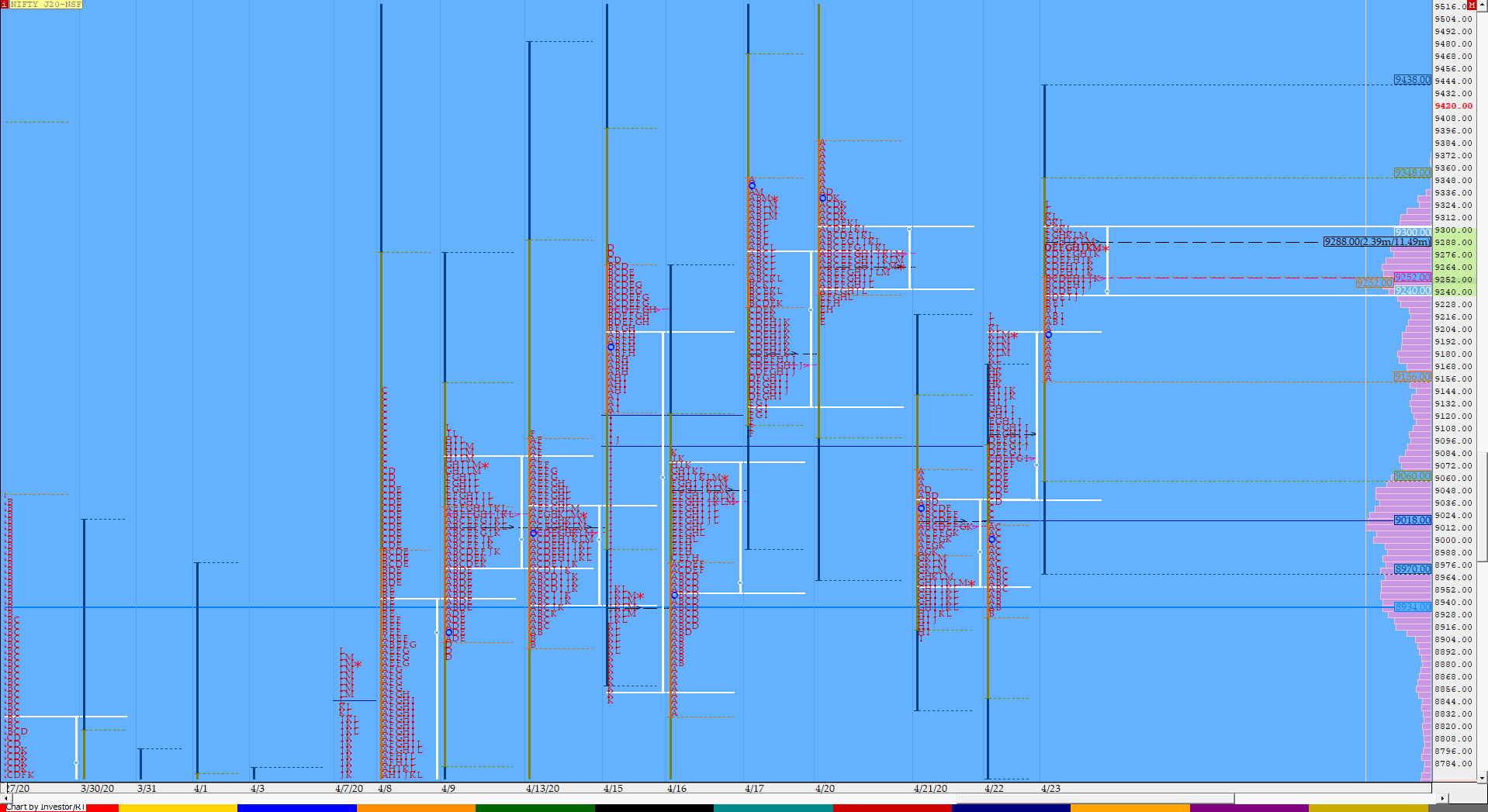

Nifty Apr F: 9297 [ 9329 / 9158 ]

