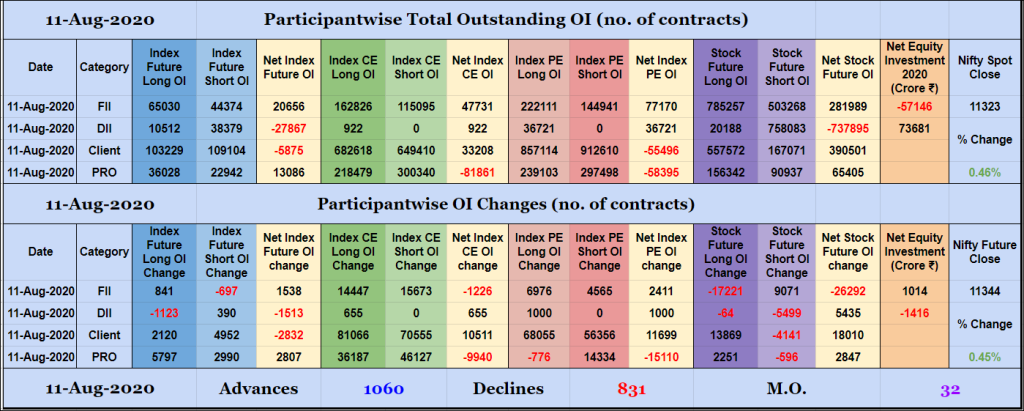

Participantwise Open Interest – 11th AUG 2020

FIIs have added net 1K short Index CE, net 2K long Index PE and 9K short Stocks Futures contracts today besides liquidating 17K long Stocks Futures contracts. They were net buyers in equity segment for ₹1014 crore. Clients have added net 2K short Index Futures, net 10K long Index CE, net 11K long Index PE […]

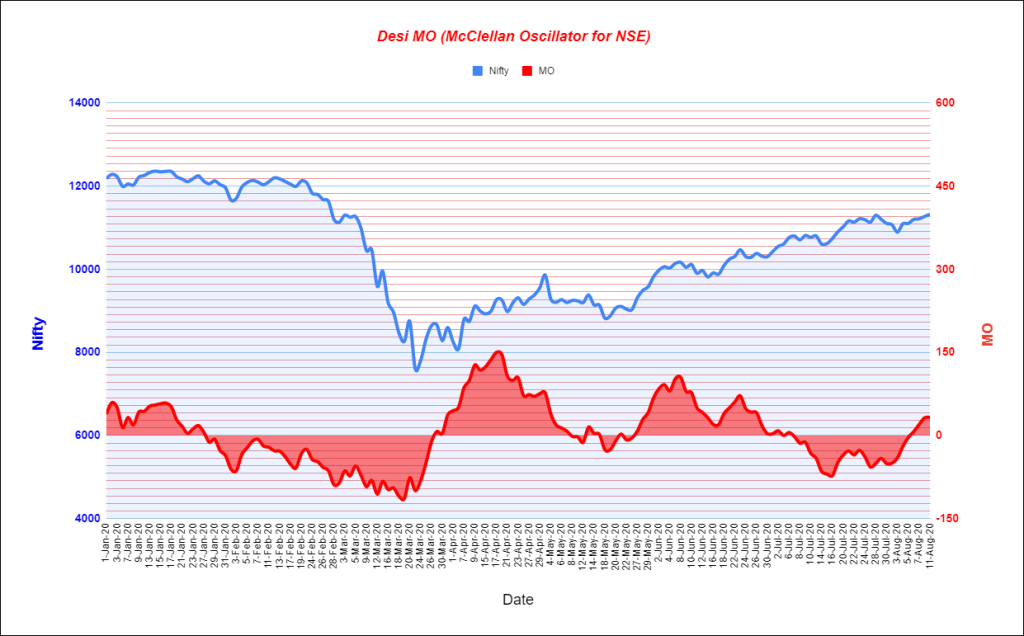

Desi MO (McClellans Oscillator For NSE) – 11th AUG 2020

MO at 32

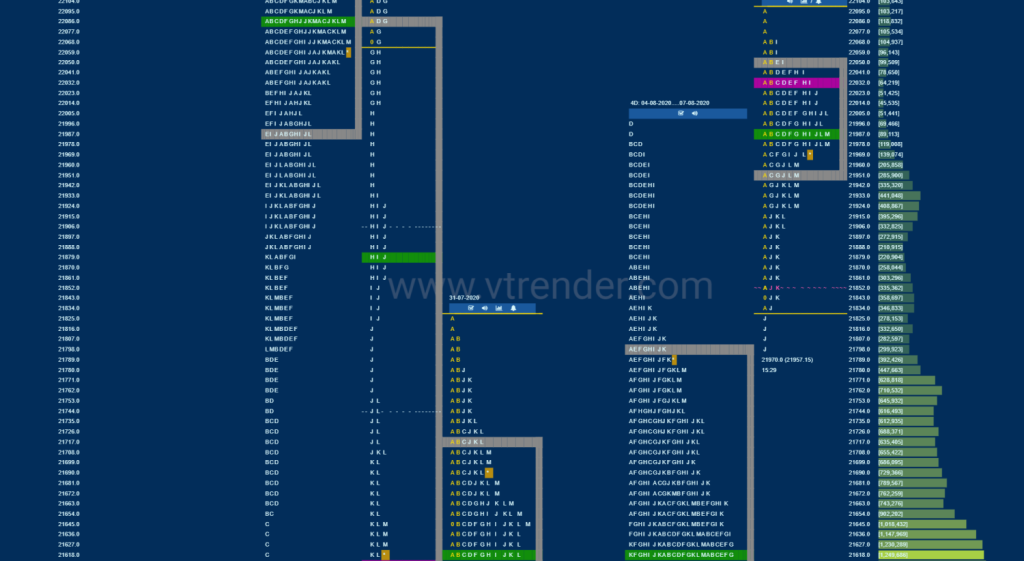

Order Flow charts dated 11th August 2020

The key to using Order Flow trading is to determine market depth. This describes the places where Market participants have taken positions or the zone they have transacted. The Order Flow is like a list of trades and helps to know how other traders are placed in the market. Vtrender helps you to stay on […]

Order Flow charts dated 11th August 2020 (5 mins)

Vtrender helps you to stay on top of the Market by understanding Order Flow. This increases your flexibility, your data analysis capability and your winning trade signals. And you make your existing systems better. NF BNF

Market Profile Analysis dated 10th August 2020

Nifty Aug F: 11293 [ 11335 / 11242 ] HVNs – 10918 / 10970 / 11095 / 11160 / 11196 NF opened higher & stayed above PDH (Previous Day High) as it continued the probe higher in the IB (Initial Balance) while tagging 11322 and left a buying tail from 11296 to 11256 which indicated […]