Market Profile Analysis dated 24th Feb 2020

Nifty Feb F: 11827 [ 11970 / 11814 ] HVNs – 11830 / (11898) / 11930 / (11976) / 12012 / 12080 / 12111 / 12130 Previous day’s report ended with this ‘NF closed the day at 12079 but has given a second successive Neutral Extreme profile though in opposite directions leaving a nice 2-day […]

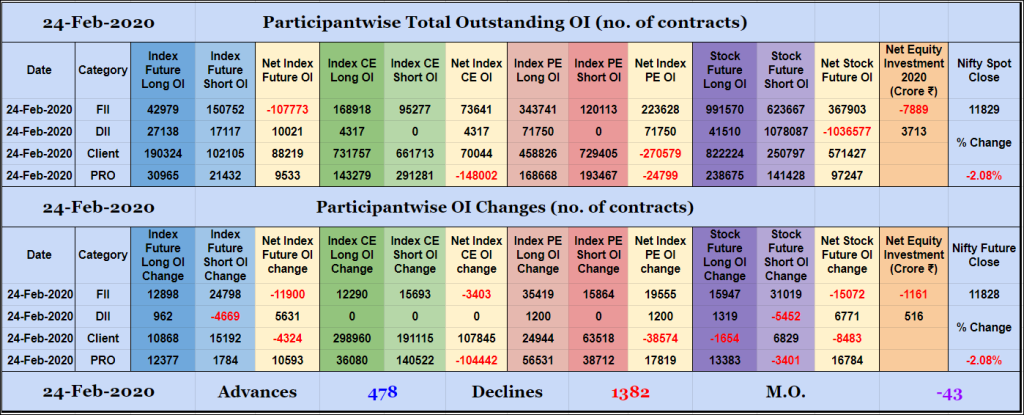

Participantwise Open Interest – 24th FEB 2020

FIIs added net 11K short Index Futures, net 3K short Index CE, net 19K long Index PE and net 15K short Stocks Futures contracts. They were net sellers in equity segment as well for ₹1161 crore. Clients added net 4K short Index Futures, net 107K long Index CE, net 38K short Index PE and 6K […]

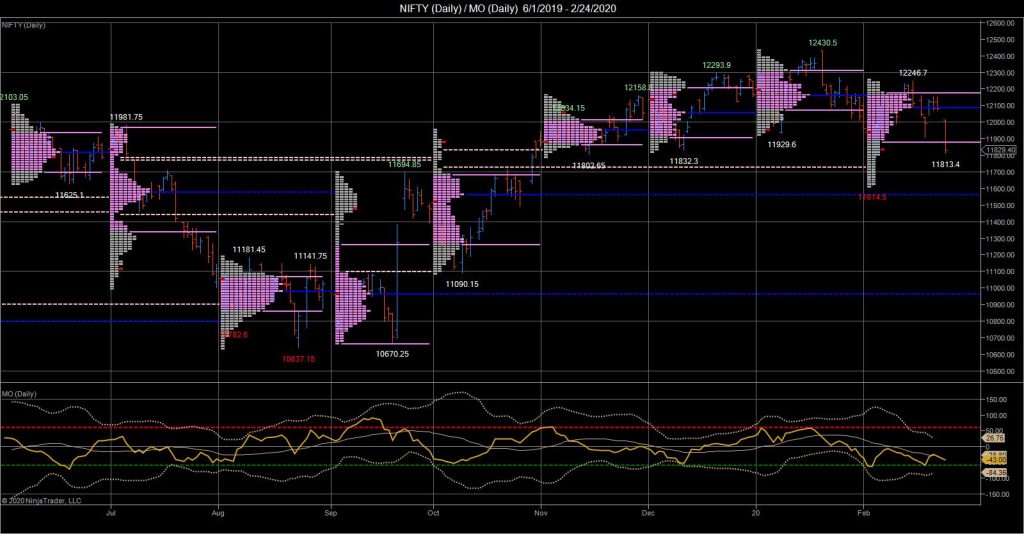

Desi MO (McClellans Oscillator For NSE) – 24th FEB 2020

MO at -43

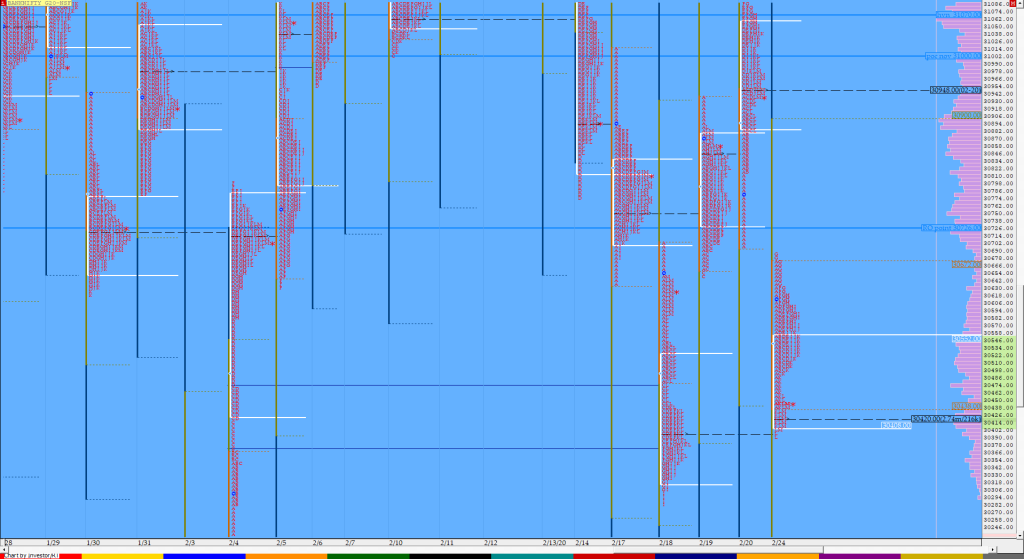

Order Flow charts dated 24th Feb 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

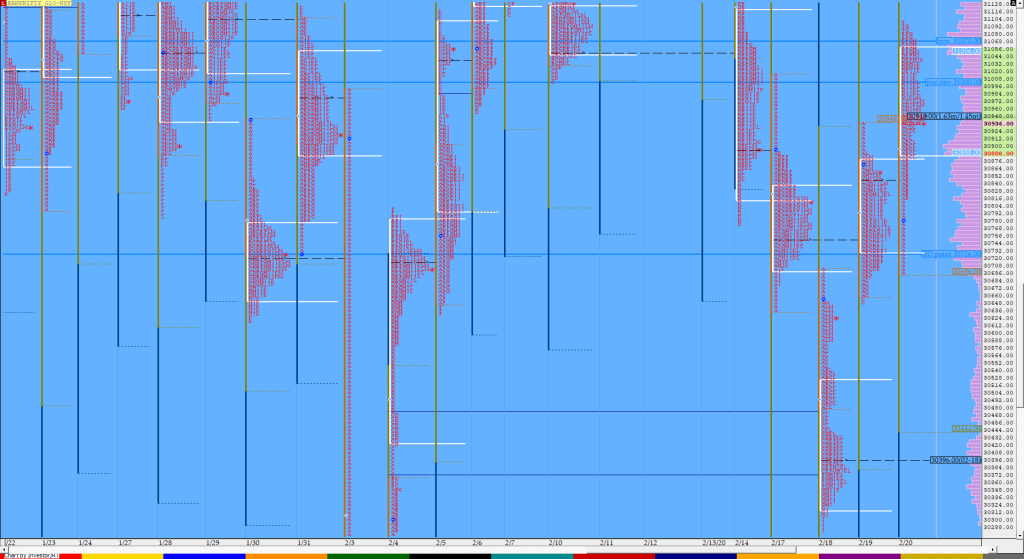

Order Flow charts dated 24th Feb 2020 (5 mins)

An Order Flow trader can actually see exactly what is happening in the market as it happens. Once you are able to understand what is happening in the present, you are able to make far better decisions about what might happen in the future. Order Flow provides traders with vision into market activity. NF BNF

Market Profile Analysis dated 20th Feb 2020

Nifty Feb F: 12079 [ 12163 / 12065 ] HVNs – (11976) / 12012 / 12080 / 12111 / 12130 / 12162 / (12220) NF opened lower below the Neutral Extreme reference of 12128 to 12150 but also made an almost OL (Open=Low) start of 12103-12100 as it made an attempt to get back into […]