Participantwise Open Interest (Mid-week changes) – 22nd MAR 2023

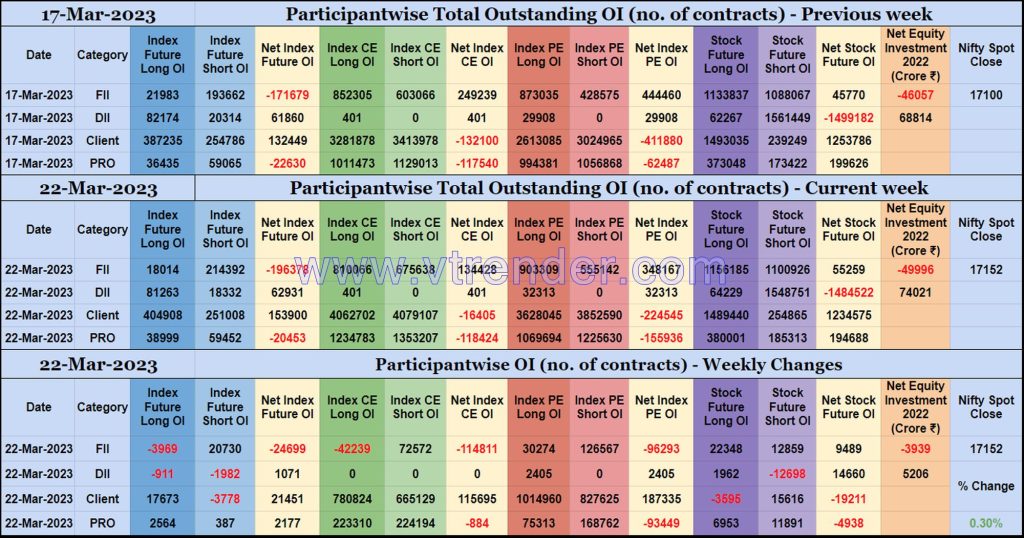

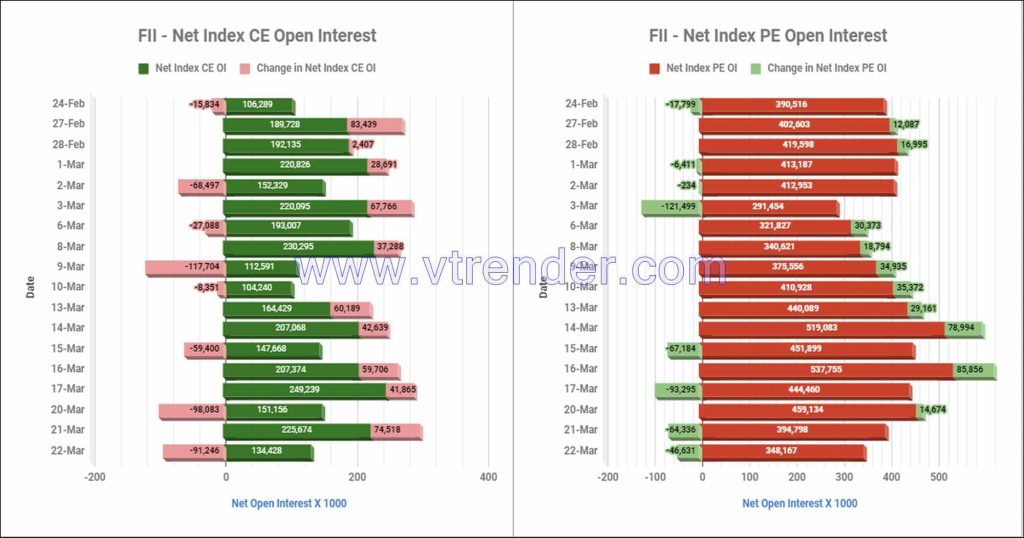

Mid-week changes in Participantwise Open Interest FIIs have added 20K short Index Futures, 72K short Index CE, net 96K short Index PE and net 9K long Stocks Futures contracts this week besides liquidating 3K long Index Futures and 42K long Index CE contracts. FIIs have been net sellers in equity segment for ₹3939 crore during […]

