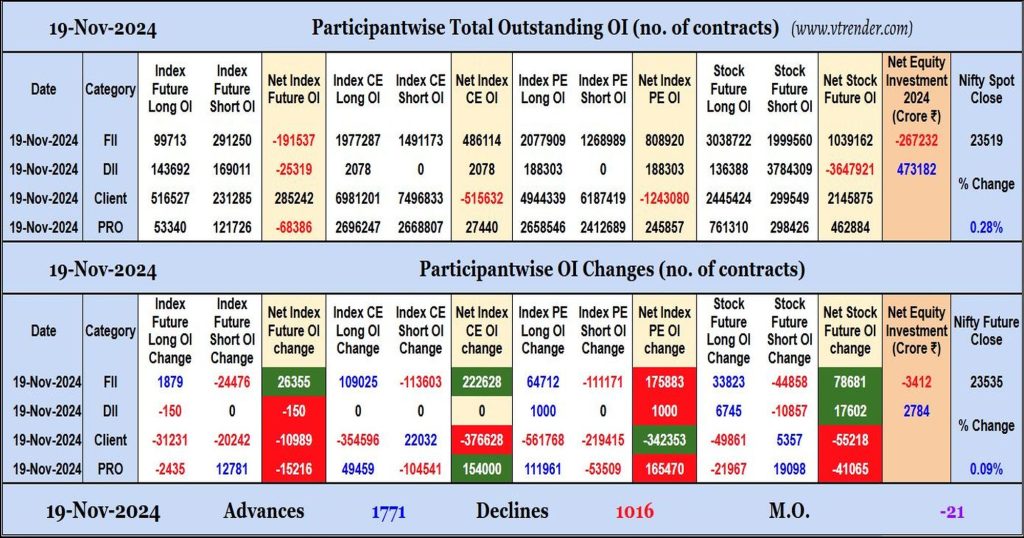

Participantwise Open Interest (Daily changes) – 19th NOV 2024

FIIs have added net longs in Index Futures, Stocks Futures, Index CE and Index PE. They remained net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 19th NOV 2024

MO at -21

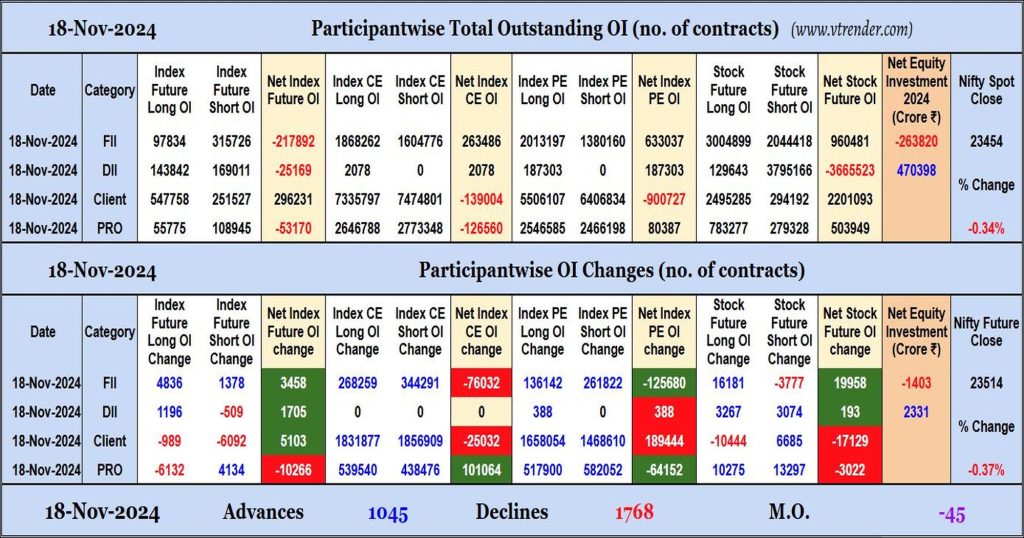

Participantwise Open Interest (Daily changes) – 18th NOV 2024

FIIs have added net longs in Index & Stocks Futures while adding net shorts in Index CE and Index PE. They continued selling in equity segment.