HVNs – 8555 / 8604 / 8670 / 8750 / 8800 / 8937 / 9018 / 9051 / 9102 / 9187 / 9265-88 / 9310

Previous day’s report ended with this ‘the auction is critically placed just below the Gaussian profile of Monday which has a prominent POC at 9276 which could act as a magnet if NF gets above 9228 in the next session. On the downside, the second extension handle of 9163 would be the immediate support‘

NF gave yet another OAIR start and tested the extension handle of 9163 where it got swiftly rejected after making a low of 9158 which set up the PLR (Path of Least Resistance) to the upside after which the auction probed higher making an OTF (One Time Frame) move till the ‘G’ period as it not only tagged the prominent POC of 9276 but went on to complete the 1.5 IB objective of 9303 while making a high of 9310. NF then gave a sharp dip breaking below VWAP in the afternoon as it made lows of 9210 taking support right at the morning ‘A’ period buying tail which meant that the demand was still present in this zone. The auction then went on to make new highs of 9328 in the ‘L’ period but could not sustain the spike as it closed around the dPOC of 9289 leaving yet another ‘p’ shape profile on the daily.

- The NF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (‘p’ shape profile)

- Largest volume was traded at 9288 F

- Vwap of the session was at 9262 with volumes of 155.5 L and range of 169 points as it made a High-Low of 9328-9158

- NF had confirmed a multi-day FA at 8686 on 09/04 and tagged the 1 ATR objective of 9211 on 15/04. The 2 ATR target comes to 9736. This FA has not been tagged & is now important support.

- NF confirmed a FA at 7521 on 24/03 and tagged the 2 ATR objective of 8595 on 26/03. This FA has not been tagged and is now positional support.

- NF confirmed a FA at 9384 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point. This FA was tagged on 20/04 but was immediately rejected from there so still holds as an important reference.

- The Trend Day VWAP of 8620 would be important support level.

- The settlement day Roll Over point (Apr) is 8686

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9237-9289-9300

Main Hypos for the next session:

a) NF has immediate supply at 9308 above which it could rise to 9321-37 / 9365-85 / 9412-16 / 9460-80 & 9510

b) The auction gets weak below 9288 for a test of 9262-37 / 9210-9191 / 9163-58 / 9144-28 & 9102*-9085

Extended Hypos:

c) Above 9510, NF can probe higher to 9550-80 / 9615 / 9650-80 & 9715

d) Below 9085, the auction can fall further to 9056-41 / 9016-13 / 8986-62 / 8925 & 8892-75

-Additional Hypos*-

e) Sustaining above 9715* could take NF to 9740 / 9775-90 / 9850 / 9890 & 9920

f) If 8875* is taken out, NF can start a new leg down to 8840-28 / 8808-04 / 8775-36 / 8700 & 8667-62

