Market Profile Analysis dated 22nd May 2020

Nifty May F: 9028 [ 9123 / 8940 ] HVNs – (8964) / 9078 / 9212 / 9320 Report to be updated… The NF Open was a Open Rejection Reverse (Up) (ORR) which failed The day type was a Normal Variation Day – Down (‘b’ shape profile) Largest volume was traded at 8980 F Vwap of […]

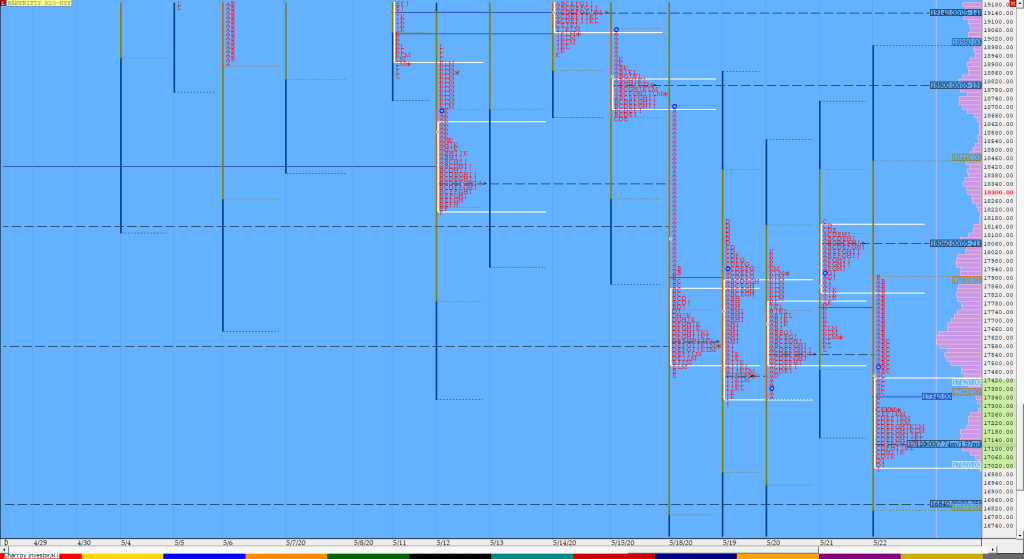

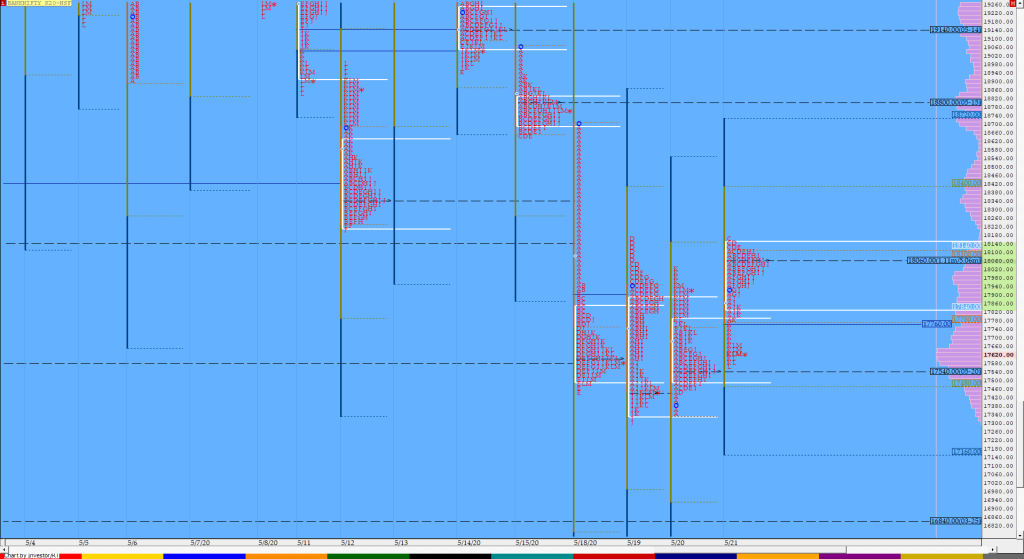

Weekly charts (18th to 22nd May 2020) and Market Profile Analysis

Nifty Spot Weekly Profile (18th to 22nd May 2020) Spot Weekly – 9039 [ 9178 / 8806 ] Previous week’s report ended with