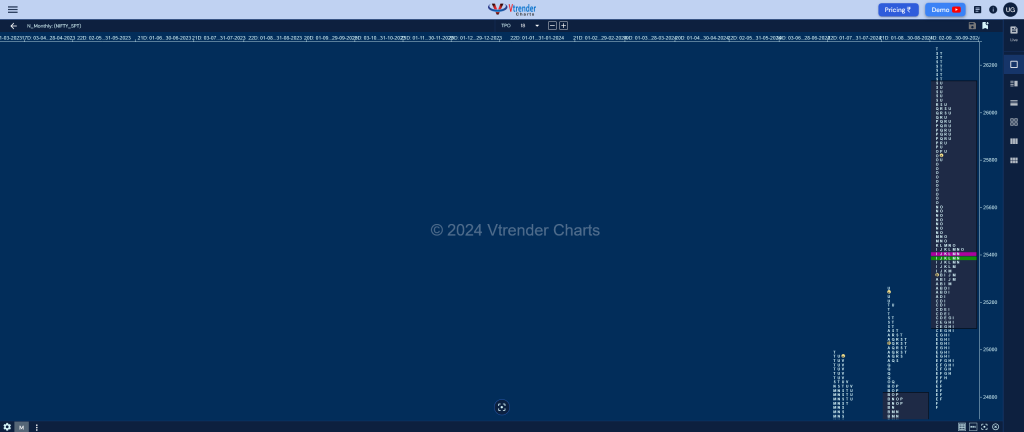

Monthly charts (October 2024) and Market Profile Analysis

Nifty Spot: 24205 [ 25907 / 24073 ] Nifty has formed a long liquidation ‘b’ shape profile on the monthly with completely lower Value at 24101-24400-25033 with an initiative selling tail from 25639 to 25907 with a TPO HVN at 25008 and a SOC (Scene Of Crime) at 24664 along with the October series VWAP of […]

Desi MO (McClellans Oscillator for NSE) – 1st NOV 2024

MO at 61,

Low volume Muhurat trading day sees declining volumes slipping to 6%

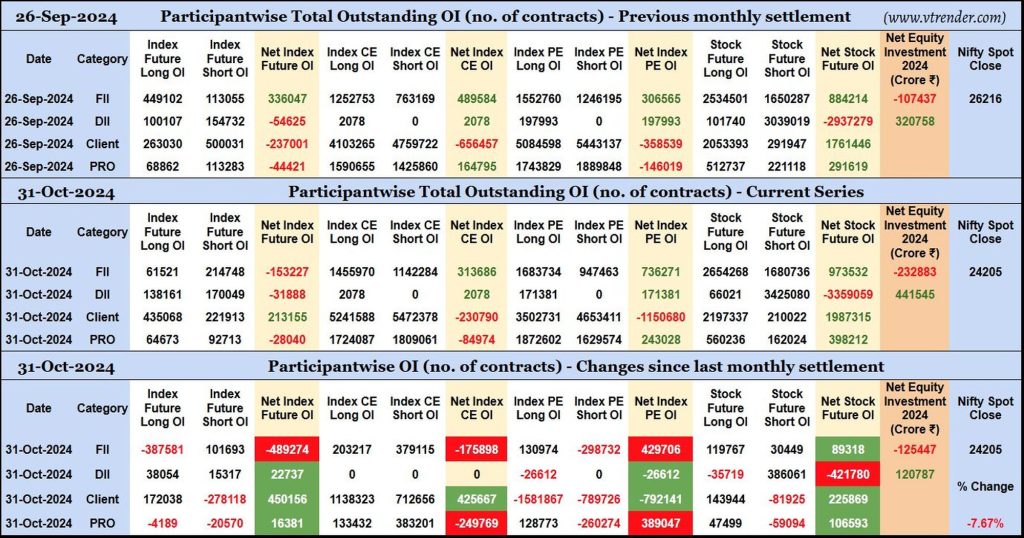

Participantwise Open Interest (Series changes) – 31st OCT 2024

FIIs have added 101K short Index Futures, net 175K short Index CE, 130K long Index PE and net 89K long Stocks Futures contracts since SEP settlement besides liquidating 387K long Index Futures contracts and covering 298K short Index PE contracts.

FIIs were net sellers in equity segment for ₹125447 crore during October series.

