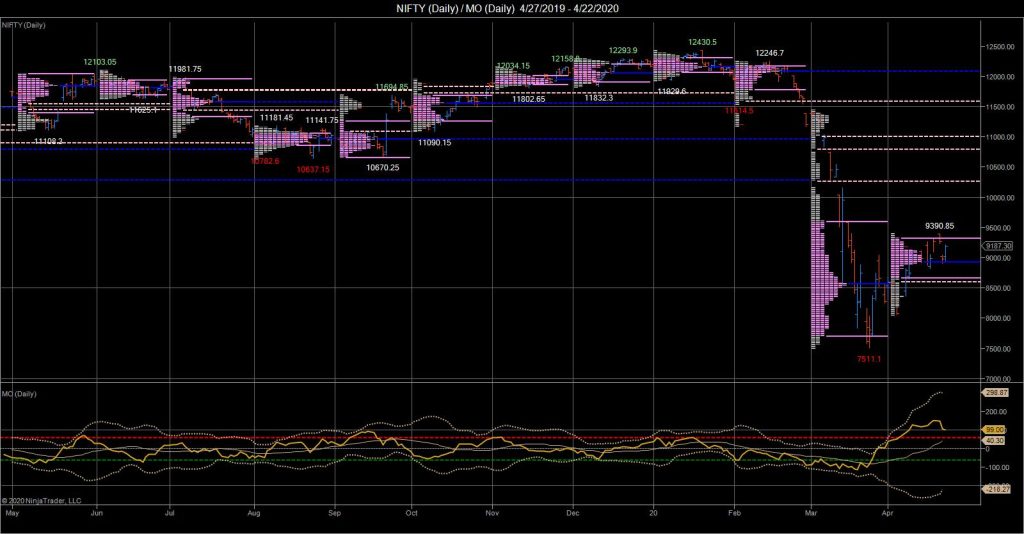

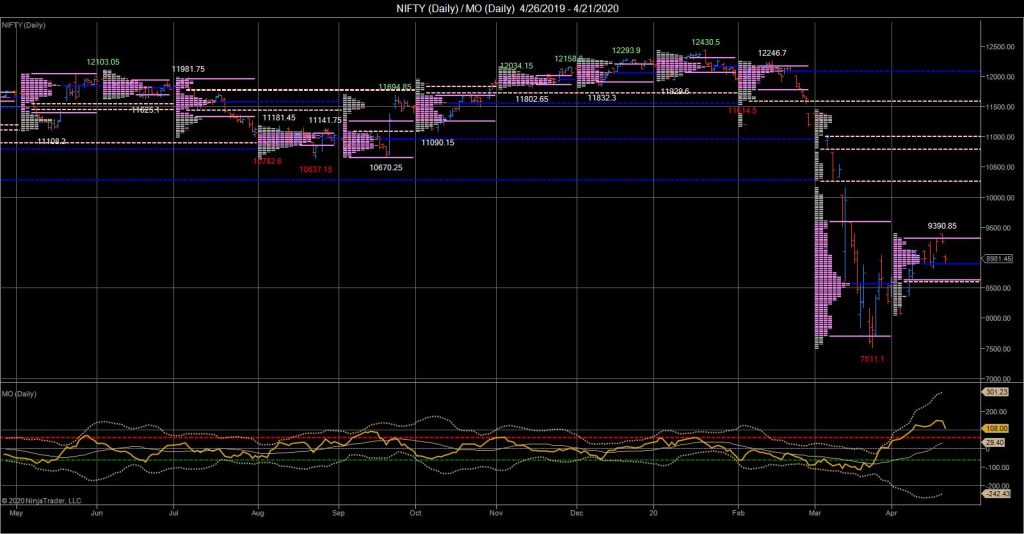

Desi MO (McClellans Oscillator For NSE) – 22nd APR 2020

MO at 99

Order Flow charts dated 22nd Apr 2020

A good trader is a one who can make money consistently over a longer period of time. But how to become one such trader, who can make money in any type of market condition? A good trader keeps a close watch on the current information of the market and assesses it for change against previous […]

Order Flow charts dated 22nd Apr 2020 (5 mins)

Order Flow can show how a collection of market participates has acted in the past and this helps to create profit by knowing if these traders are profitable or caught upside down. NF BNF

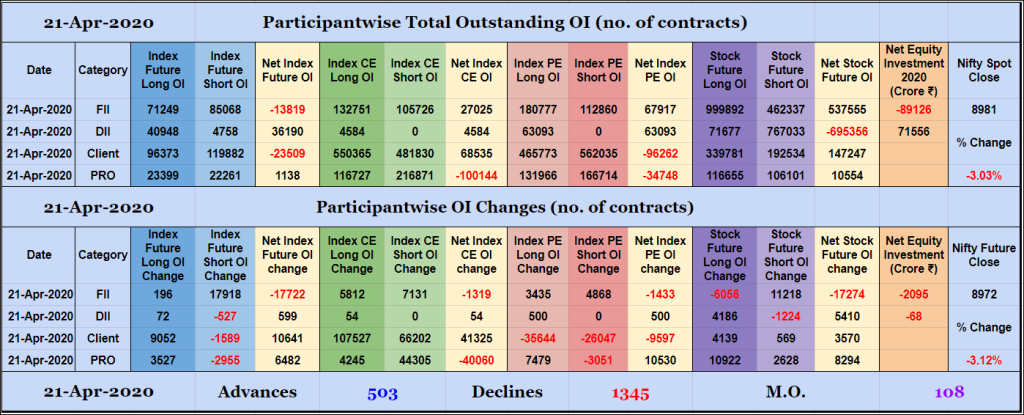

Market Profile Analysis dated 21st Apr 2020

Nifty Apr F: 8971 [ 9067 / 8909 ] HVNs – 8555 / 8604 / 8670 / 8750 / 8800 / 8937 / 9018 / 9051 / 9180 / 9265 / 9310 Previous day’s report ended with this ‘the auction formed a ‘b’ shape profile for the day with a very prominent POC at 9276 […]

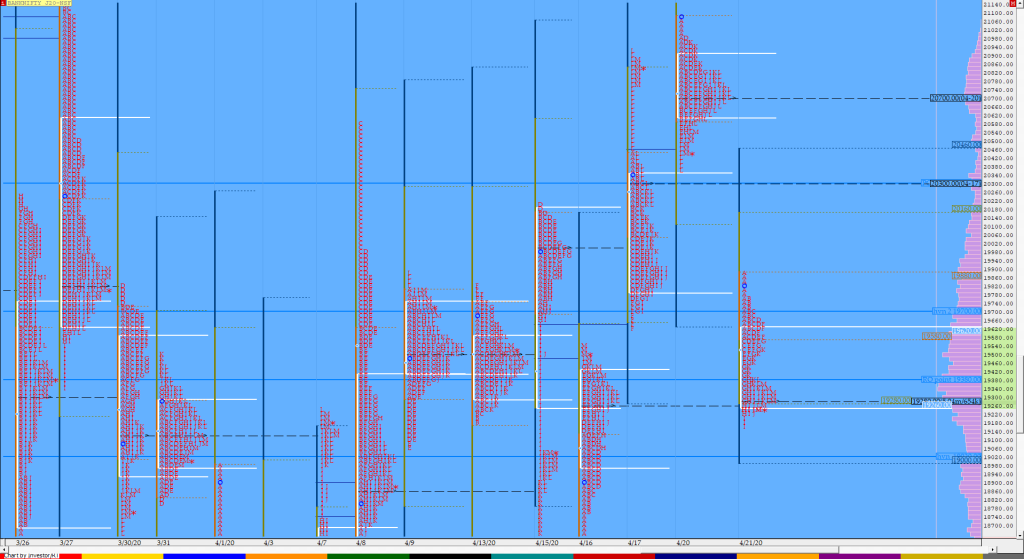

Participantwise Open Interest – 21st APR 2020

FIIs have added net 17K short Index Futures, net 1K short Index CE, net 1K short Index PE and 11K short Stocks Futures contracts today while liquidating 6K long Stocks Futures contracts. They were net sellers in equity segment for ₹2095 crore. FII net Index Futures position has turned negative again. Clients added 9K long […]

Order Flow charts dated 21st Apr 2020

Many traders are looking for information on how to use market conditions to find good trades. Order Flow is best understood as a way to see existing bias in the markets. Order Flow helps us understand who is in control of the market and who is ‘upside down’ and likely to make exits from that […]

Desi MO (McClellans Oscillator For NSE) – 21st APR 2020

MO at 108

Order Flow charts dated 21st Apr 2020 (5 mins)

Volume Profile and Order Flow are very good tools to assist you in trading. You can also use it along with your existing setup. NF BNF

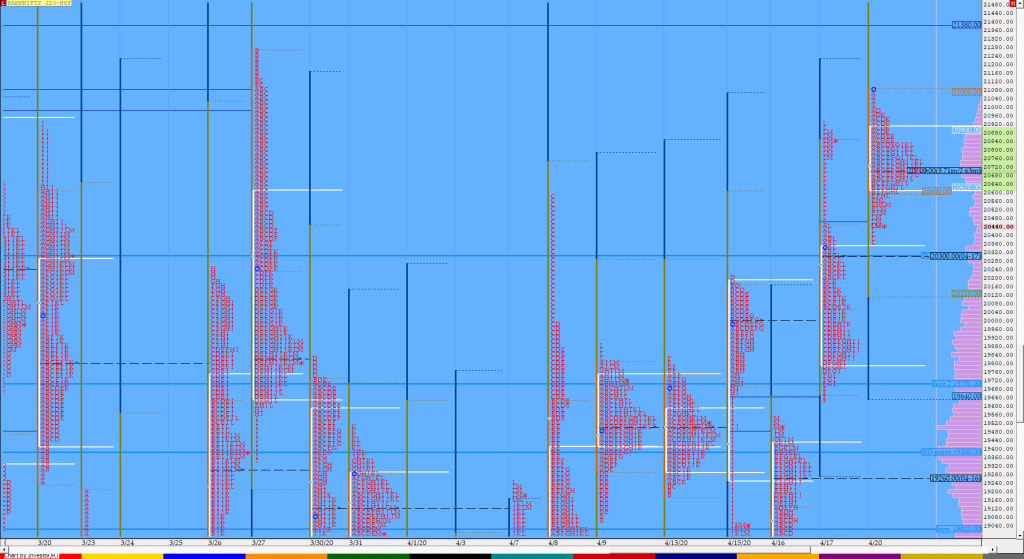

Market Profile Analysis dated 20th Apr 2020

Nifty Apr F: 9260 [ 9385 / 9215 ] HVNs – 8555 / 8604 / 8670 / 8750 / 8800 / 8937 / 9015 / 9051 / 9180 / 9265 / 9310 Previous day’s report ended with this ‘On the upside, the FA of 9384 would be the level to be taken out & sustained […]

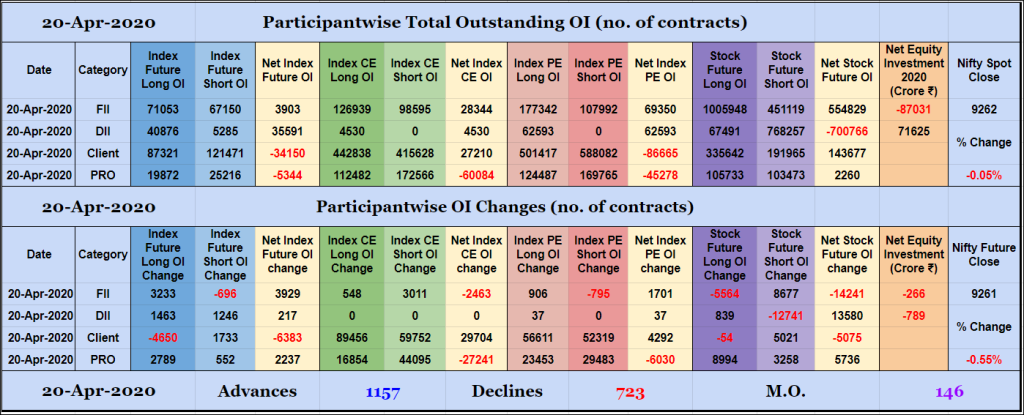

Participantwise Open Interest – 20th APR 2020

FIIs added 3K long Index Futures, net 2K short Index CE and 8K short Stocks Futures contracts besides liquidating 5K long Stocks Futures contracts. They were net sellers in equity segment for ₹266 crore. Clients added 1K short Index Futures, net 29K long Index CE, net 4K long Index PE and 5K short Stocks Futures […]