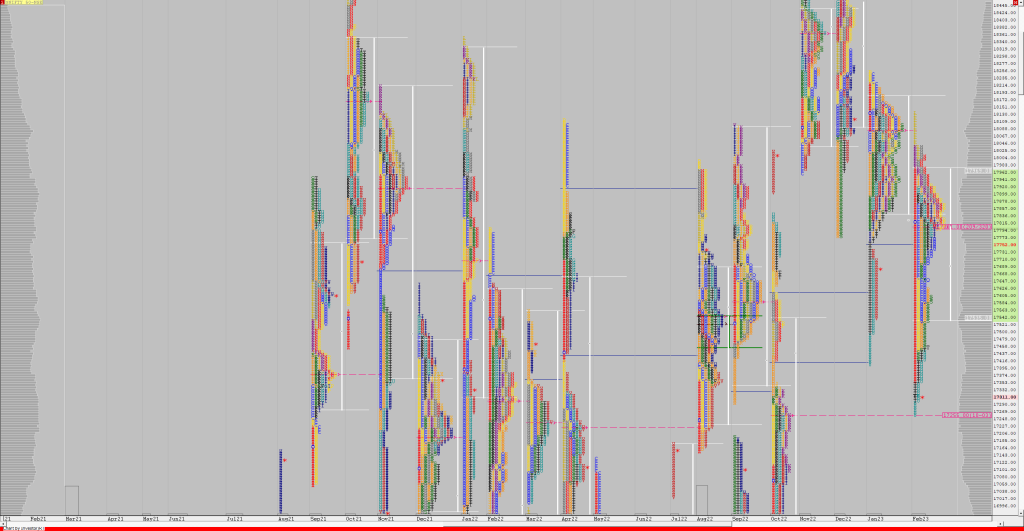

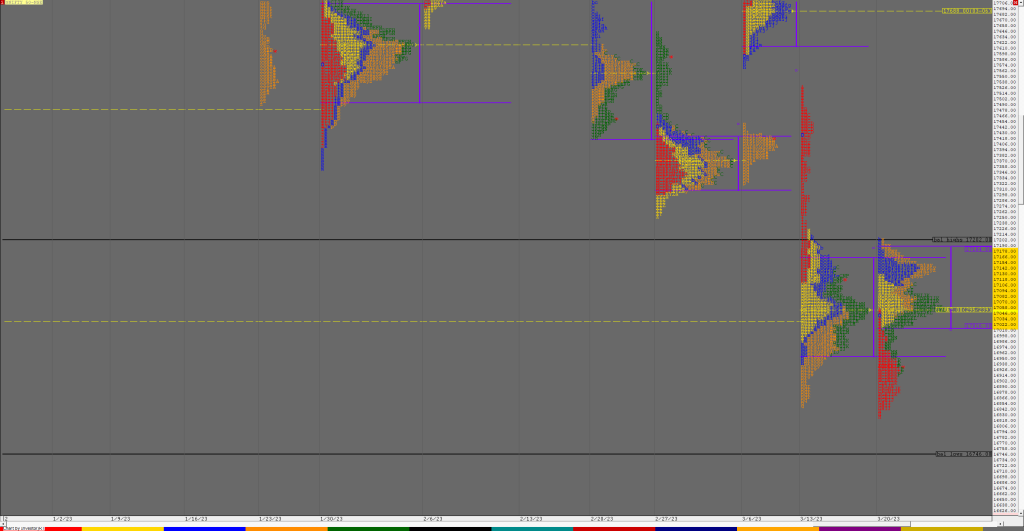

Order Flow charts dated 28th March 2023

The key to using Order Flow trading is to determine market depth. This describes the places where Market participants have taken positions or the zone they have transacted. The Order Flow is like a list of trades and helps to know how other traders are placed in the market. Vtrender helps you to stay on […]

Weekly Charts (20th to 24th Mar 2023) and Market Profile Analysis

Nifty Spot Weekly Profile (20th to 24th Mar 2023) 16945 [ 17207 / 16828 ] Previous week’s report ended with this ‘The weekly profile which started with a huge Trend Day Down is an elongated 680 point range one to the downside with completely lower Value at 16956-17052-17160 but represents a composite ‘b’ shape thanks […]