Desi MO (McClellans Oscillator for NSE) – 18th NOV 2024

MO at -45

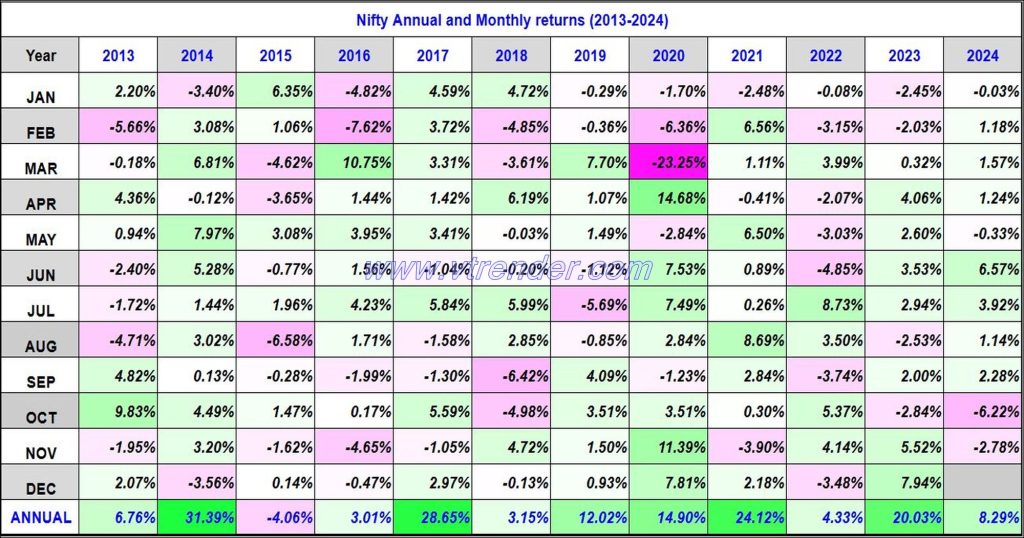

Nifty 50 Monthly and Annual returns (1991-2024) updated 14th NOV 2024

Nifty50 returns Year 2024 8.29% / Nifty50 returns NOV 2024 -2.78%

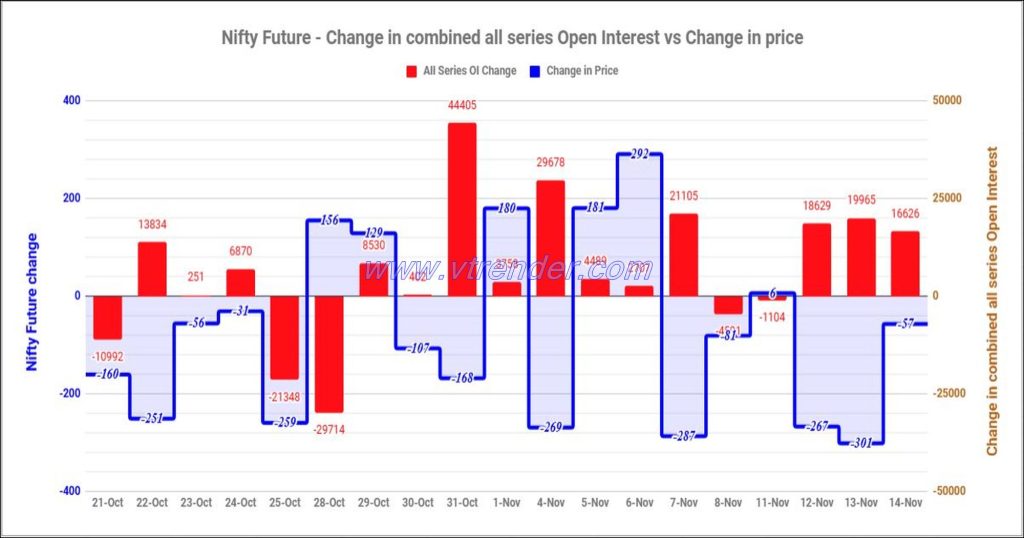

Nifty and Banknifty Futures with all series combined Open Interest – 14th NOV 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

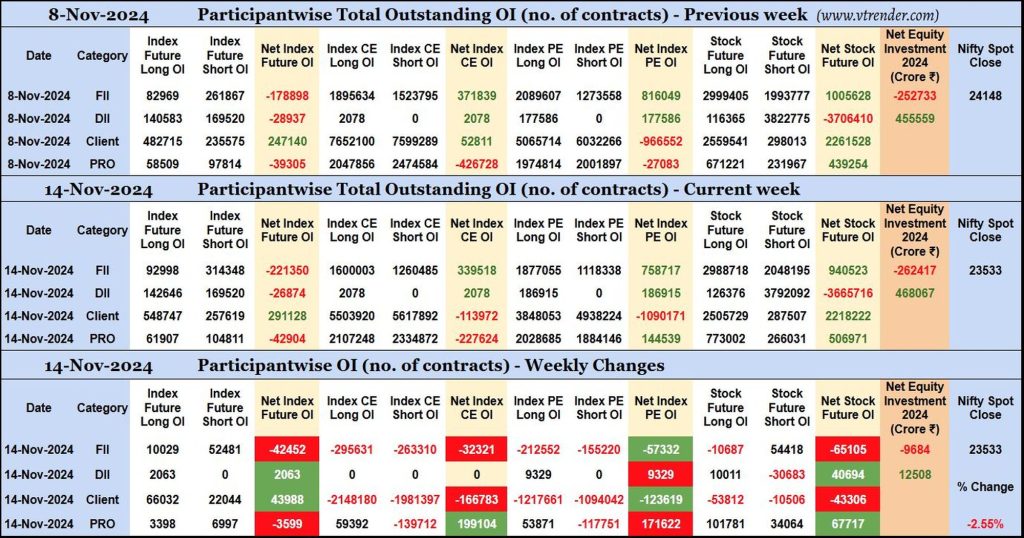

Participantwise Open Interest (Weekly changes) – 14th NOV 2024

FIIs have added net 42K short Index Futures and 54K short Stocks Futures contracts this week besides liqudating 10K long Stocks futures contracts and shedding Open Interest in Index Options.

FIIs have been net sellers in equity segment for ₹9684 crore during the week.

Desi MO (McClellans Oscillator for NSE) – 14th NOV 2024

MO at -41

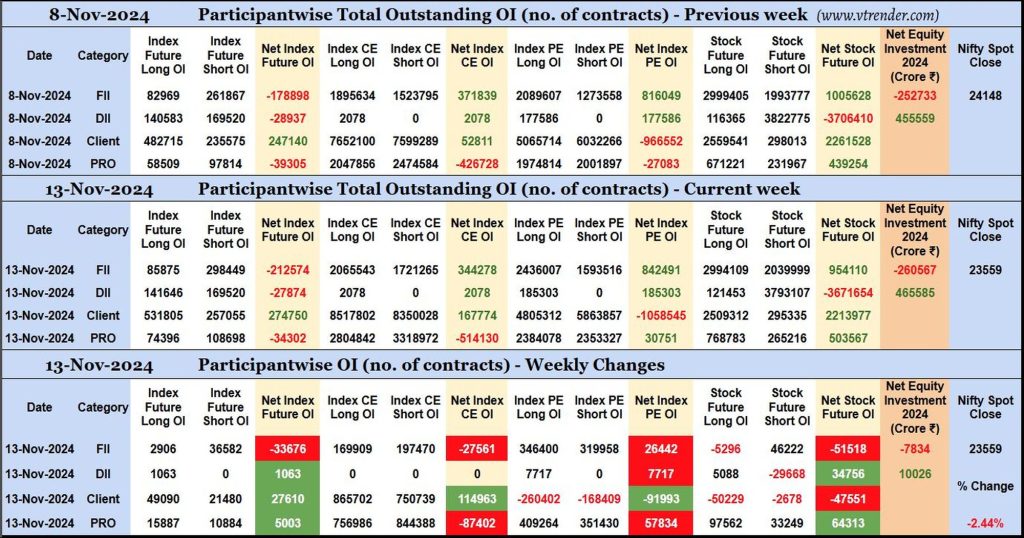

Participantwise Open Interest (Mid-week changes) – 13th NOV 2024

FIIs have added net 33K short Index Futures, net 27K short Index CE, net 26K long Index PE and 46K short Stocks Futures contracts so far this week while liquidating 5K long Stocks Futures contracts.

FIIs have been net sellers in equity segment for 7834 crore during current week.

Desi MO (McClellans Oscillator for NSE) – 13th NOV 2024

MO at -54