Desi MO (McClellans Oscillator for NSE) – 25th APR 2023

MO at 41 McClellan’s Oscillator – Calculation and Interpretation

Order Flow charts dated 25th April 2023

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

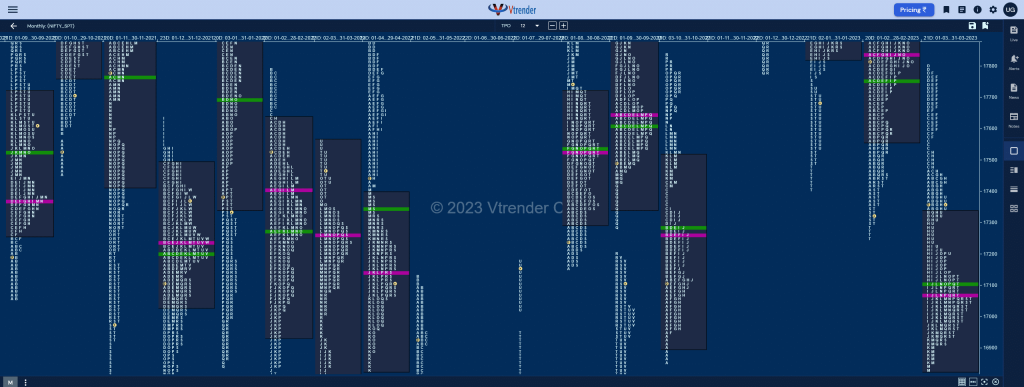

Market Profile Analysis dated 24th Apr 2023

Nifty Apr F: 17763 [ 17772 / 17633 ] NF opened with a gap up but made an almost OH (Open=High) start at 17715 as it got back into previous range & value and went on to make a low of 17635 in the IB looking set to tag the yPOC of 17618. However, the auction […]