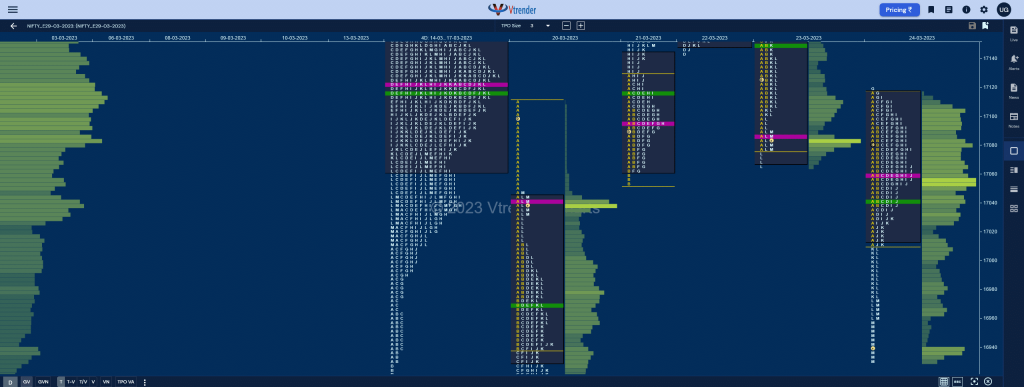

Market Profile Analysis dated 27th Mar 2023

Nifty Mar F: 17037 [ 17124 / 16940 ] NF failed to give a follow through to the NeuX close of last Friday as it opened above the NeuX zone high of 16975 and went on to tag the extension handle of 17010 while making a high of 17015 where it once again saw big supply […]

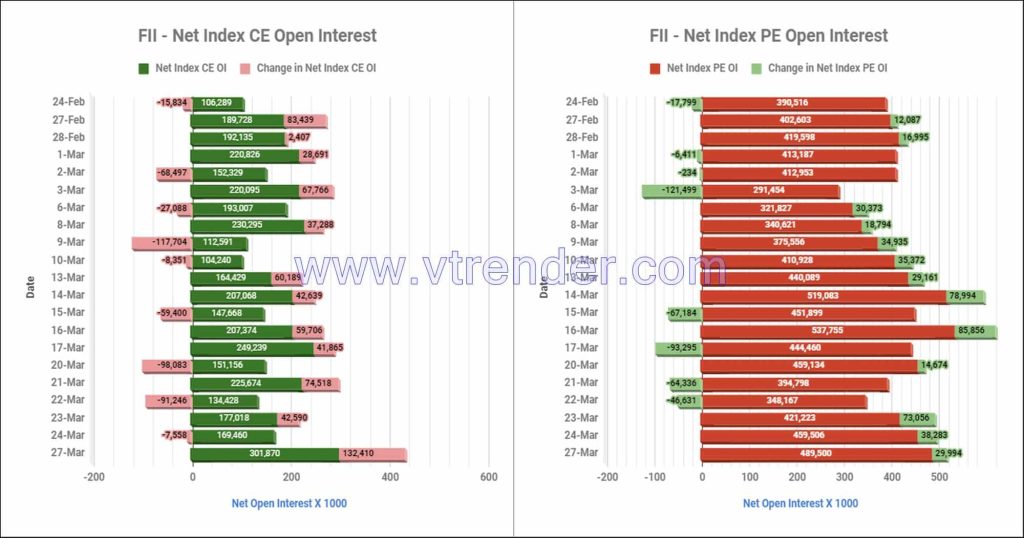

Participantwise net Open Interest and net equity investments – 27th MAR 2023

Participantwise total outstanding Open Interest & Daily changes

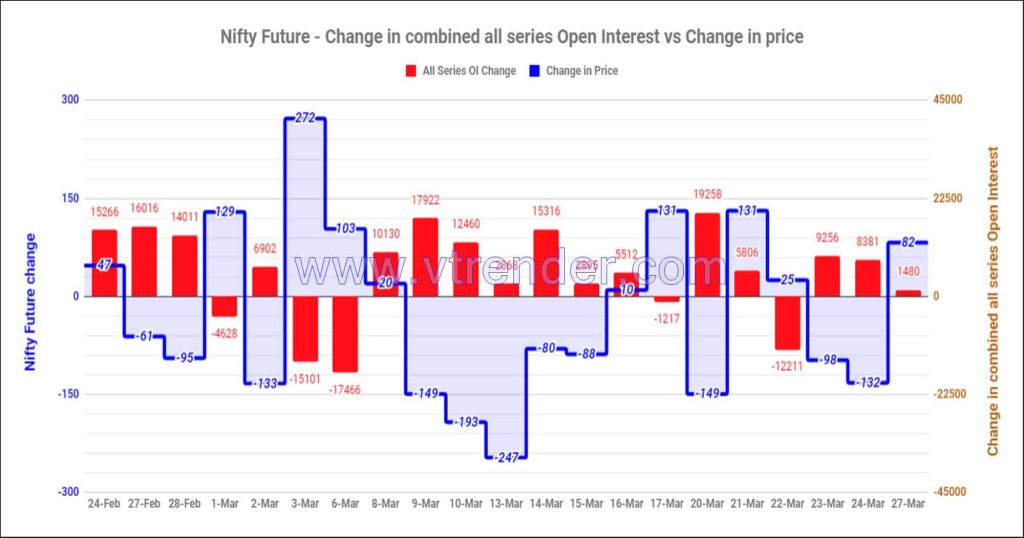

Nifty and Banknifty Futures with all series combined Open Interest – 27th MAR 2023

