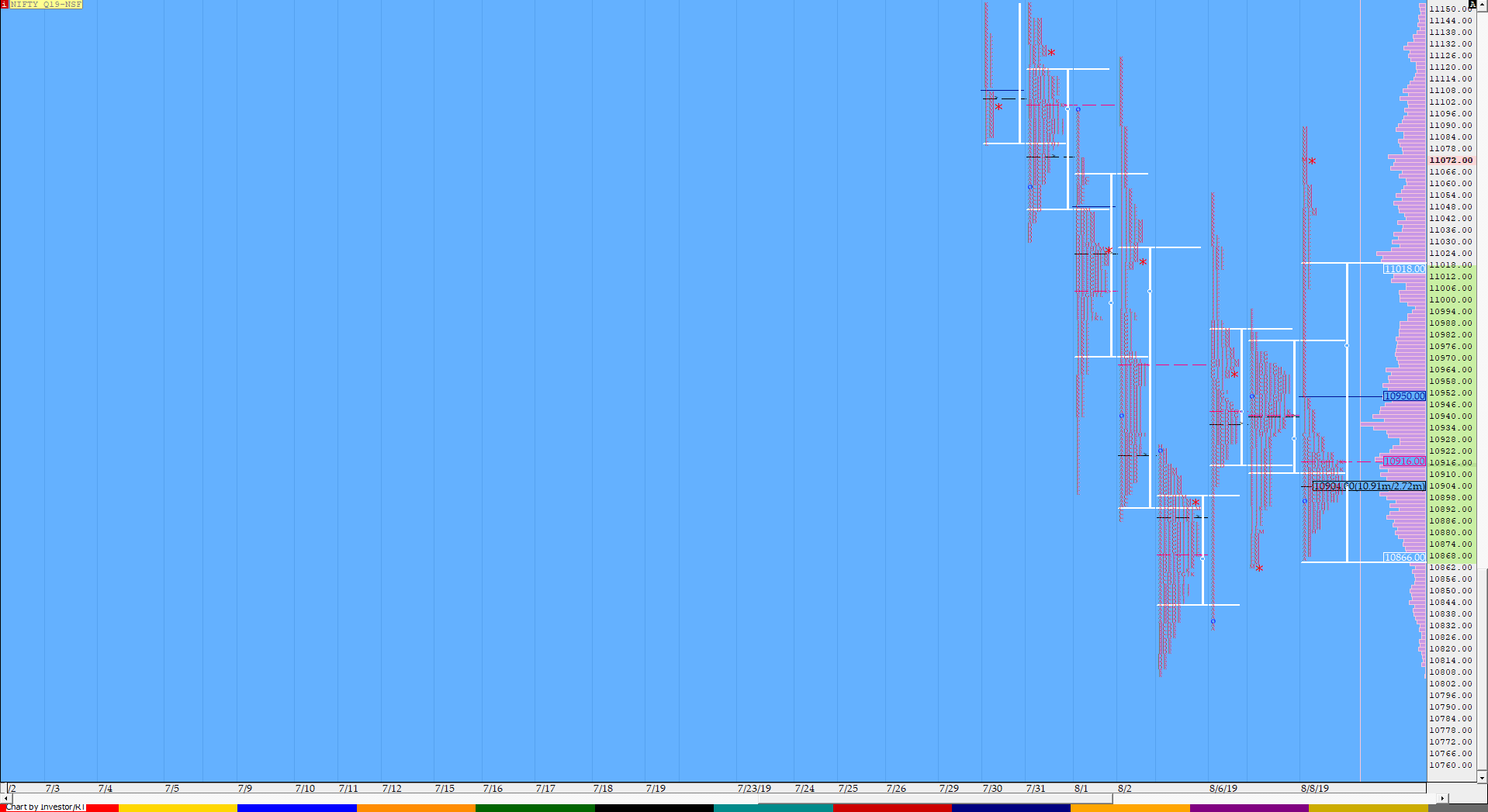

Nifty Aug F: 11104 [ 11133 / 11034 ]

