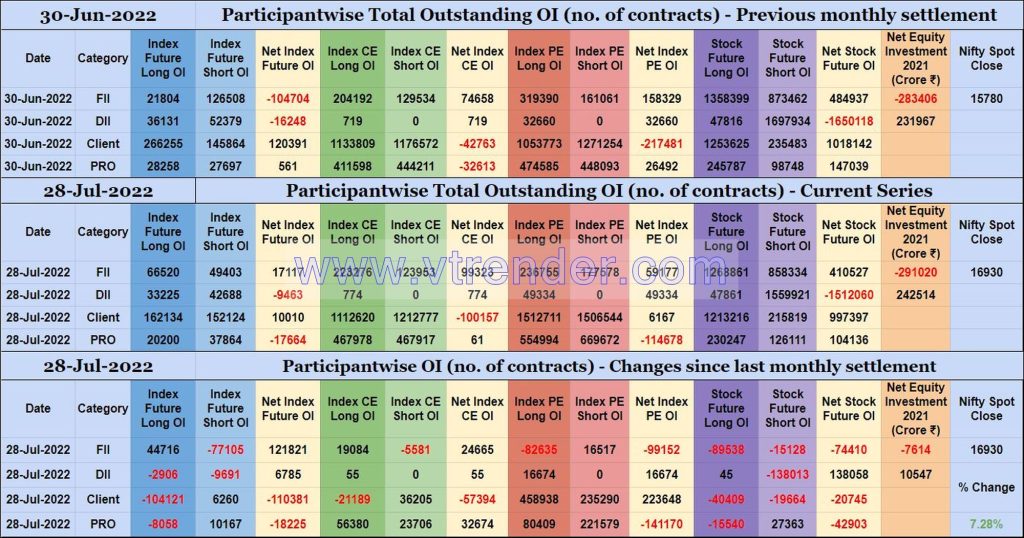

Participantwise Open Interest (Series changes) – 28th JUL 2022

Changes since June settlement in Participantwise Open Interest FIIs have added 44K long Index Futures, 19K long Index CE and 16K long Index PE contracts since June settlement besides covering 77K short Index Futures & 5K short Index CE contracts and liquidating 82K long Index PE contracts. FIIs were net sellers in equity segment for […]

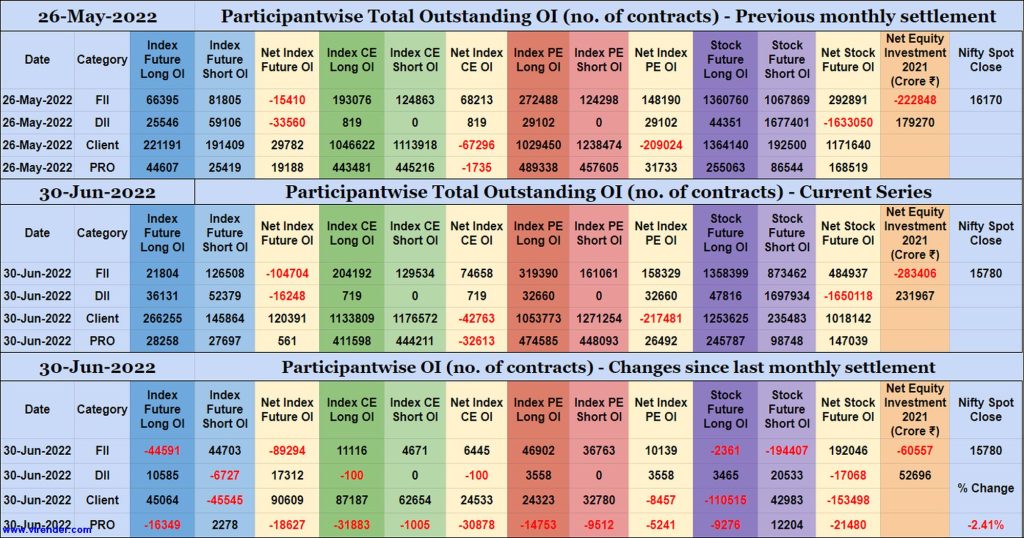

Participantwise Open Interest (Series changes) – 30th JUN 2022

Changes since May settlement in Participantwise Open Interest FIIs have added 44K short Index Futures, net 6K long Index CE and net 10K long Index PE contracts since May expiry while liquidating 44K long Index Futures. FIIs were net sellers in equity segment for ₹60557 crore during JUN series. Clients have added 45K long Index […]

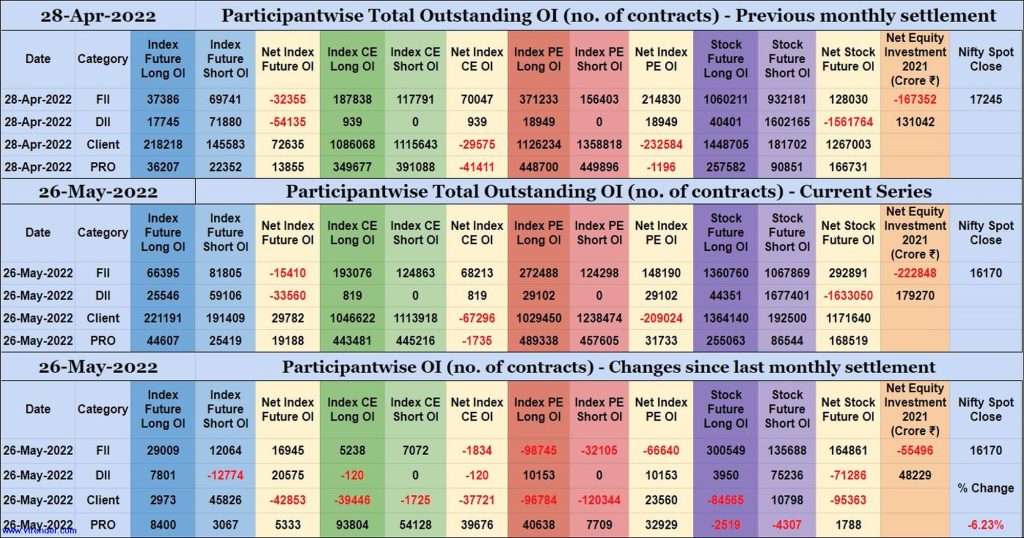

Participantwise Open Interest (Series changes) – 26th MAY 2022

Changes since April settlement in Participantwise Open Interest FIIs have added net 16K long Index Futures, net 1K short Index CE and net 164K long Stocks Futures contracts since April settlement. FIIs were net sellers in equity segment for ₹55496 crore during May series. Clients have added net 42K short Index Futures and 10K short […]

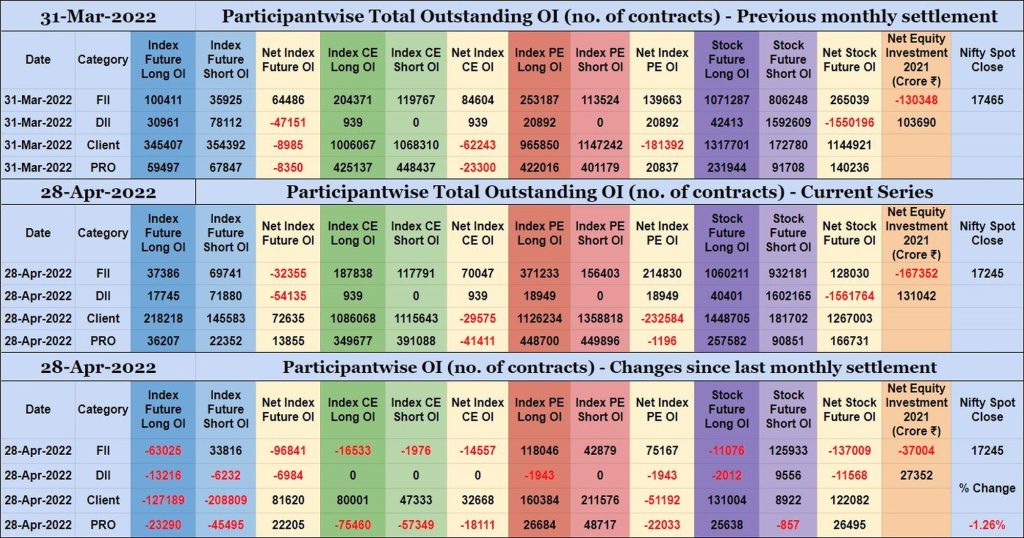

Participantwise Open Interest (Series changes) – 28th APR 2022

Changes since March settlement in Participantwise Open Interest FIIs have added 33K short Index Futures, net 75K long Index PE and 125K short Stocks Futures contracts since March expiry besides liquidating 63K long Index Futures and 11K long Stocks Futures contracts. FIIs were net sellers in equity segment for ₹37004 crore during APR series. Clients […]

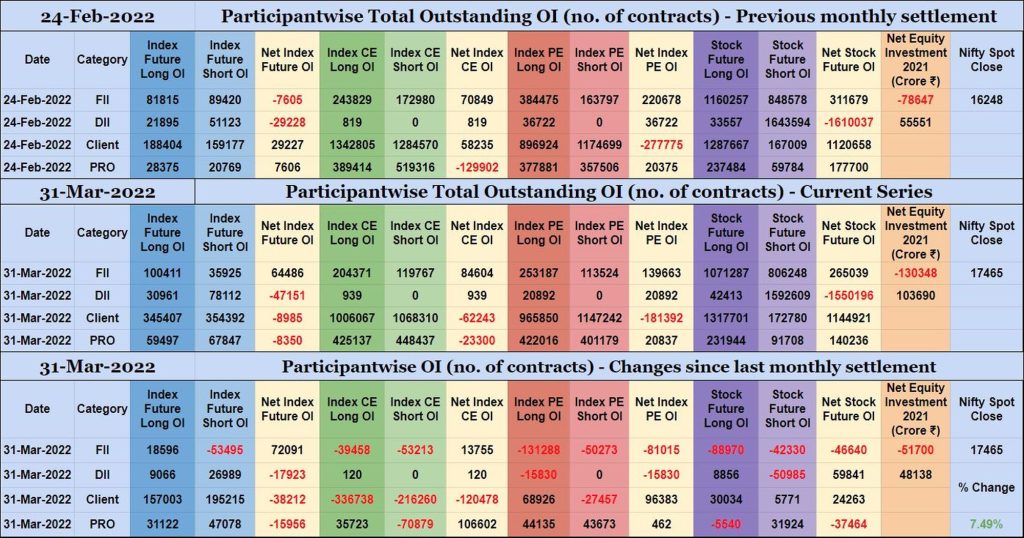

Participantwise Open Interest (Series changes) – 31st MAR 2022

Changes since February settlement in Participantwise Open Interest FIIs have added 18K long Index Futures while covering 53K short Index Futures during March series. They have shed Open Interest in Index Options and Stocks Futures during this period. FIIs were net sellers in equity segment for ₹51700 crore during MAR series. Clients have added net […]

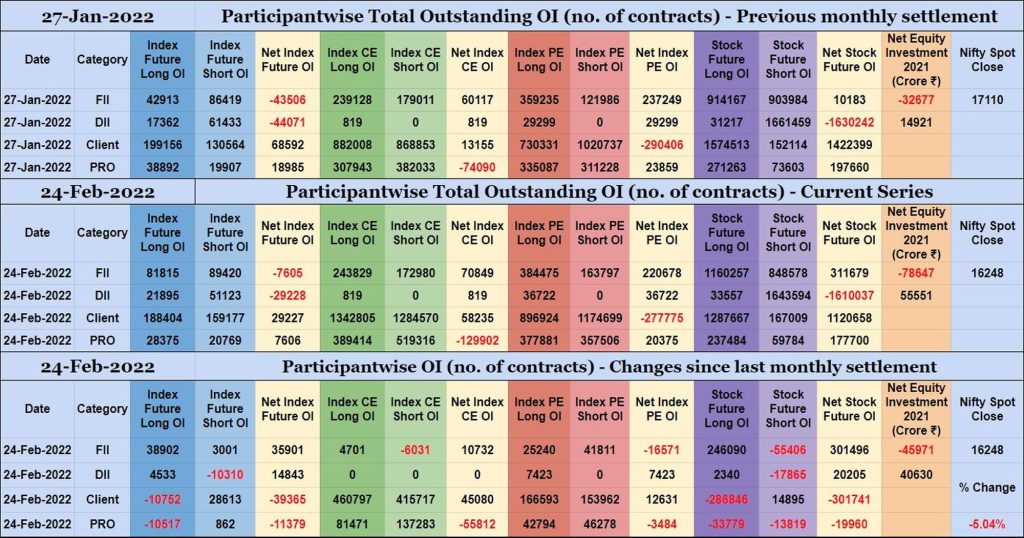

Participantwise Open Interest (Series changes) – 24th FEB 2022

Changes since January settlement in Participantwise Open Interest FIIs have added net 35K long Index Futures, 4K long Index CE, net 16K short Index PE and 246K long Stocks Futures contracts since JAN settlement besides covering 6K short Index CE and 55K short Stocks Futures contracts. FIIs were net sellers in equity segment for ₹45971 […]

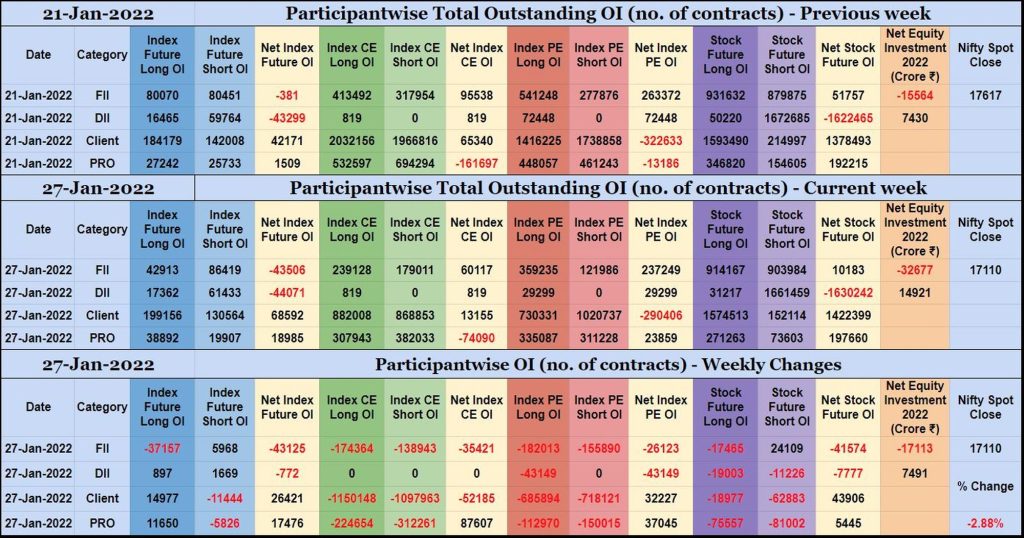

Participantwise Open Interest (Series changes) – 27th JAN 2022

Changes since December settlement in Participantwise Open Interest FIIs have added 29K short Index Futures, net 53K short Index CE, 82K long Index PE and net 180K short Stocks Futures contracts since last settlement besides liquidating 68K long Index Futures contracts and covering 18K short Index PE contracts. FIIs were net sellers in equity segment […]

Participantwise Open Interest – 30th DEC 2021

Series view FIIs have added 5K short Index Futures and 42K long Stocks Futures contracts during DEC series while liquidating 8K long Index Futures contracts and covering 125K short Stocks Futures contracts. FIIs were net sellers in equity segment for ₹50633 crore during DEC series. Clients have added 50K long Index PE contracts besides covering […]

Participantwise Open Interest – 25th NOV 2021

Series view FIIs have added 40K long Index Futures, 45K long Index CE, net 57K long Index PE and net 74K long Stocks Futures contracts during NOV series besides covering 16K short Index Futures and 48K short Index CE contracts. FIIs were net sellers in equity segment for ₹30481 crore during NOV series. Clients have […]

Participantwise Open Interest – 28th OCT 2021

Series view At the close of OCT series, FIIs are holding 26% of long and 22% of short Open Interest in Index Futures besides holding 30% long and 33% short Open Interest in Stocks Futures. FIIs were net sellers in equity segment for ₹20430 crore during the series. Clients are holding 56% long and 41% […]