Mid-week view

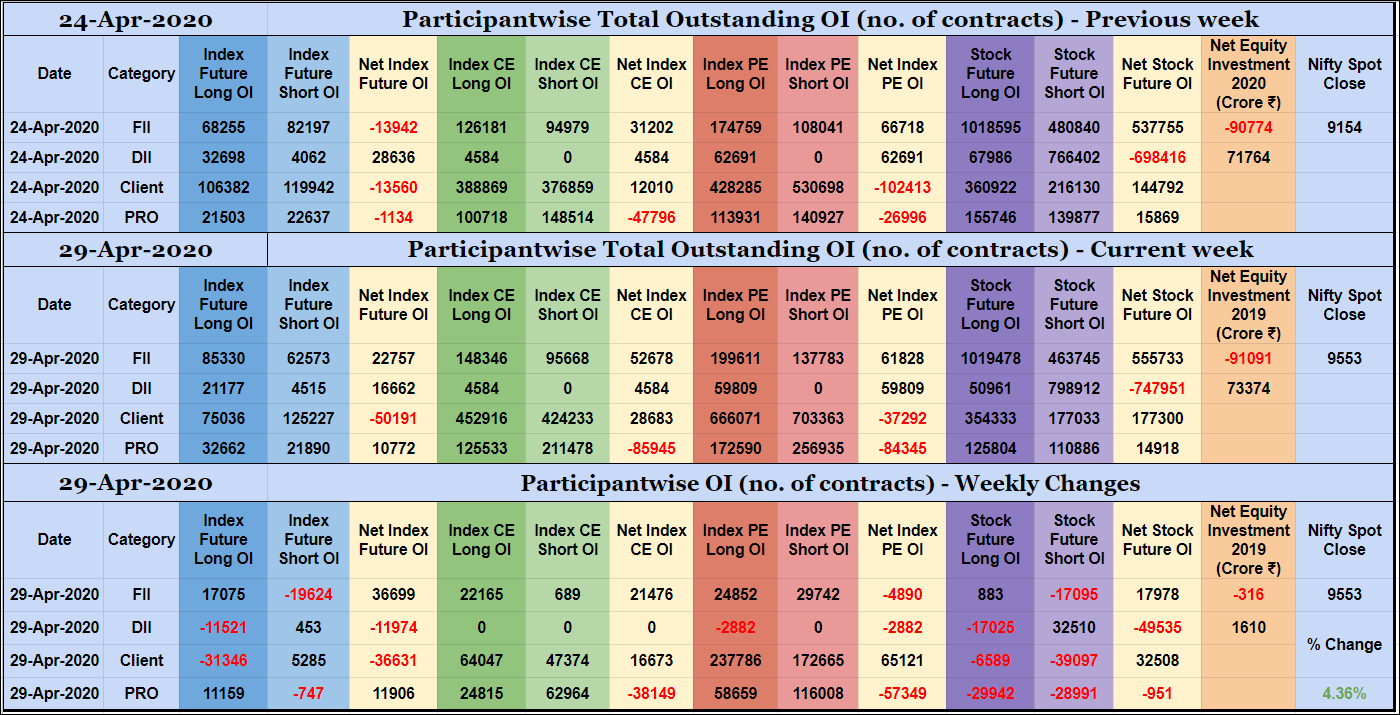

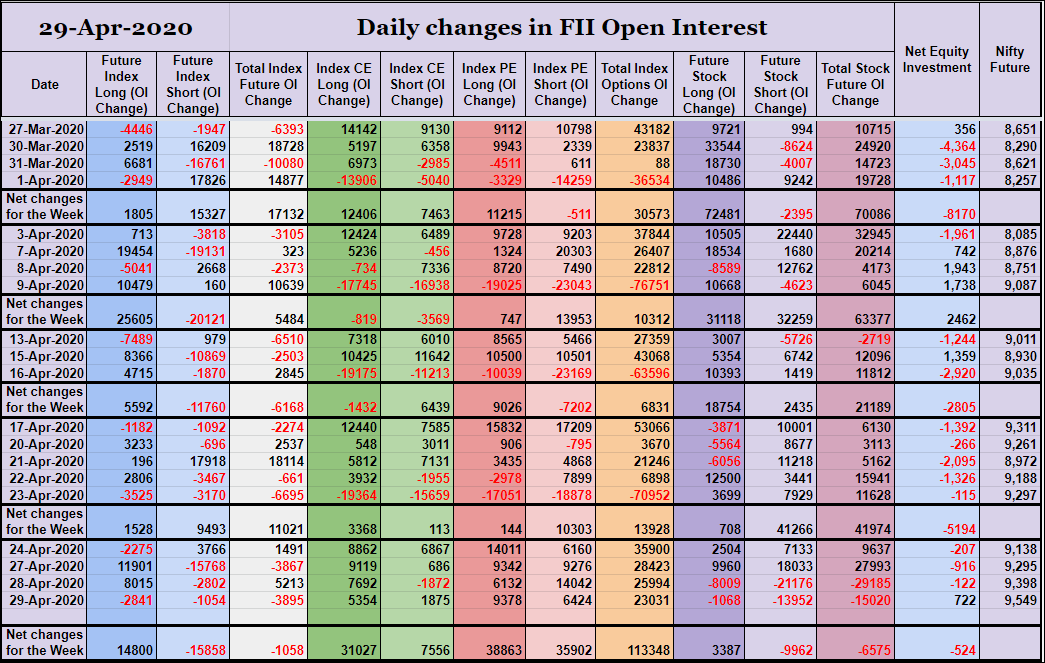

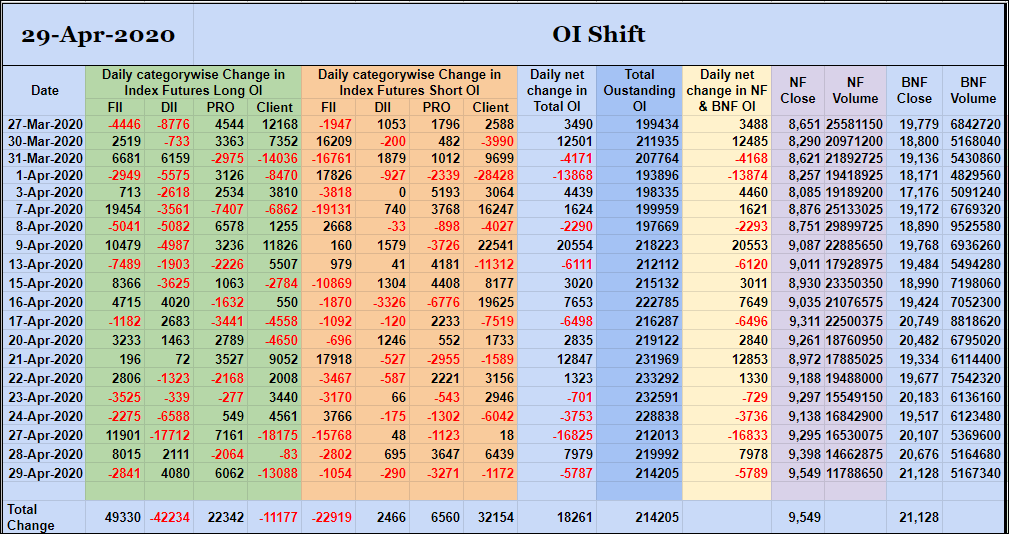

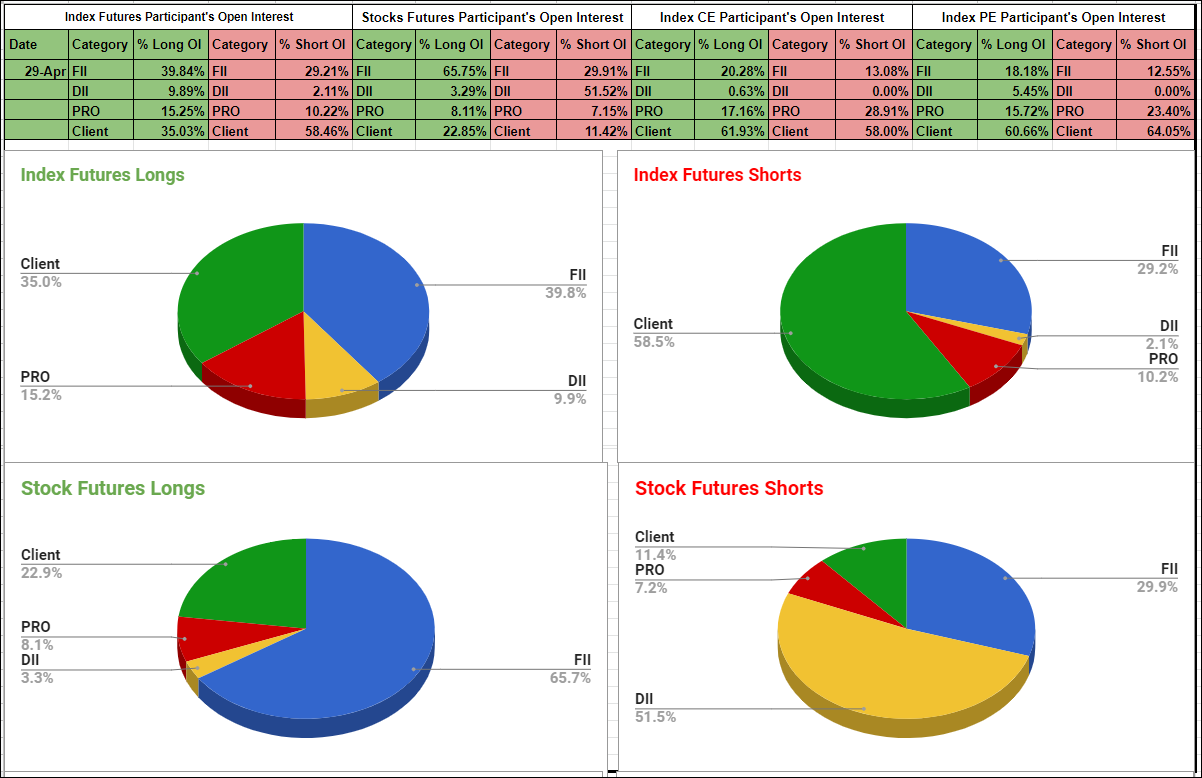

