Desi MO (McClellans Oscillator for NSE) – 26th JUL 2023

MO at -3 McClellan’s Oscillator – Calculation and Interpretation

Delta Neutral vs. Gamma Neutral: Exploring Advanced Hedging Strategies in Options Trading

Delta Neutral Vs. Gamma Neutral Risk management serves as the backbone of successful trading, particularly in derivatives like options where market volatility can substantially influence profits and losses. Two prevalent hedging strategies in this context are the Delta Neutral and Gamma Neutral strategies. Despite both being used to manage risk, the latter is often perceived […]

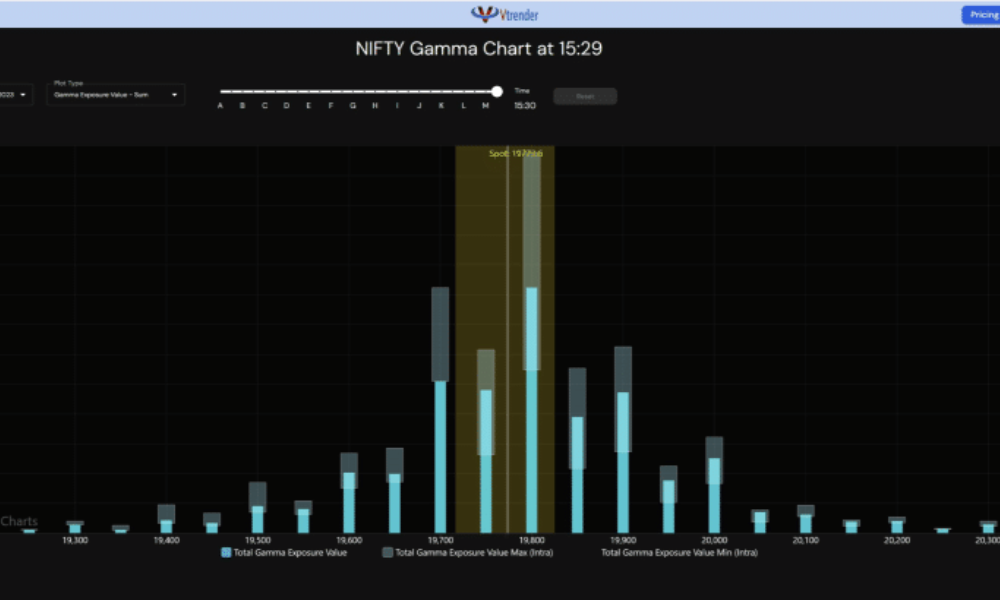

Gamma Dynamics in Options Trading: A Deep Dive into Long and Short Gamma

Gamma Dynamics in Options Trading Options trading can be an exciting realm for traders seeking a blend of risk management and potential for high returns. One essential concept in the world of options trading is “Gamma.” Today, we’ll be exploring the intriguing dynamics of long gamma and short gamma positions, and how big money managers use the […]

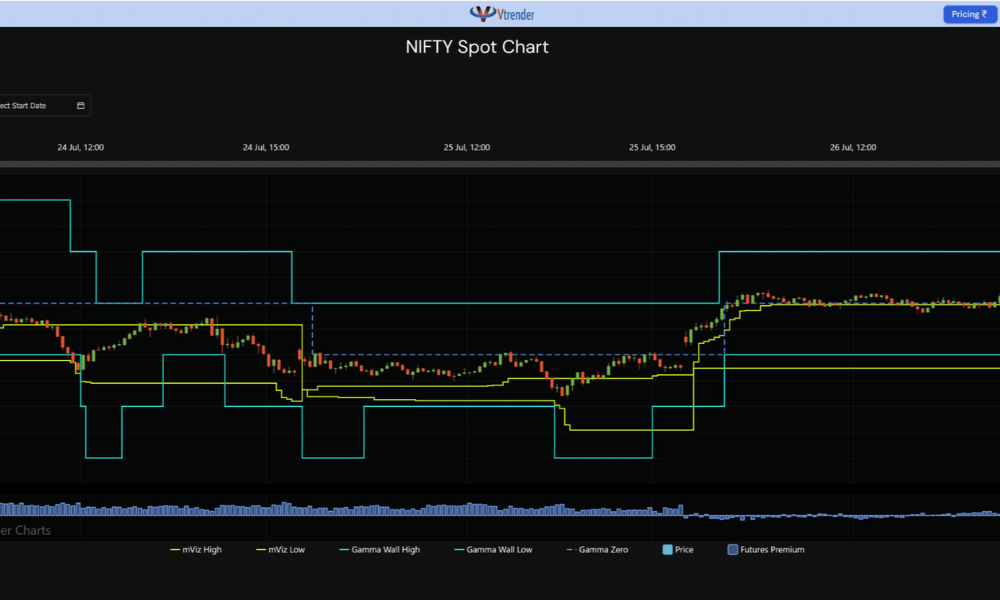

Order Flow charts dated 26th July 2023

Many traders are looking for information on how to use market conditions to find good trades. Order Flow is best understood as a way to see existing bias in the markets. Order Flow helps us understand who is in control of the market and who is ‘upside down’ and likely to make exits from that […]

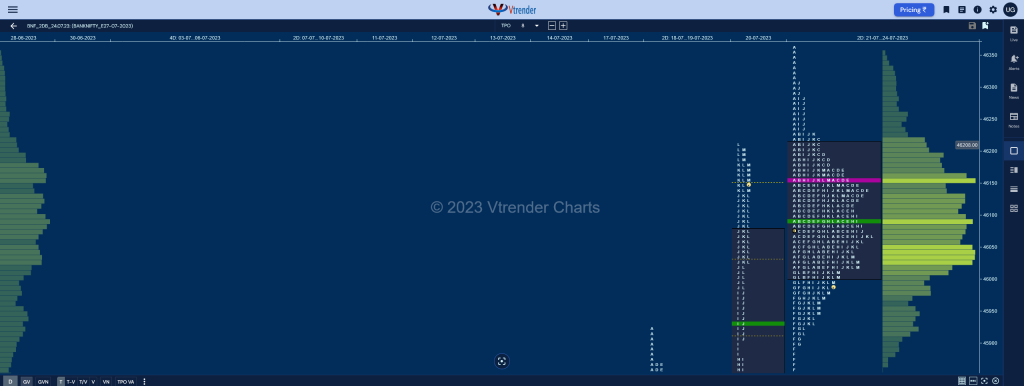

Market Profile Analysis dated 25th July 2023

Nifty July F: 19691 [ 19744 / 19632 ] NF opened higher but still an OAIR (Open Auction In Range) start which gave an important cue by the OH (Open=High) tick at 19744 which was just above the NeuX VWAP of previous session after which it remains below the 5-day composite VAL of 19727 indicating that […]