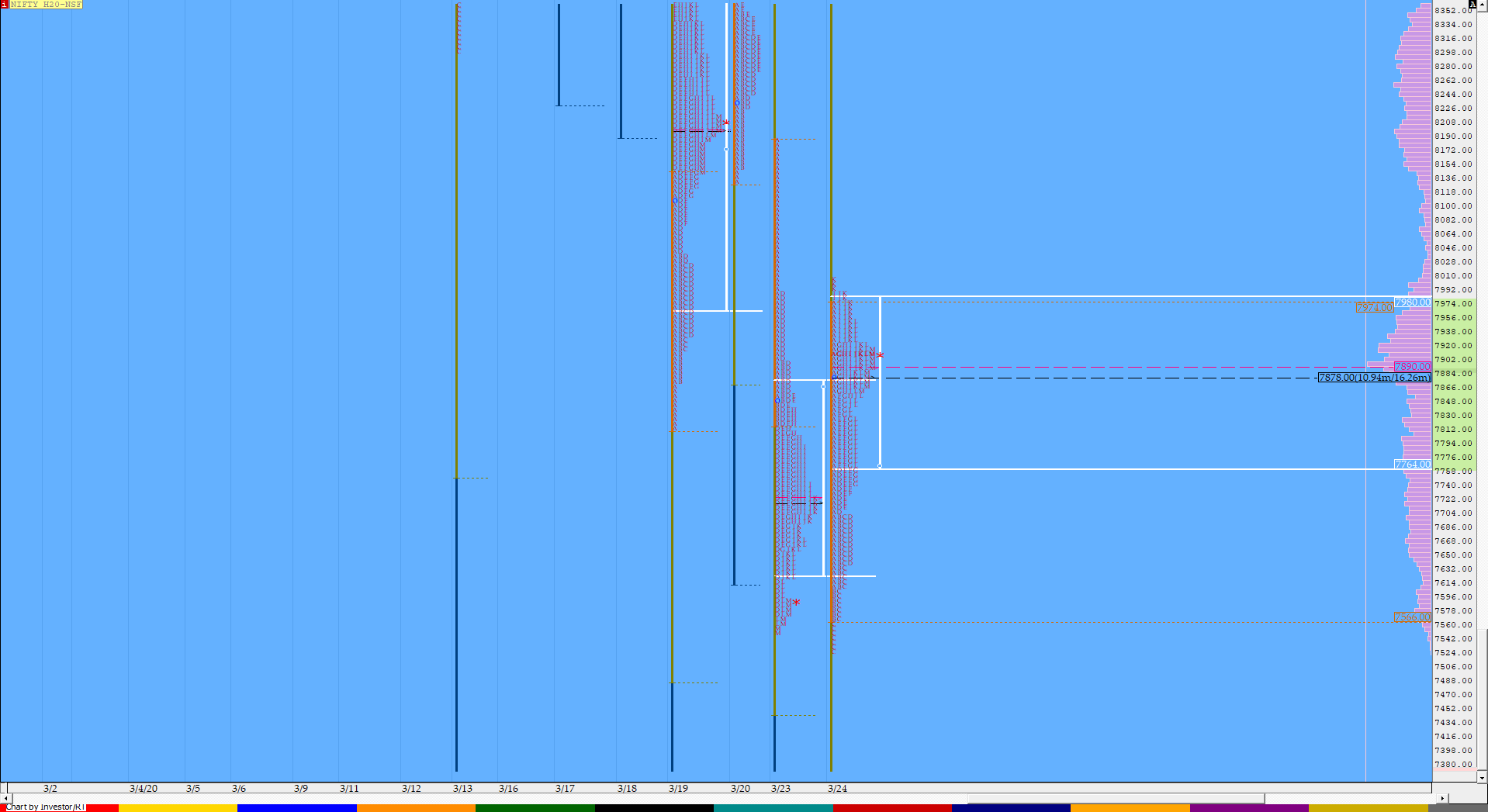

Nifty Mar F: 7850 [ 8008 / 7526 ]

HVNs – (7580) / 7719 / (7820) / 7880-7892 / (7920) / 8196 / 8280 / 8568 / 8740

NF tested Monday’s selling tail of 7989-8189 and got rejected but has also left an FA at new lows at 7526 forming a 2-day composite with the POC around 7900 & could give a move away from here in the coming session. Click here to view the composite.

- The NF Open was a Open Auction Out In Range (OAIR)

- The day type was a Neutral Centre Day (NeuD)

- Largest volume was traded at 7900 F

- Vwap of the session was at 7802 with volumes of 282 L and range of 482 points as it made a High-Low of 8008-7526

- NF confirmed a FA at 7526 on 24/03 and the 1 ATR move comes to 8061.

- NF confirmed a FA at 9358 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA is currently on ‘T+6’ Days

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 7766-7900-7981

Main Hypos for the next session:

a) NF has immediate supply at 7879-7893 above which it could rise to 7920 / 7950-71 / 7998-8007 / 8061-90 / 8130 & 8175-89

b) The auction turns weak below 7820 and could fall to 7800 / 7775-64 / 7735-01 / 7666-625 / 7575-70 & 7526

Extended Hypos:

c) Above 8189, NF can probe higher to 8226 / 8260-90 / 8340-60 / 8400 / 8435-50 / 8490-8510 & 8556-68*

d) Below 7526, the auction can move lower to 7485* / 7418-04 / 7370-47* / 7308 / 7268-40 & *7168-59*

