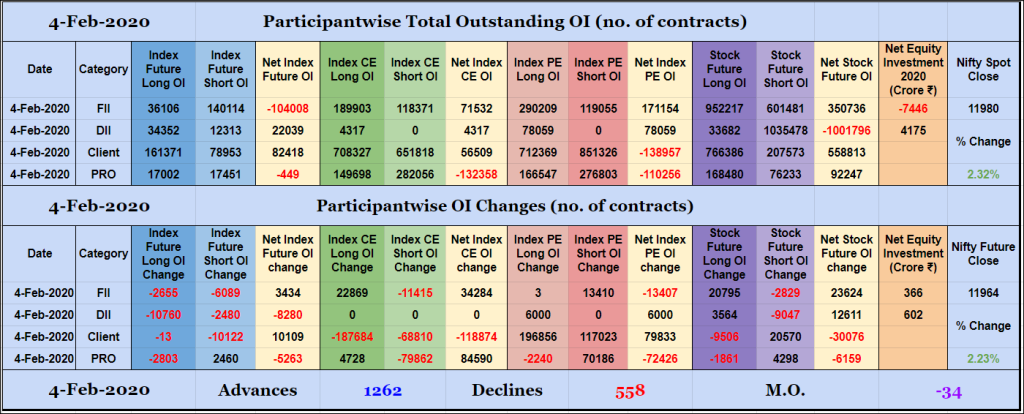

Participantwise Open Interest – 4th FEB 2020

FIIs added 22K long Index CE, 13K short Index PE and 20K long Stocks Futures contracts while reducing exposure in Index Futures. They were net buyers in equity segment for ₹366 crore. Clients reduced exposure in Index Futures and Index CE but added net 79K long Index PE and 20K short Stocks Futures contracts. Nifty […]

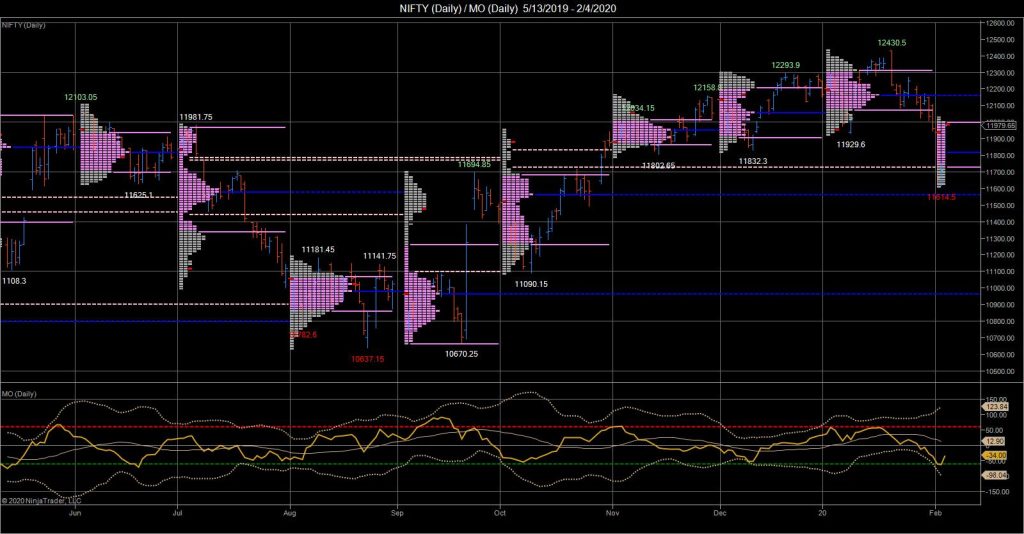

Desi MO (McClellans Oscillator For NSE) – 4th FEB 2020

MO at -34

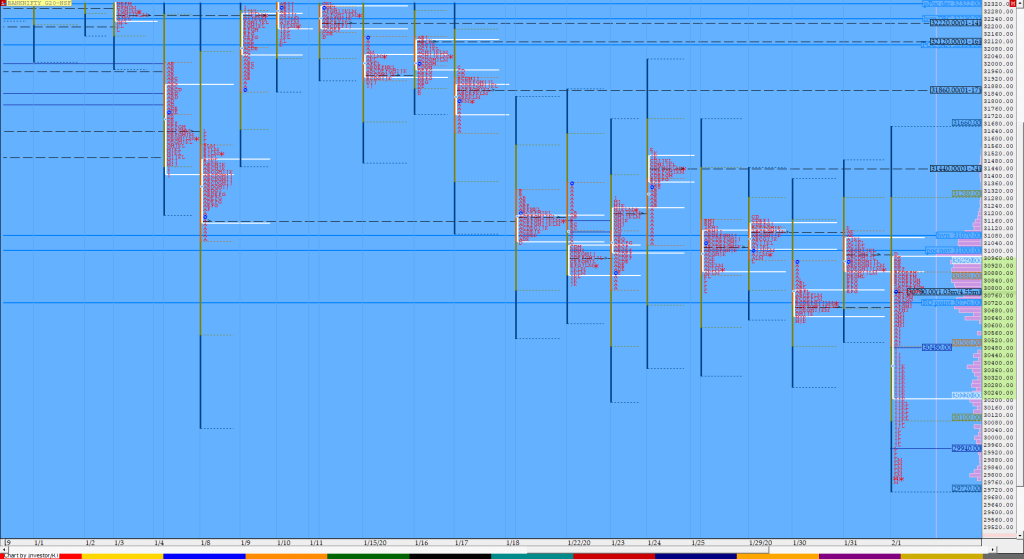

Order Flow charts dated 4th Feb 2020

When we think about how to measure volume in the market one of the keys is Order Flow. It plays a role by telling us what the other traders have done in the market and are currently doing and this provides valuable clues and potential opportunities to trade. An Order Flow trader can actually see […]

Order Flow charts dated 4th Feb 2020 (5 mins)

The way we see it is that Order Flow trading is a mindset. Well, instead of just looking for technical patterns, Trader should go a step further and think about what other market participants might do. NF BNF

Market Profile Analysis dated 3rd Feb 2020

Nifty Feb F: 11703 [ 11747 / 11598 ] HVNs – 11635 / 11685 / 11820 / 11978 / 12055 / 12078 NF continued the imbalance of 1st Feb at open as it started with a freak OL (Open=Low) tick at 11598 but was rejected from these new lows to leave a small buying tail […]