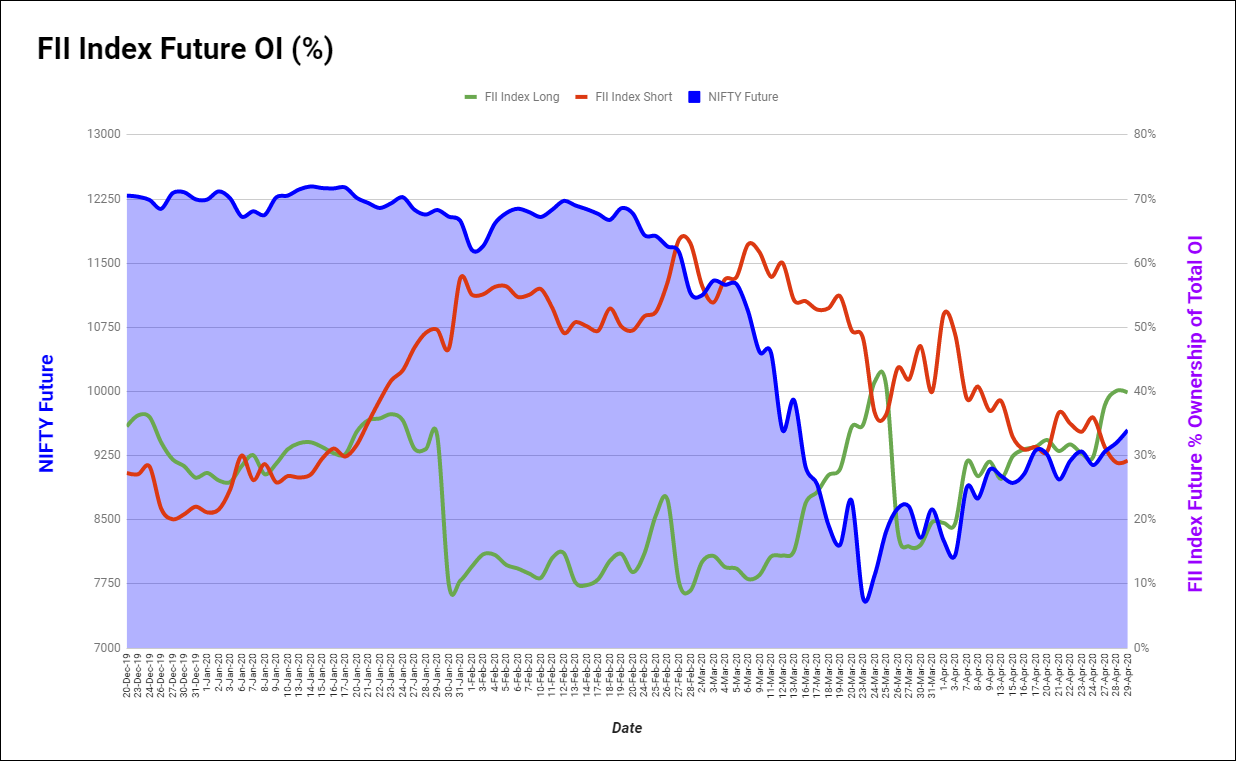

FIIs have added 17K long Index Futures, net 21K long Index CE and net 4k short Index PE contracts this week while covering 19K short Index