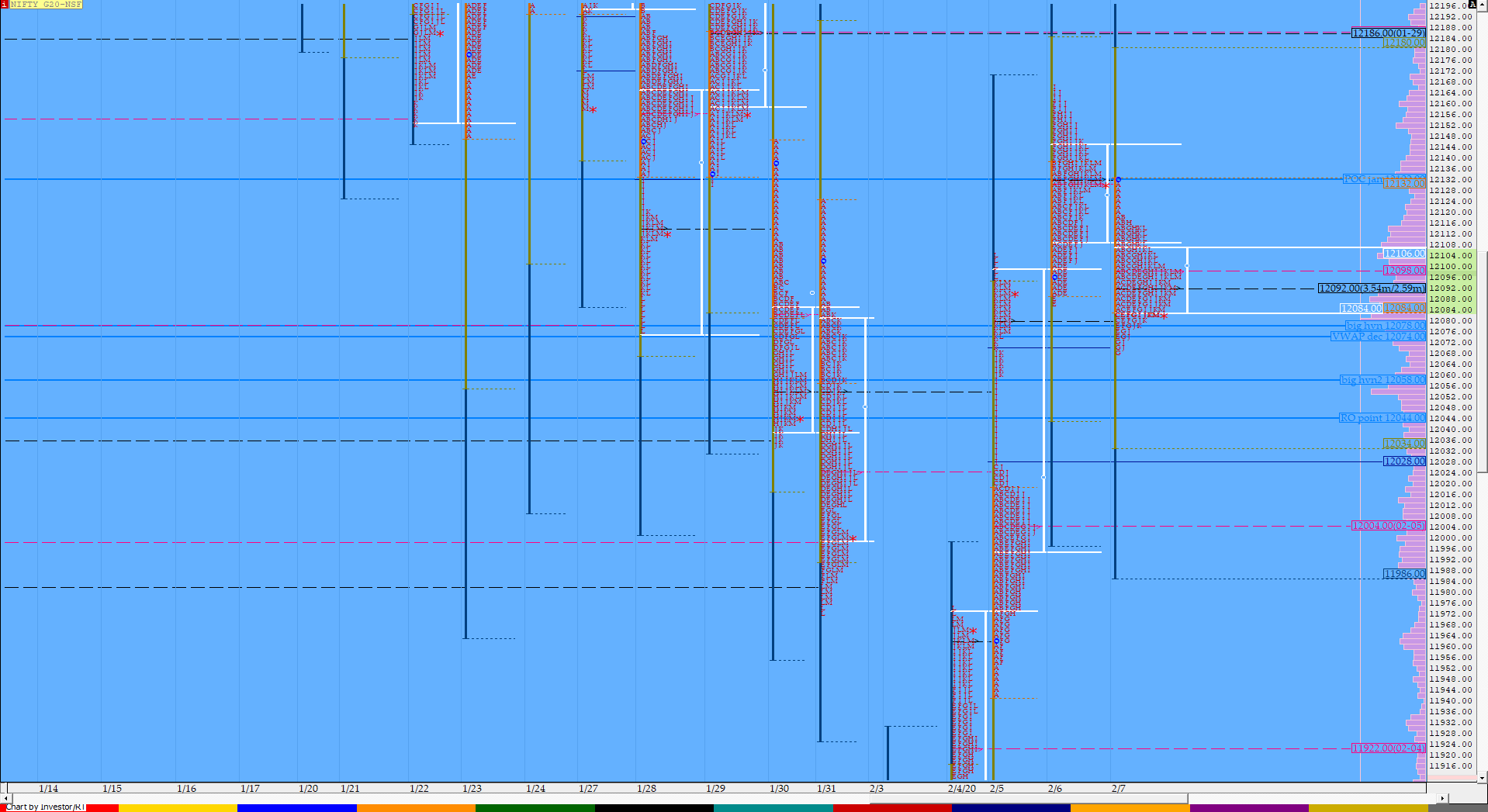

Nifty Feb F: 12096 [ 12132 / 12068 ]

HVNs – 11635 / 11685 / (11803) / 11932 / 11965-978 / 12012 / 12090-95 / 12132

NF continued to form a balance as it left the narrowest range as well as volumes of this series at just 64 points & 66.4 L forming a nice Gaussian profile for the day and looks set to give a move away from this balance in the coming session.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Day (Gaussian profile)

- Largest volume was traded at 12093 F

- Vwap of the session was at 12096 with volumes of 66.4 L and range of 64 points as it made a High-Low of 12132-12068

- NF confirmed the second FA of this series at 12087 on 06/02 and the 1 ATR objective comes to 12232. This FA got negated on 07/02.

- The 20th Jan Trend Day VWAP of 12336 remains positional supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12084-12093-12107

Hypos / Estimates for the next session:

a) NF needs to sustain above 12096 for a move higher to 12112-116 & 12132*-145

b) Immediate support is at 12077 below which the auction could test 12063-060 / 12043 & 12028

