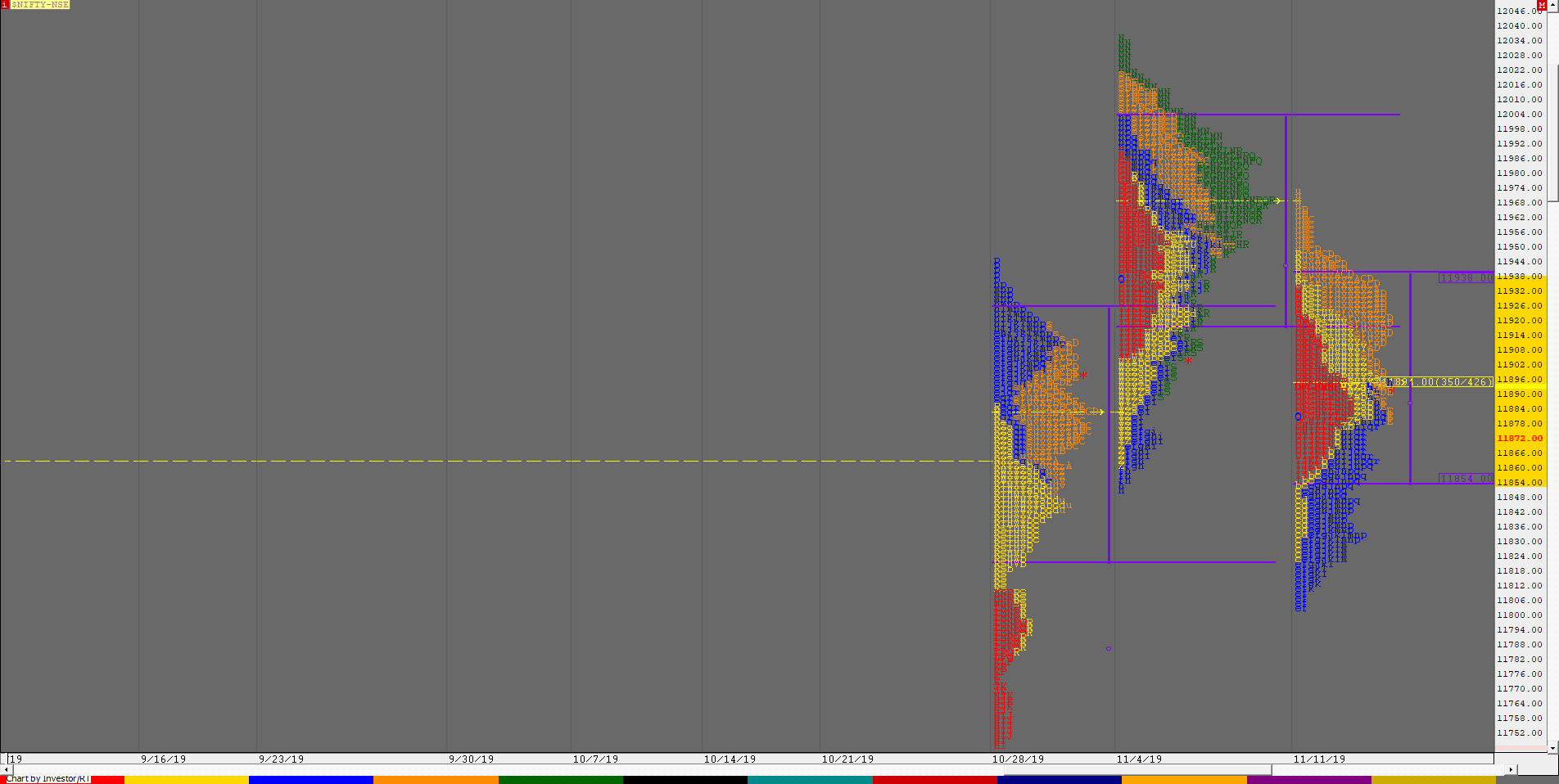

Nifty Spot Weekly Profile (11th to 15th November)

Spot Weekly 11895 [ 11974 / 11802 ]

Nifty did not give that big move away from previous week’s Gaussian profile as was expected in previous week’s report though it stayed below previous week’s POC of 11968 and also got accepted below 11880 as the downside probe this week got stalled at 11802 where the auction left poor lows on Thursday in contrast to the poor highs it had left the previous week at 12034 which indicated that the auction is forming a balance even on the higher time frame as Nifty gave a Neutral Centre profile on the weekly facing swift rejection from previous week’s POC on the upside on Friday as it made a narrower range in this holiday shortened week of just 171 points to close around the weekly POC of 11894 with mostly lower Value for this week at 11854-11894-11938. On a 3-week composite, Nifty has made a smooth ‘p’ shape composite with Value at 11823-11921-11969 with the stem of the composite from 11772 to 11611 ( Click here to view the 3-week composite ‘p’ ). The coming week could be the one with a big range expansion after 2 back-to-back narrow range weekly profiles with a probable objective of 11584 on the downside & on the upside, acceptance above 11969-990 could bring levels of 12208-211 in the coming week(s).

Weekly Hypos for Nifty (Spot):

A) Nifty needs to get above 11936 for a move to 11969-991/ 12030-46 & 12102

B) Immediate support is at 11879 below which the auction could test 11823 / 11770 & 11719

C) Above 12102, Nifty can probe higher to 12156 & 12208-211

D) Below 11719, lower levels of 11665 & 11611-584* could come into play

E) If 12211 is taken out & sustained, Nifty can have a fresh leg up to 12240-265 & 12320

F) Break of 11584 could bring lower levels of 11525-503 & 11460*-427

NF (Weekly Profile)

11943 [12009 / 11825]

NF has closed the week at the same level as the previous one after giving a similar range of just 183 points for the week though it made a lower high & lower low leaving yet another balanced Neutral Centre weekly profile. The auction started the week with a probe lower on Monday as it broke below PWL (Previous Week Low) of 11885 but found demand coming in as it reversed and closed in a spike higher to leave a Neutral Extreme Day. However, as happens most of the time, the Neutral Extreme spike got rejected the next trading day (Wednesday) as NF made a balance below it for most part of the day before closing the day with a spike lower as it made new lows for the week at 11846. This imbalance to the downside continued the next day at open as NF made lows of 11825 in the ‘A’ period but seemed to have taken support in the stem of the of the ‘p’ shape weekly profile of 28th Oct to 1st Nov and this also marked the end of the probe down for the week as the auction then not only retraced the entire move down of the week but went on to make new highs of the week as it tagged the previous week’s POC of 12003 but was met with good supply as it left a small tail at top from 12009 to 11990 in the weekly profile. This week’s Value was mostly lower at 11868-11910-11958 but the 3-week composite ‘p’ shape profile will be a bigger & better reference to watch for the next probable leg of auction. The composite has a prominent POC at 11901 from where we could get a move away in the coming week & the Composite Value is at 11889-11901-12003.

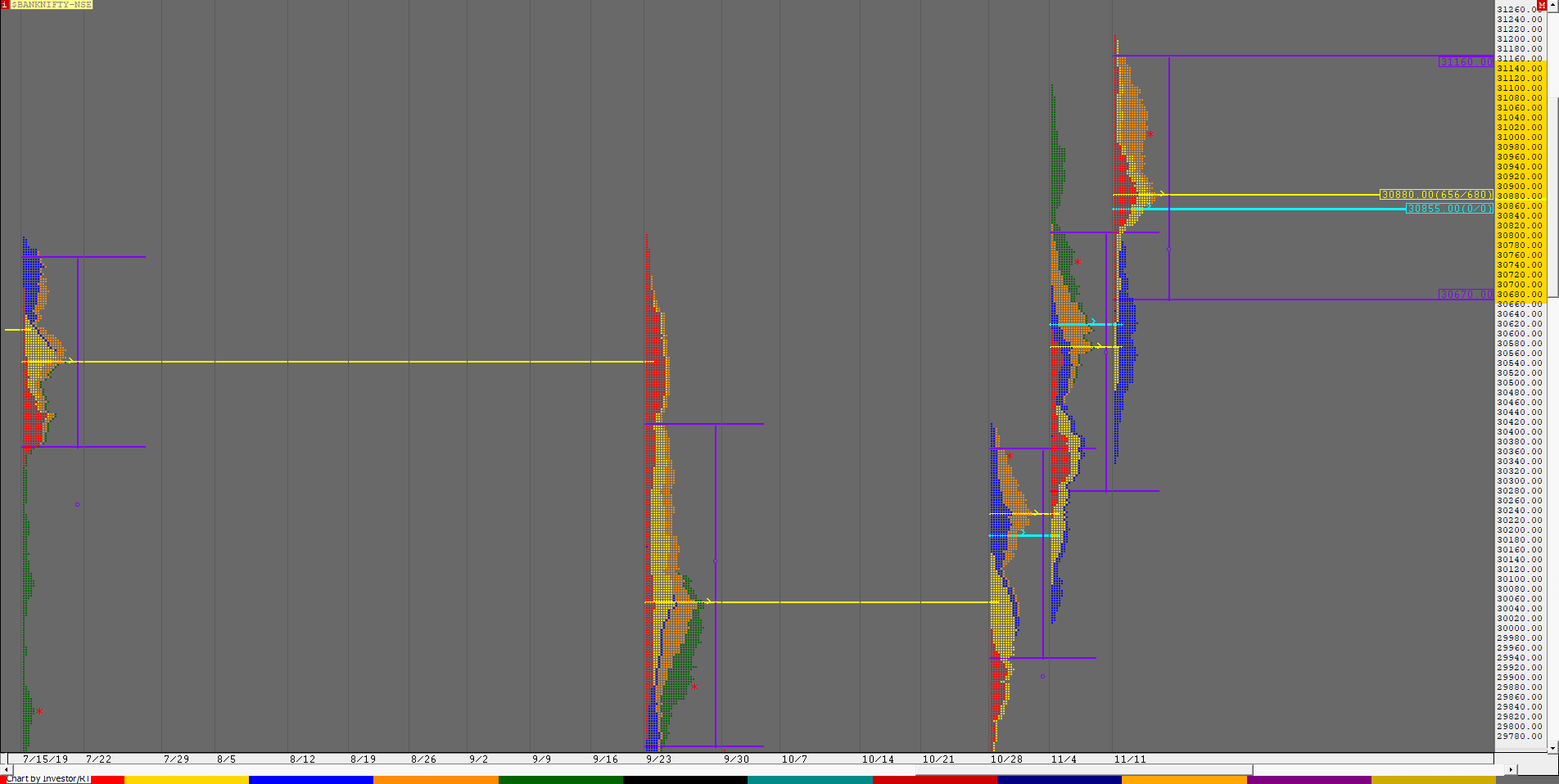

BankNifty Spot Weekly Profile (11th to 15th November)

31008 [ 31205 / 30338 ]

Previous week’s report ended with this ‘Immediate support in the coming week would be the high volume zone of 30620-570 below which the auction could probe lower to 30418 & 30204 and on the upside, BankNifty needs to sustain above 30800 to continue making higher Value with probable targets at 31082 & 31330’

BankNifty opened with a gap down on Monday but took support just above that high volume zone of 30570-30620 (mentioned in previous week’s report) as it made lows of 30625 in the ‘A’ period and went on to leave a buying tail from 30805 to 30625 to form a ‘p’ shape profile for most part of the day and gave a spike close scaling previous week’s high of 31108 and tagging 31205 leaving a spike reference of 30986 to 31205. The auction opened in this spike on Wednesday (after a holiday on Tuesday) but got rejected just below the spike high as it left a selling tail from 31108 to 31198 in the IB (Initial Balance) which was an indication that the PLR (Path of Least Resistance) has changed to the downside as BankNifty followed it up with a trending move lower as it not only got into previous day’s buying tail but went on to break below that high volume zone of 30620-30570 as it made new lows for the week at 30488 and continued this imbalance on the next day as it made new lows of 30338 in the ‘A’ period but could not extend the range lower indicating that the downside probe could be over. BankNifty then probed higher making a RE to the upside as it got back above that HVZ (High Volume Zone) of 30570-30620 to tag highs of 30789 before giving a strong close of 30750 on Thursday which led to a follow up on Friday as it opened with a gap up of more than 150 points and confirmed a new buying tail from 30870 to 30750 as it went on to test Tuesday’s selling tail of 31108 to 31198 but looked exhausted making similar highs in the range of 31160 to 31165 before closing the week at 31008 leaving an elongated weekly profile inspite of the relatively narrow range. The weekly Value was at 30670-30880-31160 which was mostly higher than previous week so the PLR remains up till BankNifty stays above 30880 in the coming week.

Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs get above 31065-78 & sustain for a move to 31155-165 / 31209-241 & 31330-345

B) Immediate support is at 30975-950 below which the auction could test 30889-870 / 30801 & 30750-713

C) Above 31345, BankNifty can probe higher to 31385-418 / 31475-505 & 31565-595

D) Below 30713, lower levels of 30625 / 30550-538 & 30450 could come into play

E) If 31595 is taken out, BankNifty could rise to 31685-708 / 31753-785 & 31853-865