Futures and 17K short Stocks Futures contracts. They have been net sellers in equity segment for ₹316 crore during the week.

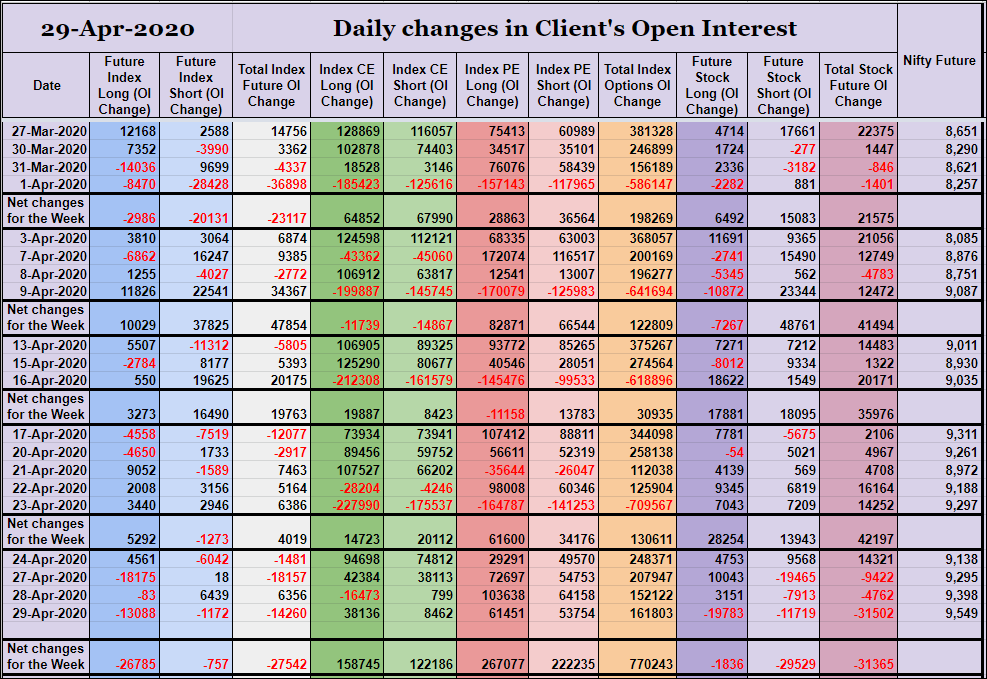

Clients have added 5K short Index Futures, net 16K long Index CE and net 65K long Index PE contracts besides liquidating 31K long Index Futures and reducing exposure in Stocks Futures during the week.