Total Nifty/Banknifty OI and daily OI changes

Desi MO (McClellans Oscillator for NSE) – 27th MAR 2023

MO at -38 McClellan’s Oscillator – Calculation and Interpretation

Order Flow charts dated 27th March 2023

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

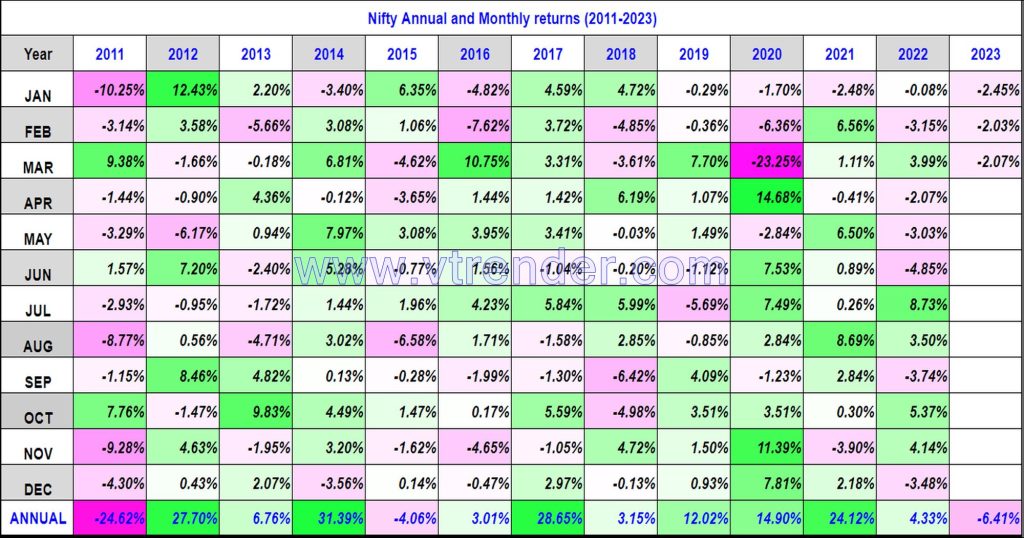

Nifty 50 Monthly and Annual returns (1991-2023) updated 24th Mar 2023

Nifty 50 returns (1991-2000)

Market Profile Analysis dated 24th Mar 2023

Nifty Mar F: 16955 [ 17120 / 16932 ] NF made an Open Auction start and continued previous day’s closing imbalance to the downside breaking below 20th Mar’s VPOC of 17040 and testing that day’s SOC (Scene Of Crime) of 17012 as it made a low of 17010 in the A period. The auction then remained […]

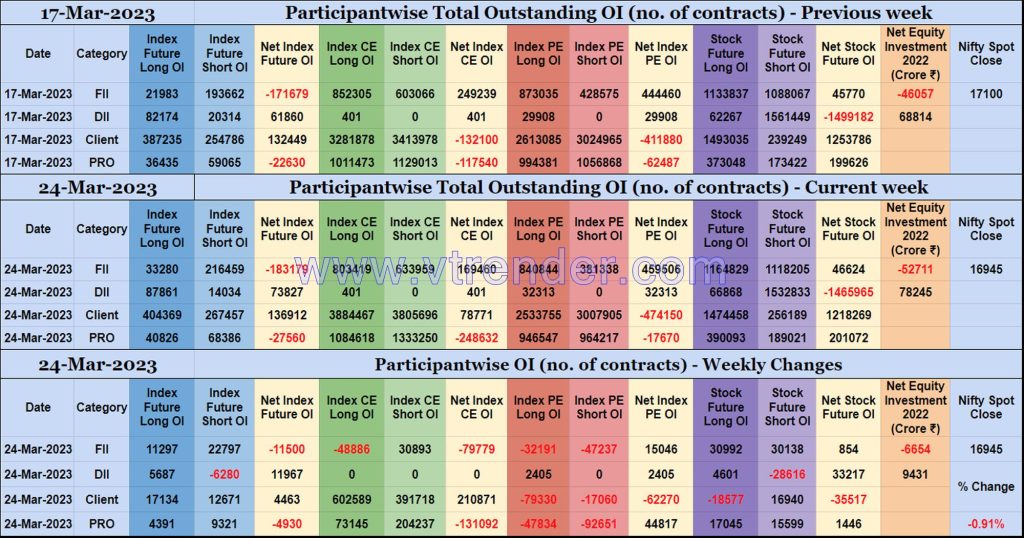

Participantwise Open Interest (Weekly changes) – 24th MAR 2023

Weekly changes in Participantwise Open Interest FIIs have added net 11K short Index Futures and 30K short Index CE contracts this week besides liquidating 48K long Index CE contracts and shedding OI in Index PE. FIIs have been net sellers in equity segment for ₹6654 crore during the week. Clients have added net 4K long […]