this ‘This week’s Value was at 9045-9090-9345 and as mentioned at the start, we have a nice 4-week composite in Nifty with Value at 9145-9316-9427 and the close below the VAL along […]

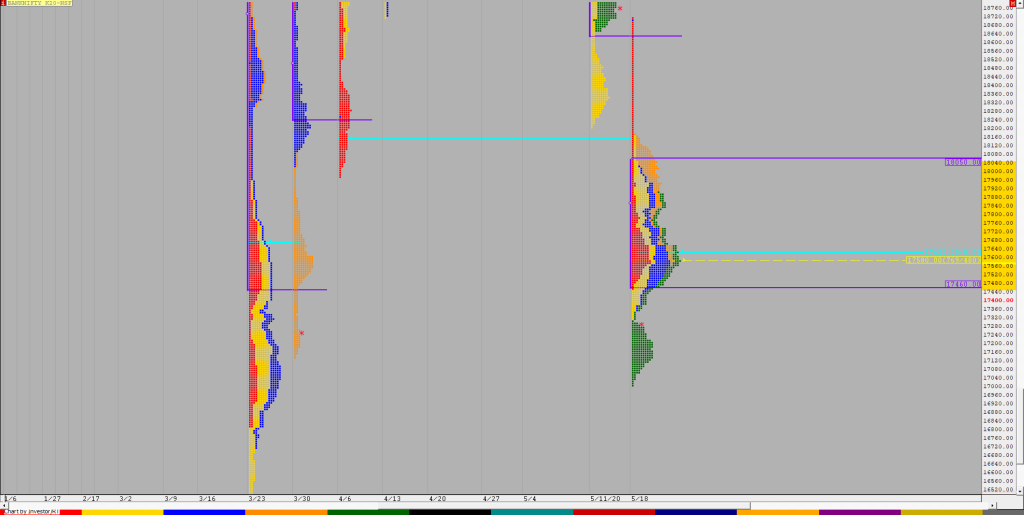

Participantwise Open Interest – 22nd MAY 2020

Weekly view FIIs have added net 10K long Index CE, net 1K long Index PE and net 26K long Stocks Futures contracts this week. They have been net sellers in equity segment for ₹6920 crore during the week. Since April settlement FIIs have added 42K short Index Futures, net 5K short Index CE, net 34K long […]

