Mid-week view

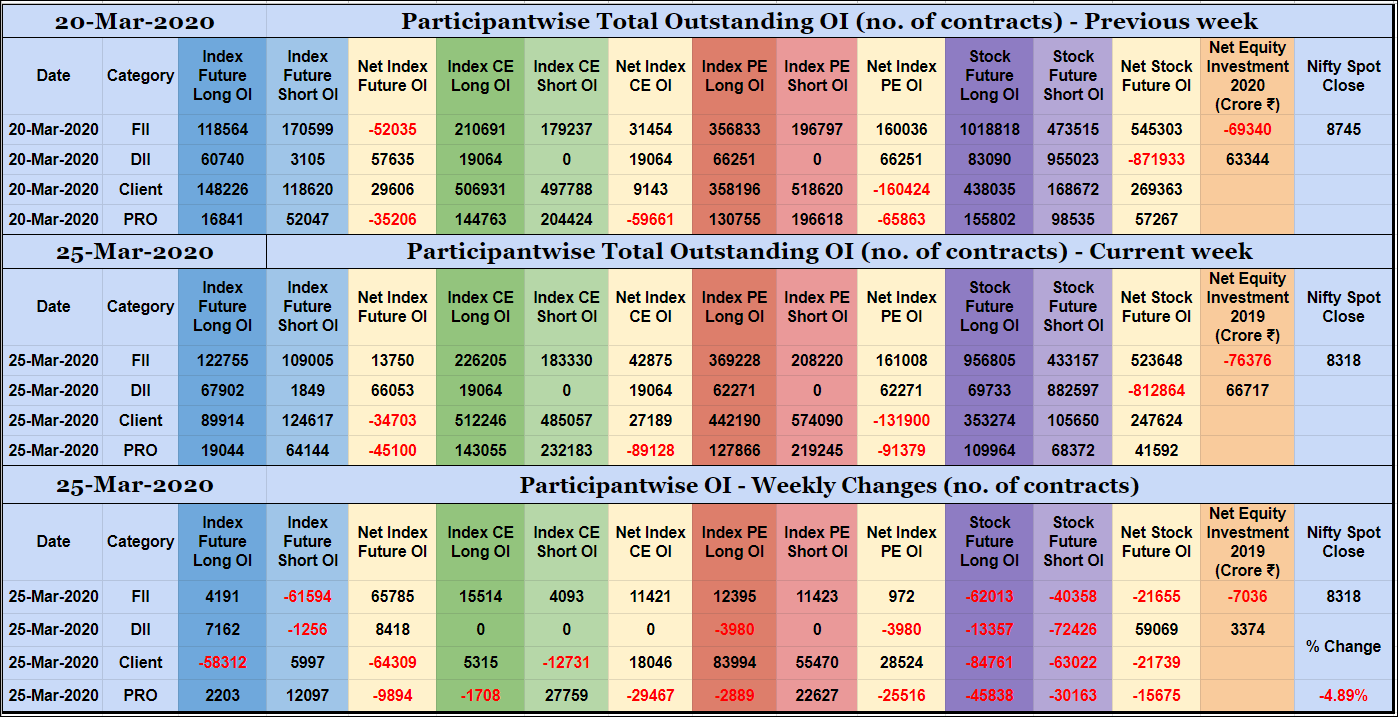

FIIs have added 4K long Index Futures and net 11K long Index CE contracts this week, covered 61K short Index Futures contracts and reduced exposure in Stocks Futures. They have been net sellers in equity segment for ₹7036 crore during the week.

Clients have added 6K short Index Futures, 5K long Index CE and net 28K long Index PE contracts this week, liquidated 58K long Index Futures contracts, covered 12K short Index CE contracts and reduced exposure in Stocks Futures.