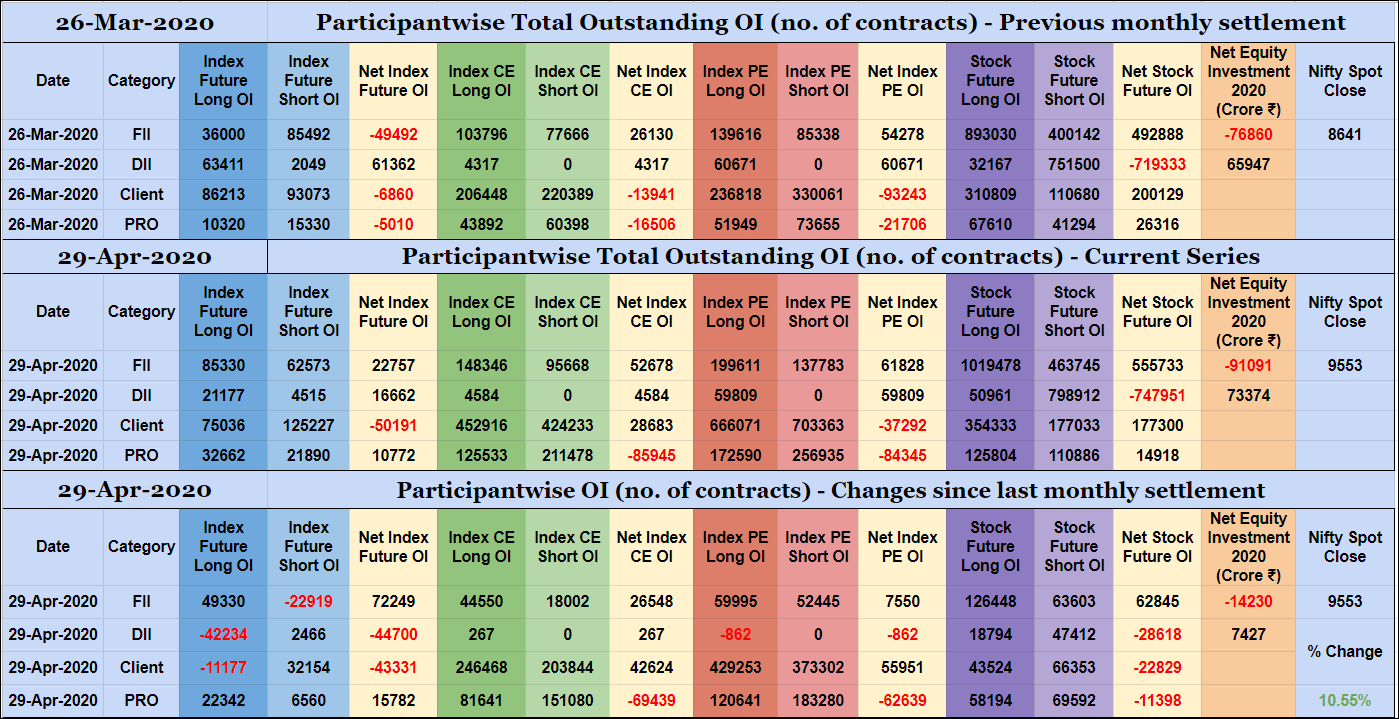

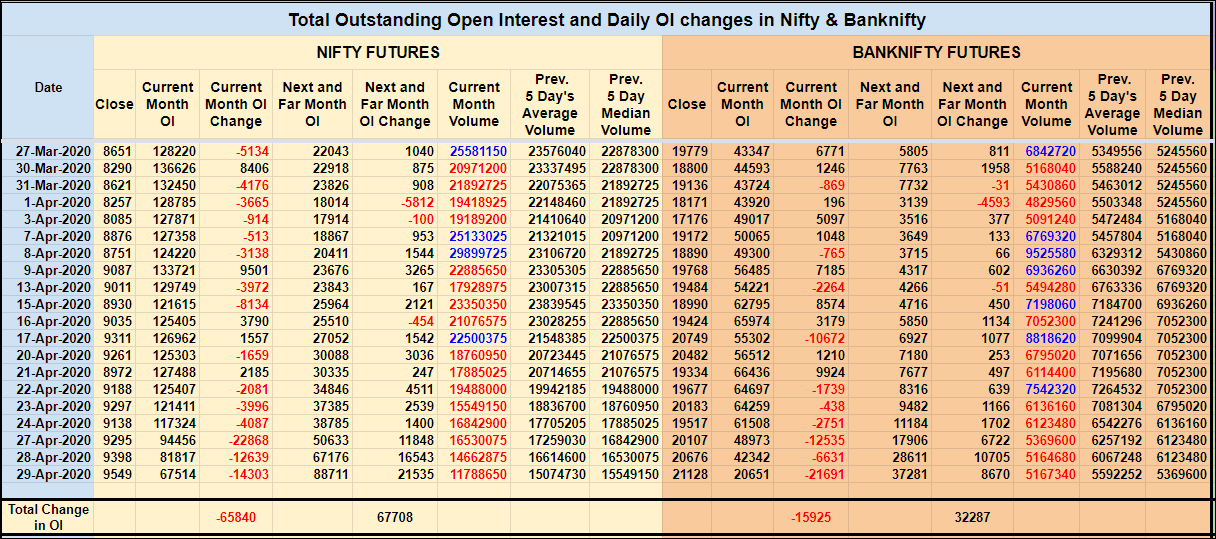

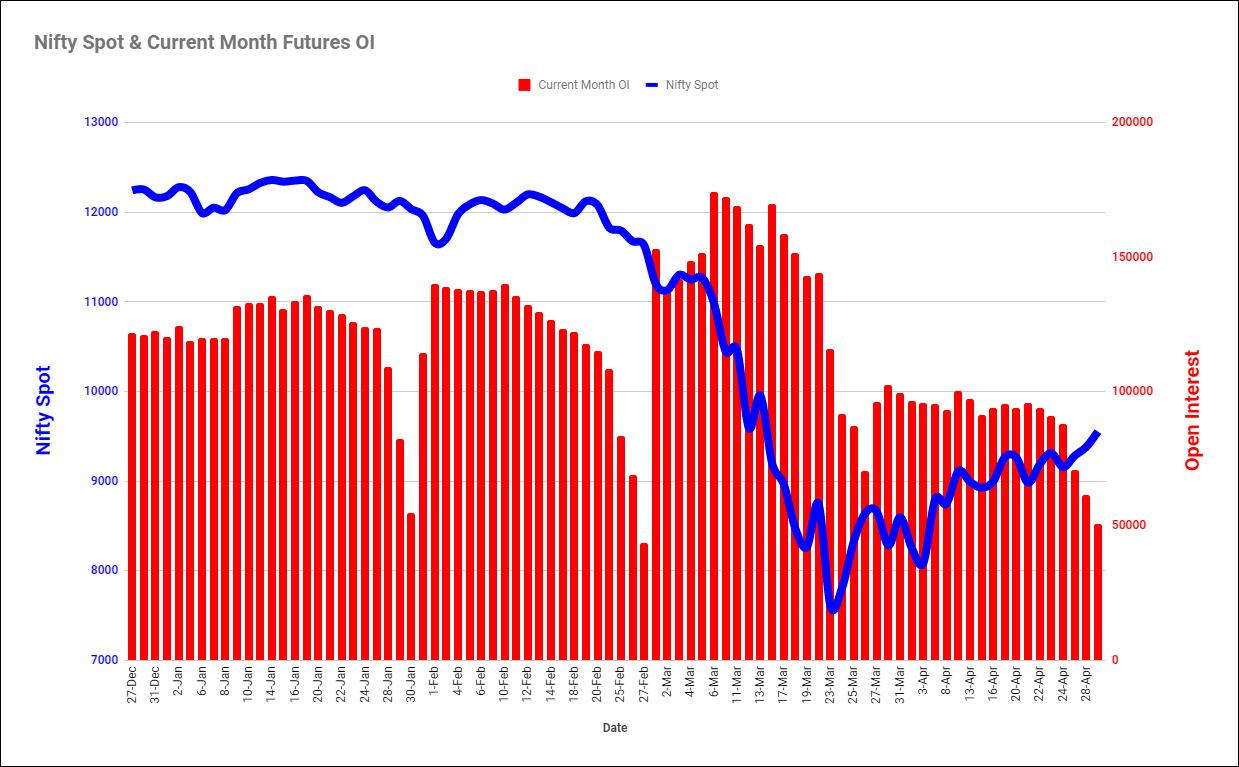