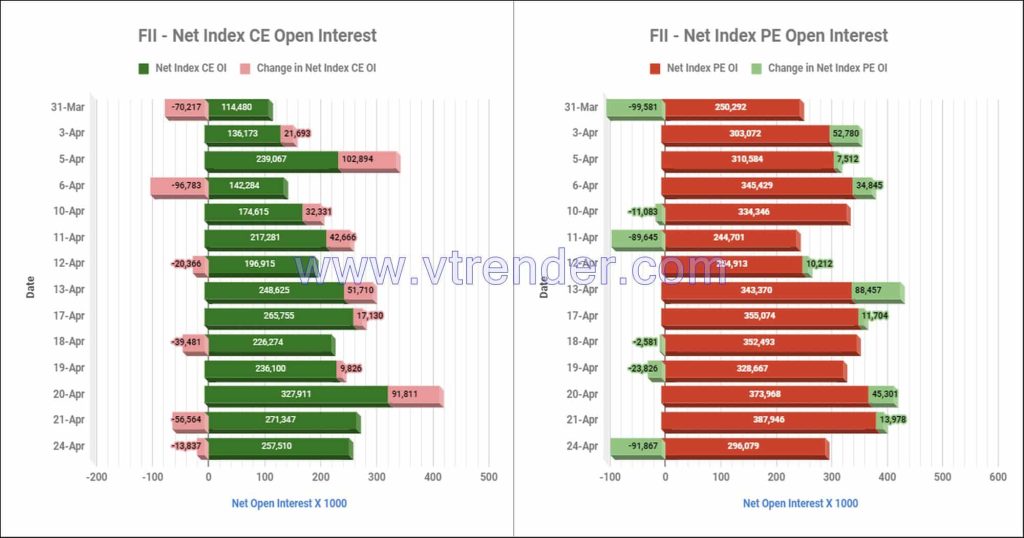

Participantwise net Open Interest and net equity investments – 24th APR 2023

Participantwise total outstanding Open Interest & Daily changes

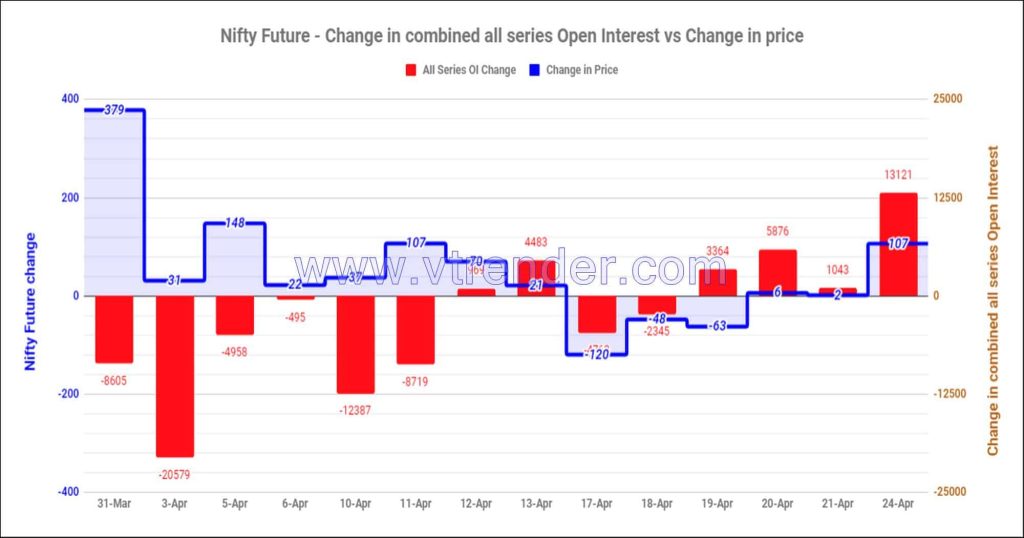

Nifty and Banknifty Futures with all series combined Open Interest – 24th APR 2023

Total Nifty/Banknifty OI and daily OI changes

Desi MO (McClellans Oscillator for NSE) – 24th APR 2023

MO at 41 McClellan’s Oscillator – Calculation and Interpretation

Order Flow charts dated 24th April 2023

Timing is the key to successfully trade the markets in the shorter time frame. Order Flow is one of the most effective methods to time your trades by seeing exactly what the other traders are trading in the market and positioning your bias accordingly. Order Flow is the most transparent way to trade and takes […]

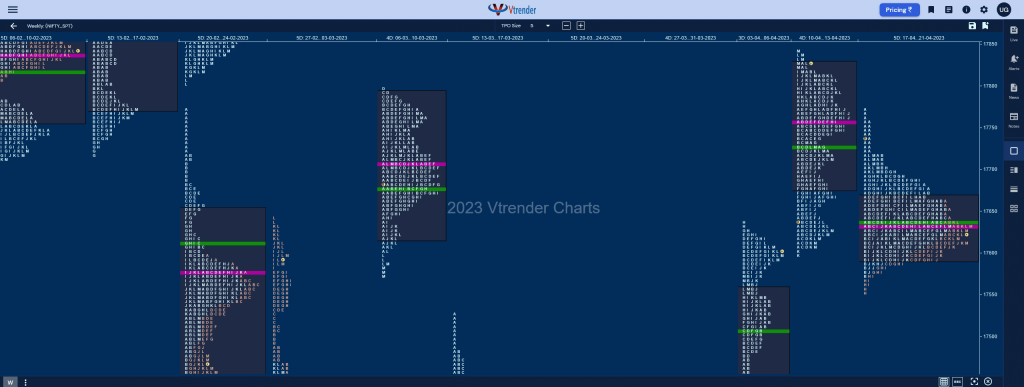

Weekly Charts (17th to 21st Apr 2023) and Market Profile Analysis

Nifty Spot Weekly Profile (17th to 21st Apr 2023) 17624 [ 17767 / 17554 ] Previous week was a Neutral Extreme profile to the upside with completely higher Value at 17679-17757-17825 with a weekly FA being confirmed at 17597 and a mini-spike close from 17825 to 17842 as Nifty tagged the February 2023’s VPOC but […]