NF had left the biggest day in terms of range (327 points) as well as volumes (213 L) of the August series on Monday (26th Aug) and in Market Profile it always happens that ‘Balance follows Imbalance & vice versa’ so after a hat-trick of big range days, it was only apt that the auction slowed down and took a breather before it gets ready for the next leg as we had the narrowest range of this calendar month at just 99 points. NF opened higher above the PDH of 11072 and probed higher as it tagged 11110 in the opening few minutes but could not get new demand here & reversed the probe to the downside as it made a quick move into the previous day’s range closing the gap as it made a low of 11035 in the A period where it was swiftly rejected as the auction got back above PDH in the B period. NF then made a RE (Range Extension) on the upside in the ‘C’ period but could only extend the morning high by just 10 points after which it gave a dip to VWAP & made similar lows of 11080 in the next 2 periods taking support above the PDH which indicated that another test of day highs could be coming. The auction then made a fresh day high in the ‘G’ period as it tagged 11130 but once again was unable to sustain the new highs which led to a quick fall over the next 2 periods as it broke below VWAP making lows of 11061 in the ‘I’ period taking support right at the composite POC. The ‘J’ period than made an inside bar followed by a mini-imbalance in terms of the day’s auction in the ‘K’ period which made an outside bar giving the second biggest range for the day after the A period as it made marginally new highs of 11133 but once again could not get above the composite VAH of 11139. The last 2 periods made double inside bars to complete a nice Gaussian profile for the day with higher Value and a prominent POC at 11100 and this balance right at the edge of the monthly composite could lead to a fresh move in either direction in the coming session(s). The updated composite chart can be seen here. (Source – MPLite)

- The NF Open was an Open Auction Out of Range (OAOR)

- The day type was a Normal Day (Gaussian Profile)

- Largest volume was traded at 11114 F

- Vwap of the session was at 11093 with volumes of 142.9 L and range of 99 points as it made a High-Low of 11133-11034

- NF confirmed a multi-day FA at 11083 on 21/08 and tagged the 2 ATR objective of 10736 on 22/08. This FA was tagged today at ‘T+5’ Days

- The Trend Day POC & VWAP of 26/08 at 10982 & 10917 would be important references on the downside.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11315

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

- The VWAP & POC of May Series is 11613 & 11696 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11082-11114-11117

Hypos / Estimates for the next session:

a) NF needs to get above 11124 & sustain for further rise to 11145-152 & 11180-186

b) Immediate support is at 11100 below which auction can test 11082 / 11061-56 & 11039-31

