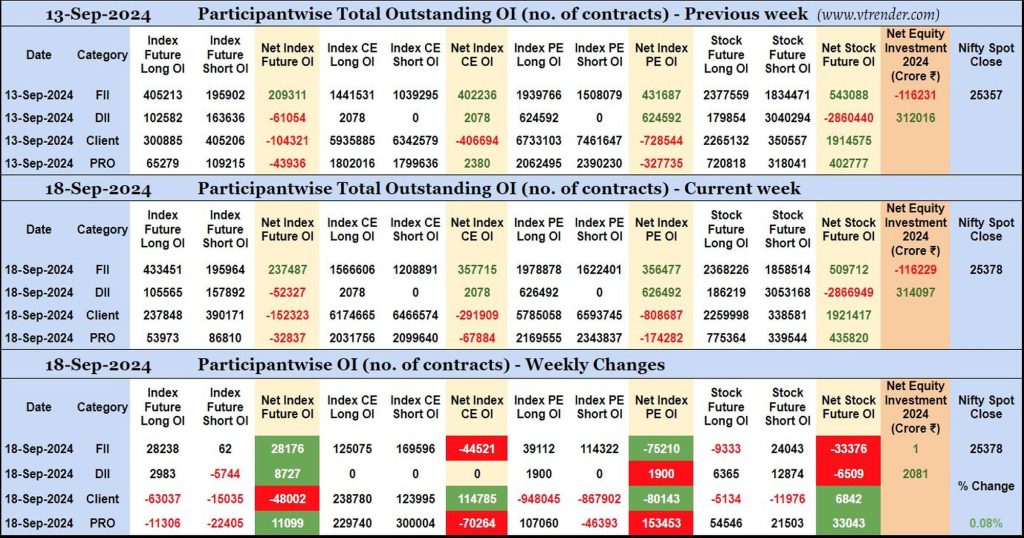

Participantwise Open Interest (Mid-week changes) – 18th SEP 2024

FIIs have added net 28K long Index Futures, net 44K short Index CE, net 75K short Index PE and 24K short Stocks Futures contracts so far this week while liquidting 9K long Stocks Futures contracts.

Desi MO (McClellans Oscillator for NSE) – 18th SEP 2024

MO at -22

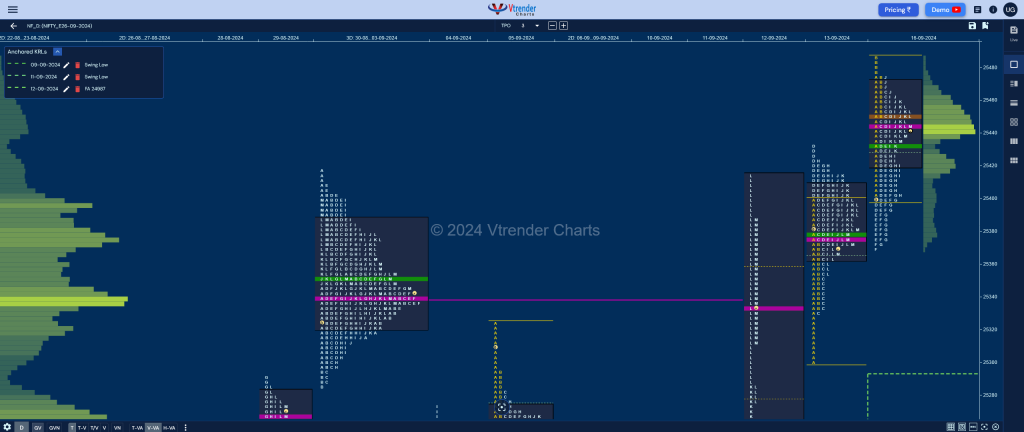

Market Profile Analysis dated 17th Sep 2024

Nifty Sep F: 25449 [ 25479 / 25385 ] Open Type OAIR (Open Auction) Volumes of 16,350 contracts Below average Initial Balance 70 points (25455 – 25385) Volumes of 40,899 contracts Below average Day Type Inside Bar – 94 pts Volumes of 1,09,306 contracts Below average NF remained in a narrow 94 point range all day […]

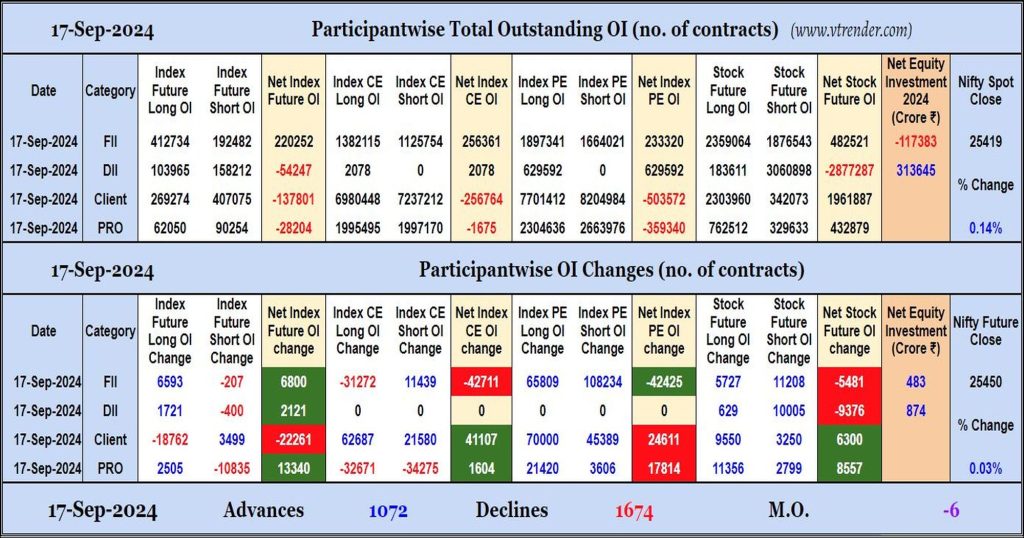

Participantwise Open Interest (Daily changes) – 17th SEP 2024

FIIs have added longs in Index Futures while adding net shorts in Index CE, Index PE and Stocks Futures. They were net buyers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 17th SEP 2024

MO at -6

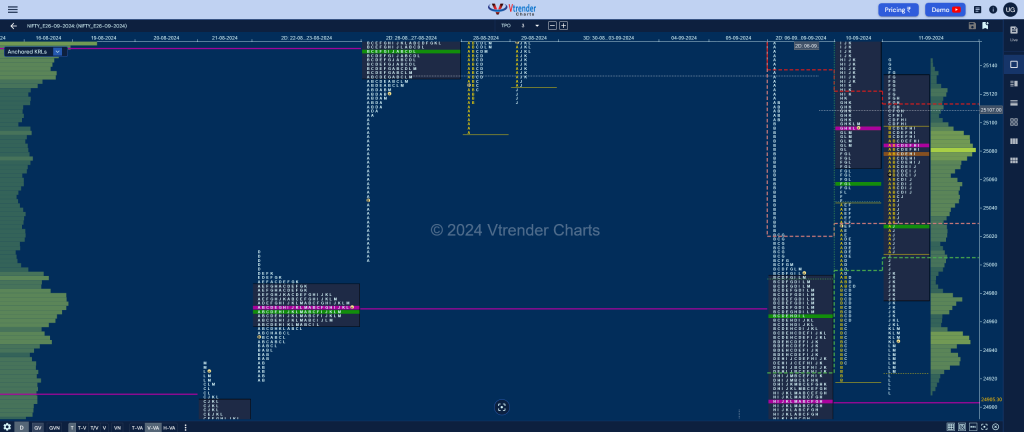

Market Profile Analysis dated 16th Sep 2024

Nifty Sep F: 25442 [ 25487 / 25367 ] Open Type OA (Open Auction) Volumes of 15,981 contracts Below average Initial Balance 103 points (25487 – 25385) Volumes of 44,149 contracts Average Day Type Normal – 121 pts Volumes of 1,44,290 contracts Below average NF made an Open Auction start with a probe above previous highs […]