Participantwise net Open Interest and net equity investments – 22nd MAR 2023

Participantwise total outstanding Open Interest & Daily changes

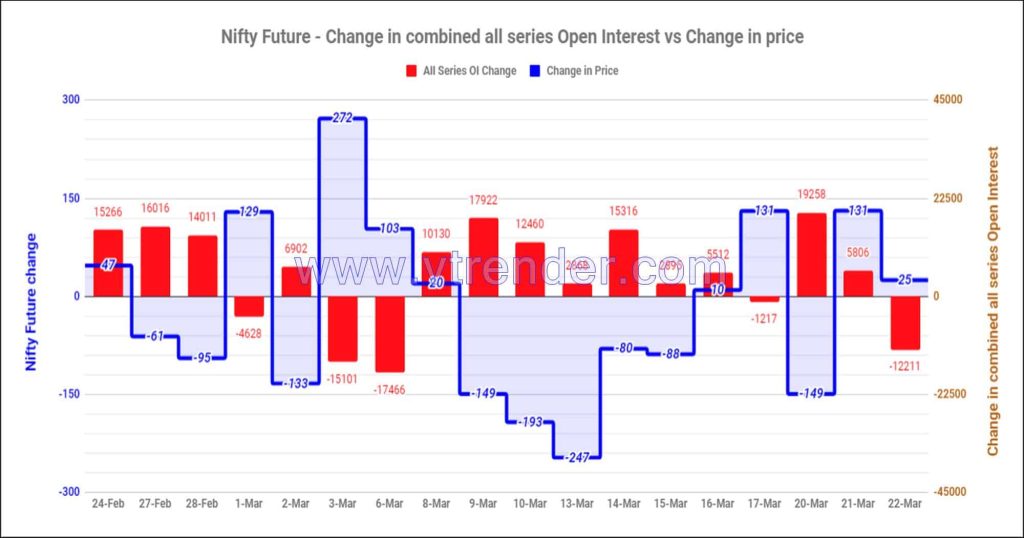

Nifty and Banknifty Futures with all series combined Open Interest – 22nd MAR 2023

Total Nifty/Banknifty OI and daily OI changes Nifty Futures have added 12853 contracts in Open Interest this week. Banknifty Futures OI increased by just 2358 contracts during the week.

