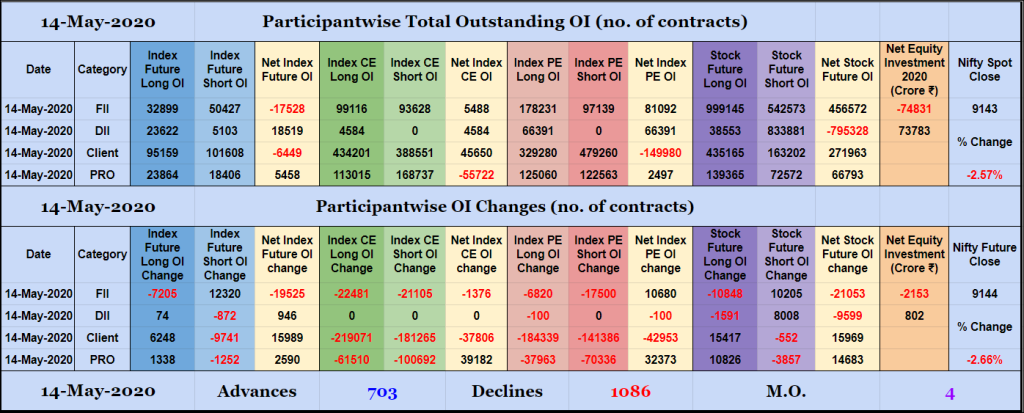

Participantwise Open Interest – 14th MAY 2020

FIIs added 12K short Index Futures and 10K short Stocks Futures contracts today while liquidating 7K long Index Futures and 10K long Stocks Futures contracts. FIIs are once again net short in Index Futures. They were net sellers in equity segment for ₹2153 crore. Clients added 6K long Index Futures and 15K long Stocks Futures […]

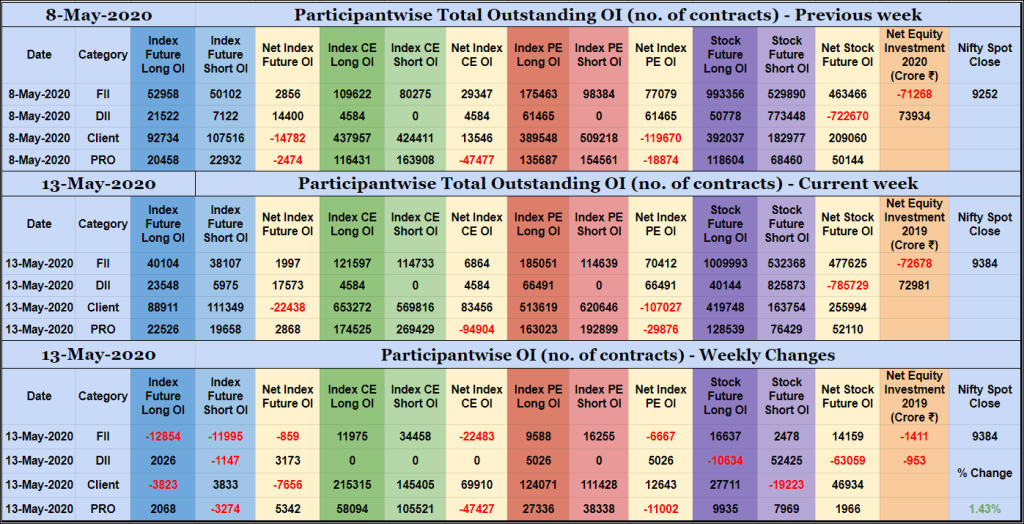

Participantwise Open Interest – 13th MAY 2020

Mid-week view FIIs have added net 22K short Index CE, net 6K short Index PE and net 14K long Stocks Futures contracts this week while reducing exposure in Index Futures. They have been net sellers in equity segment for ₹1411 crore during the week. Clients have added 3K short Index Futures, net 69K long Index […]

