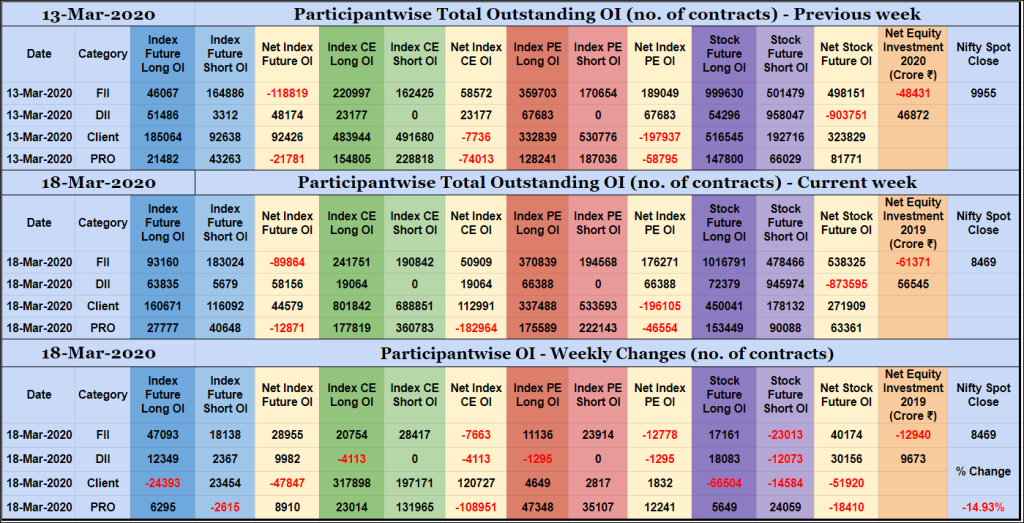

Participantwise Open Interest – 18th MAR 2020

Mid-week view FIIs have added net 28K long Index Futures, net 7K short Index CE, net 12K short Index PE and 17K long Stocks Futures contracts this week besides covering 23K short Stocks Futures contracts. They have been net sellers in equity segment for ₹12940 crore. Clients have added 23K short Index Futures, net 120K […]

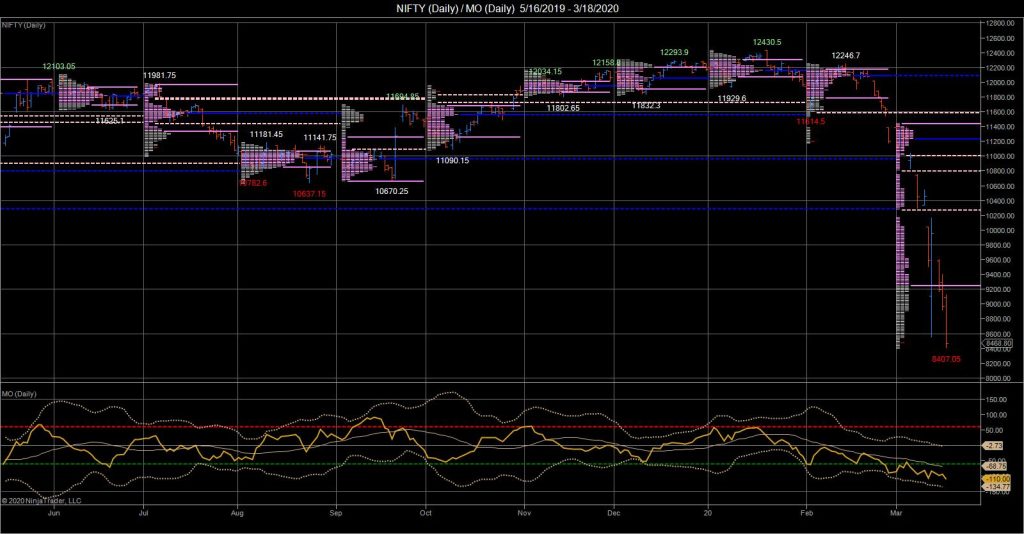

Desi MO (McClellans Oscillator For NSE) – 18th MAR 2020

MO at -110

Order Flow charts dated 18th Mar 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

Order Flow charts dated 18th Mar 2020 (5 mins)

An Order Flow trader can actually see exactly what is happening in the market as it happens. Once you are able to understand what is happening in the present, you are able to make far better decisions about what might happen in the future. Order Flow provides traders with vision into market activity. NF BNF

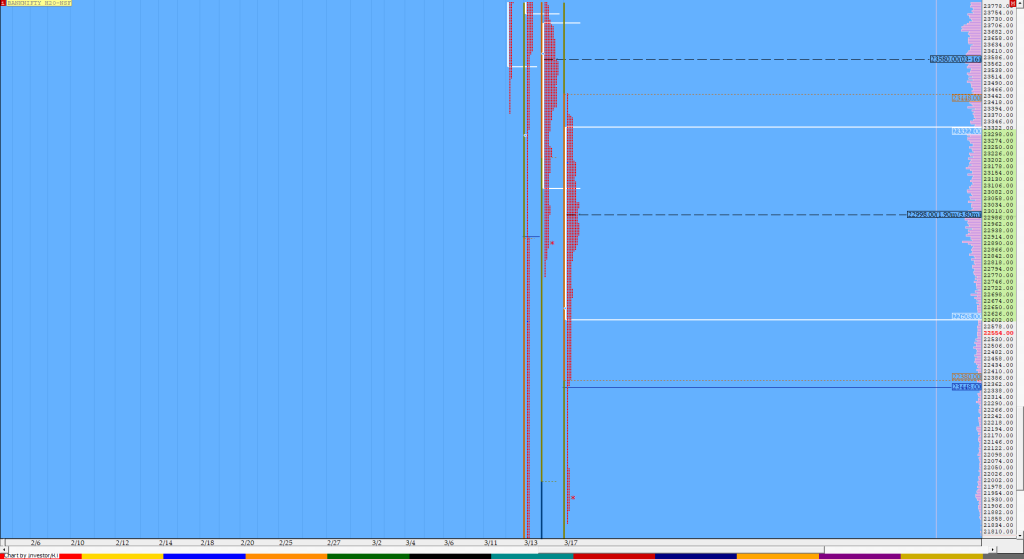

Market Profile Analysis dated 17th Mar 2020

Nifty Mar F: 8915 [ 9358 / 8851 ] HVNs – (8680) / (8900) / (9110-120) / 9200 / 9380 / [9425] / (9530) / 9680 / 9740 / 9900 / 9950 / 10450 / 10544 NF opened with a first gap up in 7 days of more than 100 points which was promptly sold […]