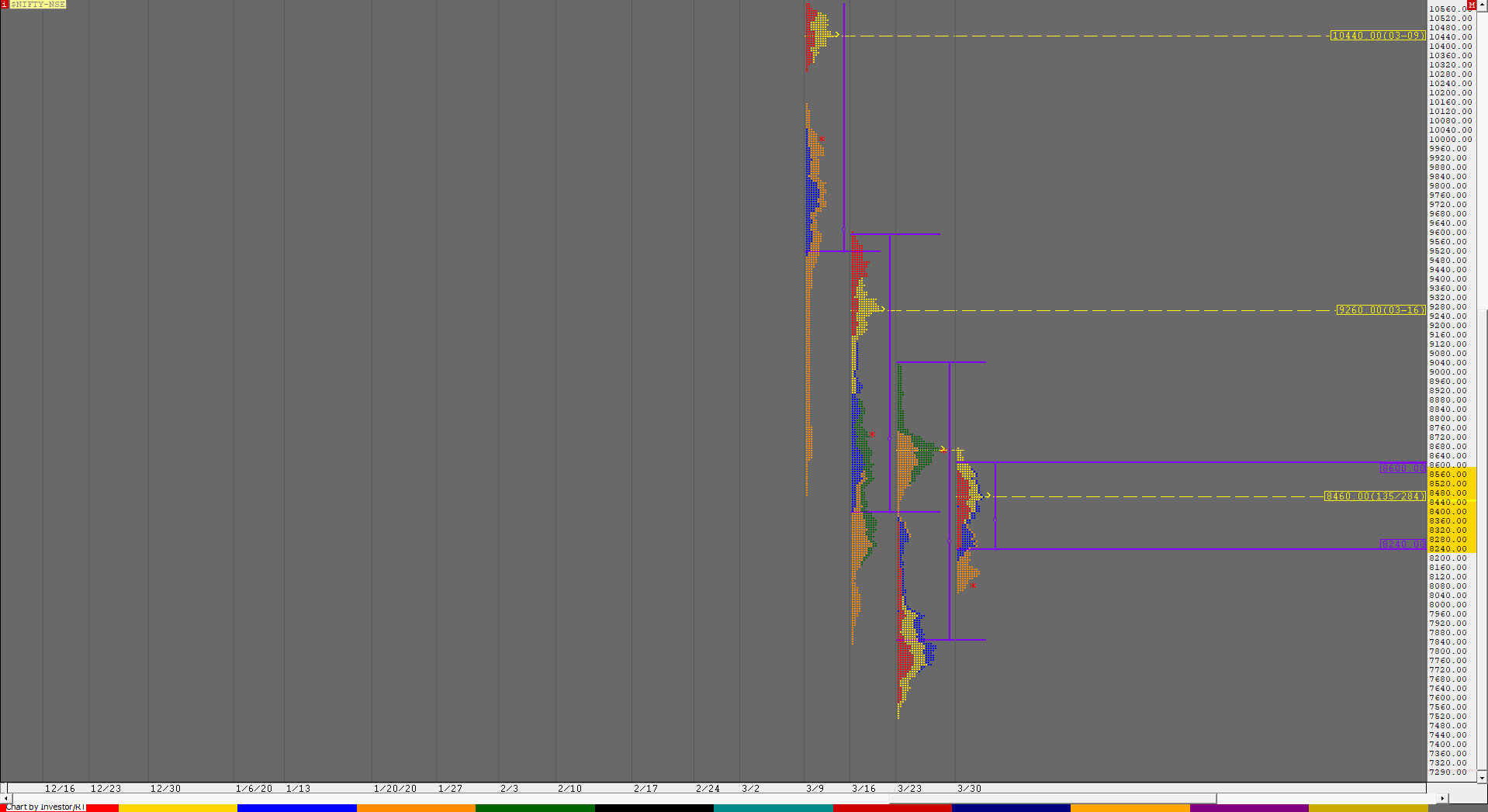

Nifty Spot Weekly Profile (6th to 10th Apr 2020)

Spot Weekly – 9112 [ 9132/ 8360 ]

Previous week’s report ended with this ‘This week’s Value is at 8240-8460-8600 and the 2-week composite Value stands at 7953-8626-9030 and as the close has been around the lows of the week, the PLR for the coming 3-day week which starts and ends with a holiday would be to the downside.‘

Nifty made a complete U-turn from previous week’s close as it opened with a big gap up of 362 points on Tuesday ending the sequence of opening the week with a gap down after 4 weeks as it made highs of 8468 in the ‘A’ period getting stalled near the weekly POC of 8460 to probe lower where it took support at 8360 leaving the narrowest IB range of 107 points in over a month hinting at a big Range Extension (RE) coming. The auction then made a successful RE in the ‘D’ period as it got above the important level of 8460 triggering a OTF move all day as it went past previous week’s VAH of 8600 & even negated the weekly FA of 8678 completing a 4 IB day as it made a high of 8819 starting the week with a Trend Day Up which meant the PLR had very firmly changed to the upside. The Trend Day had not left any PBL in the afternoon which meant the auction was looking a bit stretched and the retracement came in the form of a lower opening at 8688 on Wednesday but took support above that 2 week composite POC of 8626 and was rejected from that negated weekly FA of 8678 resuming the probe higher as Nifty scaled above PDH and went on to hit 8980 recording the highest IB range in April of 327 points and continued the surge with a manic C period extension of 155 points it completed the swipe in the selling tail of the profile of 18th Mar which was from 8953 to 9127, the day from when Nifty had started the new leg lower after leaving couple of FAs at 9404 & 9602 on the first 2 days of that week. This was an important supply zone and the auction made a sharp retracement over the next 7 periods after leaving a selling tail from 9054 to 9132 as it made a low of 8700 before closing the day at the dPOC of 8748. Thursday saw a gap up open of 225 points as Nifty started to form a balance above previous day’s Value but below the selling tail as it stayed in a narrow range of 115 points till the C period after which it made an attempt to make a RE lower in the ‘D’ period which was rejected at 8904 and this led to a fresh probe on the upside resulting in a successful RE higher which confirmed a FA at lows as Nifty got acceptance in the singles negating it completely as it made a high of 9128 before closing the week at 9112. The weekly profile resembles a ‘p’ shape indicating short covering on a higher time frame with the Value also being completely higher at 8740-9020-9100 plus the close at the highs keeps it on track for a probe towards the weekly VPOC of 9260 & the FA of 9404 in the coming week provided it stays above the weekly VAH of 9100 and is able to sustain above the VWAP of the March series which was at 9148. On the downside, 9020 would be the important level on watch below which the PLR would change lower.

Click here to view this week’s auction in Nifty with respect to previous week’s profile on MPLite

Main Weekly Hypos for Nifty (Spot):

A) Nifty needs to sustain above 9121 for a move to 9169 / 9217 / 9260**-82* / 9313-22 & 9354-61

B) The auction has immediate support at 9100-70 below which it could test 9025-20 / 8978 / 8924-04 & 8860-40

Extended Weekly Hypos

C) If 9361 is taken out, Nifty can probe higher to 9404-15 / 9441*-58 / 9491-9507 / 9556-65 & 9602-05

D) Break of 8840 could bring lower levels of 8790 / 8748*-40 / 8700 / 8649 & 8599-40

-Additional Hypos*-

E) Above 9605*, Nifty could start a new leg up to 9655 / 9702 / 9733-52 / 9801 & 9850-9906

F) Below 8540*, the auction can fall further to 8510-8499 / 8445* / 8413-8394 / 8363-25 & 8284*-81

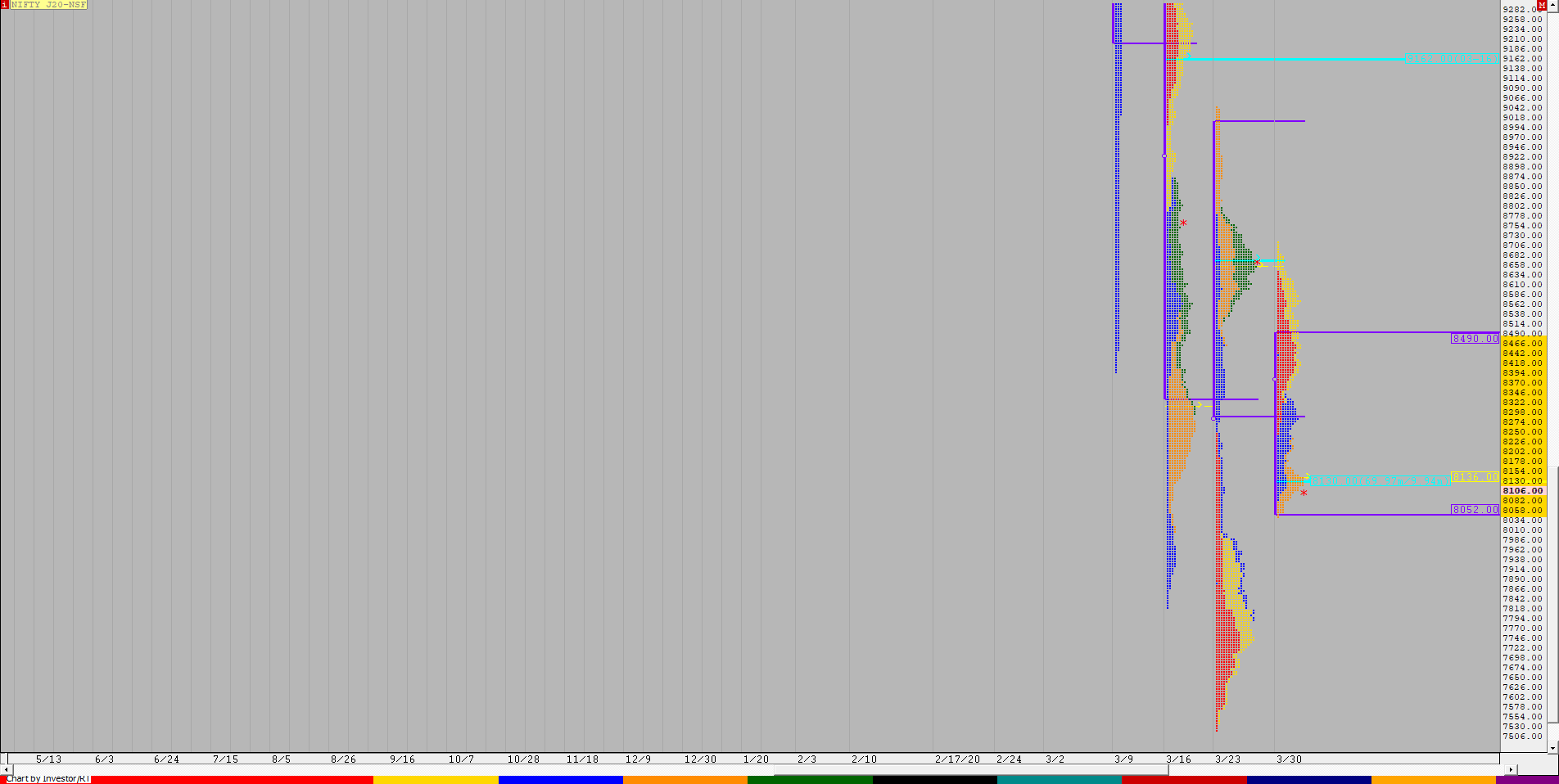

NF (Weekly Profile)

9087 [9145 / 8372]

NF has closed exactly 1000 points above the previous week’s close after opening with a Gap up of 366 points on Tuesday and probed higher all day moving away from previous week’s Value as it left a Trend Day Up on the first day of the week and continued this imbalance into the first 90 minutes of Wednesday as it made highs of 9145 in a ‘C’ side extension which marked the end of the upmove and led to a retracement to 8686 which was also the RO (Roll Over) point of the April series. Thursday saw another gap up open as the auction confirmed a multi-day FA at 8686 and formed a balance above previous day’s Value for most part of the day before it confirmed another FA at 8891 which led to a fresh RE to the upside as NF made highs of 9111 before closing at 9087. The weekly profile resembles a ‘p’ shape with Value completely higher at 8736-9024-9090 and the close at the VAH means the PLR for the coming week would be to the upside towards the VPOC of 9169, the 1 ATR objective of 9211 from 8686 & finally that FA of 9384. On the downside, acceptance below 9012 would mean that the sellers are taking control thus negating the bullish bias.

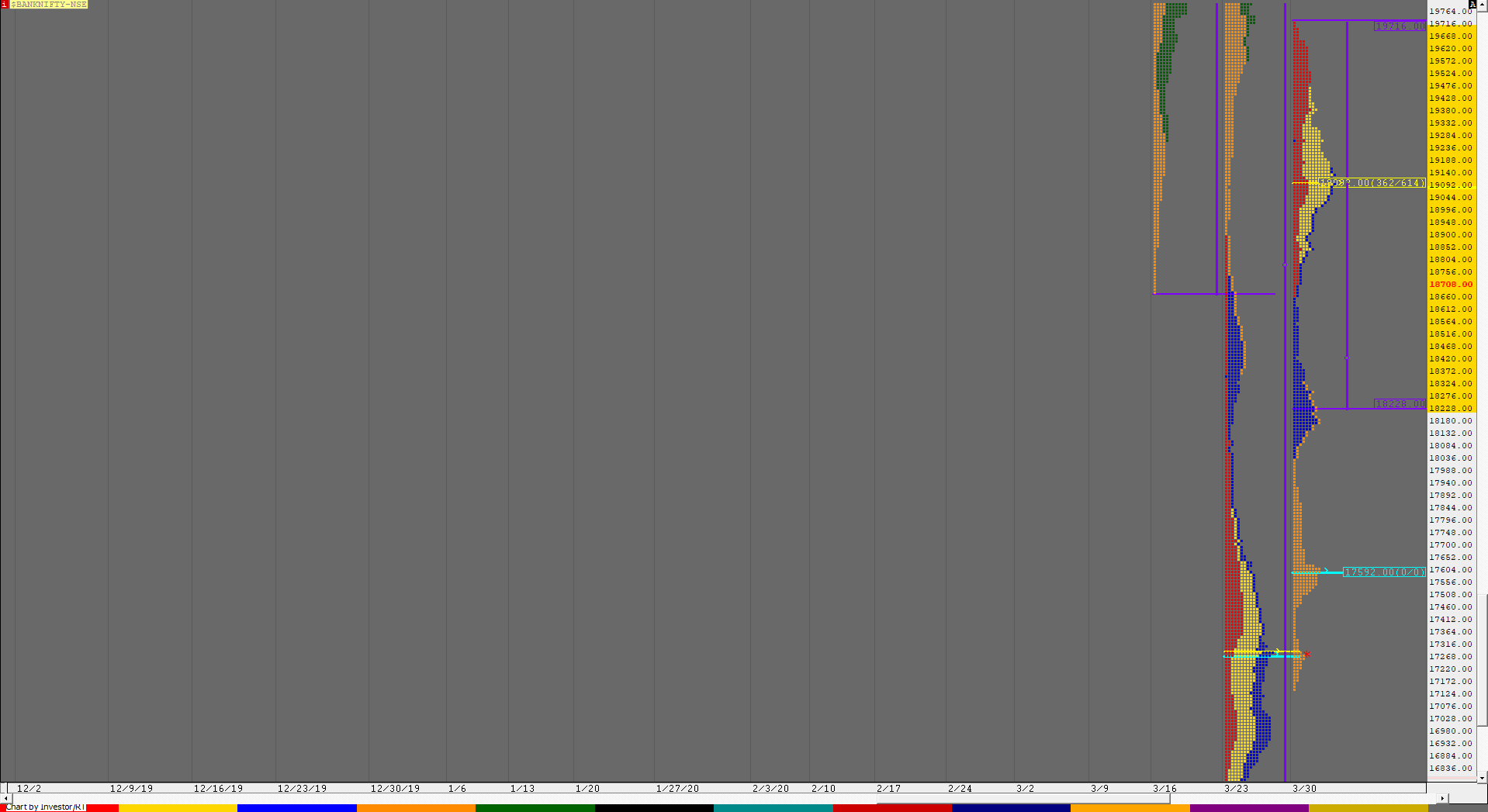

BankNifty Spot Weekly Profile (6th to 10th Apr 2020)

Spot Weekly – 19913 [ 20234 / 17953 ]

Previous week’s report ended with this ‘the 2-week composite Value formed is at 16322-17280-19519 so staying below 17280, the PLR for the coming week would remain to the downside for a probable target of the 2 ATR objective of 16078 from the daily FA of 19716.’

BankNifty opened this week with a big gap up of 1205 points rejecting previous week’s spike close as it made highs of 18498 at open and gave a retracement lower ending in a C side Range Extension as it made lows of 17953 but was pushed back into the Initial Balance (IB) in the ‘D’ period which started an OTF (One Time Frame) probe higher for the rest of the day as the auction first confirmed a FA at lows after which it went on to take out previous week’s main extension handle of 18669 to set up the trend to the upside for the week just like it had done with a FA at 19716 at highs in the previous week but in the opposite direction as it tagged the weekly POC & HVN of 19092 while making highs of 19190 leaving a Neutral Extreme (NeuX) Day on the upside. A NeuX Day is notorious for not giving any follow up and this was seen again on Wednesday as the auction not only opened with a gap down but also continued lower testing previous day’s extension handle of 18498 and took support there as it made lows of 18483 which indicated that the demand was coming back and this resulted in a quick move to the upside as BankNifty made new highs for the week at 19665 in the IB completing the 1 ATR objective of 19573 from the FA of 17954 leaving a big range of 1183 points which a long buying tail from 19017 to 18483. The auction then made a C side RE extending the day’s range by another 659 points as it made a swipe at the HVN & monthly POC of 20248 while forming highs of 20324 where it was swiftly rejected with the confirmation coming in the form of big selling tail from 20324 to 19980. This rejection led to a big liquidation move over the next 7 periods as BankNifty trended lower and in the process negated 50% of the morning buying tail as it left a PBL (Pull Back Low) at 18675 in the ‘J’ period which was an important nuance as it meant that the auction was getting buying interest around the level of 18669. Thursday open gave more confirmation that the downside was limited in form of a 600 point gap up after which BankNifty made a nice balance inside previous day’s range but formed higher Value leaving the second NeuX profile in 3 days as it closed the week at 19913. The PBLs (Pull Back Low) at 19167 & 19522 along with the prominent POC at 19608 would be the important references on the downside for the coming week which has overlapping to higher Value at 18768-19572-19944 and on the upside, we have the singles at top of the weekly profile from 19988 to 20324 which needs to be taken out for the PLR to remain higher.

Main Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to get above 19950 & sustain for a probe to 20040-094 / 20165-235 / 20310-325 / 20375 & 20450-488 and acceptance above 20488 could go for 20521-593 / 20665-735 / 20800-810 / 20880 & 20955-21026

B) Immediate support is at 19880-860* below which the auction could test 19810-740 / 19655 / 19608-572 / 19522-460 & 19390-321 and staying below 19321 could further fall to 19252-236 / 19166-110 / 19045 / 18976-960* & 18875-835

Extended Weekly Hypos

C) Above 21026, BankNifty can probe higher to 21098-120 / 21171-245 / 21287-317 / 21390-463 / 21515-555 & 21610-685

D) Below 18835, lower levels of 18768-675 / 18595-565 / 18498 / 18412 / 18272* & 18225-184 could come into play

-Additional Hypos*-

E) Above 21685*, BankNifty could start a new leg up to 21831-845 / 21910 / 21979-999 / 22055-125 / 22200-275 & 22350

F) Below 18184*, the auction can go down to 18094-009 / 17954* / 17890-825 / 17750-680 / 17596* & 17510-490