Desi MO (McClellans Oscillator for NSE) – 22nd MAR 2023

MO at 12 McClellan’s Oscillator – Calculation and Interpretation

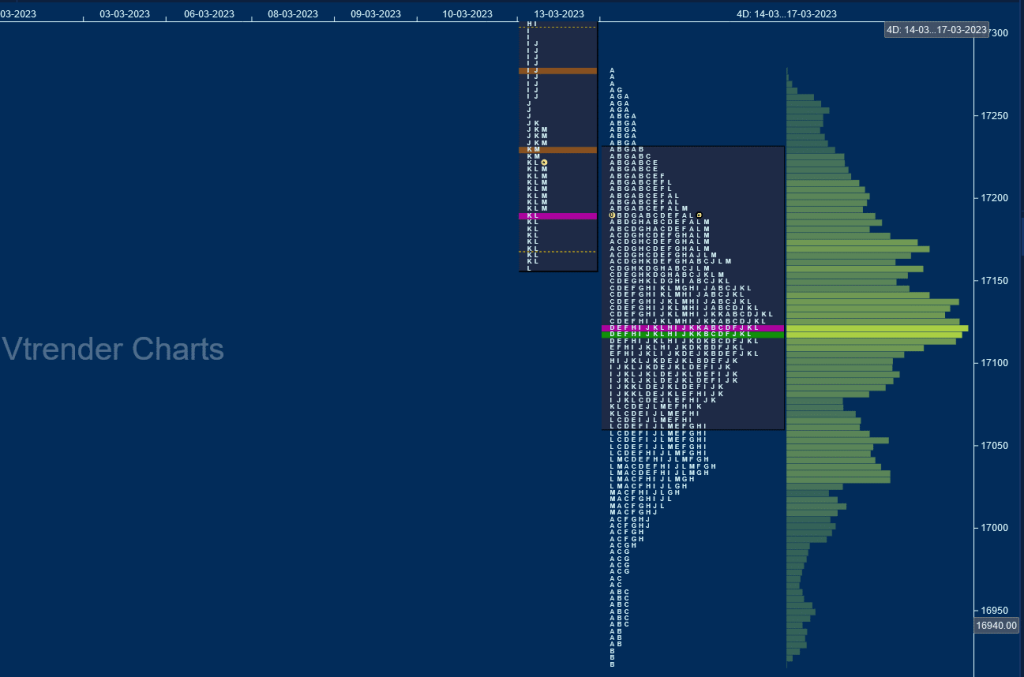

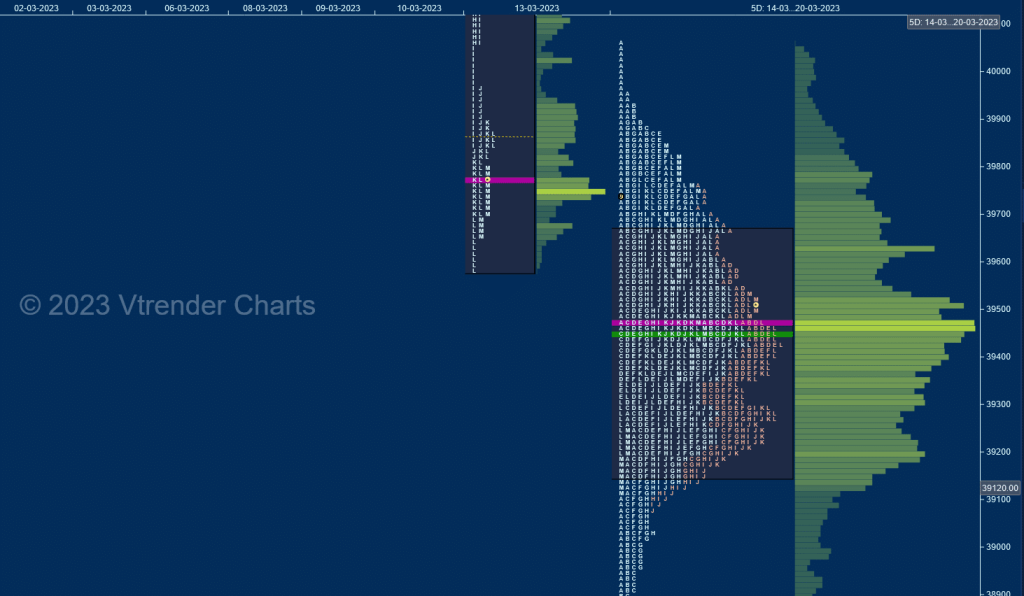

Market Profile Analysis dated 22nd Mar 2023

Nifty Mar F: 17185 [ 17238 / 17142 ] NF opened higher but got rejected from the initiative selling singles from 15th Mar as it left a fresh A period tail from 17238 to 17215 in the IB (Initial Balance) and got back into the 4-day composite balance even making couple of REs (Range Extension) lower […]

Order Flow charts dated 22nd March 2023

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

Market Profile Analysis dated 21st Mar 2023

Nifty Mar F: 17160 [ 17183 / 17052 ] NF opened higher rejecting previous session’s move away from the 4-day composite as it got accepted in the selling tail from 17048 to 17109 and made a low of 17052 taking support above the yPOC of 17040 whereas on the upside could not sustain above the 4-day […]