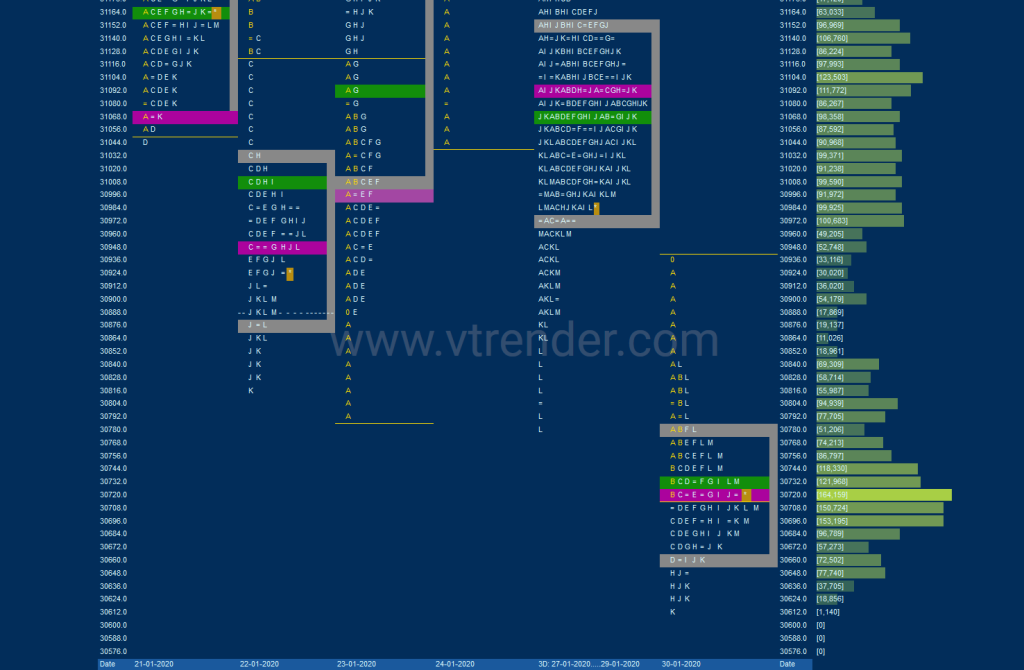

Order Flow charts dated 31st Jan 2020

Order Flow trading is thinking about what order market participants do and when you think along this, you can anticipate what kind of action they will be taking in the market. This is a very important concept in Order Flow. Market participants always look for the weaker side of the market, so both buy and […]

Order Flow charts dated 31st Jan 2020 (5 mins)

The way we see it is that Order Flow trading is a mindset. Well, instead of just looking for technical patterns, Trader should go a step further and think about what other market participants might do. NF (Feb) BNF (Feb)

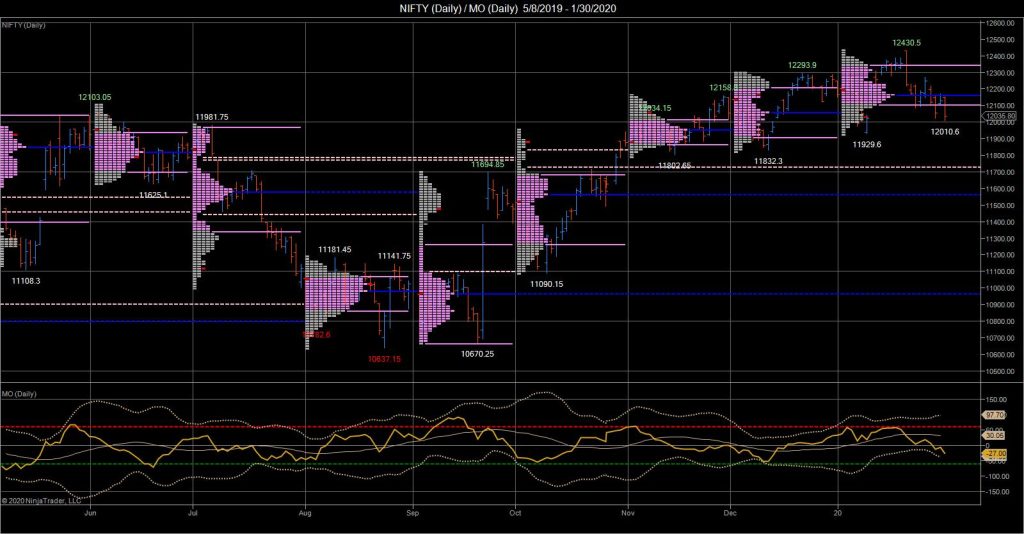

Market Profile Analysis dated 30th Jan 2020

Nifty Feb F: 12060 [ 12139 / 12035 ] HVNs – 11980 / 12055 / 12078 / 12160 / 12230 / 12310 / 12395 NF did move away from the 2-day balance to once again form lower Value leaving a ‘b’ shape profile for the day so the dPOC of 12055 will be the important […]