c) Above 11186, NF can probe higher to 11205-217 & 11240-248

d) Below 11031, auction becomes weak for 11015-07 / 10980-975 & 10958-950

e) If 11248 is taken out, the auction can rise to 11268-286 & 11306-315

f) Break of 10950 can trigger a move lower to 10930 / 10910-905 & 10890-878

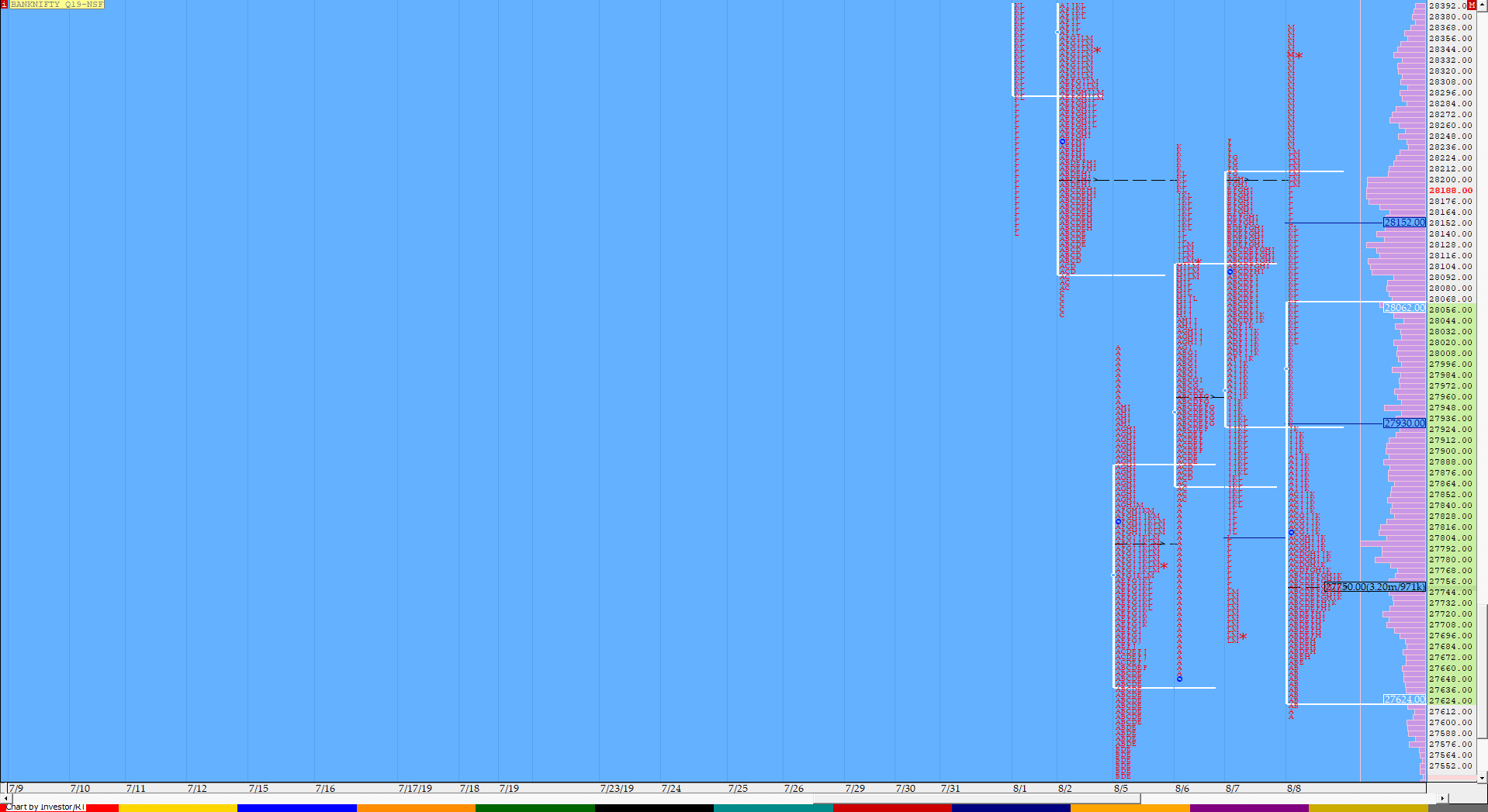

BankNifty Aug F: 28116 [ 28246 / 27917 ]

Yesterday’s report ended with this line ‘BNF closed at the HVN of 27925 well inside the composite & could continue to probe higher for a tag of 28184 & 28270 in the coming session(s)‘

Today, BNF opened with a gap up at 28090 & probed higher as it got above 28184 making a high of 28245 in the opening 10 minutes but lack of new demand meant it could not sustain these new highs as it reversed the probe and went on to close the gap as it made lows of 27917 in the ‘A’ period taking support at this HVN of 27925 after which the auction remained inside this range of 327 points for the entire day leaving a nice Gaussian profile with higher Value and a prominent POC at 28150. This balance has come at the top of the composite from 1st Aug to 21st Aug (click here to view the updated chart) and has a good chance of giving a move away from here in the remaining sessions of this week.

- The BNF Open was an Open Auction Out of Range (OAOR)

- The day type was a Normal Day (Gaussian Profile)

- Largest volume was traded at 28150 F

- Vwap of the session was also at 28091 with volumes of 39.8 L in a session which traded in a range of 329 points making a High-Low of 28246-27917

- The Trend Day VWAP of 26/08 at 27411 would be important reference on the downside.

- The Trend Day VWAP of 19/07 at 30085 is now positional supply point.

- The higher Trend Day VWAP of 18/07 & 08/07 at 30598 & 30995 remain important references going forward

- The settlement day Roll Over point is 29250

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

- The VWAP & POC of May Series 30211 & 28940 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 28005-28150-28164

Hypos / Estimates for the next session:

a) BNF needs to sustain above 28152-165 for a move to 28215-225 & 28280-291

b) Staying below 28110-090, the auction can test 28030-012 / 27975-960 & 27915-900

c) Above 28291, BNF can probe higher to 28346-365 / 28410-425 & 28475-485

d) Below 27900, lower levels of 27840 / 27790 & 27744-723 could come into play

e) Sustaining above 28485, BNF can give a fresh move up to 28550-596 & 28655-675

f) Break of 27723 could trigger a move down 27680-675 / 27624-604 & 27560

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout