Desi MO (McClellans Oscillator for NSE) – 27th SEP 2024

MO at -15

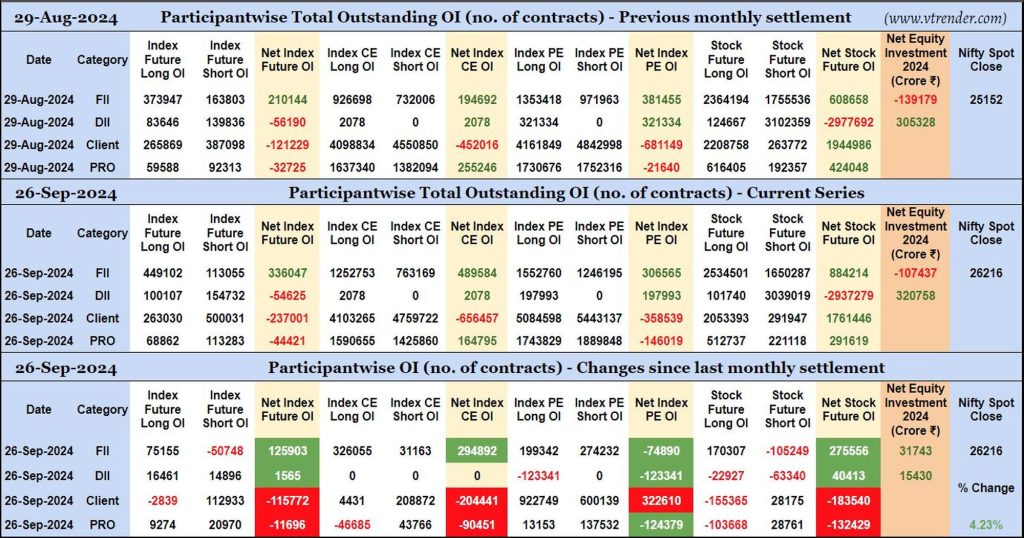

Participantwise Open Interest (Series changes) – 26th SEP 2024

FIIs have added 75K long Index Futures, net 294K long Index CE, net 74K short Index PE and 170K long Stocks Futures contracts since August settlement besides covering 50K short Index Futures and 105K short Stocks Futures contracts.

FIIs were net buyers in equity segment for ₹31743 crore during September series.

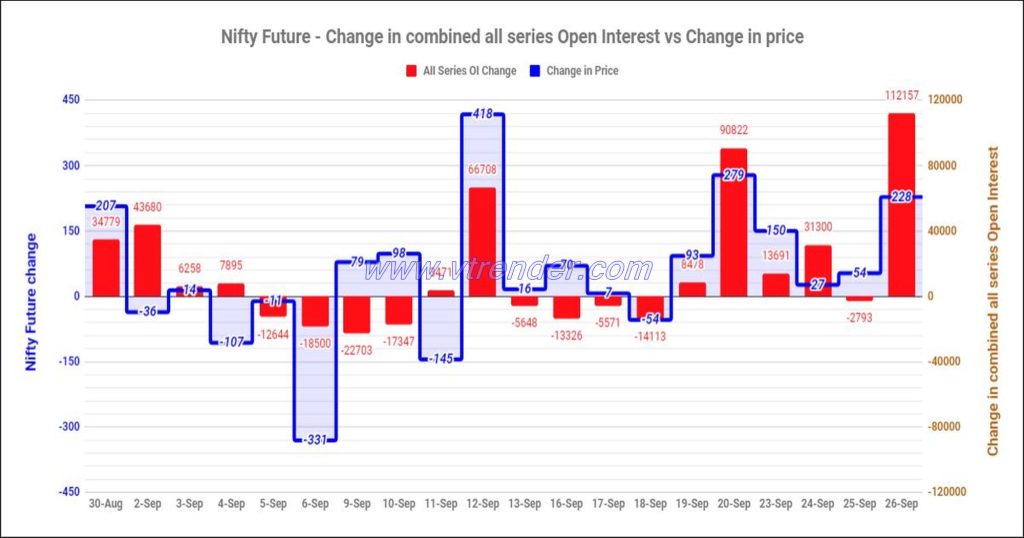

Nifty and Banknifty Futures with all series combined Open Interest – 26th SEP 2024

Nifty & Banknifty combined Open Interest across all series & change in OI

Desi MO (McClellans Oscillator for NSE) – 26th SEP 2024

MO at -18

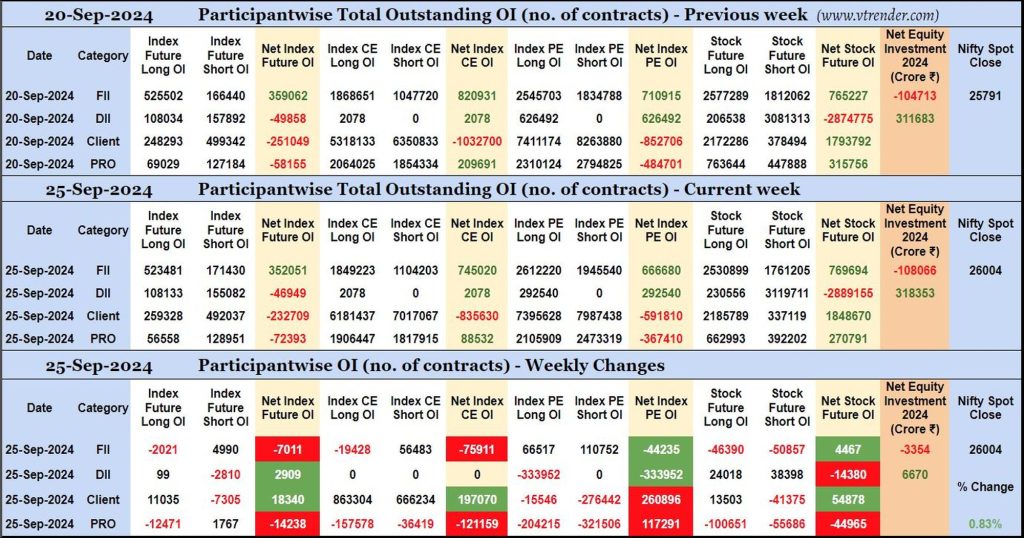

Participantwise Open Interest (Mid-week changes) – 25th SEP 2024

FIIs have added 5K short Index Futures, 56K short Index CE and net 44K short Index PE contracts so far this week besides liquidating 2K long Index Futures and 19K long Index CE contracts. They shed Open Interest in Stocks Futures.

FIIs have been net sellers in equity segment for ₹3354 crore during the running week.

Desi MO (McClellans Oscillator for NSE) – 25th SEP 2024

MO at -12

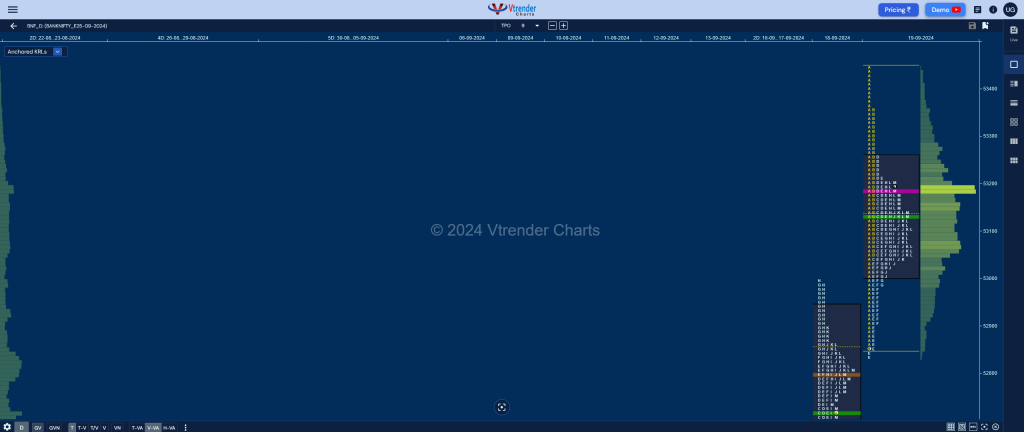

Market Profile Analysis dated 24th Sep 2024

Nifty Sep F: 25944 [ 26000 / 25899 ] Open Type OAIR (Open Auction) Volumes of 11,187 contracts Below average Initial Balance 96 points (25996 – 25899) Volumes of 43,756 contracts Below average Day Type Normal – 100 pts Volumes of 2,25,409 contracts Below average NF made an OAIR start but took support right at previous […]

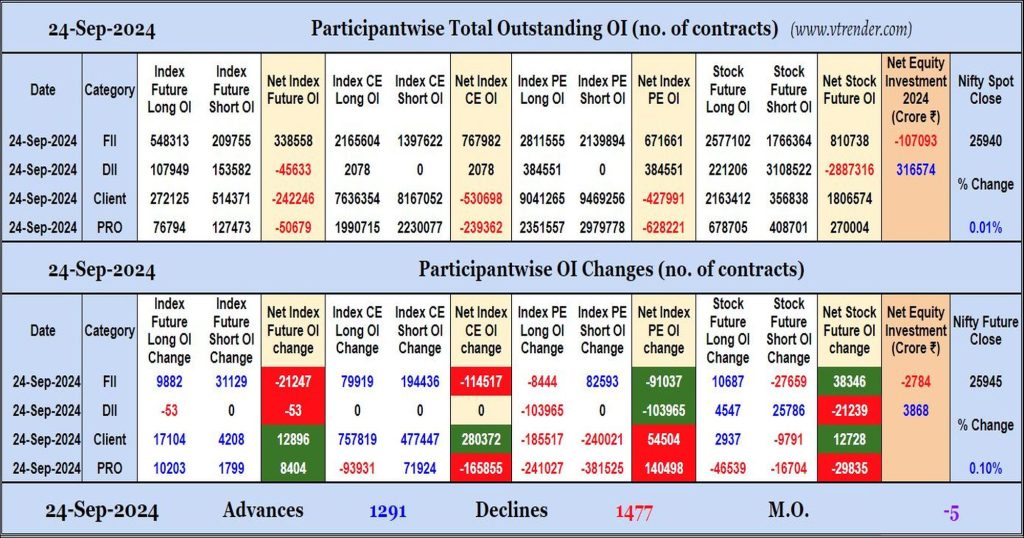

Participantwise Open Interest (Daily changes) – 24th SEP 2024

FIIs have added net shorts in Index Futures, Index CE and Index PE while adding net longs in Stocks Futures. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 24th SEP 2024

MO at -5

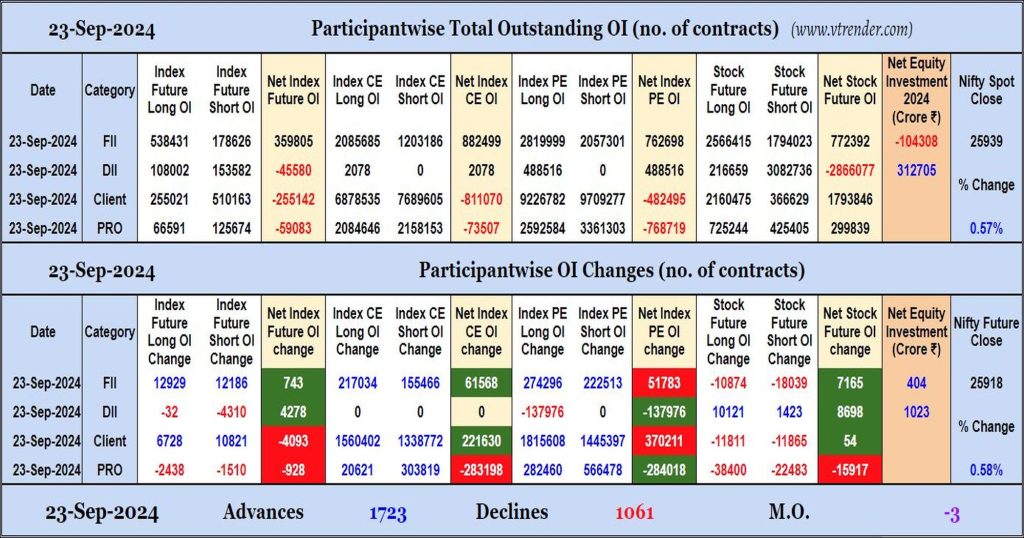

Participantwise Open Interest (Daily changes) – 23rd SEP 2024

FIIs have added net longs in Index Futures, Index CE and Index PE. They were net buyers in equity segment as well.