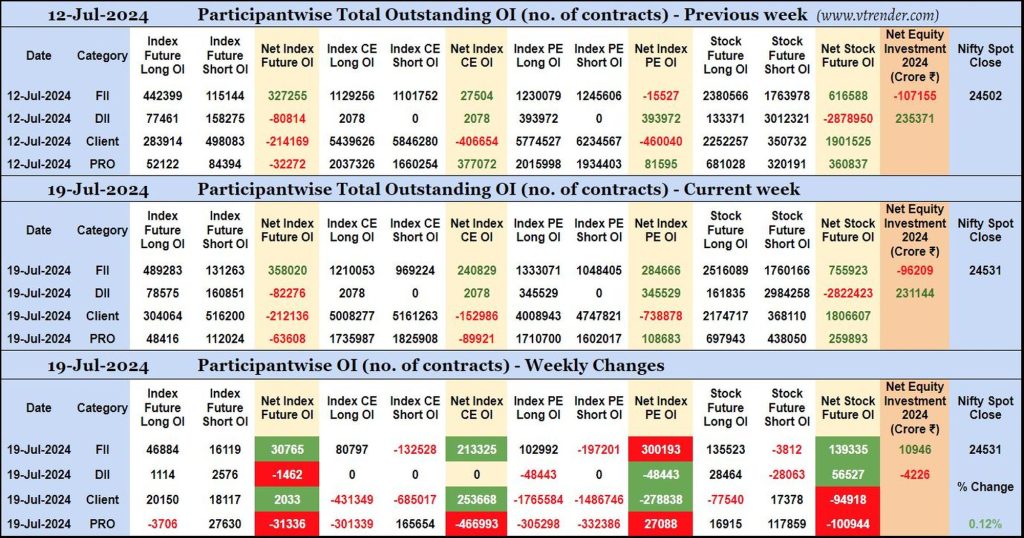

Participantwise Open Interest (Weekly changes) – 19th JUL 2024

FIIs have added net 30K long Index Futures, 80K long Index CE, 102K long Index PE and 135K long Stocks Futures contracts this week besides covering 132K short Index CE, 197K short Index PE and 3K short Stocks Futures contracts.

FIIs have been net buyers in equity segment for ₹10946 crore during the week.

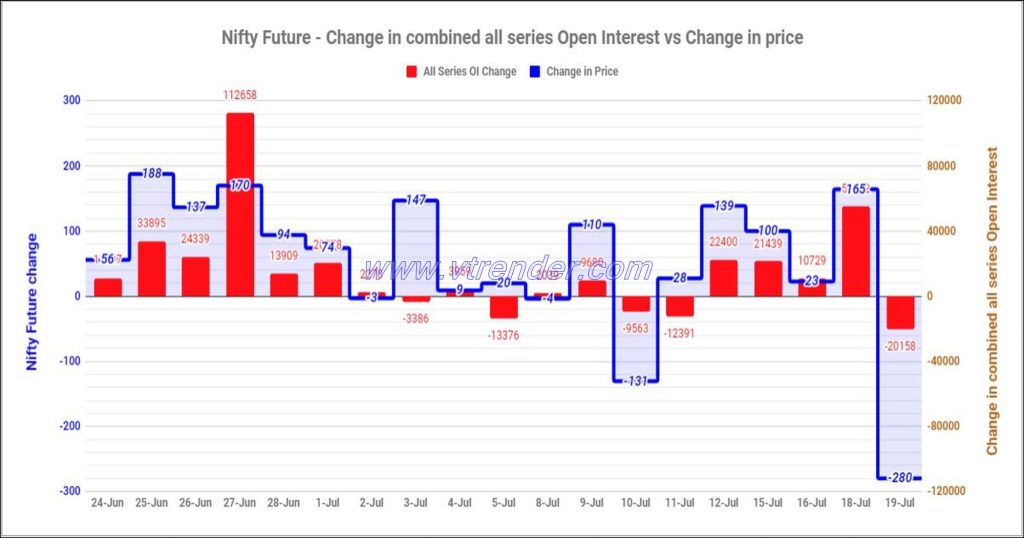

Nifty and Banknifty Futures with all series combined Open Interest – 19th JUL 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