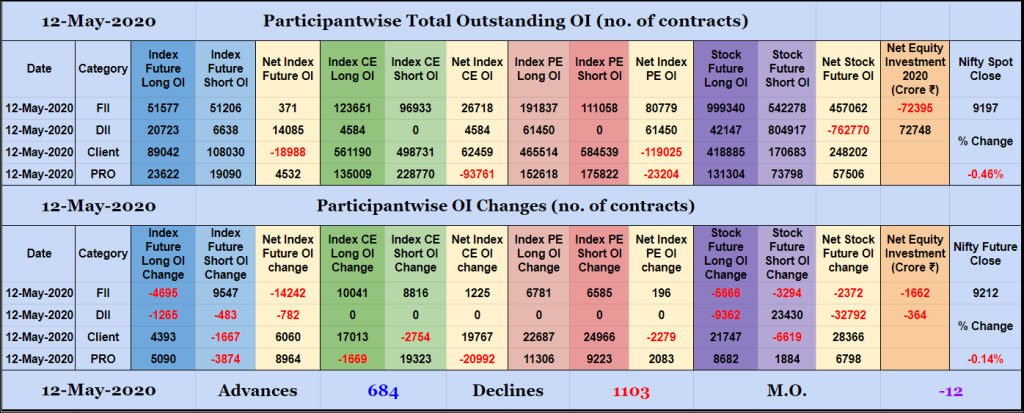

Participantwise Open Interest – 12th MAY 2020

FIIs have added 9K short Index Futures and net 1K long Index CE contracts besides liquidating 4K long Index Futures contracts. They have been net sellers in equity segment for 1662 crore. Clients have added 4K long Index Futures, 17K long Index CE, net 2K short Index PE and 21K long Stocks Futures contracts while […]

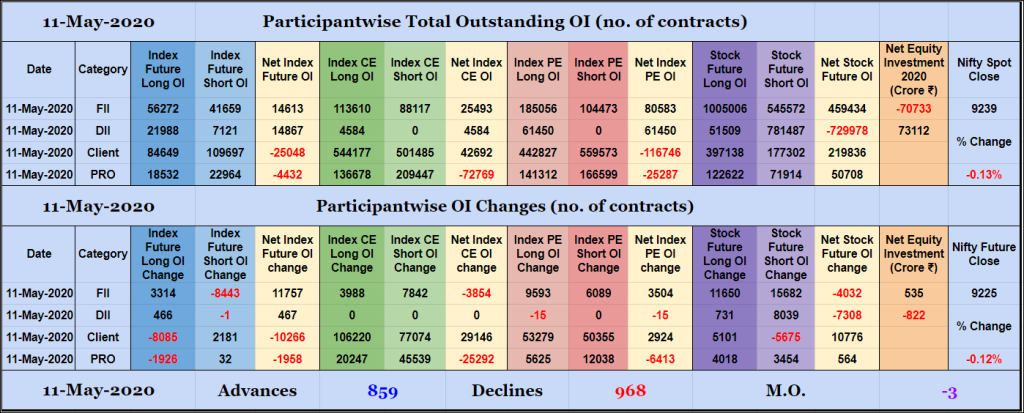

Participantwise Open Interest – 11th MAY 2020

FIIs have added 3K long Index Futures, net 3K short Index CE, net 3K long Index PE and net 4K short Stocks Futures contracts besides covering 8K short Index Futures contracts. They have been net buyers in equity segment for ₹535 crore. Clients have added 2K short Index Futures, net 29K long Index CE, net […]