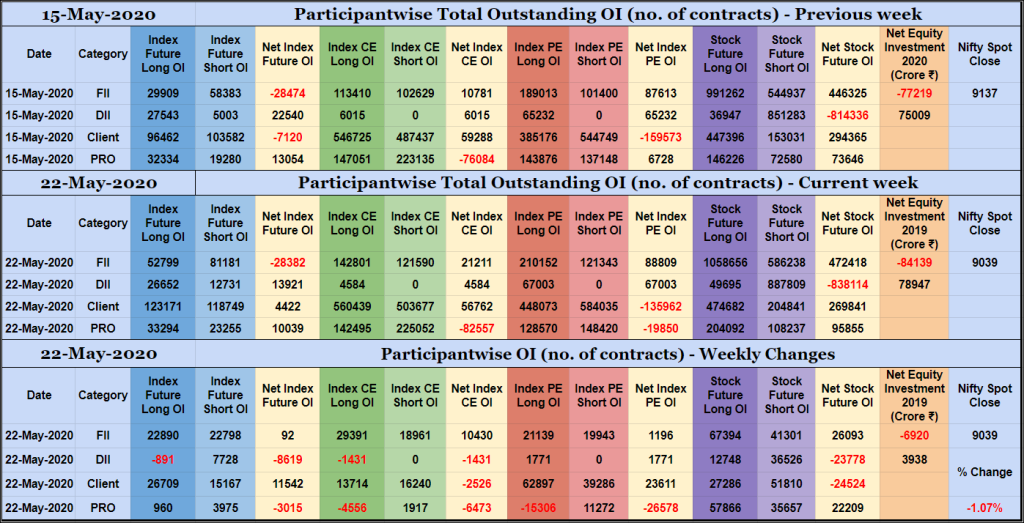

Desi MO (McClellans Oscillator For NSE) – 22nd MAY 2020

MO at -8

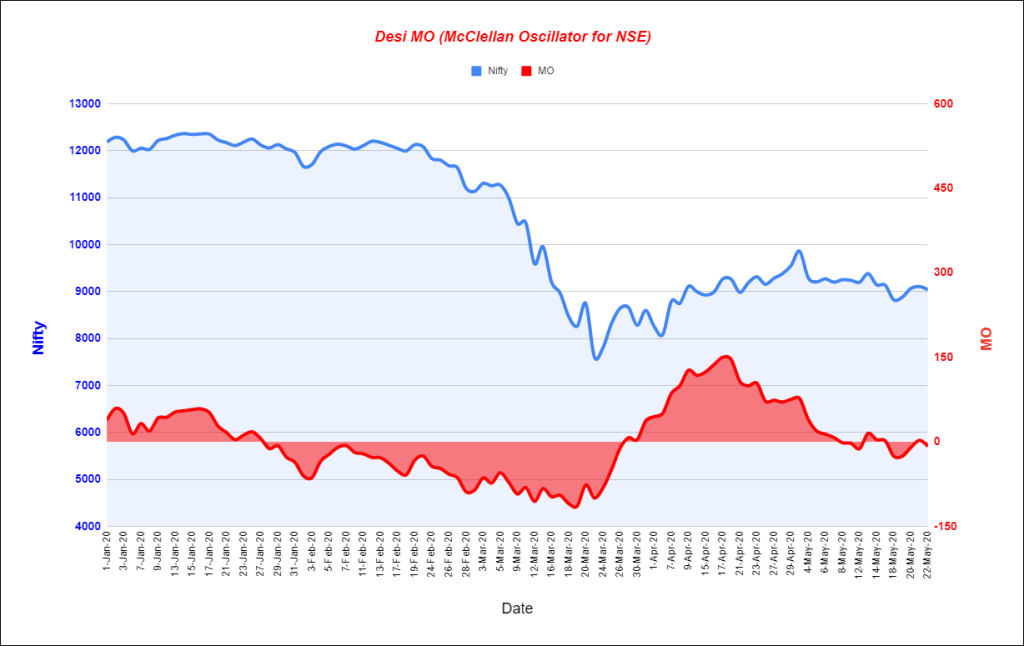

Order Flow charts dated 22nd May 2020

Order Flow trading is thinking about what order market participants do and when you think along this, you can anticipate what kind of action they will be taking in the market. This is a very important concept in Order Flow. Market participants always look for the weaker side of the market, so both buy and […]

Order Flow charts dated 22nd May 2020 (5 mins)

Market participants always look for the weaker side of the market, so both buy and sell stops will be targeted. Just one of the many concepts of Order Flow trading. NF BNF

Market Profile Analysis dated 21st May 2020

Nifty May F: 9075 [ 9169 / 9046 ] HVNs – (8884) / (8965) / (9111) / (9180) / 9210 / 9306 / (9400) As mentioned in previous day’s report, NF continued the imbalance at open today as it got above PDH & scaled higher in the initiative selling tail of Monday but on lower […]

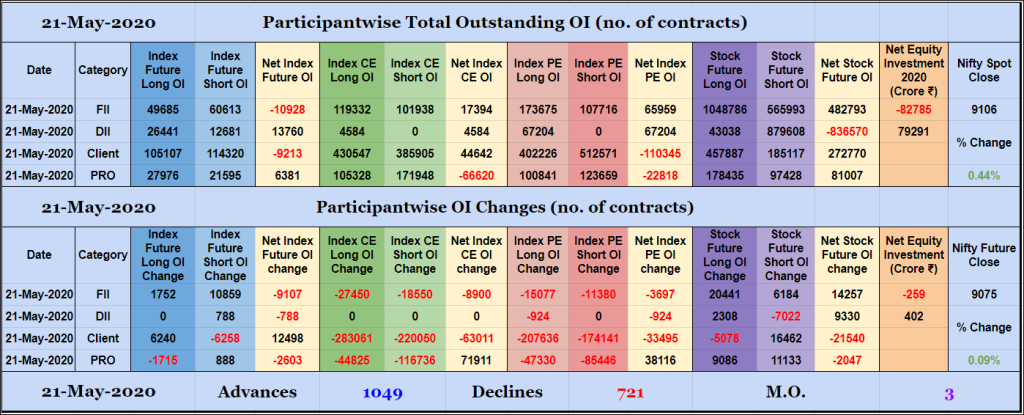

Participantwise Open Interest – 21st MAY 2020

FIIs have added net 9K short Index Futures and net 14K long Stocks Futures contracts today. They were net sellers in equity segment for ₹259 crore. Clients have added 6K long Index Futures and 16K short Stocks Futures contracts today while covering 6K short Index Futures contracts and liquidating 5K long Stocks Futures contracts. Nifty […]

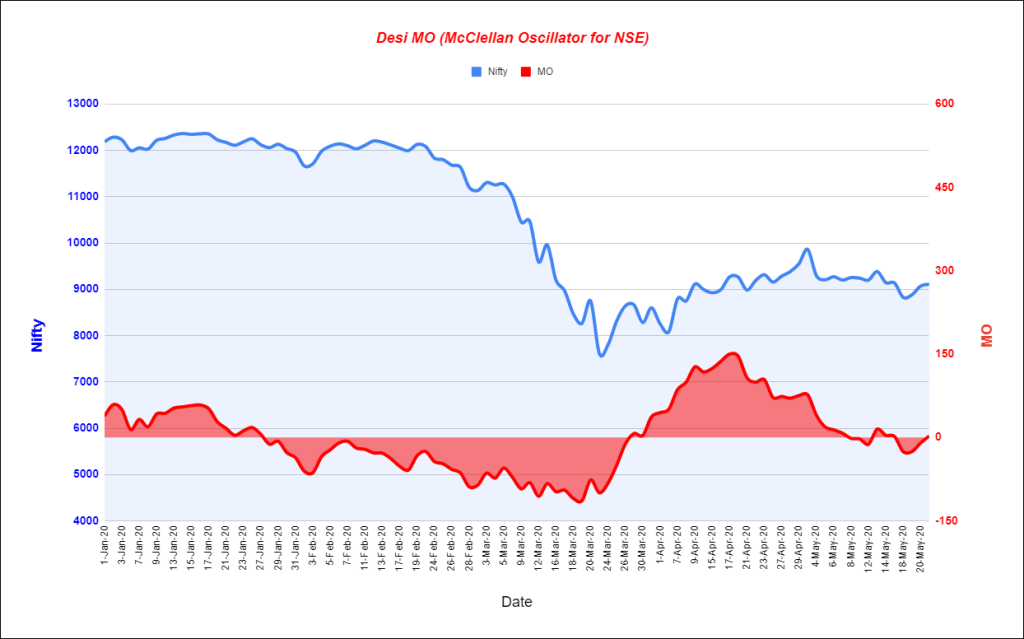

Desi MO (McClellans Oscillator For NSE) – 21st MAY 2020

MO at 3

Order Flow charts dated 21st May 2020

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]