Monthly charts (September 2024) and Market Profile Analysis

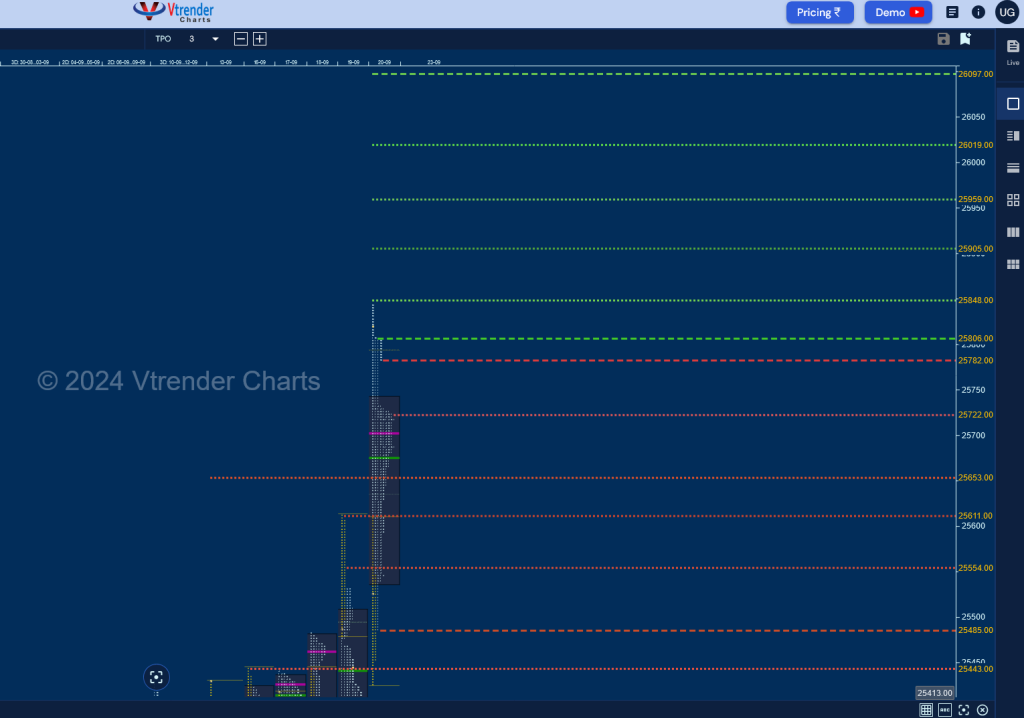

Nifty Spot: 25810 [ 26277 / 24753 ] Previous month’s report ended with this ‘The monthly profile is a Neutral One as it first dropped by a whopping 1184 points in the first 3 sessions but took support at an important Swing level of 23889 and not only retraced the entire fall but went on to […]

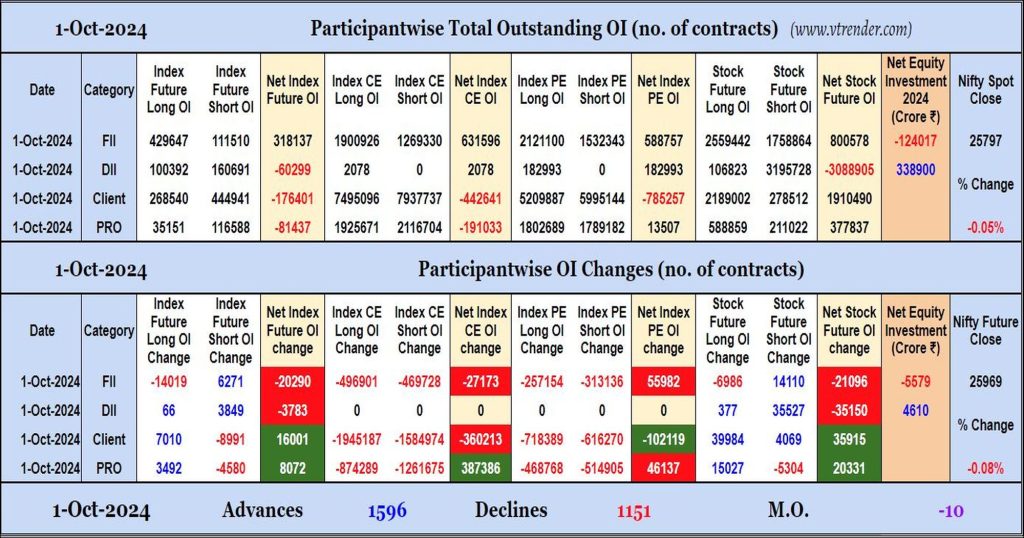

Participantwise Open Interest (Daily changes) – 1st OCT 2024

FIIs have added net shorts in Index & Stocks Futures while shedding Open Interest in Index Options. They were net sellers in equity segment also.

Desi MO (McClellans Oscillator for NSE) – 1st OCT 2024

MO at -10

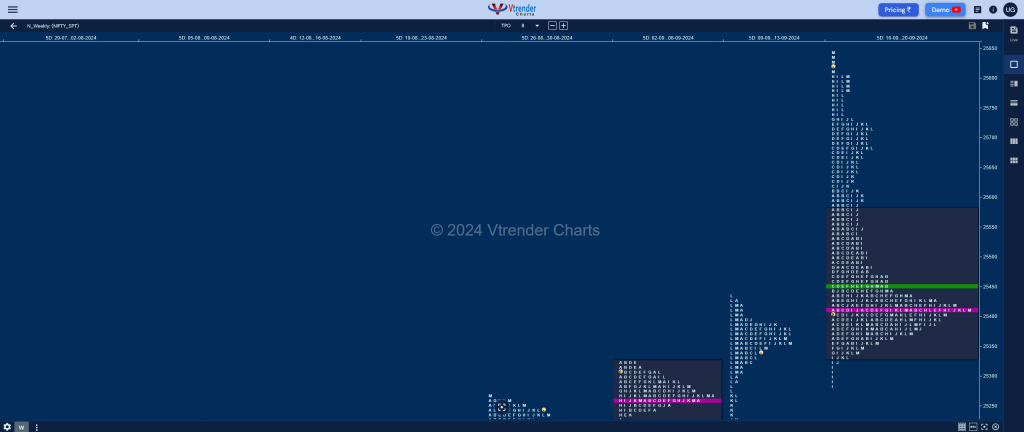

Weekly Spot Charts (23rd to 27th Sep 2024) and Market Profile Analysis

Nifty Spot: 26179 ( 26277 / 25847 ) Irregular Trend (Up) Previous week’s report ended with this ‘The weekly profile is a Neutral Extreme One to the upside with completely higher Value at 25335-25415-25584 and looks good to end the month of September on a bullish note as long as it stays above the daily extension […]

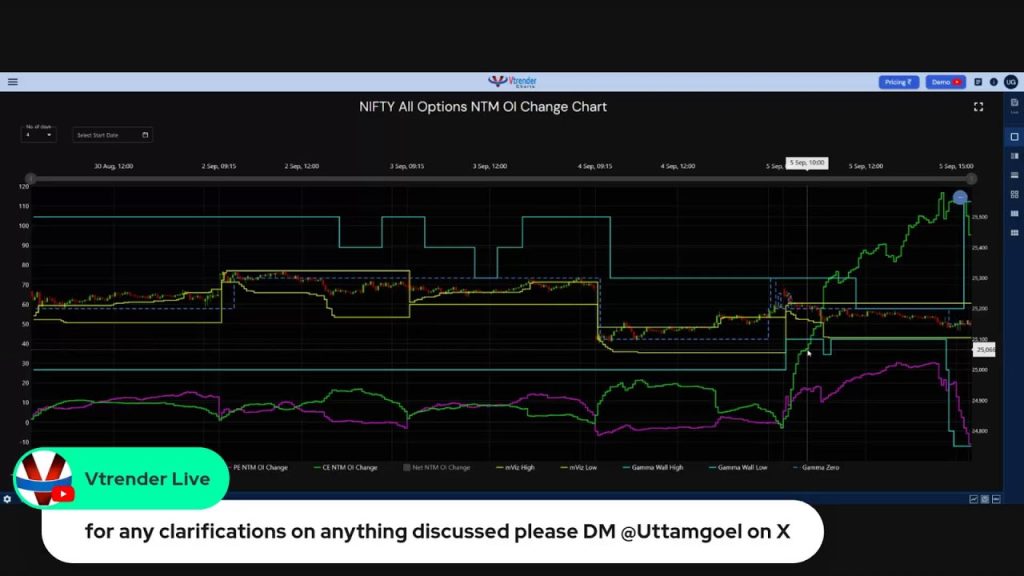

VMR Audio Sessions (Oct 2024)

31 Oct 2024 30 Oct 2024 29 Oct 2024 28 Oct 2024 25 Oct 2024 24 Oct 2024 23 Oct 2024 22 Oct 2024 21 Oct 2024 18 Oct 2024 17 Oct 2024 16 Oct 2024 15 Oct 2024 14 Oct 2024 11 Oct 2024 10 Oct 2024 09 Oct 2024 08 Oct 2024 07 […]

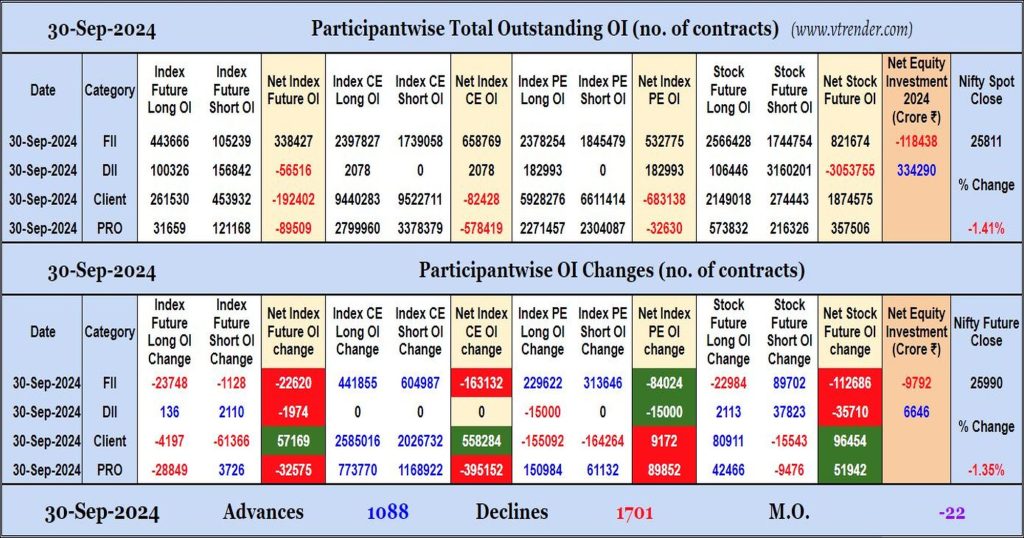

Participantwise Open Interest (Daily changes) – 30th SEP 2024

FIIs have added net shorts in Index CE, Index PE and Stocks Futures. They were net sellers in equity segment too.

Desi MO (McClellans Oscillator for NSE) – 30th SEP 2024

MO at -22

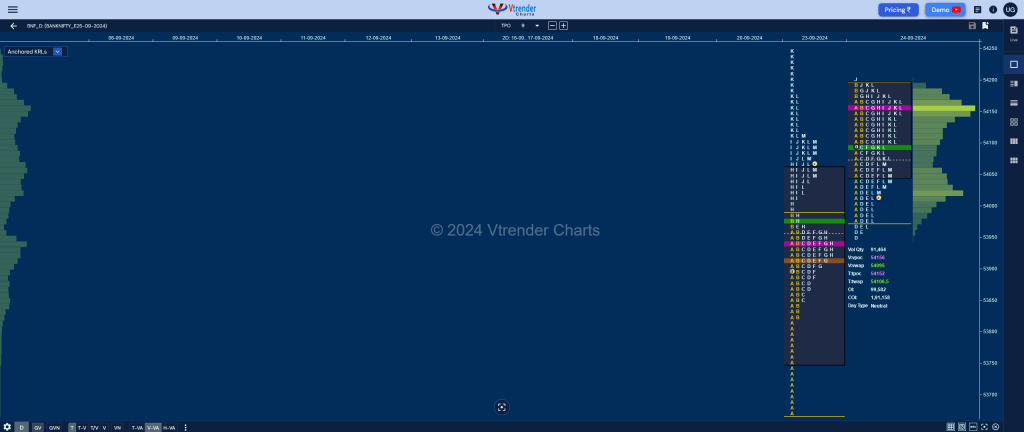

Market Profile Analysis dated 27th Sep 2024

Nifty Oct F: 26345 [ 26403 / 26304 ] Open Type OA (Open Auction) Volumes of 27,35 contracts Average Initial Balance 87 points (26391 – 26304) Volumes of 59,235 contracts Average Day Type Normal – 99 pts Volumes of 1,91,859 contracts Below average NF continued previous session’s imbalance with a probe higher in the Initial Balance […]

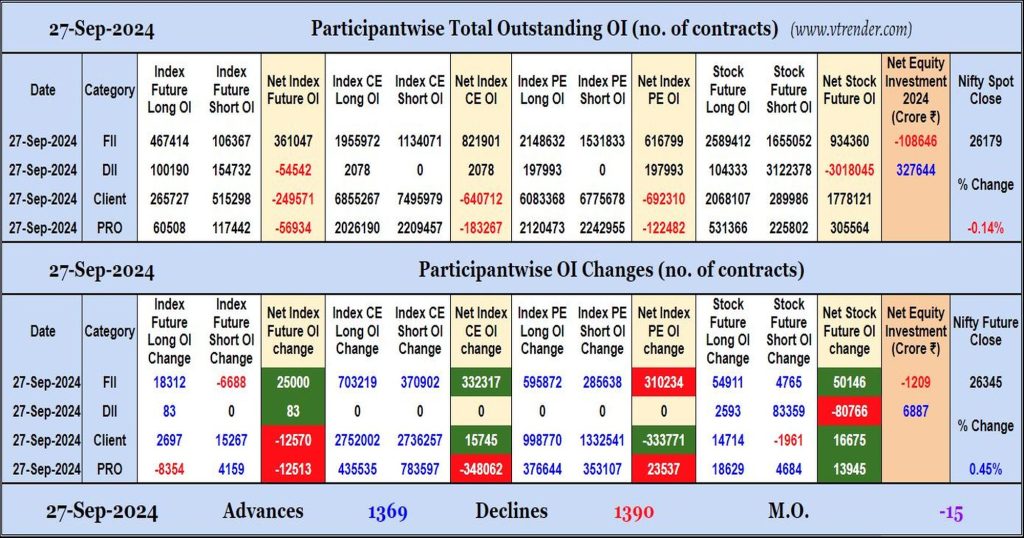

Participantwise Open Interest (Daily changes) – 27th SEP 2024

FIIs have added net longs in Index Futures, Stocks Futures, Index CE and Index PE. They were net sellers in equity segment.

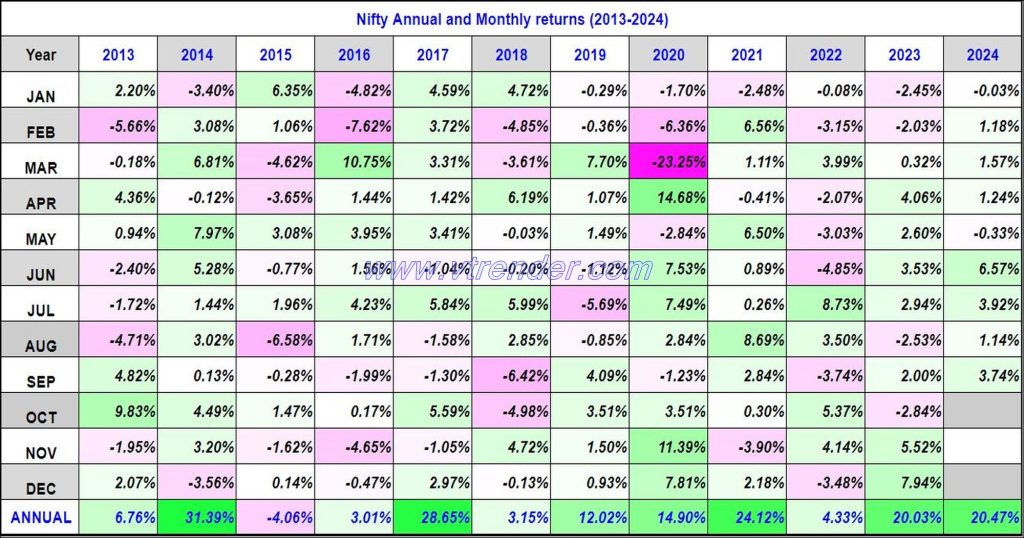

Nifty 50 Monthly and Annual returns (1991-2024) updated 27th SEP 2024

Nifty50 returns Year 2024 20.47% / Nifty50 returns SEP 2024 3.74%