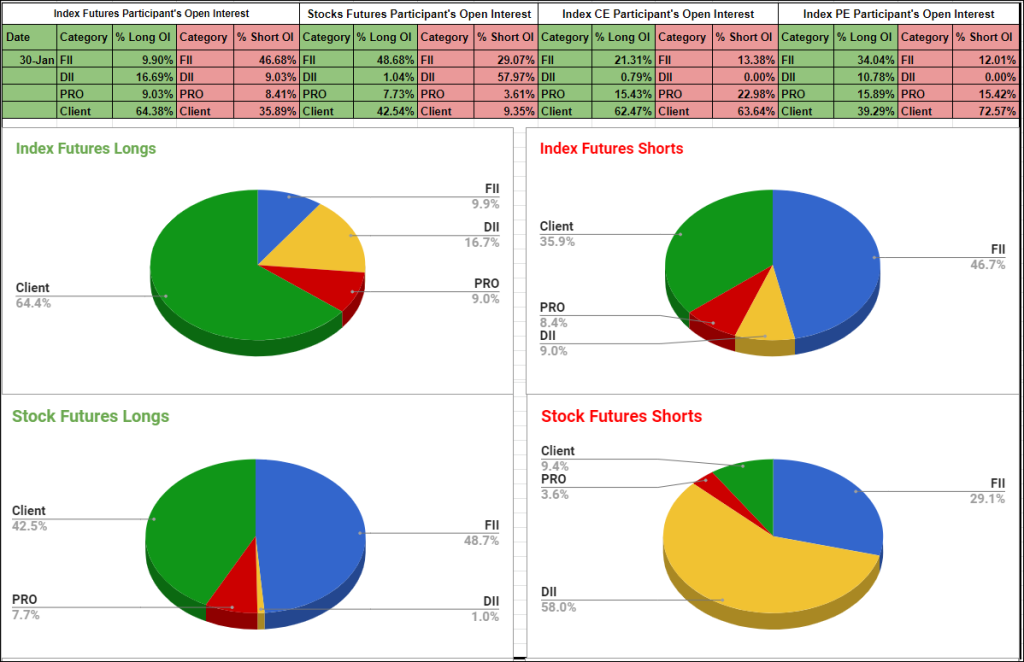

Participantwise Open Interest – 30th JAN 2020

Series view At the close of JAN series FIIs are holding 10% long and 47% short Open Interest in Index Futures, they are holding 49% long and 29% short OI in Stocks Futures. Clients are holding 64% long and 36% short Open Interest in Index Futures, they are holding 43% long and 9% short Open Interest […]

Desi MO (McClellans Oscillator For NSE) – 30th JAN 2020

MO at -27

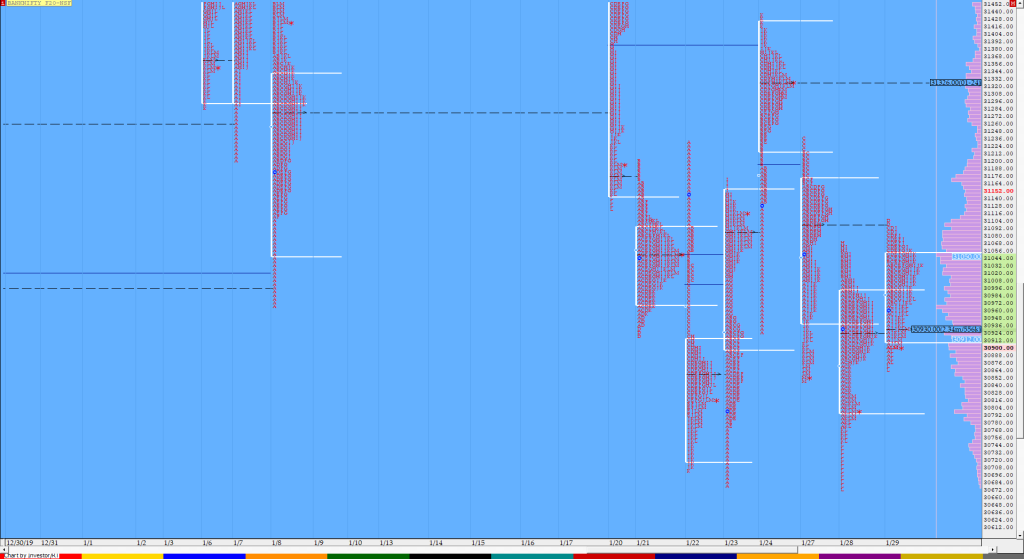

Order Flow charts dated 30th Jan 2020

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

Order Flow charts dated 30th Jan 2020 (5 mins)

Order Flow can show how a collection of market participates has acted in the past and this helps to create profit by knowing if these traders are profitable or caught upside down. NF (Feb) BNF (Feb)

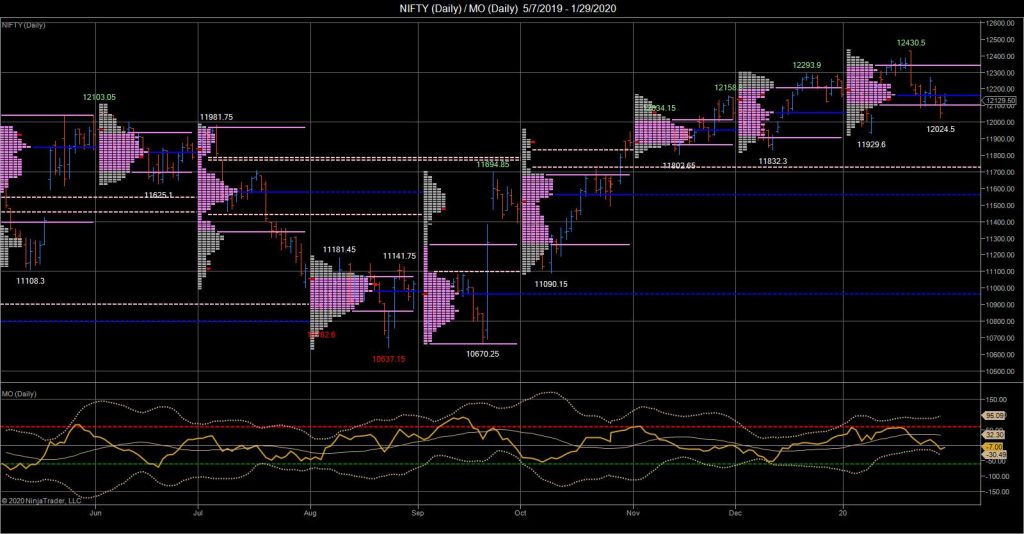

Market Profile Analysis dated 29th Jan 2020

Nifty Jan F: 12121 [ 12182 / 12095 ] HVNs – (11946-964) / 11994 / 12040 / 12062 / 12120 / 12153 / 12189 / 12244 / 11272 / 12305 NF opened with a gap up leaving a buying tail from 12105 to 12068 and made an attempt to tag the VPOC of 12189 as […]

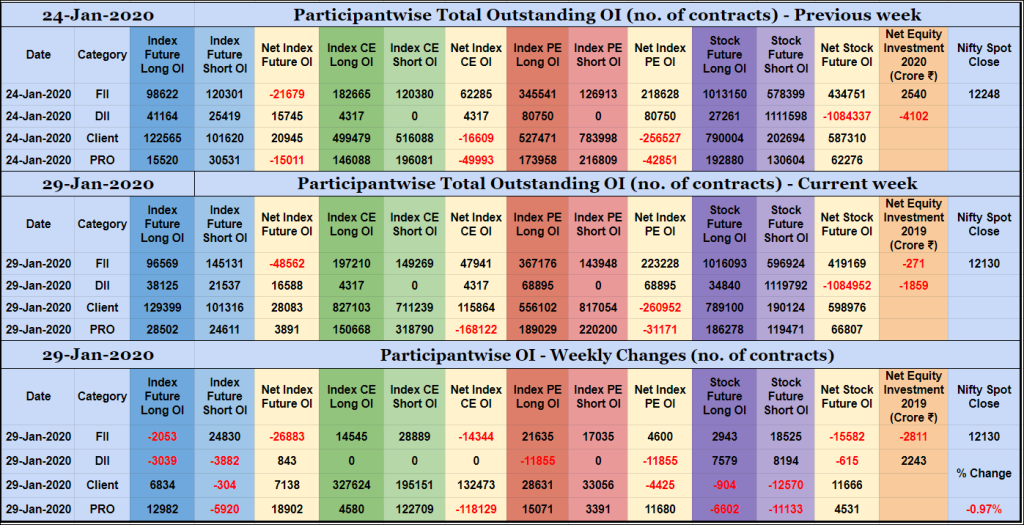

Participantwise Open Interest – 29th JAN 2020

Mid-week view FIIs have added 24K short Index Futures, net 14K short Index CE, net 4K long Index PE and net 15K short Stocks Futures contracts this week. They have also been net sellers in equity segment for ₹2811 crore during the week. FII’s are net short by 48K contracts in Index Futures going into […]

Desi MO (McClellans Oscillator For NSE) – 29th JAN 2020

MO at -7