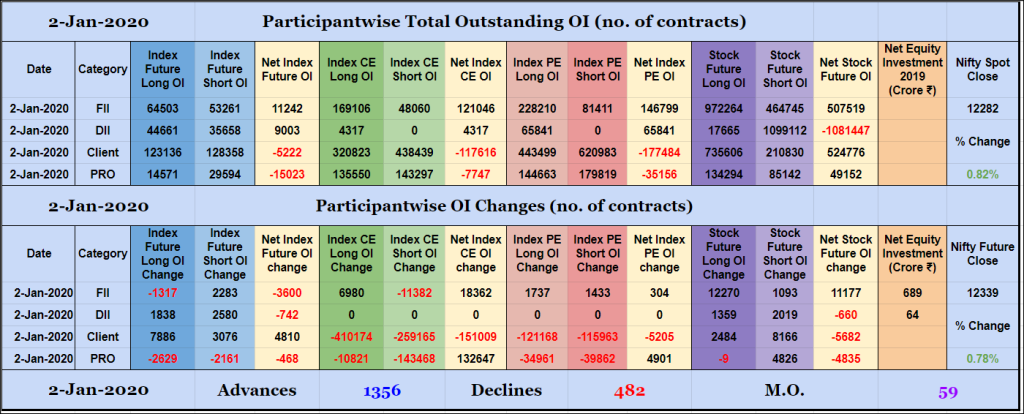

Participantwise Open Interest – 2nd JAN 2020

FIIs added 2K short Index Futures, 6K long Index CE and net 11K long Stocks Futures contracts, they were net buyers in equity segment for ₹689 crore. Clients added net 4K long Index Futures and net 5K short Stocks Futures contracts today, they reduced exposure in Index Options.

Market Profile Analysis dated 2nd January 2020

Nifty Jan F: 12339 [ 12344/ 12245 ] HVNs – 12130 / 12160 / 12193 / (12240-250) / 12270-280 / 12320 NF started the day with an Open Test Drive higher as it moved away from yesterday’s POC of 12240 and went on to scale above the important zone of 12274-12278 in the Initial Balance […]

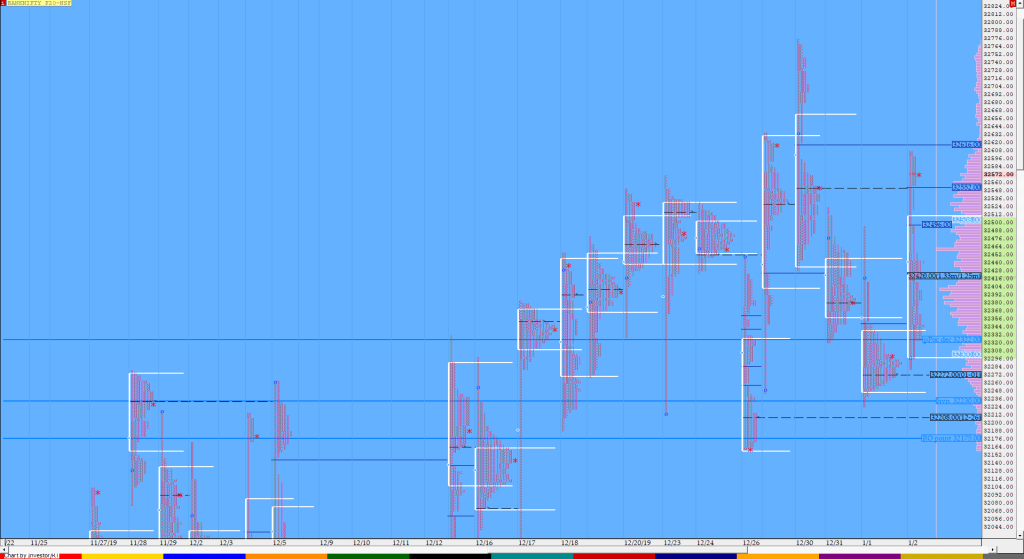

Desi MO (McClellans Oscillator For NSE) – 2nd JAN 2020

MO at 59 Declining volume dip below 10%

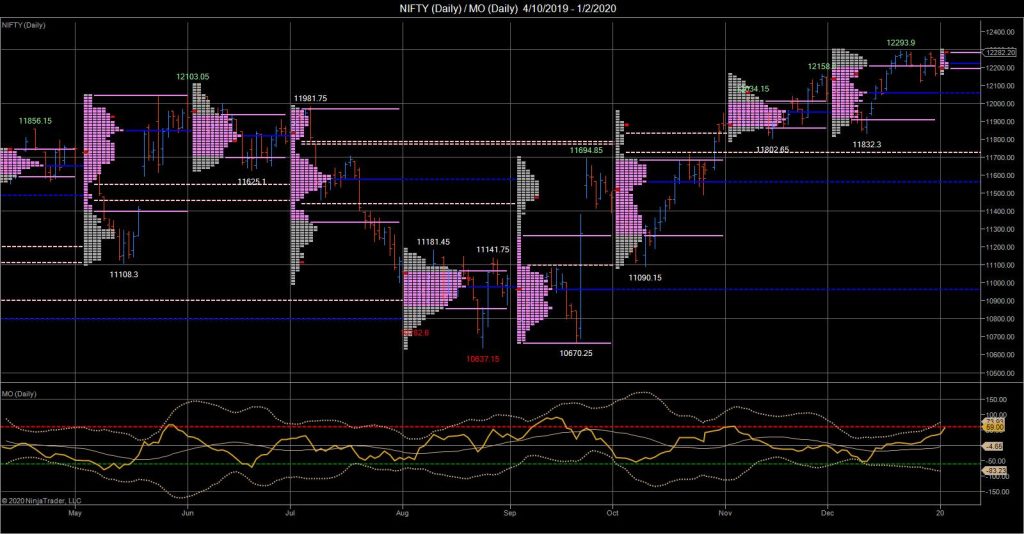

Order Flow charts dated 2nd Jan 2020

Many traders are looking for information on how to use market conditions to find good trades. Order Flow is best understood as a way to see existing bias in the markets. Order Flow helps us understand who is in control of the market and who is ‘upside down’ and likely to make exits from that […]

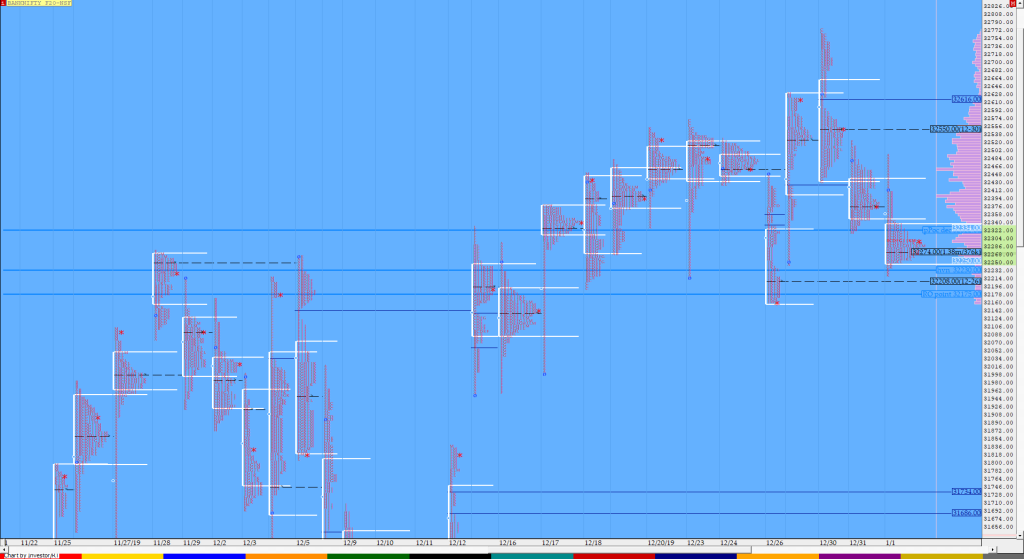

Order Flow charts dated 2nd Jan 2020 (5 mins)

Order Flow can show how a collection of market participates has acted in the past and this helps to create profit by knowing if these traders are profitable or caught upside down. NF BNF

Market Profile Analysis dated 1st January 2020

Nifty Jan F: 12244 [ 12270/ 12226 ] HVNs – 12130 / 12160 / 12193 / (12240-250) / 12274 / 12330 Previous day’s report ended with this ‘The reference for the first open of 2020 would be 12265 to 12230 above which 12274-278 will be an important zone in the coming sessions.’ NF opened in […]