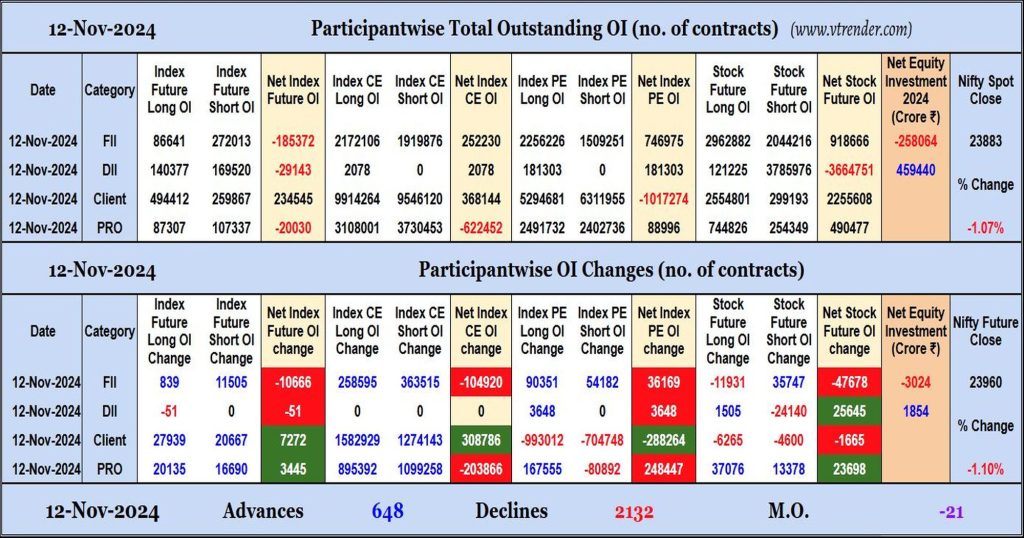

Participantwise Open Interest (Daily changes) – 12th NOV 2024

FIIs have added net shorts in Index Futures, Stocks Futures and Index CE while adding net longs in Index PE. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 12th NOV 2024

MO at -21

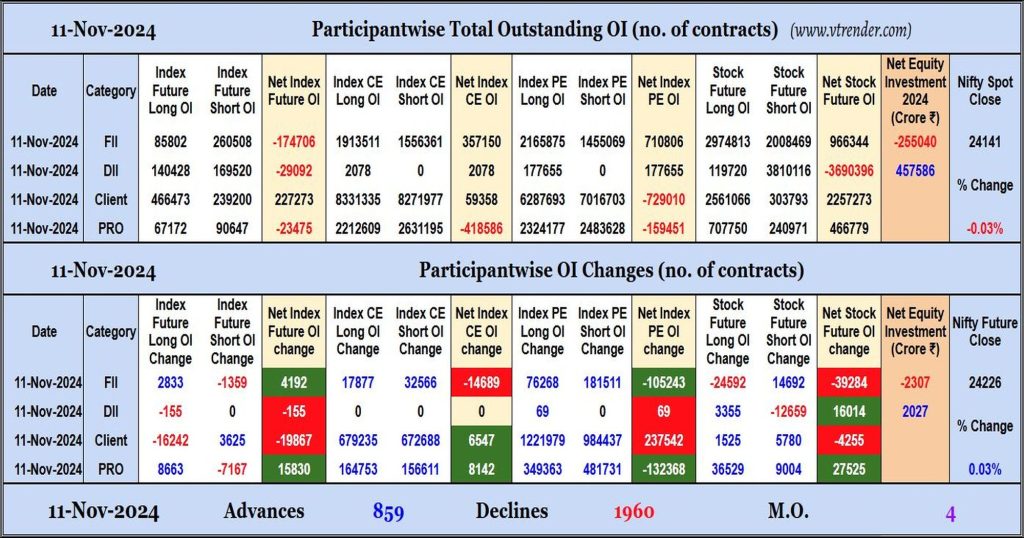

Participantwise Open Interest (Daily changes) – 11th NOV 2024

FIIs have added net longs in Index Futures while adding net shorts in Index CE, Index PE and Stocks Futures. They remained net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 11th NOV 2024

