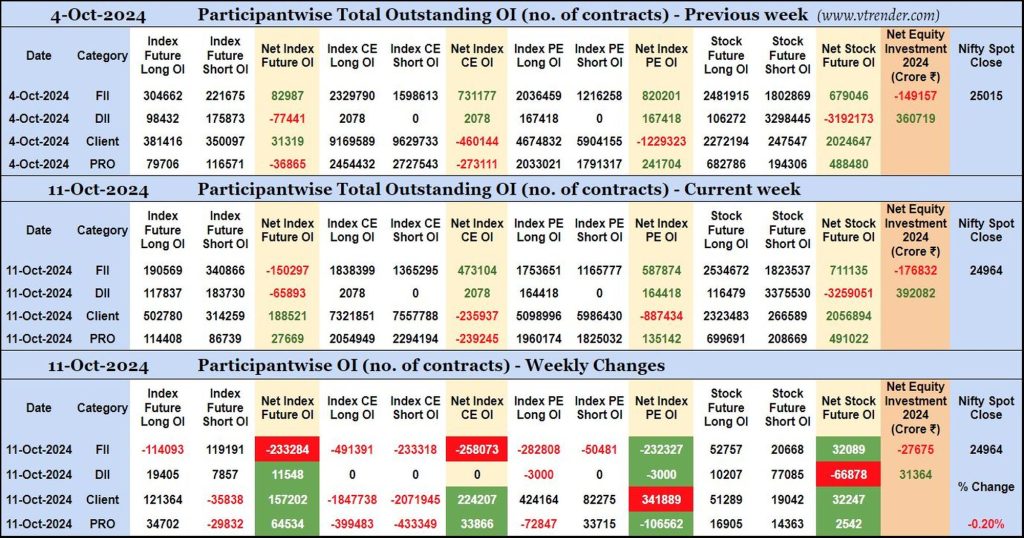

Participantwise Open Interest (Weekly changes) – 11th OCT 2024

FIIs have added 119K short Index Futures and net 32K long Stocks Futures contracts this week besides liquidating 114K long Index Futures contracts and shedding Open Interest in Index options.

FIIs have been net sellers in equity segment for ₹27675 crore during the week.

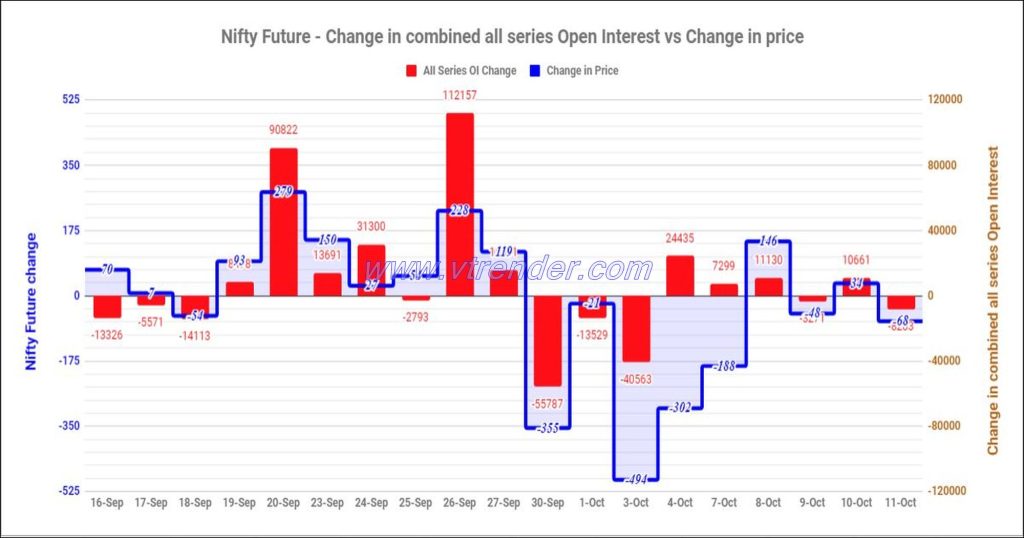

Nifty and Banknifty Futures with all series combined Open Interest – 11th OCT 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