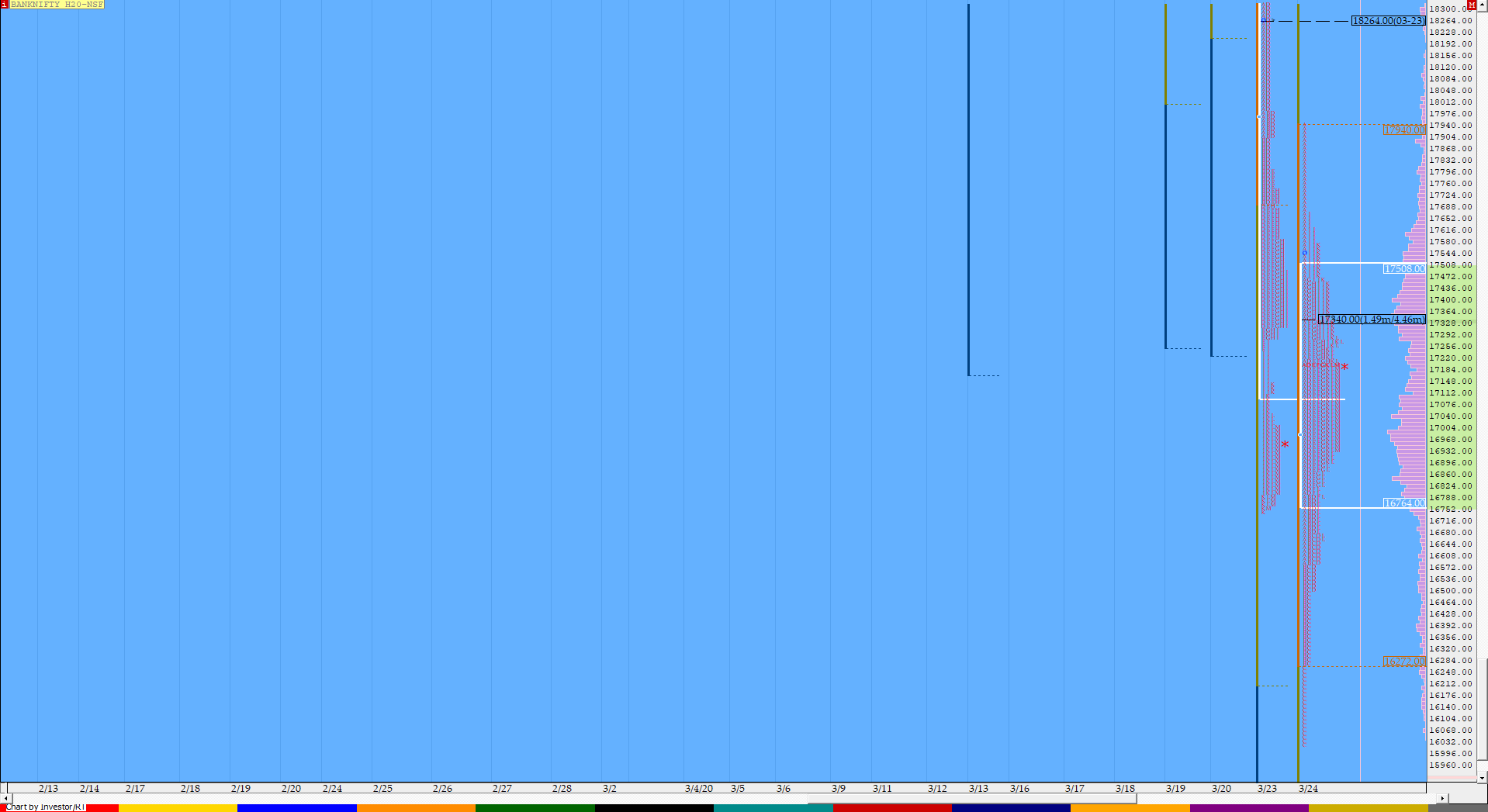

BankNifty Mar F: 16930 [ 17950/ 16020 ]

HVNs – 16900 / 16975 / 17085 / 17355 / (18280) / 18930 / 19550 / 19785 / 19930

BNF also probed higher at open but was swiftly rejected at 17950 as it went on to probe lower making new lows for the week at 16020 via a C-side extension after which it formed a 3-1-3 balanced profile for the day with tails at both ends and an overlapping POC around 17350 which would be the level to watch for acceptance or rejection in the coming session(s). Click here to view the 2-day composite.

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Day (3-1-3 profile)

- Largest volume was traded at 17340 F

- Vwap of the session was at 17025 with volumes of 60.6 L and range of 1929 points as it made a High-Low of 17950-16020

- The Trend Day VWAP of 18/03 at 20990 will be an important positional supply point in the days to come.

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 16815-17340-17535

Main Hypos for the next session:

a) BNF needs to sustain above 16975 for a rise to 17025-85 / 17150-200 / 17275 / 17355 / 17430-500 & 17550-580

b) The auction has immediate support at 16900-880 below which it could probe down to 16785 / 16670-658 / 16600 / 16490 / 16360 & 16275

Extended Hypos:

c) Above 17580, BNF can probe higher to 17630 / 17711-720 / 17810-880 / 17925-950 / 18025 & 18130-200

d) Below 16275, lower levels of 16170 /16110 / 16008 / 15906 /15855 & 15660 could come into play

Additional Hypos*:

e) BNF if gets accepted above 18200* could lead to a rise to 18280-300 / 18435 / 18523-599 / 18790 & 18910-930

f) If 15660* is taken out, the auction can fall to 15555 / 15489-450 / 15325 / 15212 / 15090 & 14950

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout