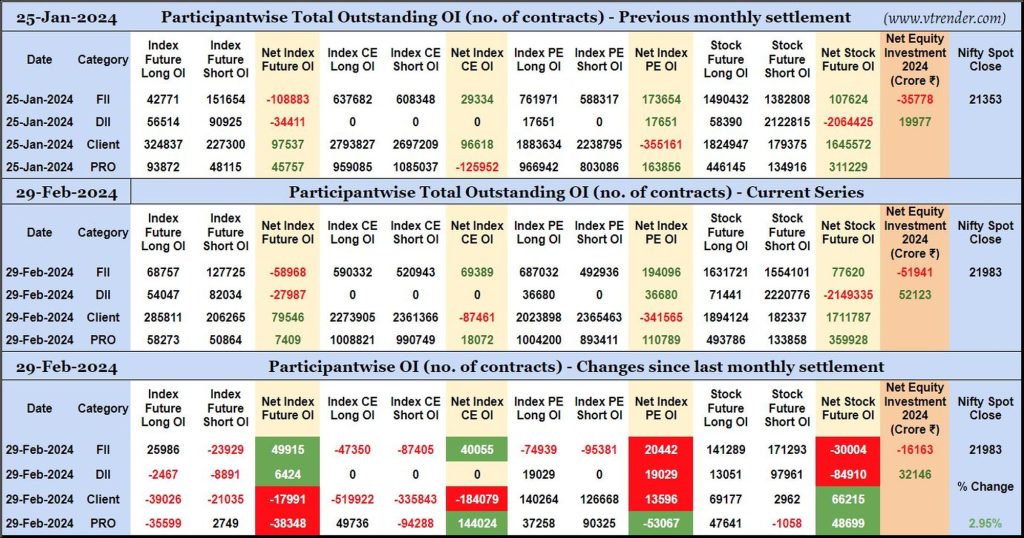

Participantwise Open Interest (Series changes) – 29th FEB 2023

FIIs have added 25K long Index Futures and net 30K short Stocks Futures contracts since JAN expiry besides covering 23K short Index Futures contracts and shedding Open Interest in Index Options.

FIIs were net sellers in equity segment for ₹16163 crore during FEB series.

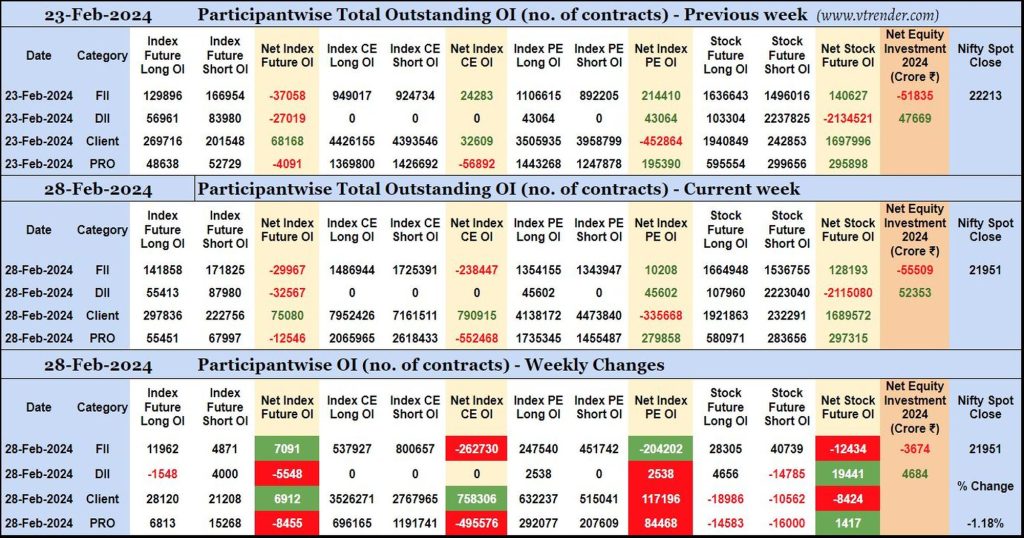

Participantwise Open Interest (Mid-week changes) – 28th FEB 2024

FIIs have added net 7K long Index Futures, net 262K short Index CE, net 204K short Index PE and net 12K short Stocks Futures contracts in the current week.

FIIs have been net sellers in equity segment for ₹3674 crore during the week.

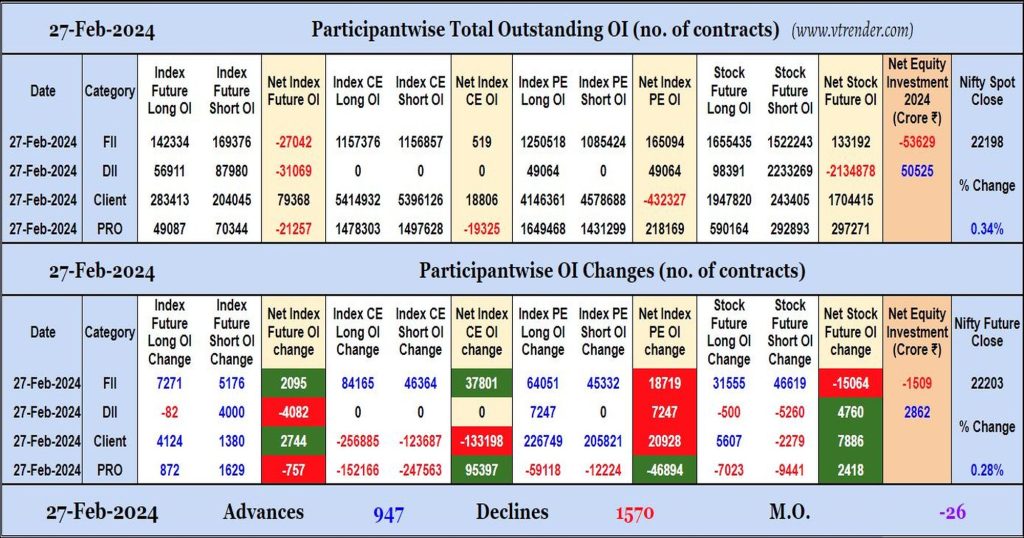

Participantwise Open Interest (Daily changes) – 27th FEB 2024

FIIs have added net longs in Index Futures, Index CE and Index PE while adding net shorts in Stocks Futures. They were net sellers in equity segment.

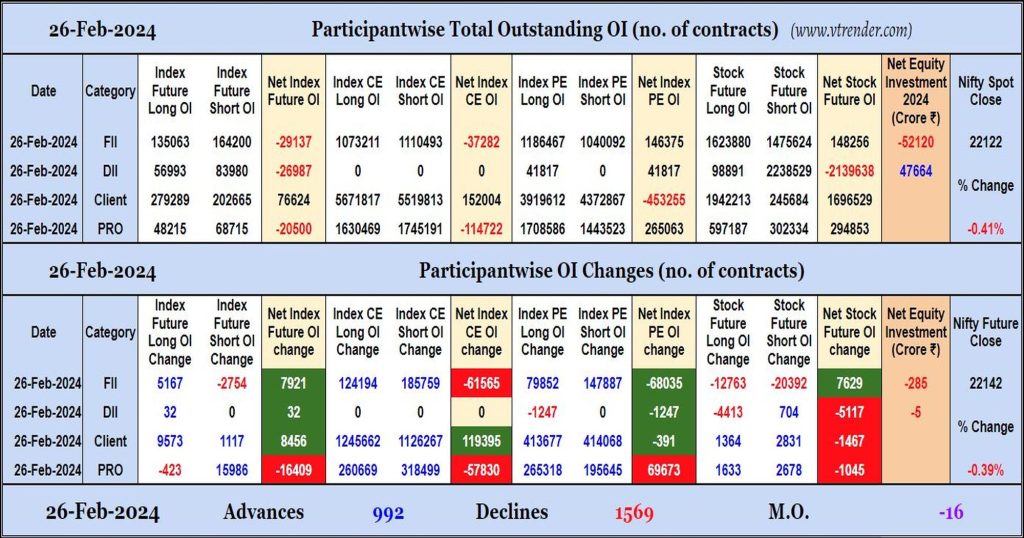

Participantwise Open Interest (Daily changes) – 26th FEB 2024

FIIs have added longs in Index Futures while adding net shorts in Index CE and Index PE. They were net sellers in equity segment.

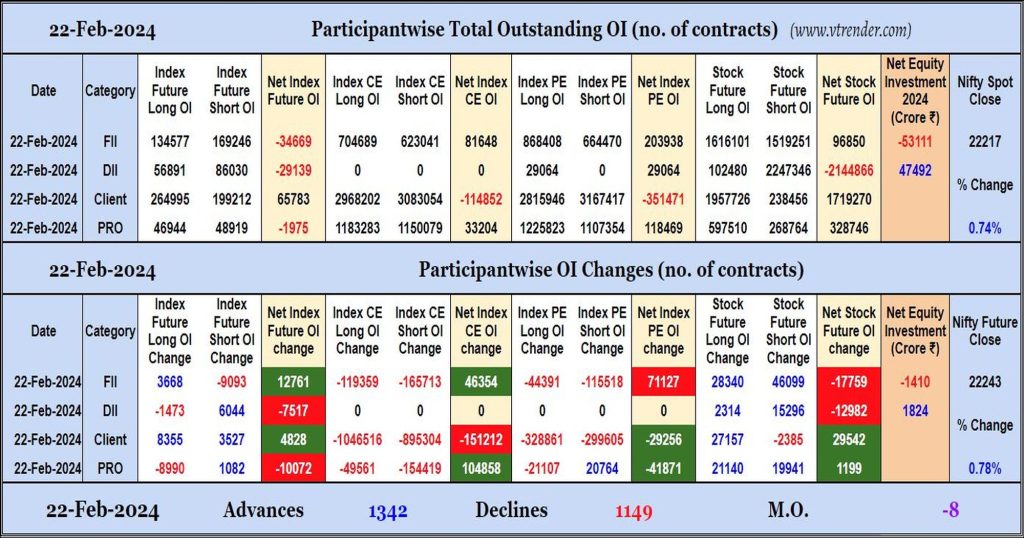

Participantwise Open Interest (Daily changes) – 22nd FEB 2024

FIIs have added net longs in Index Futures, net shorts in Stocks Futures and have shed Open Interest in Index Options. They have been net sellers in equity segment.

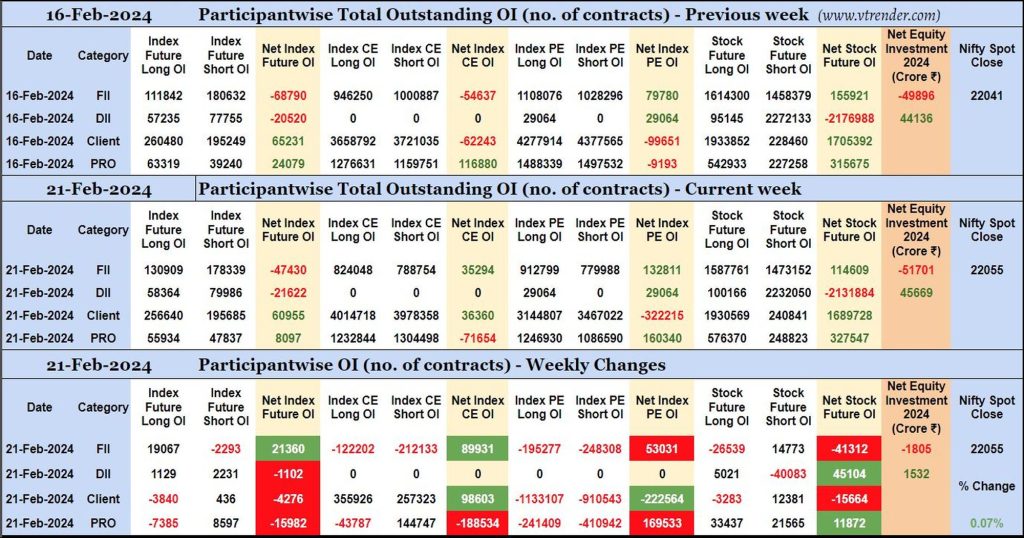

Participantwise Open Interest (Mid-week changes) – 21st FEB 2024

FIIs have added 19K long Index Futures and 14K short Stocks Futures contracts so far this week besides covering 2K short Index Futures contracts, liquidating 26K long Stocks futures contracts and shedding Open Interest in Index Options.

FIIs have been net sellers in equity segment for ₹1805 crore during the week.

