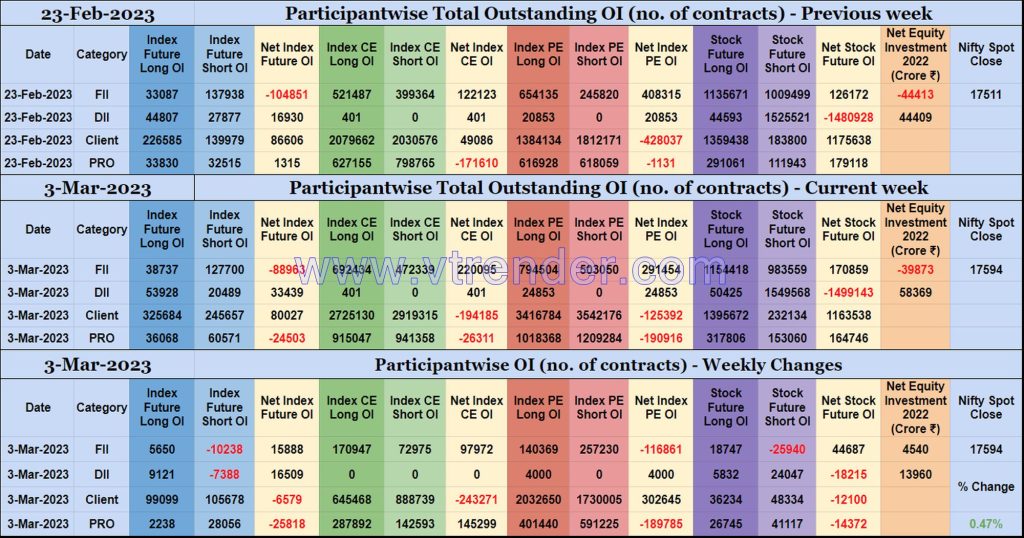

Participantwise Open Interest (Weekly changes) – 3rd MAR 2023

Weekly changes in Participantwise Open Interest FIIs have added 5K long Index Futures, net 97K long Index CE, net 116K short Index PE and 18K long Stocks Futures contracts this week besides covering 10K short Index Futures and 25K short Stocks Futures contracts. FIIs have been net buyers in equity segment for ₹4540 crore during […]

Participantwise net Open Interest and net equity investments – 3rd MAR 2023

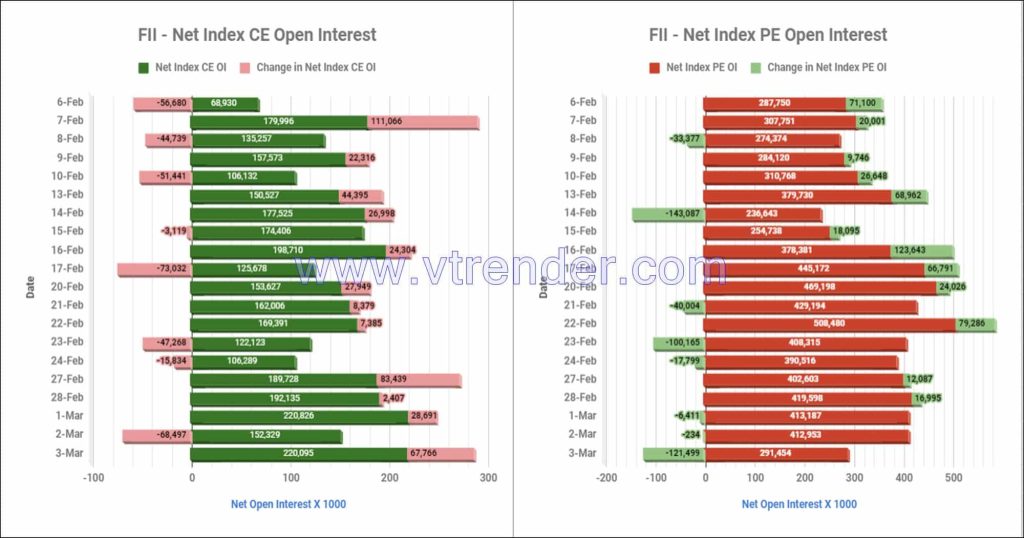

Participantwise total outstanding Open Interest & Daily changes

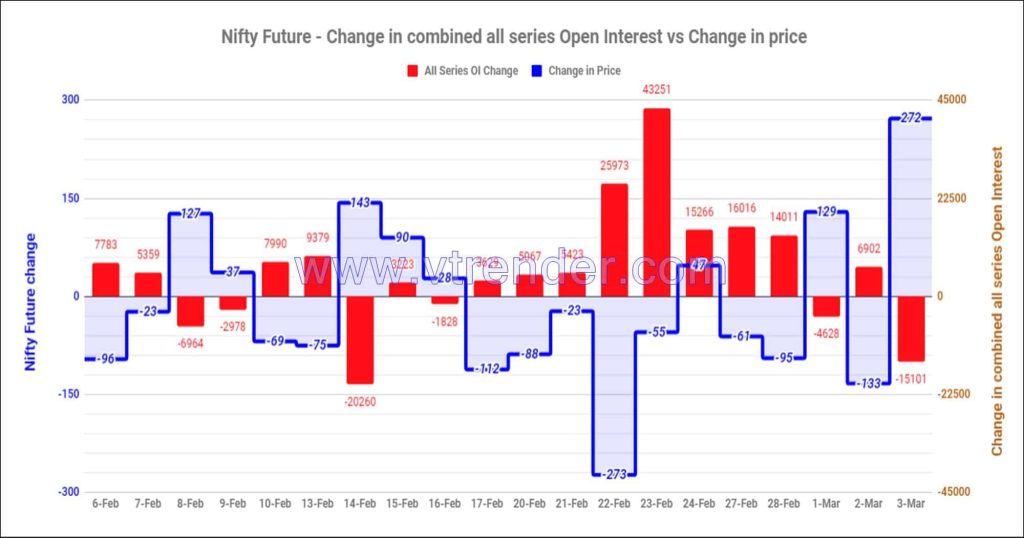

Nifty and Banknifty Futures with all series combined Open Interest – 3rd MAR 2023

Total Nifty/Banknifty OI and daily OI changes

Desi MO (McClellans Oscillator for NSE) – 3rd MAR 2023

MO at 21

Order Flow charts dated 03rd March 2023

Many traders are looking for information on how to use market conditions to find good trades. Order Flow is best understood as a way to see existing bias in the markets. Order Flow helps us understand who is in control of the market and who is ‘upside down’ and likely to make exits from that […]

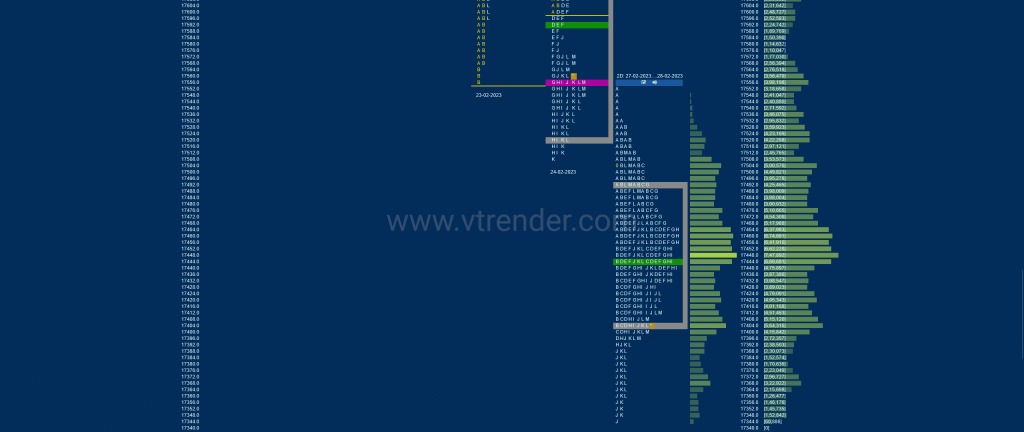

Market Profile Analysis & Weekly Settlement Report dated 02nd Mar 2023

Nifty Mar F: 17399 [ 17518 / 17380 ] NF made it a hat-trick of OAIR starts but remained below the yPOC of 17536 confirming that the previous day’s buyers had all booked out as it went on to negate the buying singles from 17468 to 17417 in the IB as it left a new A […]

Order Flow charts dated 02nd March 2023

Many traders are used to viewing volume as a histogram beneath a price chart. But the Order Flow approach shows the amount of volume traded during each price bar, and also it breaks this volume down into the Volume generated by the Buyers and the Volume generated by the sellers again at every row of […]