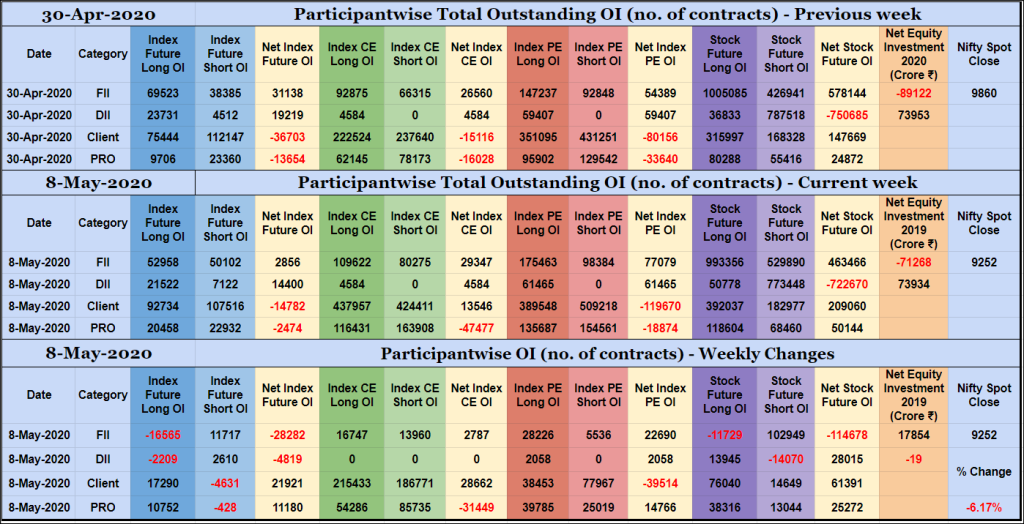

Participantwise Open Interest – 8th MAY 2020

Weekly view FIIs have added 11K short Index Futures, net 2K long Index CE, net 22K long Index PE and 102K short Stocks Futures contracts this week besides liquidating 15K long Index Futures and 11K long Stocks Futures contracts. They have been net buyers in equity segment for ₹17854 crore during the week. Clients have added […]

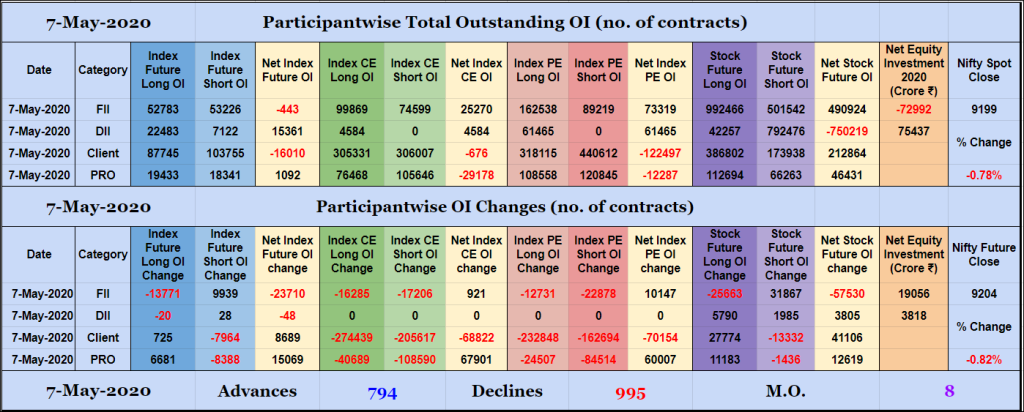

Participantwise Open Interest – 7th MAY 2020

FIIs have added 9K short Index Futures and 31K short Stocks Futures contracts while liquidating 13K long Index Futures and 25K long Stocks Futures contracts, their net Index Futures position is negative once again. They were net buyers in equity segment for ₹19056 crore today. Clients added 27K long Stocks Futures contracts today besides covering […]

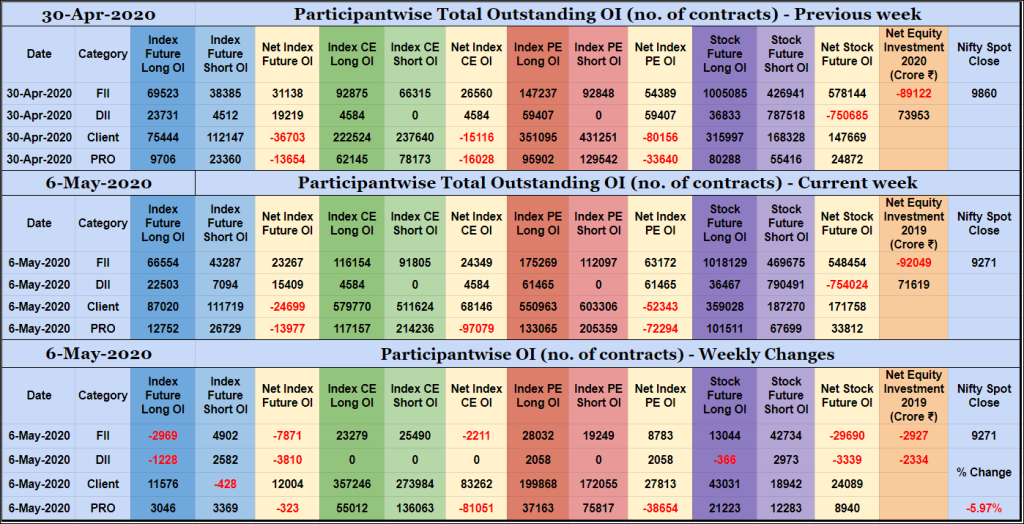

Participantwise Open Interest – 6th MAY 2020

Mid-week view FIIs have added 5K short Index Futures, net 2K short Index CE, net 8K long Index PE and net 29K short Stocks Futures contracts this week besides liquidating 3K long Index Futures contracts. They have been net sellers in equity segment for ₹2927 crore during the week. Clients have added 11K long Index […]

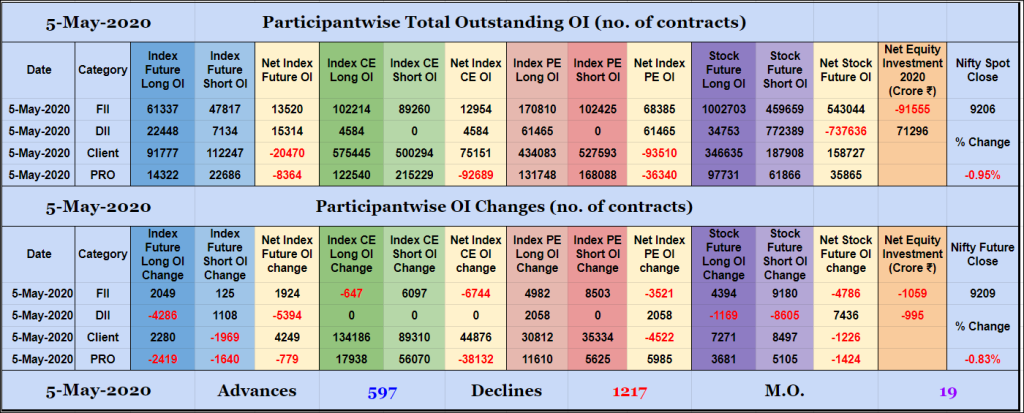

Participantwise Open Interest – 5th MAY 2020

FIIs added net 2K long Index Futures, 6K short Index CE, net 3K short Index PE and net 4K short Stocks Futures contracts today. They were net sellers in equity segment for ₹1059 crore. Clients added 2K long Index Futures, net 44K long Index CE, net 4K short Index PE nad net 1K short Stocks […]

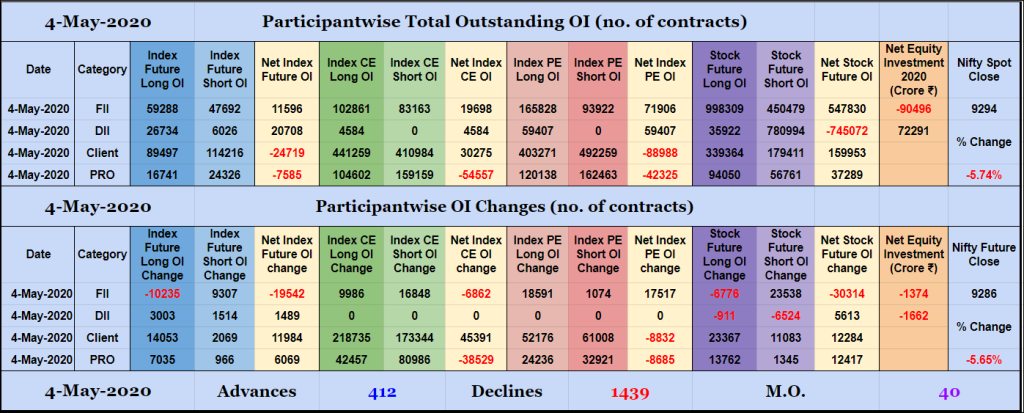

Participantwise Open Interest – 4th MAY 2020

FIIs added 9K short Index Futures, net 6K short Index CE, net 17K long Index PE and 23K short Stocks Futures contracts today besides liquidating 10K long Index Futures and 6K long Stocks Futures contracts. They were net sellers in equity segment as well for ₹1374 crore. Clients added net 11K long Index Futures, net […]

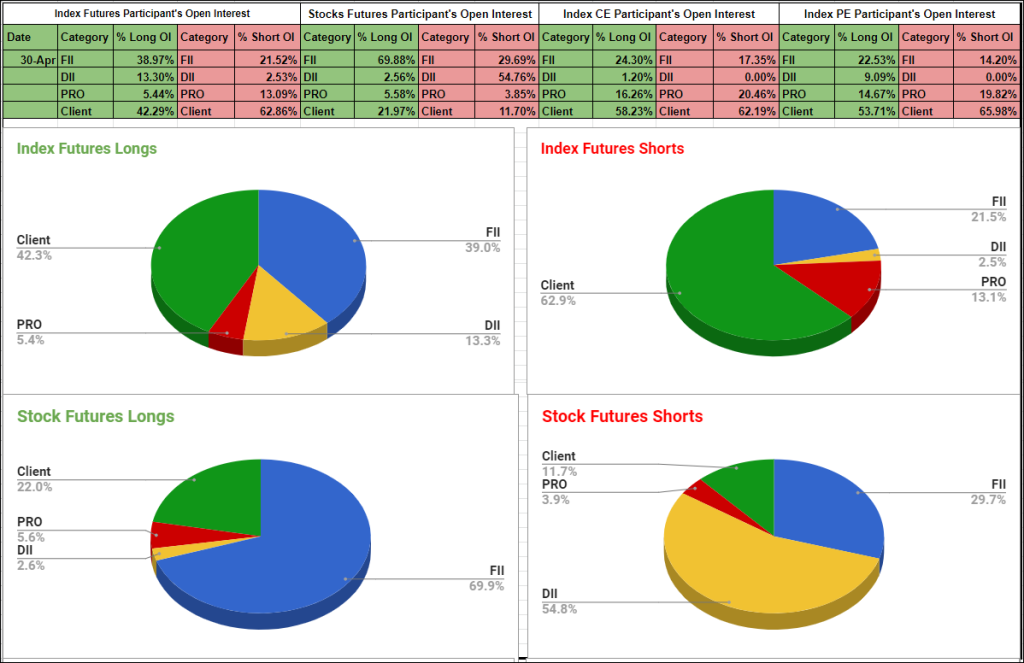

Participantwise Open Interest – 30th APR 2020

Series view At the close of APR series FIIs are once again net positive in Index Future’s position. They are now holding 39% of long Open Interest and 22% of short Open Interest in Index Futures, in Stocks Futures they are holding 70% of long and 30% of short Open Interest. Clients are holding 42% of […]