Participantwise Open Interest (Series changes) – 27th JUN 2024

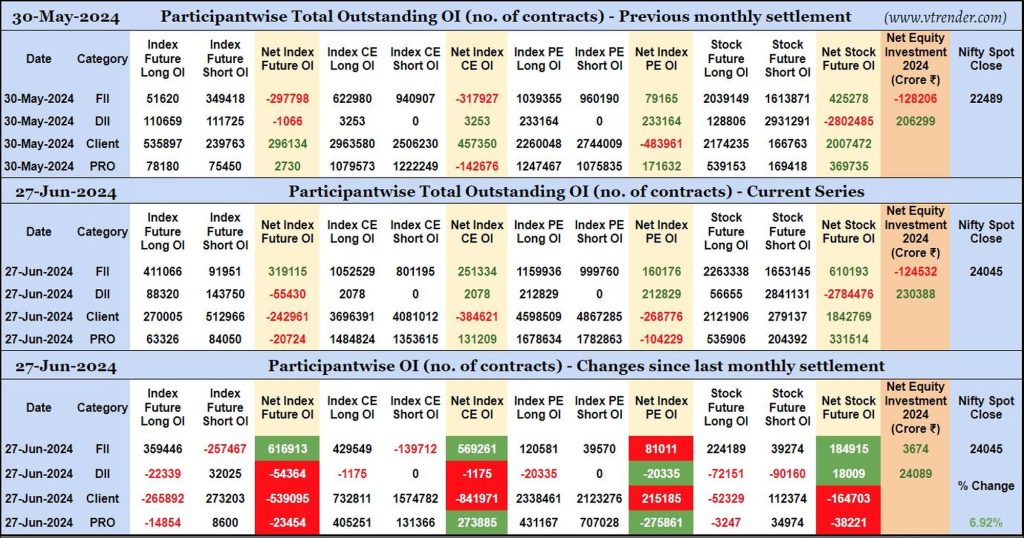

FIIs have added 359K long Index Futures, 429K long Index CE, net 81 long Index PE and net 184K long Stocks Futures contracts in June series besides covering 257K short Index Futures and 139K short Index CE contracts.

FIIs were net buyers in equity segment for ₹3674 crore during June series.

Nifty and Banknifty Futures with all series combined Open Interest – 27th JUN 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

Desi MO (McClellans Oscillator for NSE) – 27th JUN 2024

MO at -9

Market Profile Analysis dated 26th Jun 2024

Nifty Jun F: 23868 [ 23906 / 23676 ] Open Type OAIR (Open Auction) Volumes of 16,088 contracts Below average Initial Balance 59 points (23735 – 23676) Volumes of 49,332 contracts Below average Day Type Double Distribution – 231 pts Volumes of 2,28,932 contracts Below average NF made a slow start on low volumes as it […]