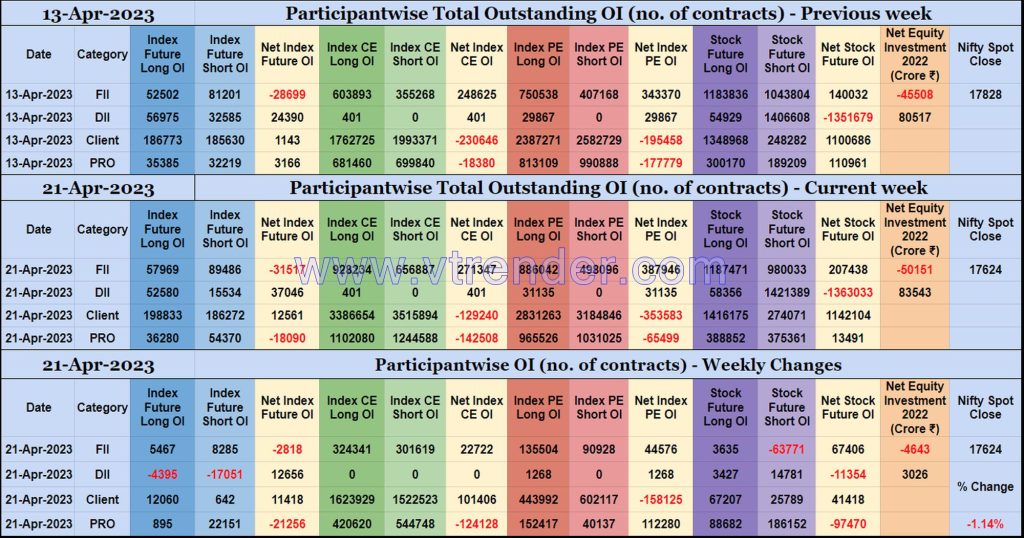

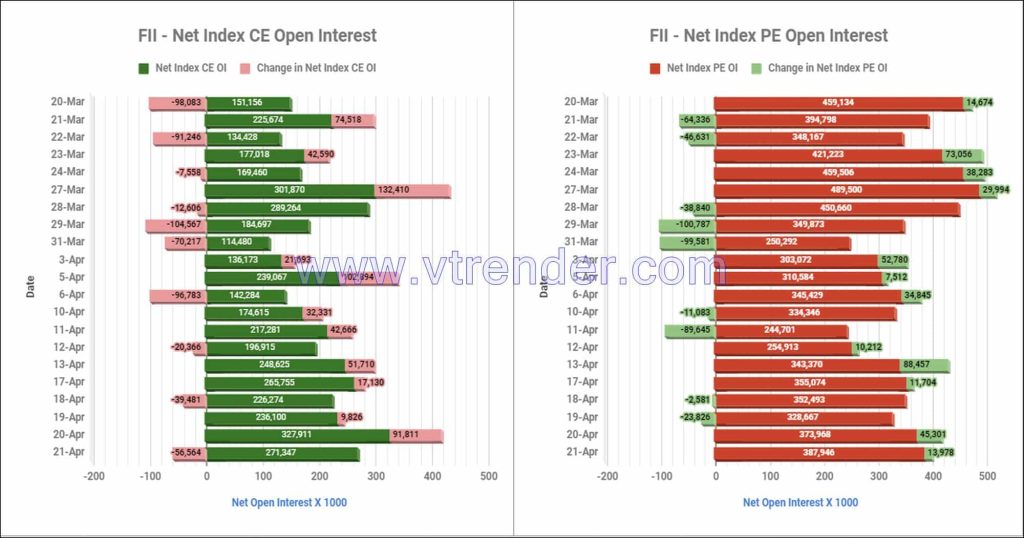

Participantwise Open Interest (Weekly changes) – 21st APR 2023

Weekly changes in Participantwise Open Interest FIIs have added net 2K short Index Futures, net 22K long Index CE, net 44K long Index PE and 3K long Stocks Futures contracts this week while covering 63K short Stocks Futures contracts. FIIs have been net sellers in equity segment for ₹4643 crore during the week. Clients have […]

Participantwise net Open Interest and net equity investments – 21st APR 2023

Participantwise total outstanding Open Interest & Daily changes