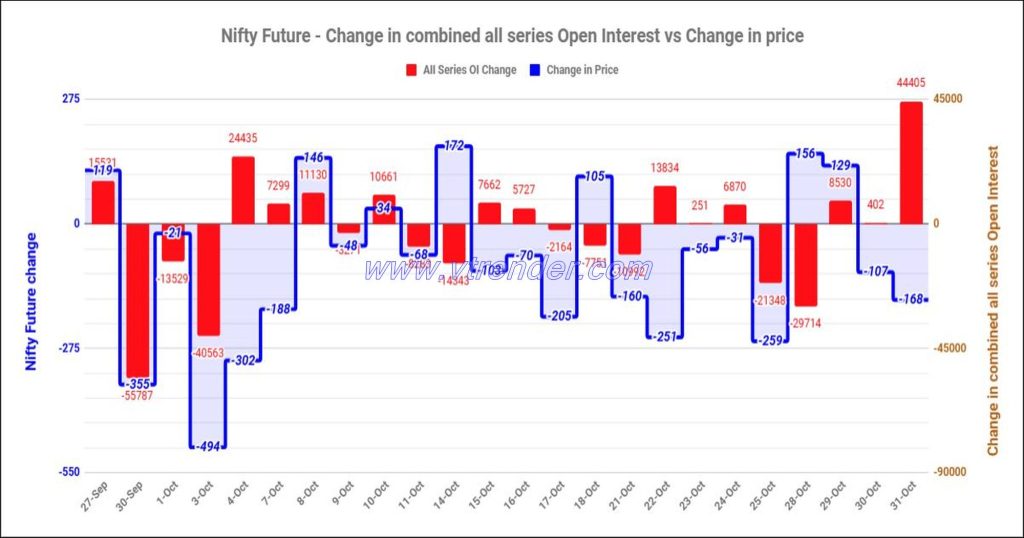

Nifty and Banknifty Futures with all series combined Open Interest – 31st OCT 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

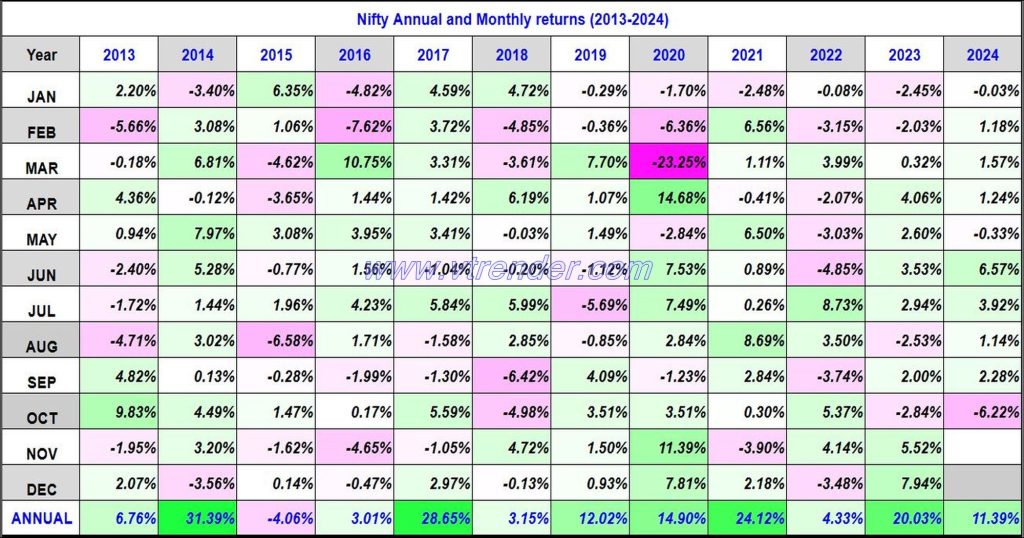

Nifty 50 Monthly and Annual returns (1991-2024) updated 31st OCT 2024

Nifty50 returns Year 2024 11.39% / Nifty50 returns OCT 2024 -6.22%

Desi MO (McClellans Oscillator for NSE) – 31st OCT 2024

MO at 24

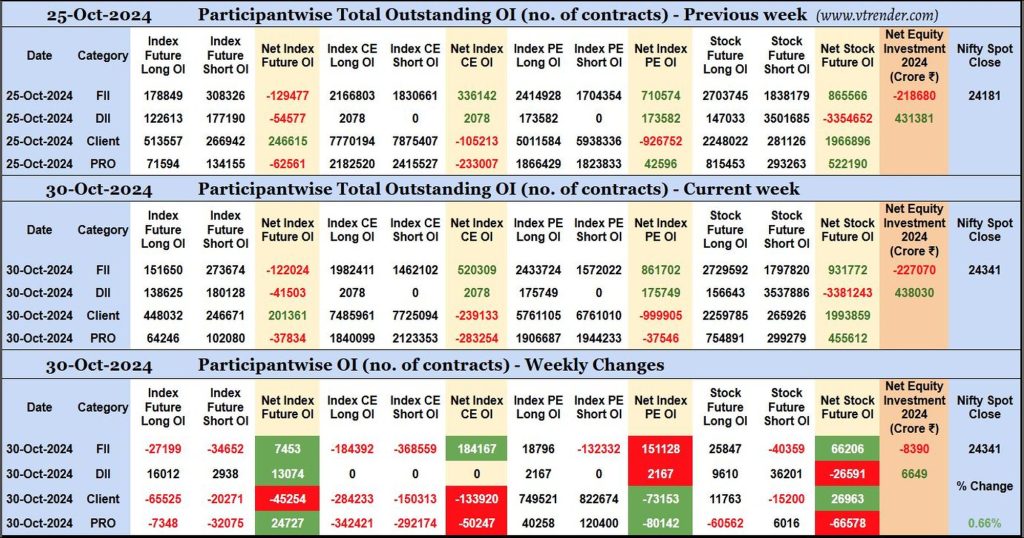

Participantwise Open Interest (Mid-week changes) – 30th OCT 2024

FIIs have added 18K long Index PE and 25K long Stocks Futures contracts so far this week besides covering 132K short Index PE, 40K short Stocks futures contracts and shedding Open Interest in Index Futures and Index CE.

FIIs have been net sellers in equity segment for ₹8390 crore during the running week.

Desi MO (McClellans Oscillator for NSE) – 30th OCT 2024

MO at 8

Desi MO (McClellans Oscillator for NSE) – 29th OCT 2024

MO at -25

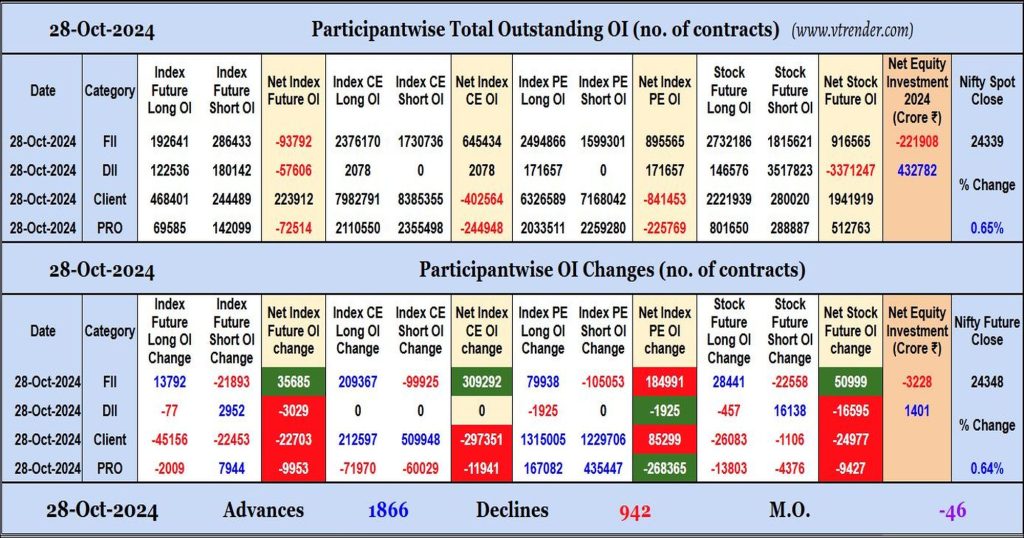

Participantwise Open Interest (Daily changes) – 28th OCT 2024

FIIs have added net longs in Index Futures, Stocks Futures, Index CE and Index PE. They were net sellers in equity segment.