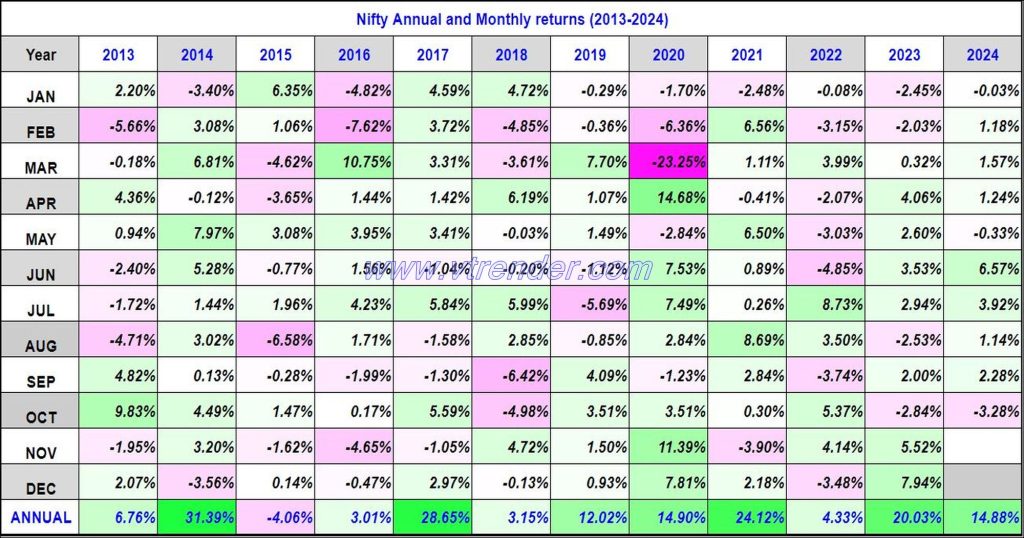

Nifty 50 Monthly and Annual returns (1991-2024) updated 11th OCT 2024

Nifty50 returns Year 2024 14.88% / Nifty50 returns OCT 2024 -3.28%

Desi MO (McClellans Oscillator for NSE) – 11th OCT 2024

MO at 2

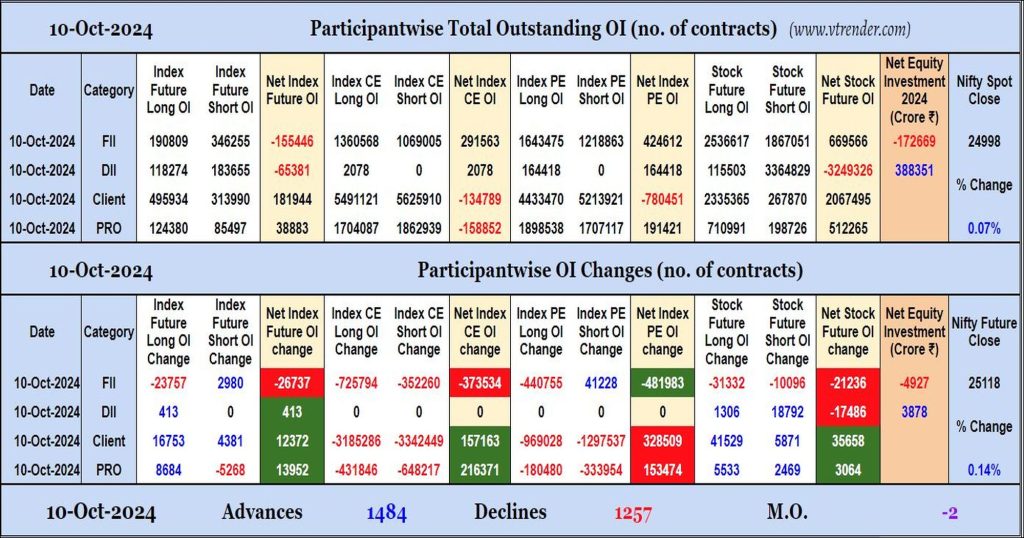

Participantwise Open Interest (Daily changes) – 10th OCT 2024

FIIs have added net shorts in Index Futures and Index PE and have shed Open Interest in Index CE and Stocks Futures. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 10th OCT 2024

MO at -2

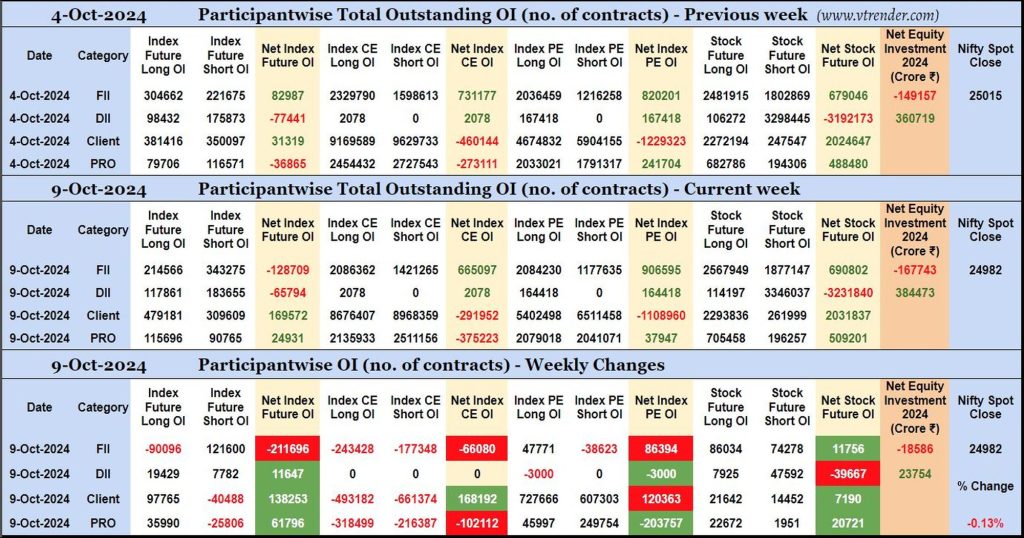

Participantwise Open Interest (Mid-week changes) – 9th OCT 2024

FIIs have added 121K short Index Futures, 47K long Index PE and net 11K long Stocks Futures contracts so far this week besides liquidating 90K long Index Futures contracts and covering 38K short Index PE contracts. They have shed Open Interest in Index CE during the current week.

FIIs have been net sellers in equity segment for 18586 crore during the running week.

Desi MO (McClellans Oscillator for NSE) – 9th OCT 2024

MO at -10

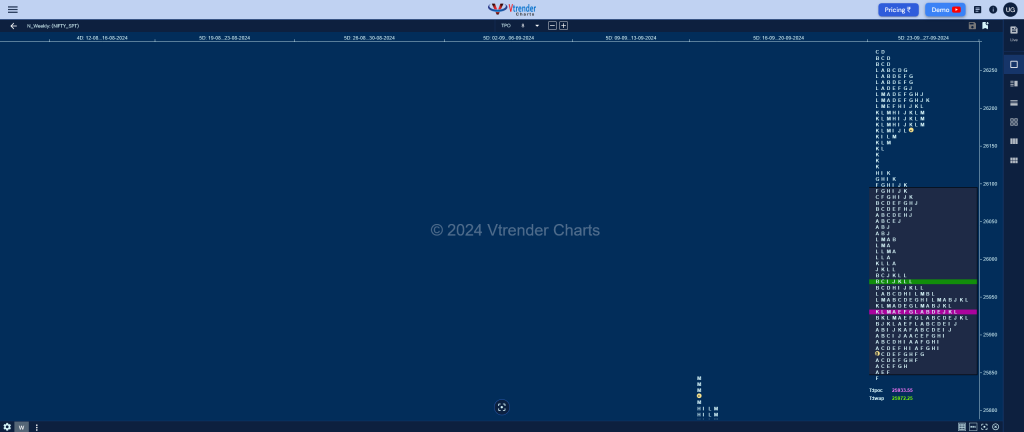

Weekly Spot Charts (30th Sep to 04th Oct 2024) and Market Profile Analysis

Nifty Spot: 25014 [ 26134 / 24966 ] Trend Down Previous week’s report ended with this ‘Value was completely higher at 25849-25933-26094 with an extension handle at 26114 and a zone of singles till 26151 which will be the immediate support to watch for in the coming week as it looks to fill up the current […]

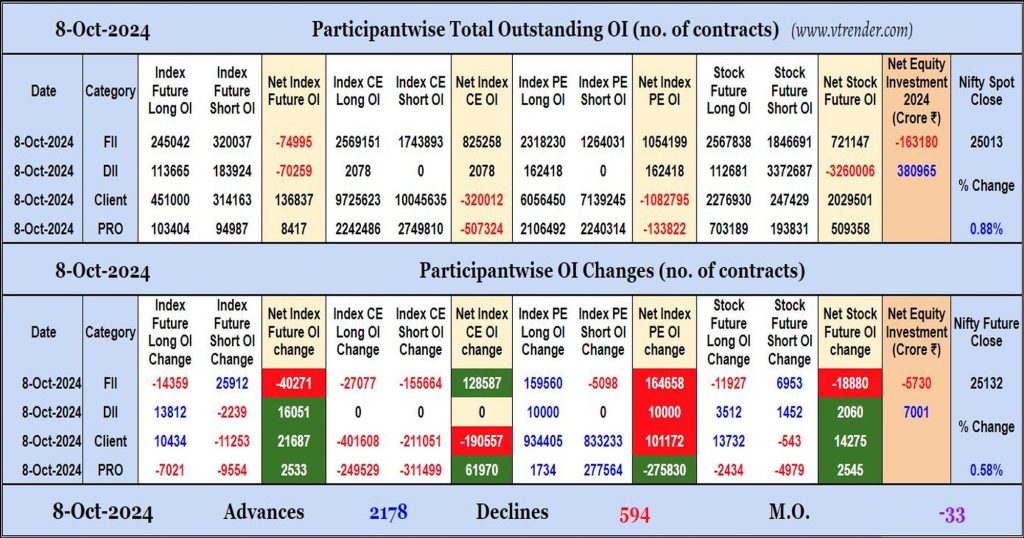

Participantwise Open Interest (Daily changes) – 8th OCT 2024

FIIs have added net shorts in Index & Stocks Futures while adding net longs in Index PE. They were net sellers in equity segment.