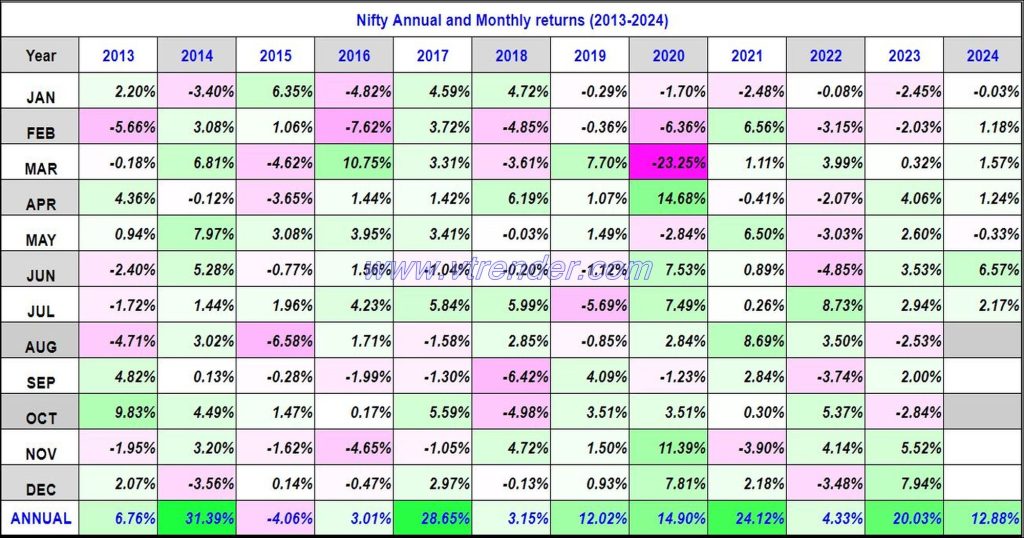

Nifty 50 Monthly and Annual returns (1991-2024) updated 19th JUL 2024

Nifty50 returns Year 2024 12.88% / Nifty50 returns JUL 2024 2.17%

Desi MO (McClellans Oscillator for NSE) – 19th JUL 2024

MO at -59

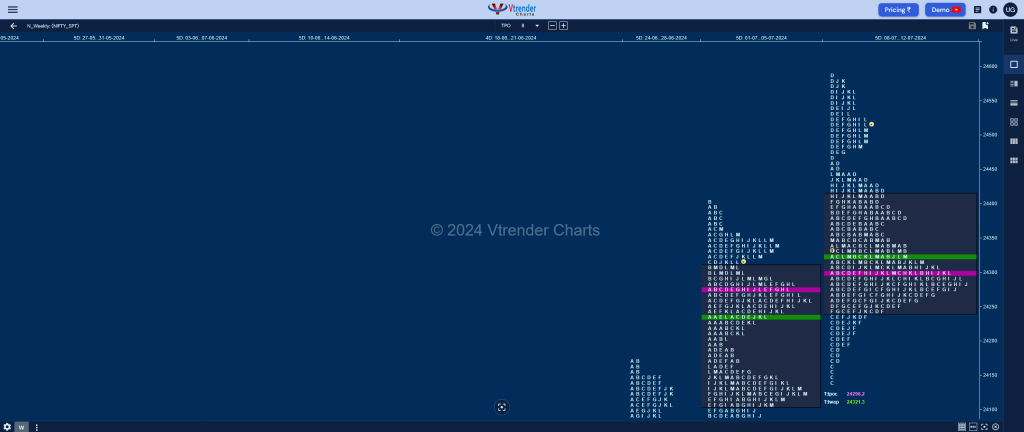

Weekly Spot Charts (15th to 19th Jul 2024) and Market Profile Analysis

Nifty Spot: 24530 [ 24854 / 24504 ] Previous week’s report ended with this ‘The weekly profile is a Neutral Extreme one to the upside with a small responsive buying tail at lows from 24173 to 24141 and has formed overlapping to higher Value at 24242-24296-24415 which is a nice balance and has given a move […]