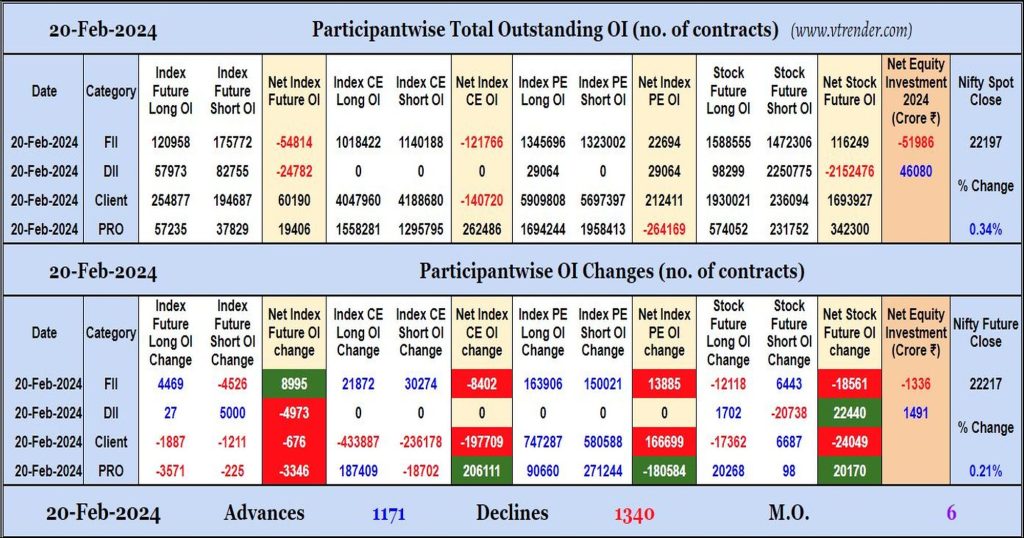

Participantwise Open Interest (Daily changes) – 20th FEB 2024

FIIs have added net longs in Index Futures and Index PE while adding net shorts in Index CE and Stocks Futures. They were net sellers in equity segment.

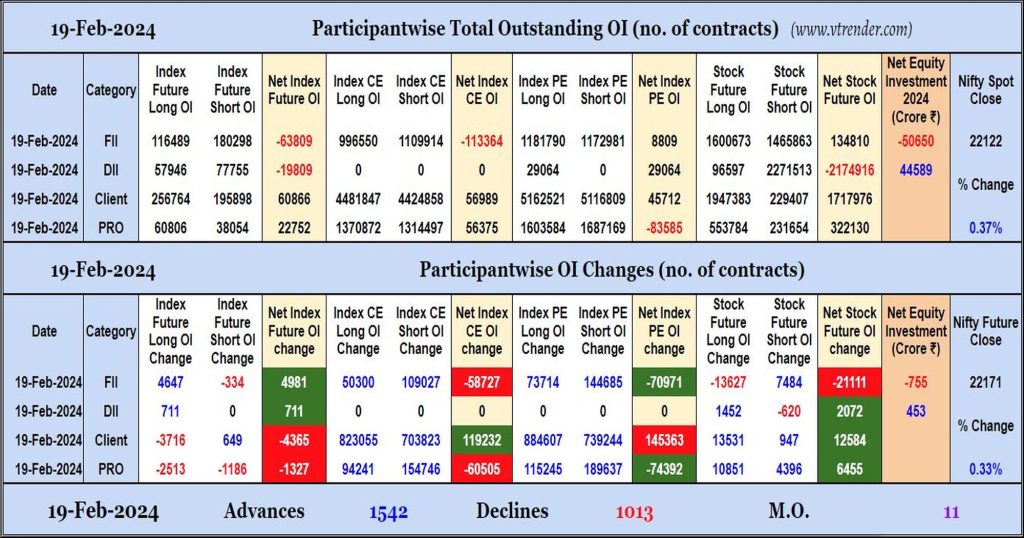

Participantwise Open Interest (Daily changes) – 19th FEB 2024

FIIs have added net longs in Index Futures but have added net shorts in Index CE, Index PE and Stocks Futures. They have been net sellers in equity segment.

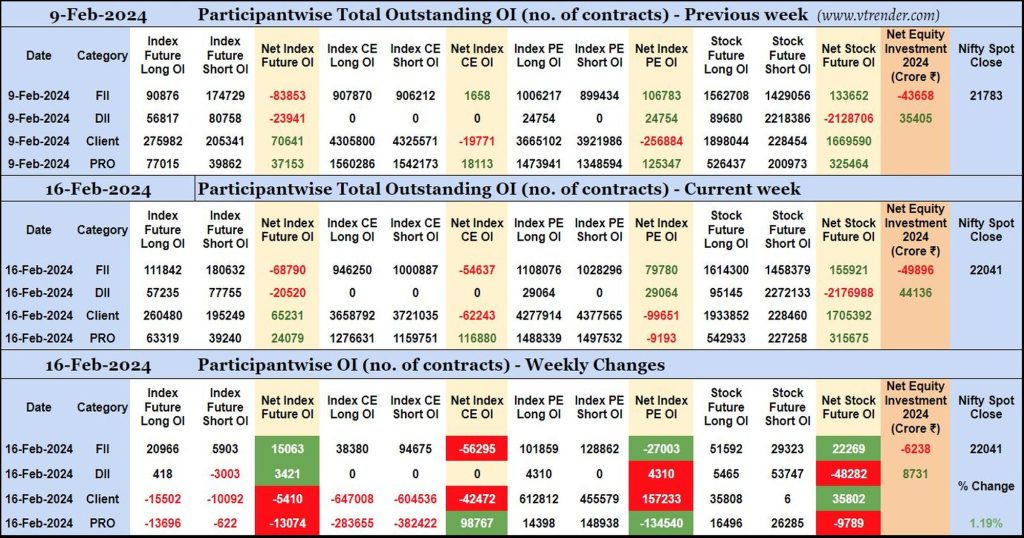

Participantwise Open Interest (Weekly changes) – 16th FEB 2024

Weekly changes in Participantwise Open Interest FIIs have added net 15K long Index Futures, net 56K short Index CE, net 27K short Index PE and net 22K long Stocks Futures contracts this week. FIIs have been net sellers in equity segment for ₹6238 crore during the week. Clients have added net 157K long Index PE […]

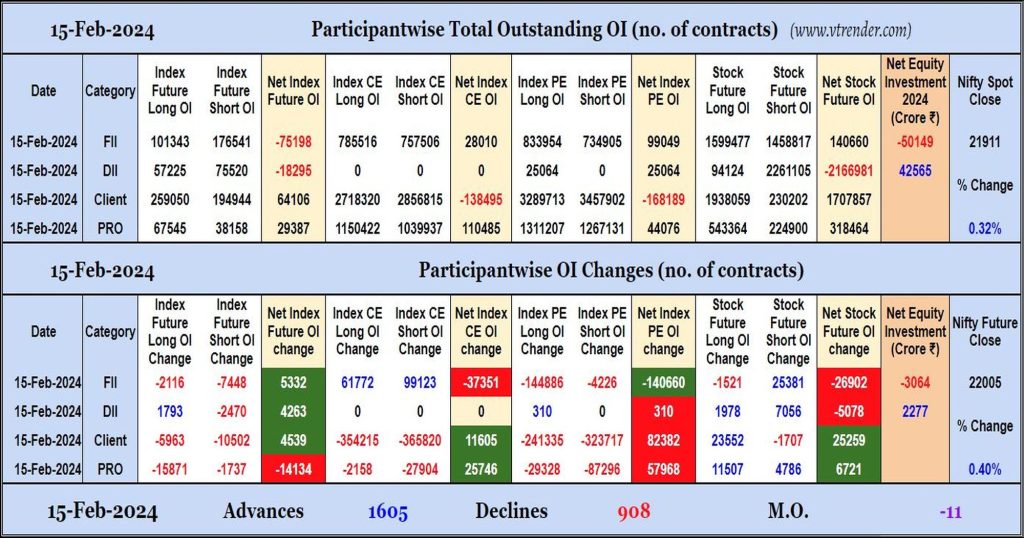

Participantwise Open Interest (Daily changes) – 15th FEB 2024

FIIs have added net shorts in Index CE and Stocks Futures while shedding Open Interest in Index Futures and Index PE. They were net sellers in equity segment.