Mid-week view

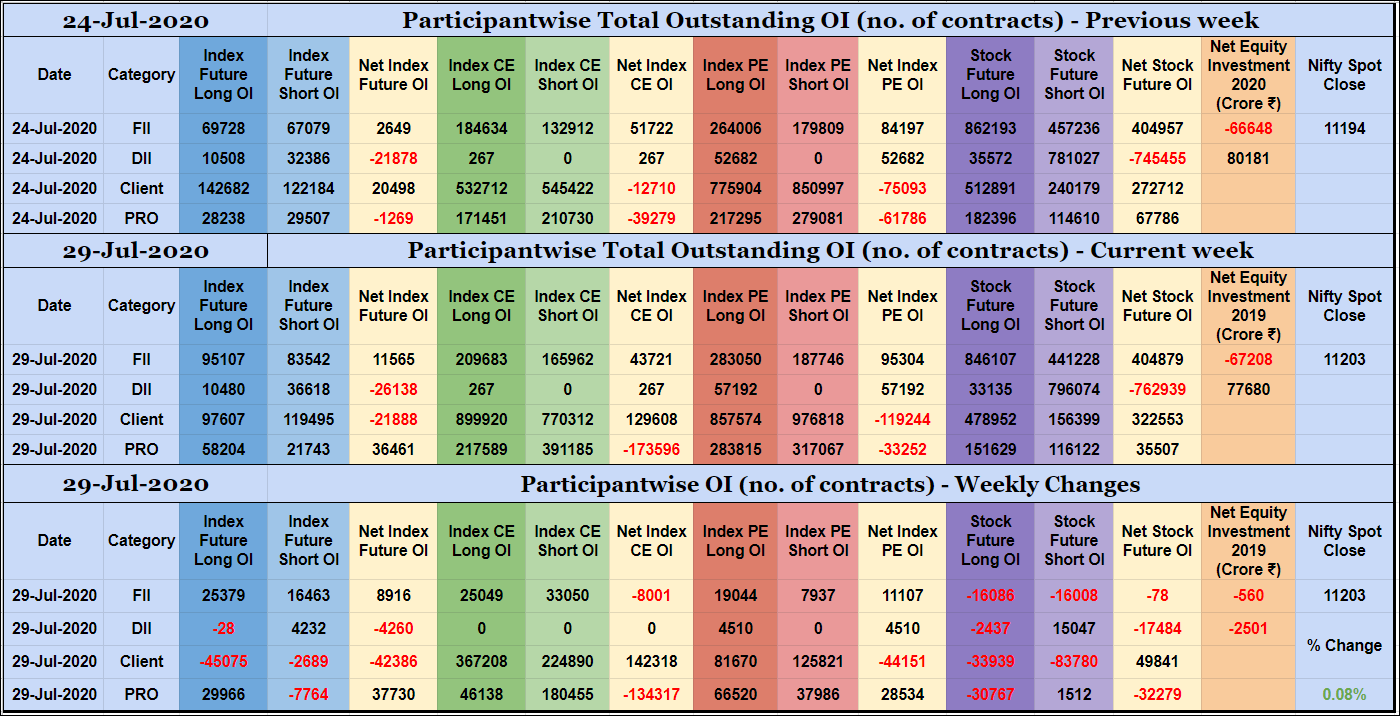

FIIs have added net 8K long Index Futures, net 8K short Index CE and net 11K long Index PE contracts this week while reducing exposure in Stocks Futures. They have been net sellers in equity segment for ₹560 crore during the week.

Since June settlement FIIs have added net 25K long Index Futures, net 26K long Index CE, net 32K long Index PE and 70K short Stocks Futures contracts while liquidating 49K long Stocks Futures contracts. They were net sellers in equity segment for ₹1449 core during this period.

Nifty spot has gone up by almost 9% since June settlement.

Clients have added net 142K long Index CE and net 44K short Index PE contracts this week while reducing exposure in Index and Stocks Futures.

Nifty JUL has shed 48914 contracts this week with 60372 contracts added to AUG/SEP series. Banknifty JUL OI came down by 25764 contracts during the week but only 19395 contracts were rolled over to AUG/SEP.