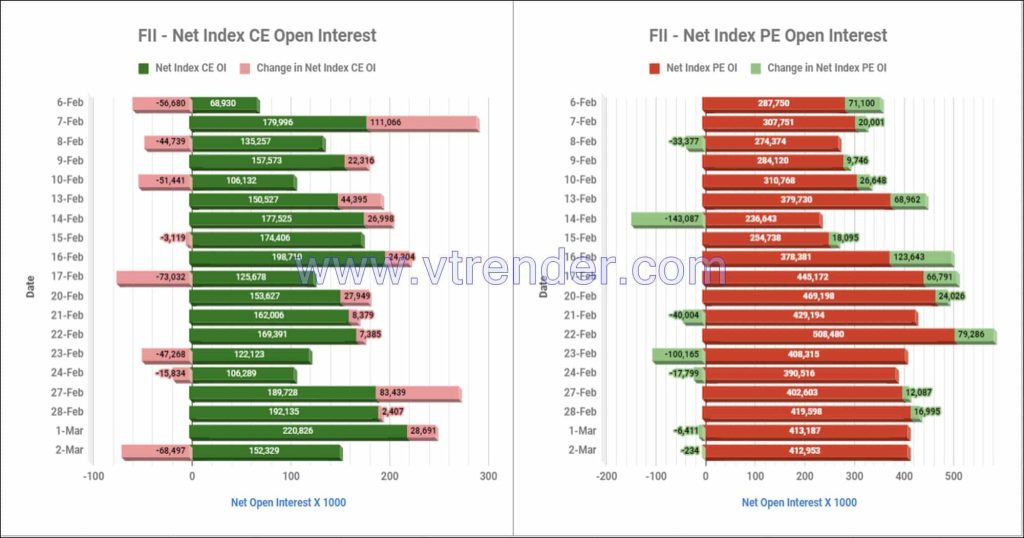

Participantwise net Open Interest and net equity investments – 2nd MAR 2023

Participantwise total outstanding Open Interest & Daily changes

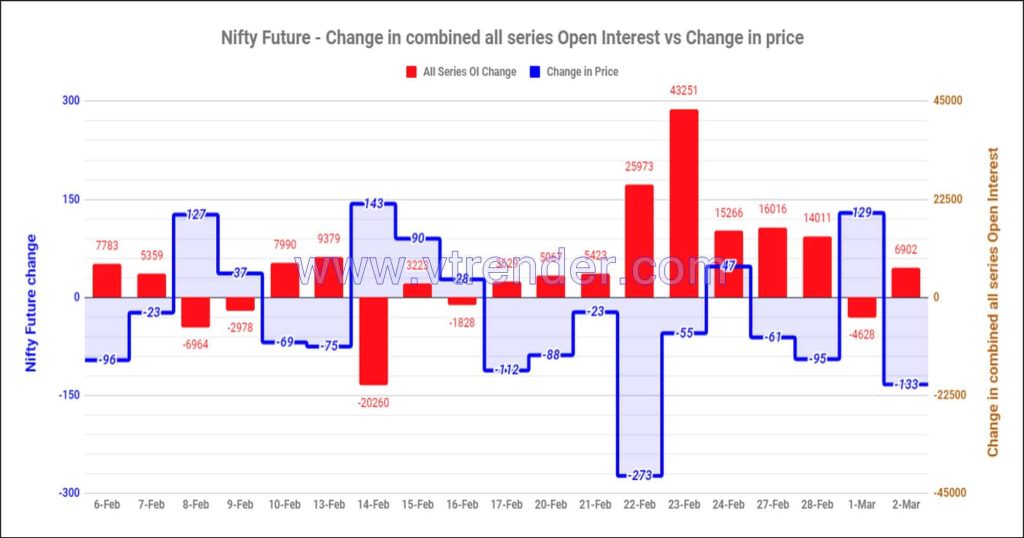

Nifty and Banknifty Futures with all series combined Open Interest – 2nd MAR 2023

Total Nifty/Banknifty OI and daily OI changes

Market Profile Analysis dated 01st Mar 2023

Nifty Mar F: 17532 [ 17550 / 17417 ] NF opened above the yPOC of 17406 and negated the VWAP of 17433 as it left an A period buying tail from 17468 to 17417 but could only manage a narrow range of just 133 points forming a ‘p’ shape profile for the day with the upside […]