c) Above 12145, NF can probe higher to 12165-170 / 12189* & 12210-215

d) Below 12028 auction gets weak for a test of 12012-003 / 11982 & 11960

e) If 12215 is taken out, the auction go up to to 12230* / 12258 & 12275-285

f) Break of 11960 can trigger a move lower to 11942 / 11922 & 11904

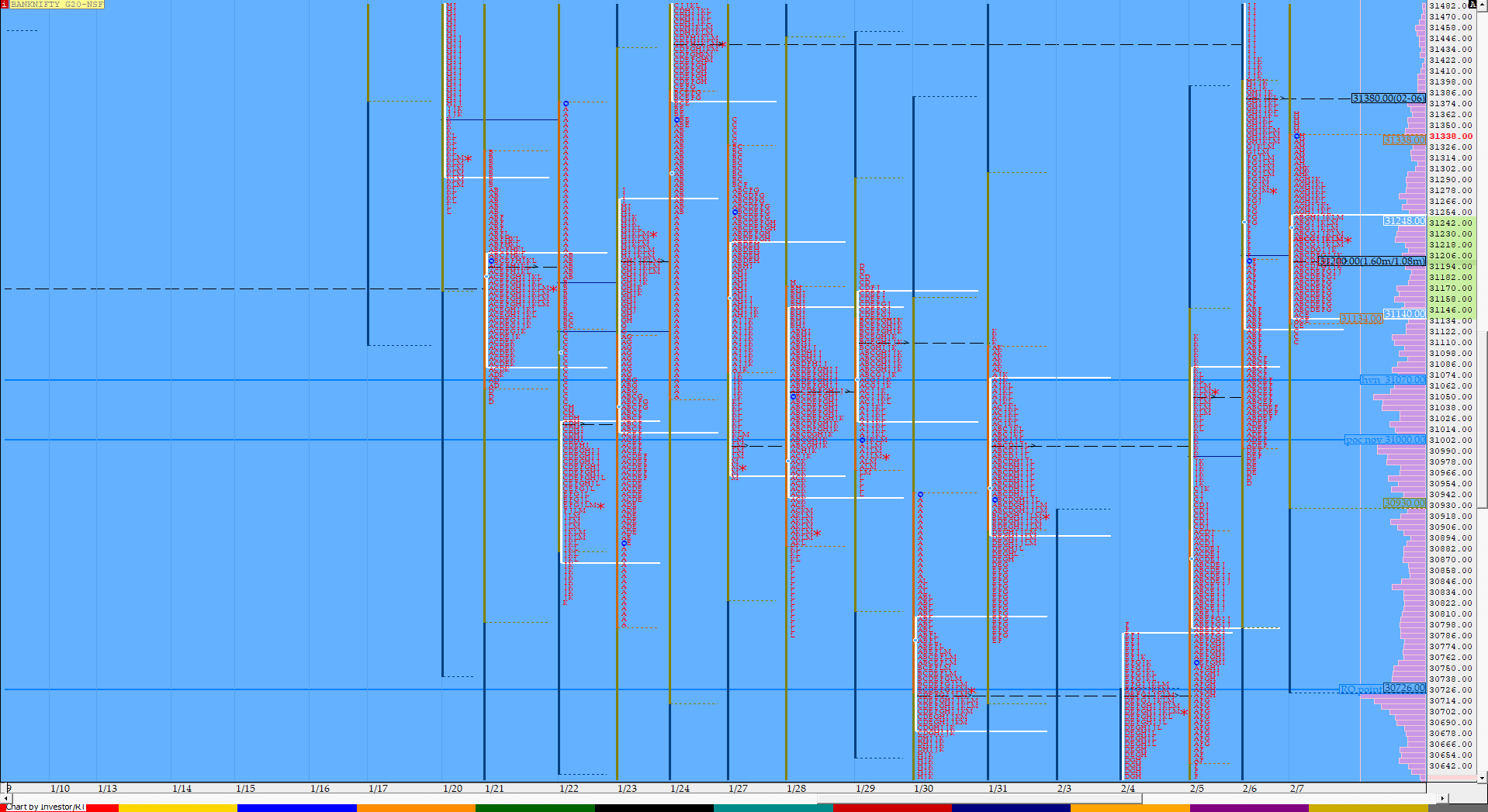

BankNifty Feb F: 31240 [ 31364 / 31110 ]

HVNs – 29900 / (30040) / (30150) / 30355 / 30720 / 30800 / 30870 / 31050 / 31160 / 31200-230 / 31345-380

BNF filled up the low volume zone of previous day’s DD profile with a nice balance making an inside bar on the day as it left confirmed yet another FA at 31110 to leave a second successive Neutral Centre profile with the lowest range & volumes of this series at just 254 points & 28.3 L and similar to NF looks set to give a move away from this balance in the coming session(s).

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 31200 F

- Vwap of the session was at 31214 with volumes of 28.3 L and range of 254 points as it made a High-Low of 31364-31110

- BNF confirmed the 5th FA of this series in 7 sessions at 31110 on 07/02 and 2 ATR move from this FA comes to 31623

- BNF confirmed the 4th FA of this series in 6 sessions at 30956 on 06/02 and tagged the 1 ATR objective of 31453 on the same day. The 2 ATR move from this FA comes to 31950. This FA is currently on ‘T+2‘ Days.

- BNF confirmed the third FA of this series in 5 sessions at 30631 on 05/02 and tagged the 1 ATR objective of 31116 on the same day. The 2 ATR move from this FA comes to 31600. This FA is currently on ‘T+3‘ Days.

- BNF confirmed the first FA of the new series at 31126 on 31/01 and tagged the 2 ATR objective of 30345 on 01/02. This FA was tagged on 06/02 which was the ‘T+5‘th Day

- The 20th Jan Trend Day VWAP of 31500 remains positional supply point.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31157-31200-31260

Hypos / Estimates for the next session:

a) BNF has immediate supply in the zone of 31270-290 above which it could rise to 31364-380* / 31426-472 & 31520

b) The auction would get weak below 31200-188 for a test of 31120-110 / 31050 & 30987-956

c) Above 31520, BNF can probe higher to 31584*-600 / 31650 & 31720

d) Below 30956, lower levels of 30870-855 / 30800 & 30720** could be tagged

e) If 31720 is taken out, BNF can give a fresh move up to 31775-800 / 31850 / 31936-961 & 32040-057

f) Break of 30720 could trigger a move down to 30675-645 / 30616-585 & 30500-475

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout