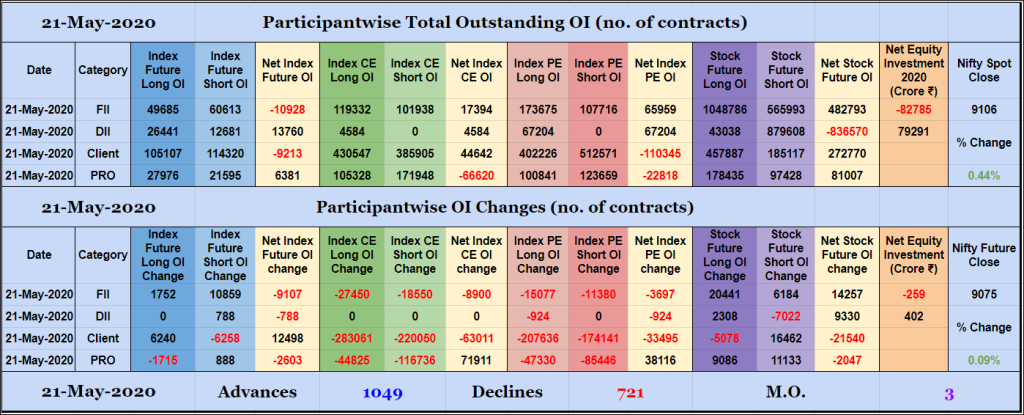

Participantwise Open Interest – 21st MAY 2020

FIIs have added net 9K short Index Futures and net 14K long Stocks Futures contracts today. They were net sellers in equity segment for ₹259 crore. Clients have added 6K long Index Futures and 16K short Stocks Futures contracts today while covering 6K short Index Futures contracts and liquidating 5K long Stocks Futures contracts. Nifty […]

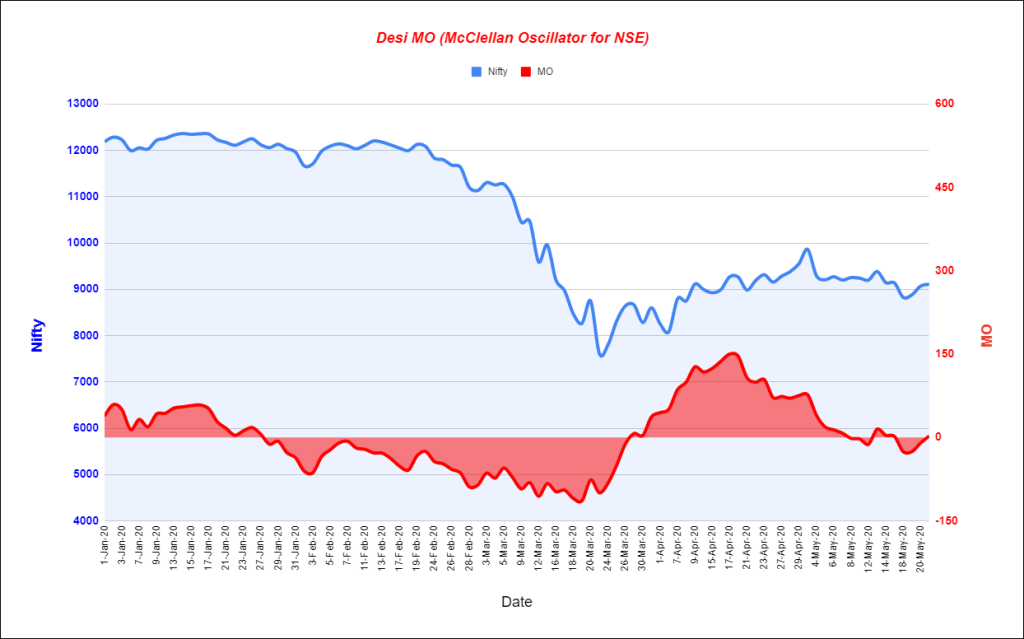

Desi MO (McClellans Oscillator For NSE) – 21st MAY 2020

MO at 3

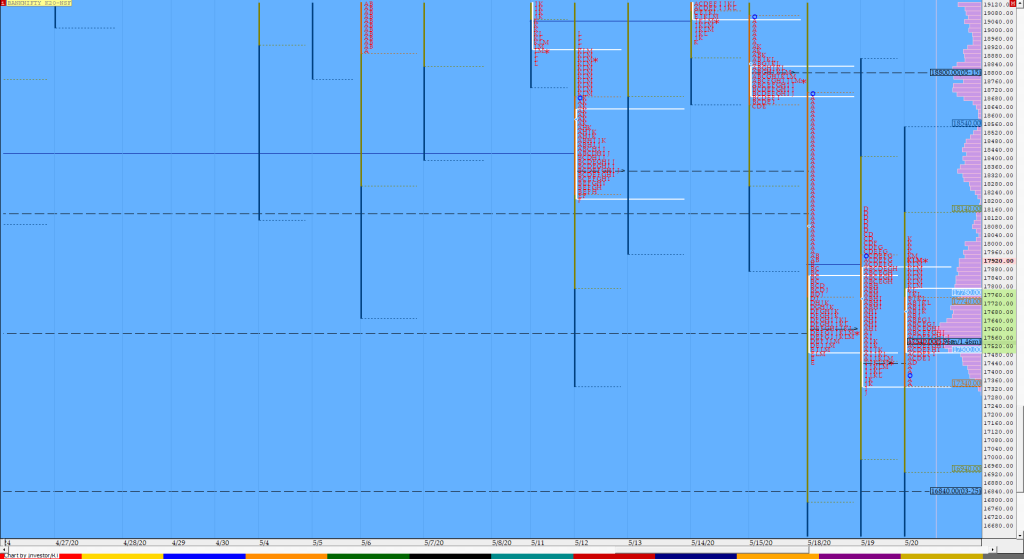

Order Flow charts dated 21st May 2020

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

Order Flow charts dated 21st May 2020 (5 mins)

The way we see it is that Order Flow trading is a mindset. Well, instead of just looking for technical patterns, Trader should go a step further and think about what other market participants might do. NF BNF

Market Profile Analysis dated 20th May 2020

Nifty May F: 9066 [ 9098 / 8879 ] HVNs – (8884) / (8965) / (9111) / (9180) / 9210 / 9306 / (9400) NF moved away from the 2-day POC as it confirmed a multi-day FA at 8852 and the buying interest was further confirmed by the buying tail it left in the IB […]