F) Break of 30450 could trigger a move lower to 30364-335 / 30277 & 30204

G) Sustaining above 31865, the auction can tag higher levels of 31950 & 32025-40

H) Staying below 30204, BankNifty can probe down to 30105-090 & 30015

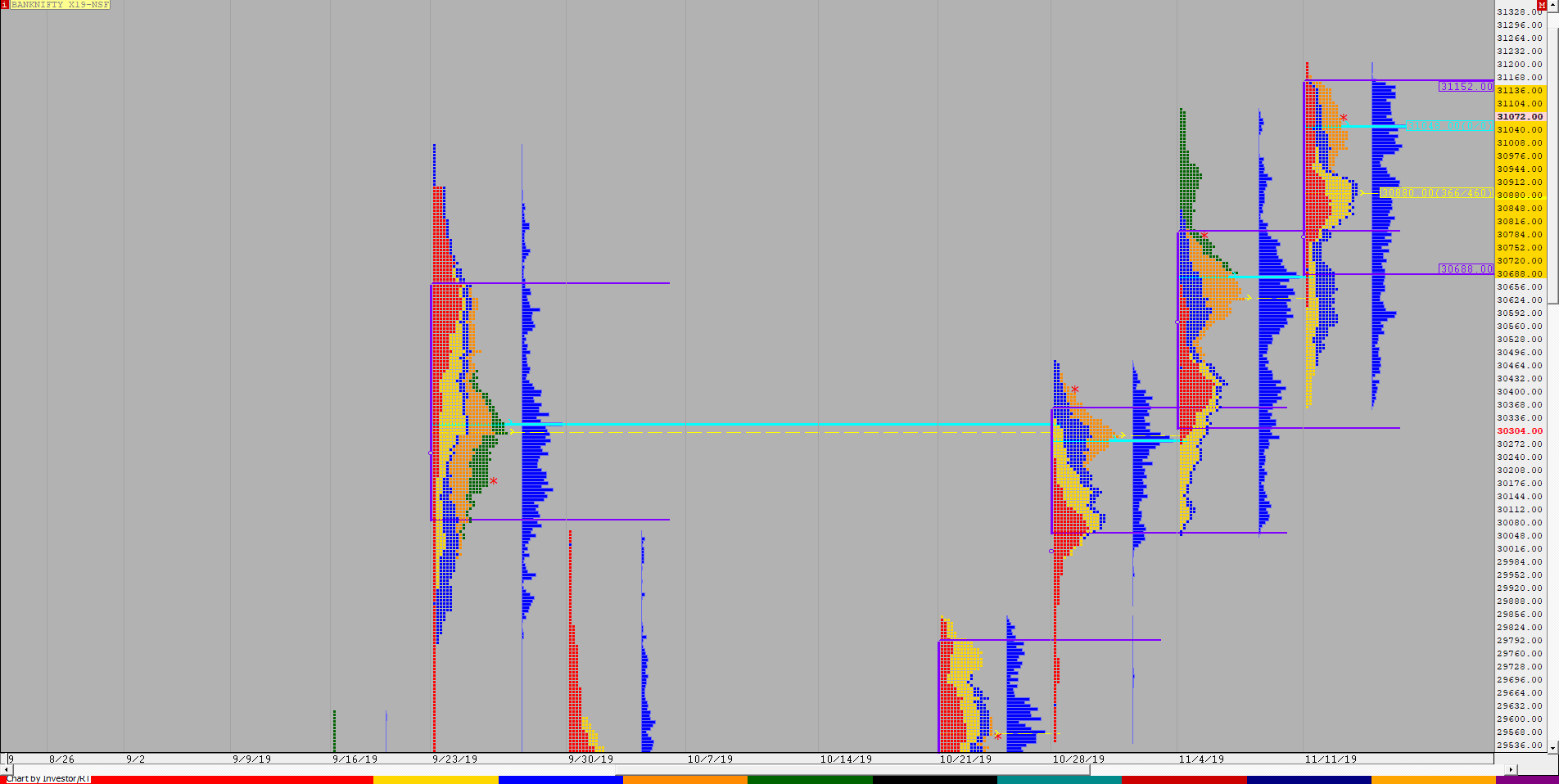

BNF (Weekly Profile)

31052 [ 31223 / 30361 ]

BNF opened lower this week on Monday but left singles at the previous week’s POC of 30680 as it left a buying tail from 30765 to 30610 on Monday and went on to probe higher closing the day with a big spike from 30968 to 31223. However, this spike was rejected in the next session confirming a short term excess from 31071 to 31223 which triggered a big & quick liquidation move as the auction negated the buying tail of Monday & went on to close the day with a spike down making a low of 30538. This imbalance continued in the next open as BNF made new lows of 30361 in the ‘A’ period on Thursday but could not extend the range further to the downside thus staying above previous week’s VAL (Value Area Low) of 30310 which indicated that the downside for the week could be done which was confirmed later in the day as it closed around the highs & also the weekly VAH of 30784. This strong close led to a gap up open on Friday and a probe higher as BNF got into the selling tail of 31071 to 31223 and made a RE to the upside in the ‘C’ period as it made highs of 31165 matching the Wednesday highs but once again was swiftly rejected as it made a fast swipe down making new lows for that day at 30860 but was quickly rejected here too as it confirmed a FA on the daily time frame and made a balance for most part of the day before making a marginally new high of 31185 but could not make new highs for the week and closed at 31052 which was the prominent POC for the day. The weekly Value was mostly higher at 30688-30880-31152 with a HVN at 31048 which would be the immediate reference to watch for a move away in the coming week.