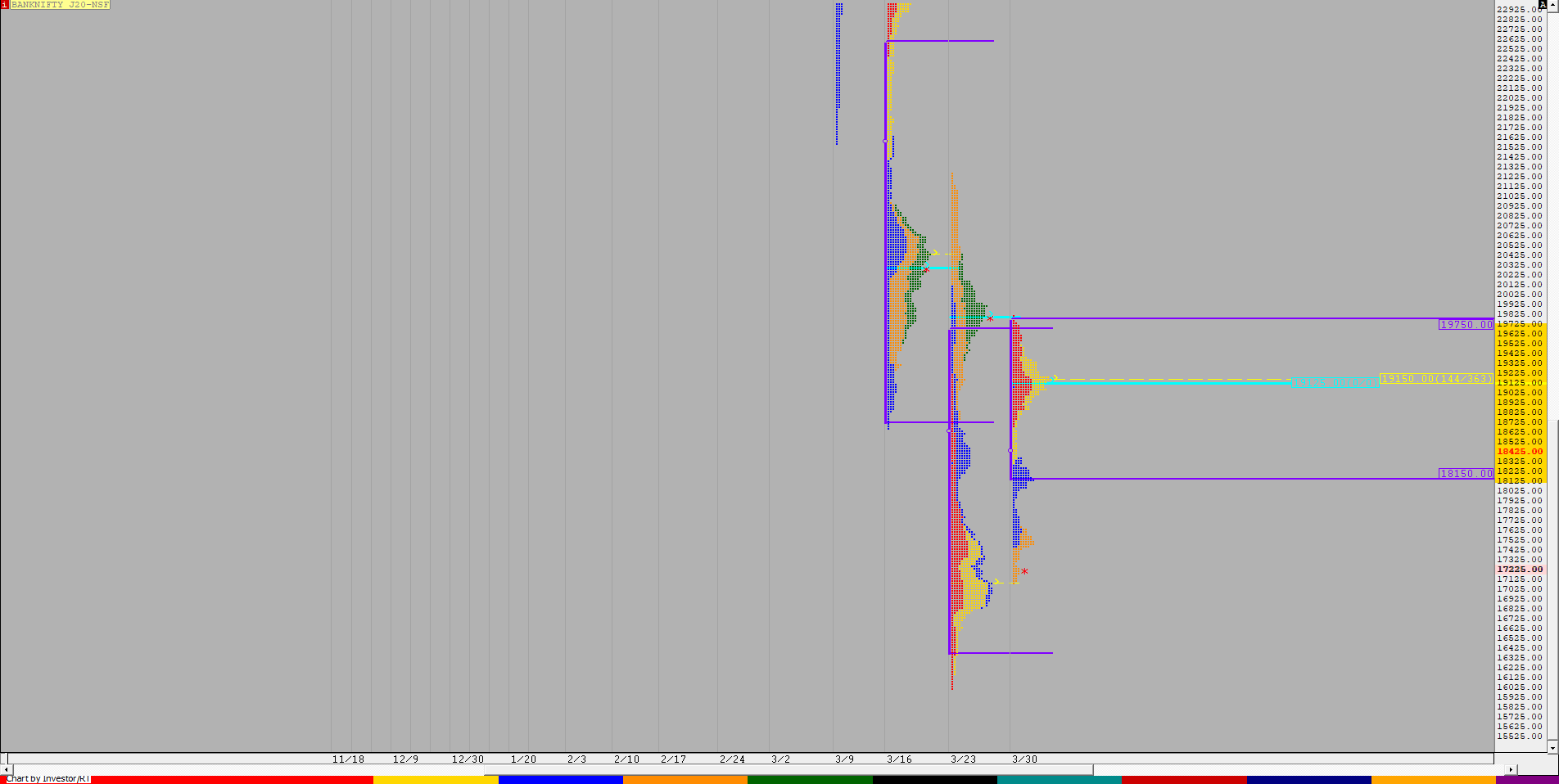

BNF (Weekly Profile)

19768 [ 20599 / 17921 ]

BNF also opened with a big gap of more than 1000 points this week after which it confirmed a daily FA at 17921 which set up the week for more upside as the auction went on to tag the weekly POC of 19150 while making a high of 19250 on Tuesday and continued this imbalance on Wednesday after making a dip to 18495 in the IB as it not only took out the HVN of 19820 which was incidentally also the 1 ATR from the FA but also went on to make a swipe to 20599 in a ‘C’ side extension of almost 1000 points. BNF then retraced the entire move higher to drop by more than 2000 points as it left a PBL at 18570 before closing around the dPOC of 18860 confirming an excess from 19980 to 20599 on the daily time frame and just as it seemed that the auction would continue to probe lower on Thursday, it opened with a gap up of 500 points and made a narrow range inside day forming a balanced profile with higher Value with a close at 19768. The weekly Value was at 18800-19550-19800 which was almost inside previous week’s Value and the volume cluster of 19500-550 would be the important reference on the downside for the coming week. BNF will need to get accepted above 19980 for the auction to continue probing higher towards the 2 ATR objective of 21715 in the coming session(s)