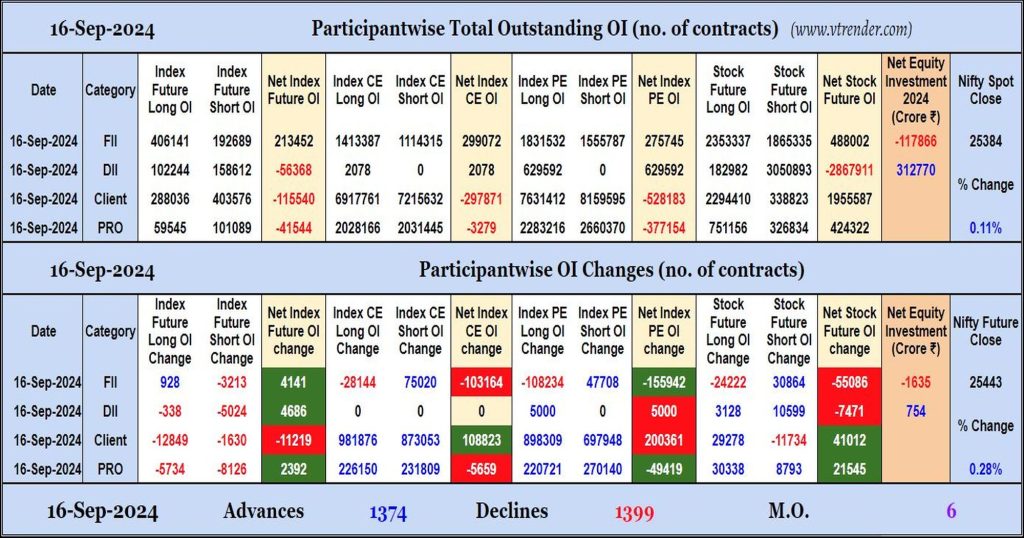

Participantwise Open Interest (Daily changes) – 16th SEP 2024

FIIs have added small quantity of longs in Index Futures while adding shorts in Index CE, Index PE and Stock Futures. They were net sellers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 16th SEP 2024

MO at 6

Market Profile Analysis dated 13th Sep 2024

Nifty Sep F: 25372 [ 25433 / 25300 ] Open Type OAIR (Open Auction) Volumes of 28,919 contracts Average Initial Balance 110 points (25410 – 25300) Volumes of 57,361 contracts Average Day Type Normal – 133 pts Volumes of 1,74,129 contracts Below average NF opened in the previous session’s NeuX zone making a low of 25300 […]

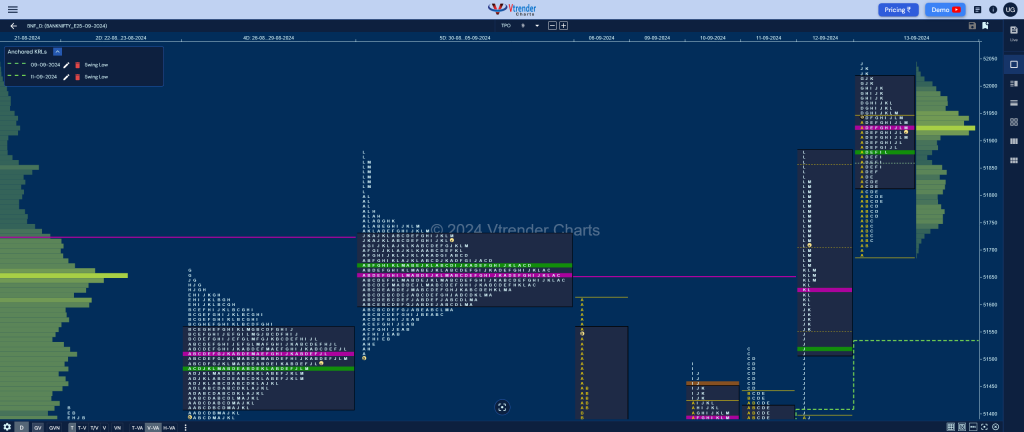

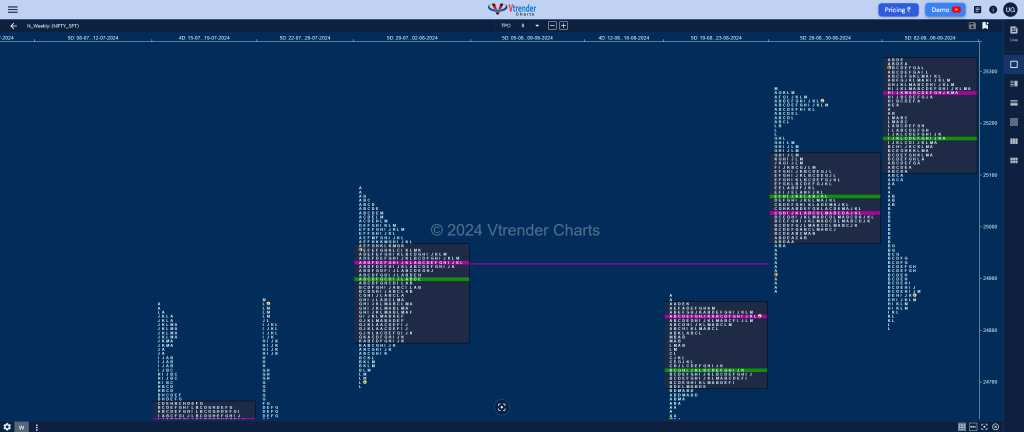

Weekly Spot Charts (09th to 13th Sep 2024) and Market Profile Analysis

Nifty Spot: 25356 [ 25433 / 24753 ] Double Distribution (Up) Previous week’s report ended with this ‘Value was overlapping to higher at 25106-25260-25323 but the close has been around the lows suggesting that the downside imbalance could continue into the next week towards the HVNs of 24722 & 24582 (19-23 Aug) along with the buying […]