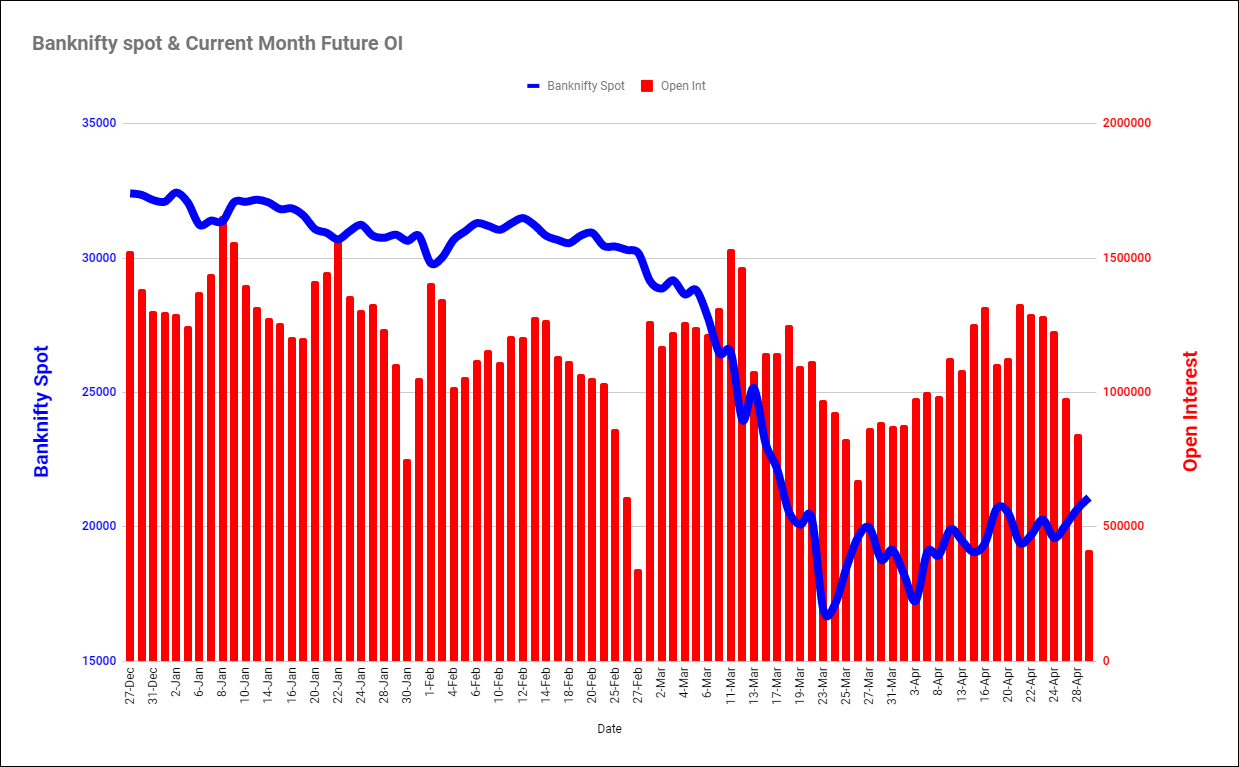

Nifty APR has shed 49810 contracts this week with 49926 contracts being added to MAY/JUN Open Interest. Banknifty APR has shed 40857 contracts this week with only 26097 contracts rolled over to MAY/JUN series.