MO at 4

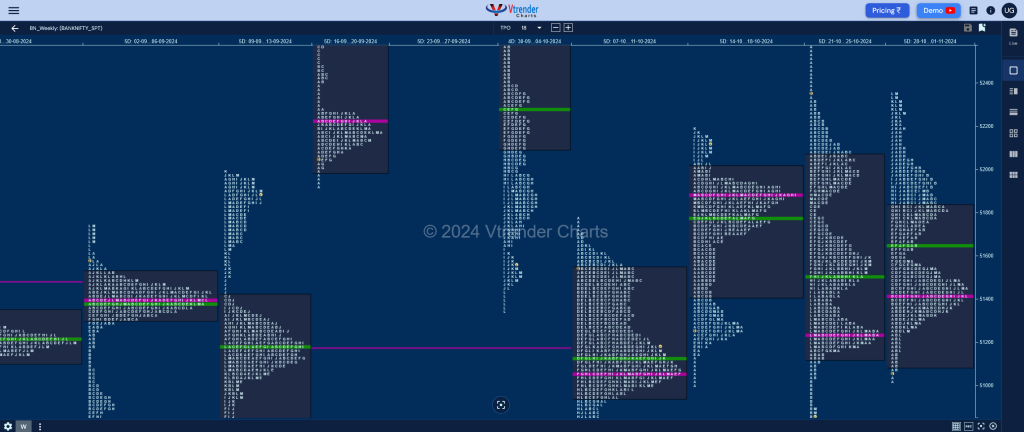

Weekly Spot Charts (04th to 08th Nov 2024) and Market Profile Analysis

Nifty Spot: 24148 [ 24537 / 23816 ] Outside Bar Previous week’s report ended with this ‘The weekly profile is a Normal Gaussian Curve of mere 363 points as the auction tested the 24400-24451 zone multiple times on the upside but could not sustain whereas on the downside it confirmed a FA (Failed Auction) at 24140 […]

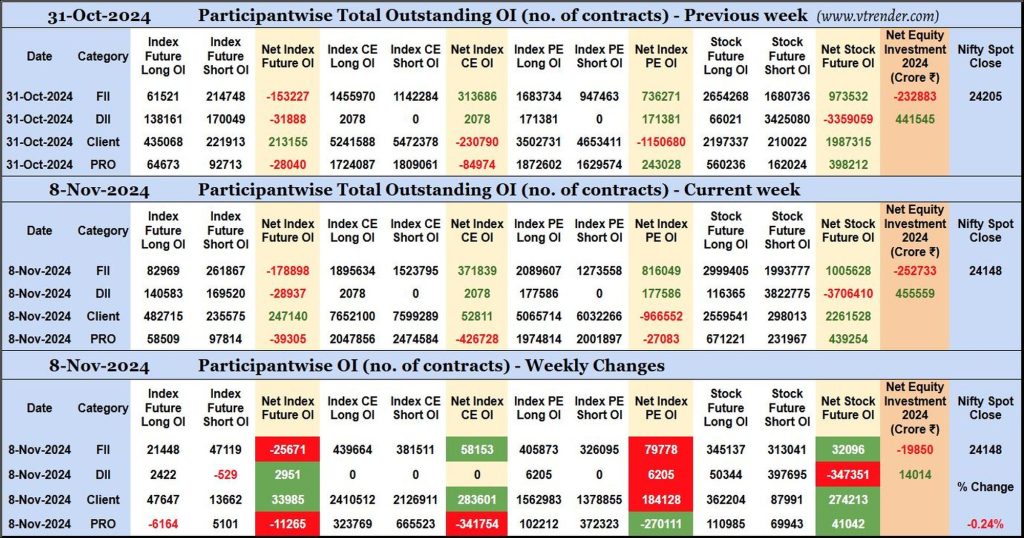

Participantwise Open Interest (Weekly changes) – 8th NOV 2024

FIIs have added net 25K short Index Futures, net 58K long Index CE, net 79K long Index PE and net 32K long Stocks Futures contracts this week.

FIIs have been net sellers in equity segment for ₹19850 crore during the week.

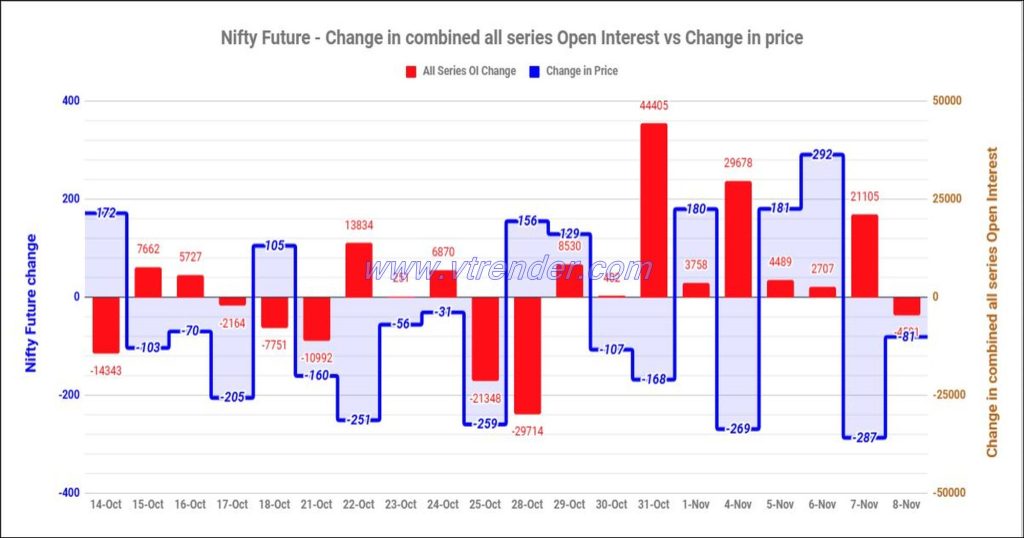

Nifty and Banknifty Futures with all series combined Open Interest – 8th NOV 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

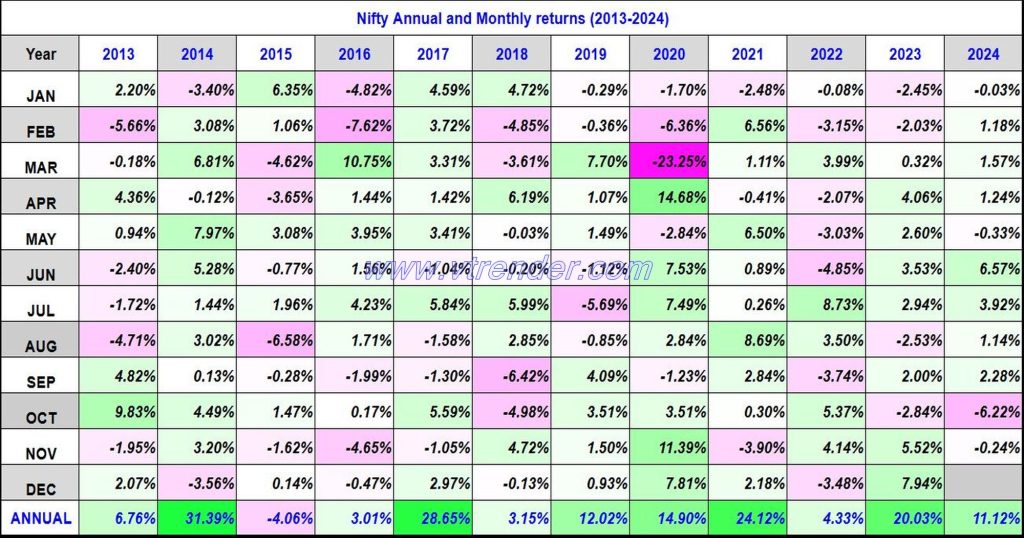

Nifty 50 Monthly and Annual returns (1991-2024) updated 8th NOV 2024

Nifty50 returns Year 2024 11.12% / Nifty50 returns NOV 2024 -0.24%

Desi MO (McClellans Oscillator for NSE) – 8th NOV 2024

MO at 24

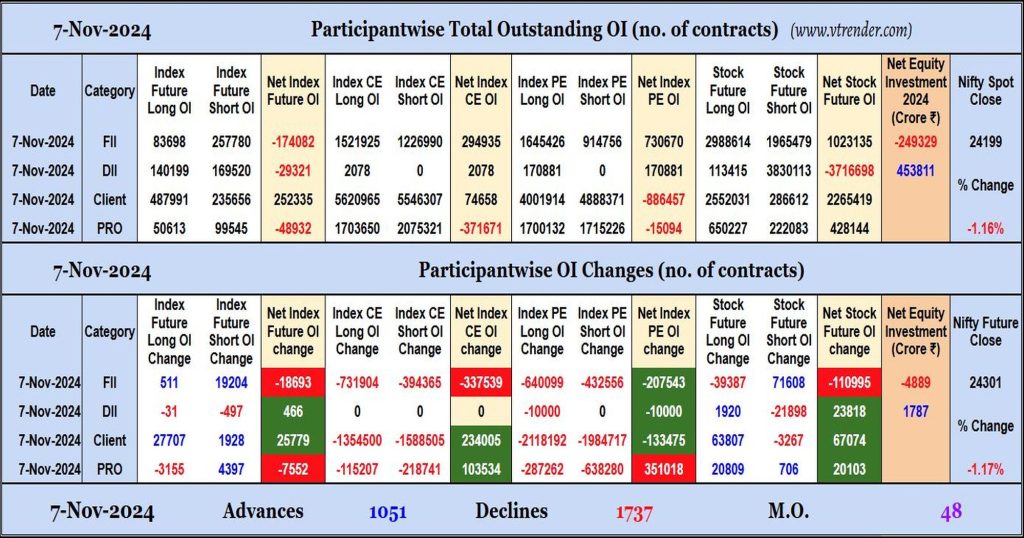

Participantwise Open Interest (Daily changes) – 7th NOV 2024

FIIs have added net shorts in Index & Stocks Futures while shedding Open Interest in Index Options. They have continued selling in equity segment.