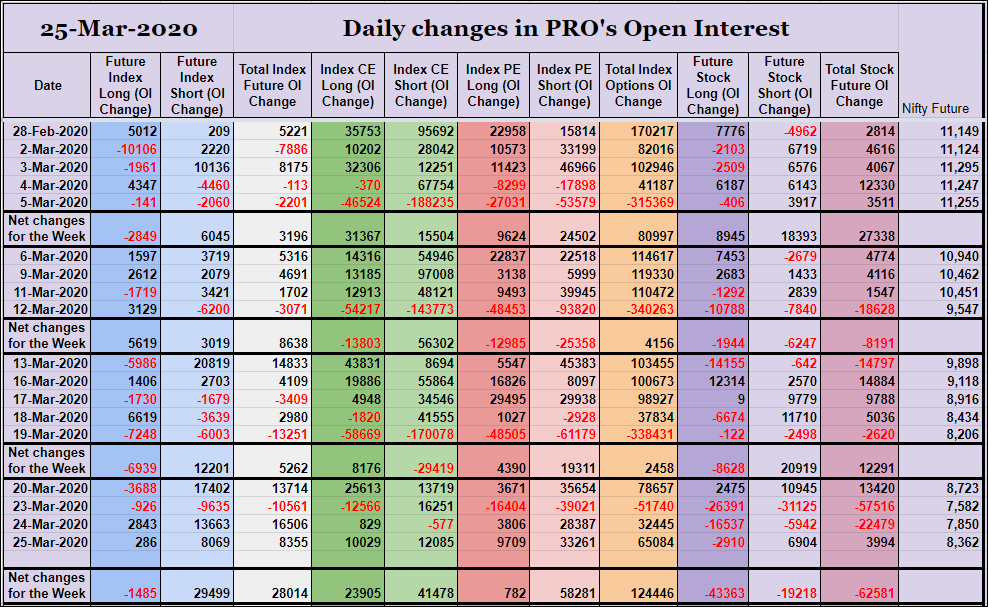

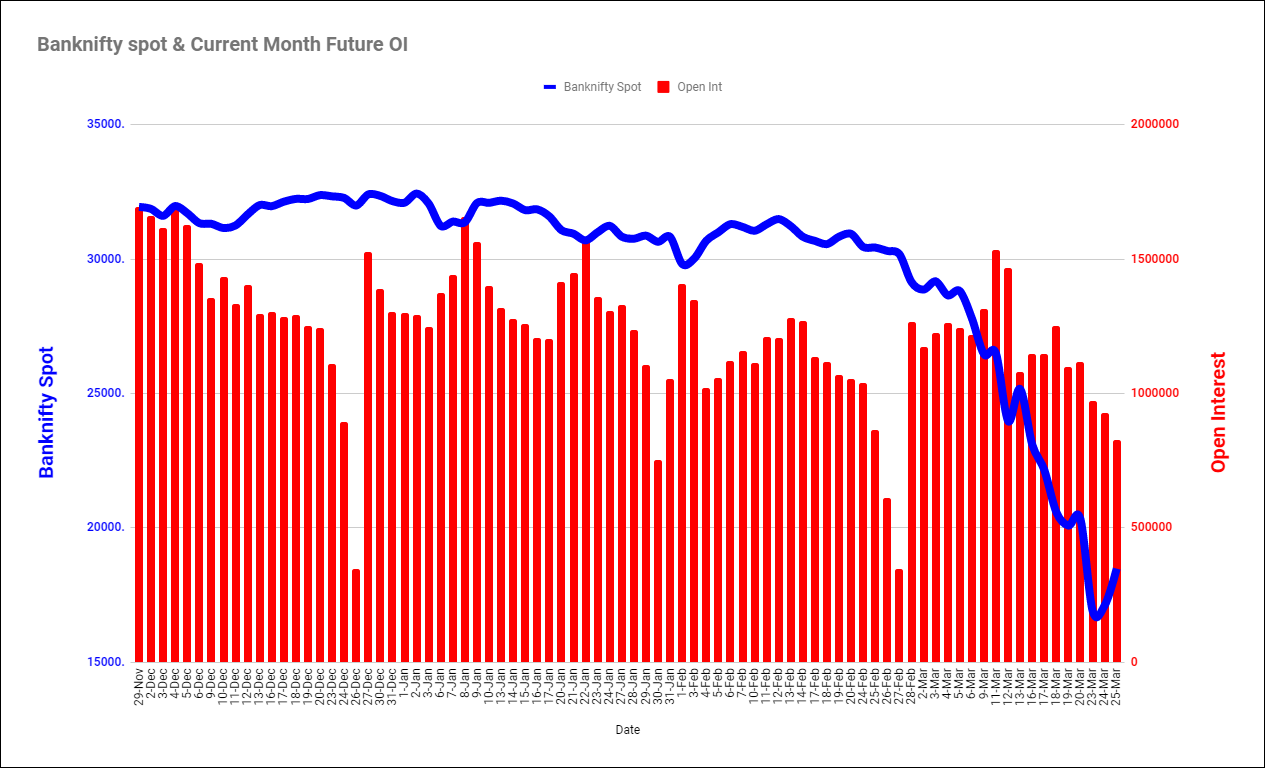

Nifty MAR has shed 75947 contracts this week while APR/MAY series have added 32528 contracts in Open Interest. Banknifty MAR OI has come down by 14437 contracts during the week with 13126 contracts rolled over to APR/MAY.