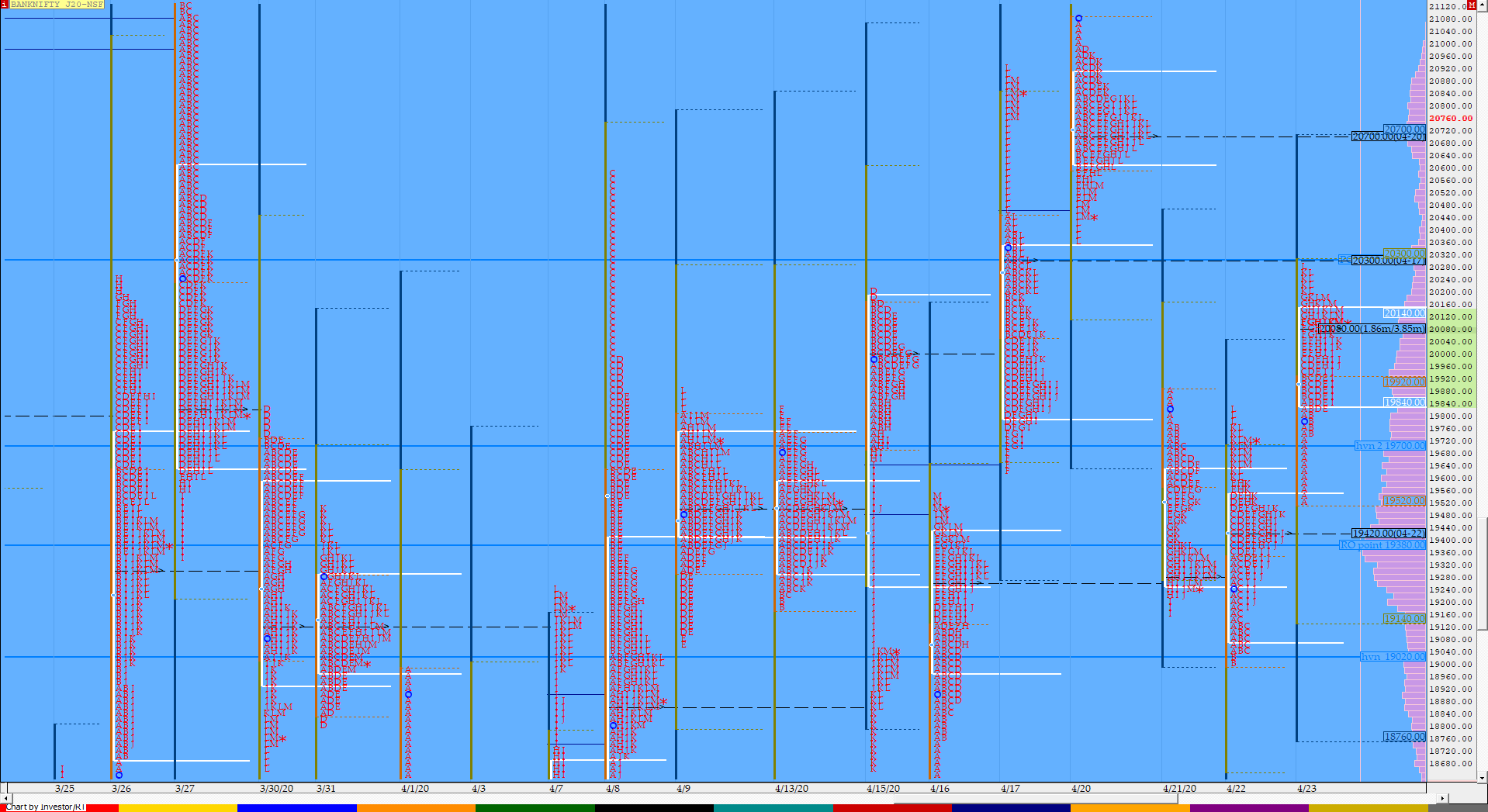

BankNifty Apr F: 19677 [ 19838 / 19002 ]

HVNs – 18790 / 18970 / 19125 / 19280 / 19440 / 19820 / 19875 / 20000 / 20300 / 20700

Report to be updated...

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (‘p’ shape profile)

- Largest volume was traded at 20080 F

- Vwap of the session was at 20003 with volumes of 61.4 L and range of 760 points as it made a High-Low of 20300-19540

- BNF confirmed a FA at 17921 on 07/04 and tagged the 1 ATR target of 19818 on 08/04. The 2 ATR objective from this FA is at 21715.. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (Apr) is 19380

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19840-20080-20140

Main Hypos for the next session:

a) BNF has immediate supply at 20196 above which it could rise to 20232-286 / 20374-395 / 20456 / 20517-550 & 20620-690

b) The auction staying below 20140 could test levels of 20080-003 / 19944-927 / 19870-825 / 19764-732 & 19635-620

Extended Hypos:

c) Above 20690, BNF can probe higher to 20730-800 / 20880-916 / 21000 / 21095-150 & 21250-275

d) Below 19620, lower levels of 19575 / 19510-483 / 19420-358 / 19260-230 & 19184-125 could come into play

-Additional Hypos*-

e) BNF sustaining above 21275* could start a new leg up to 21312-400 / 21460-480 / 21530-574 / 21634 & 21715-750

f) If 19125* is taken out, BNF could fall further to 19044 / 18970-905 / 18770-700 / 18660-650 & 18570

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout