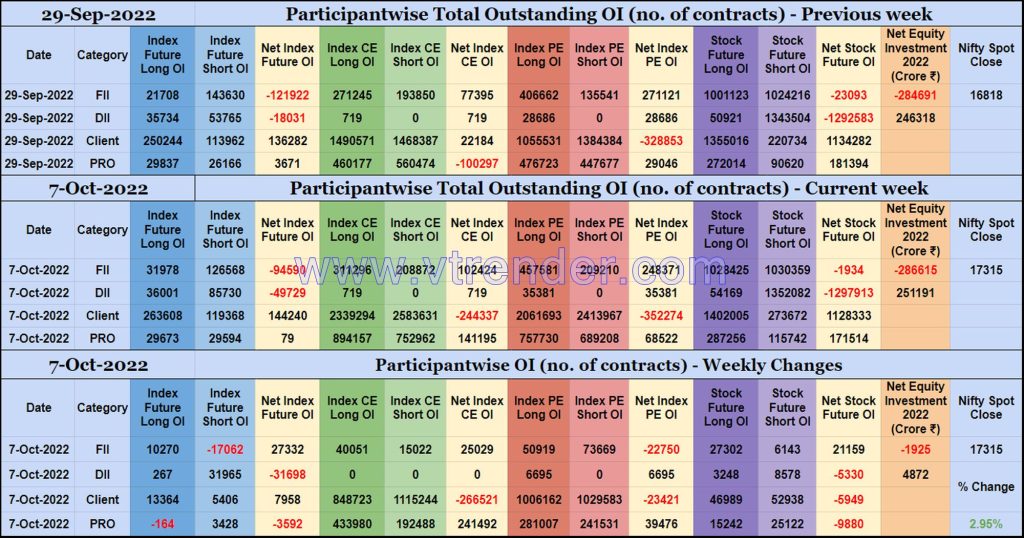

Participantwise Open Interest (Weekly changes) – 7th OCT 2022

Weekly changes in Participantwise Open Interest FIIs have added 10K long Index Futures, net 25K long Index CE, net 22K short Index PE and net 21K long Stocks Futures contracts this week besides covering 17K short Index Futures contracts. FIIs have been net sellers in equity segment for ₹1925 crore during the week. Clients have […]

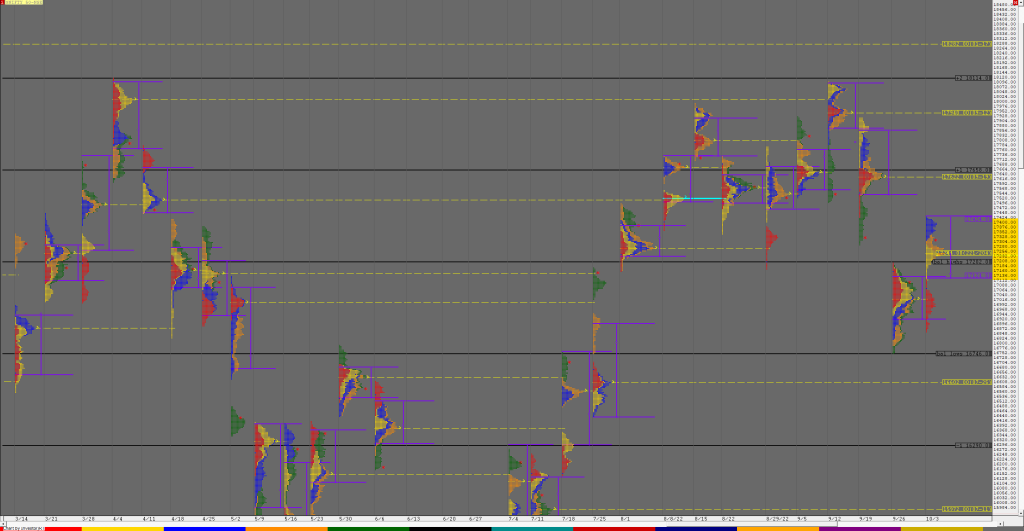

Market Profile Analysis dated 07th Oct 2022

Nifty Oct F: 17328 [ 17354 / 17220 ] NF made an OAOR (Open Auction Out of Range) start and went on to break below 04th Oct’s VPOC of 17267 while making a low of 17247 where it took support just above that day’s VWAP of 17243 triggering a quick short covering bounce to 17354 in […]

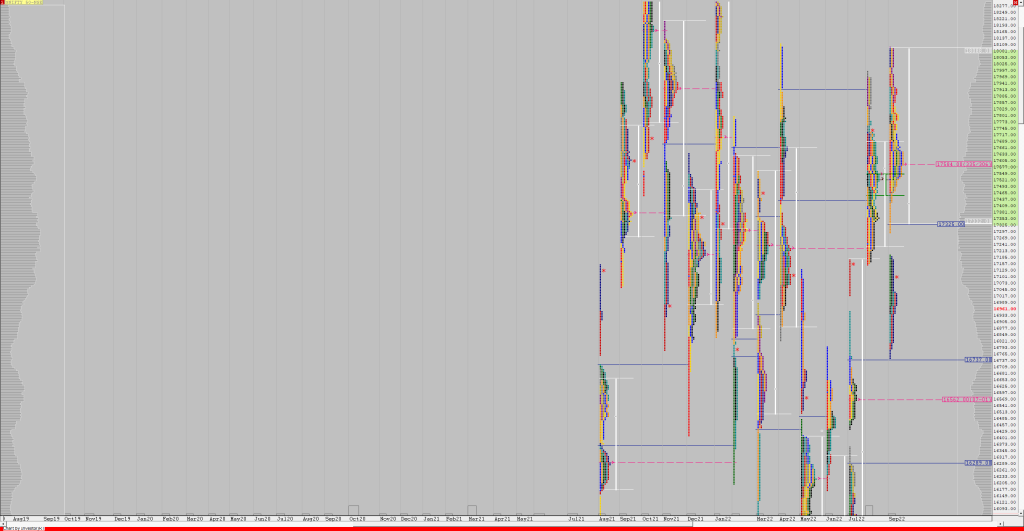

Weekly Charts (03rd to 07th Oct 2022) and Market Profile Analysis

Nifty Spot Weekly Profile (03rd to 07th Oct 2022) 17314 [ 17428 / 16855 ] Previous week’s report ended with this ‘The weekly profile is a well balanced one inside a narrow range of 449 points with completely lower Value at 16920-17016-17124 with a bit of filling needed in the zone of 16854 to 17087 […]