Desi MO (McClellans Oscillator for NSE) – 11th SEP 2024

MO at -23

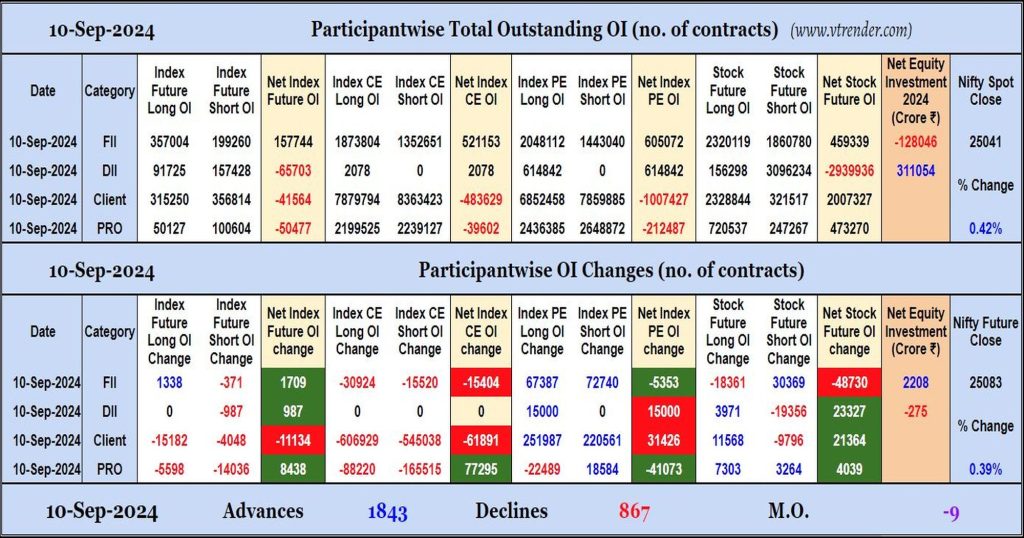

Participantwise Open Interest (Daily changes) – 10th SEP 2024

FIIs have added small quantity of longs in Index Futures while adding net shorts in Index PE and Stocks Futures. They were net buyers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 10th SEP 2024

MO at -9

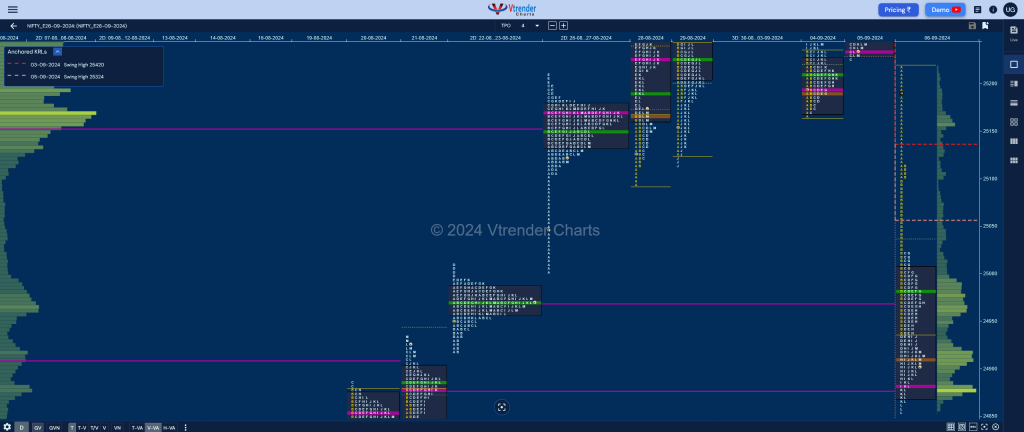

Market Profile Analysis dated 09th Sep 2024

Nifty Sep F: 24985 [ 25000 / 24816 ] Open Type OA (Open Auction) Volumes of 31,510 contracts Above average Initial Balance 112 points (24928 – 24816) Volumes of 66,658 contracts Above average Day Type Normal Variation – 185 pts Volumes of 2,13,948 contracts Above average NF opened with a look down below previous low but […]

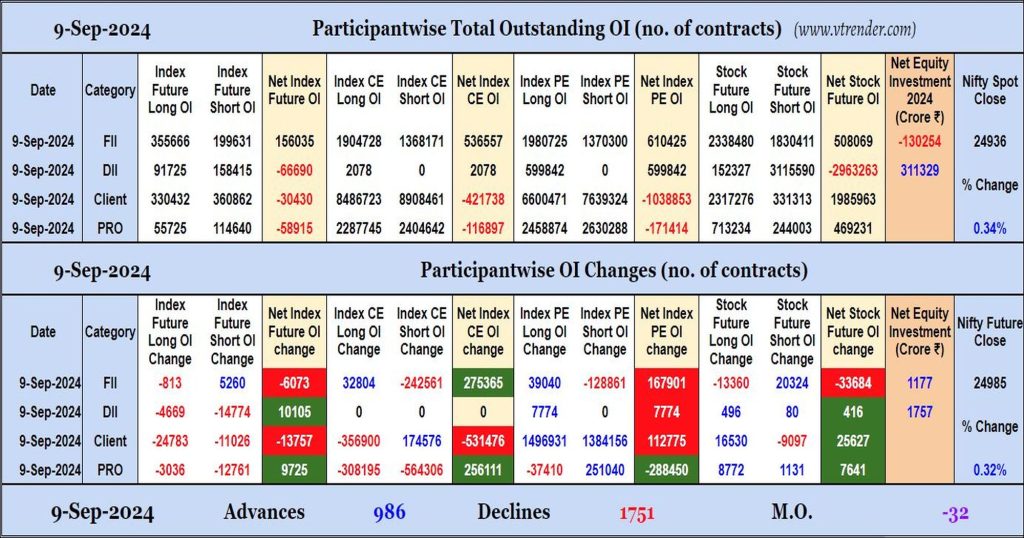

Participantwise Open Interest (Daily changes) – 9th SEP 2024

FIIs have added shorts in Index & Stocks Futures while adding longs in Index CE & Index PE. They were net buyers in equity segment.

Desi MO (McClellans Oscillator for NSE) – 9th SEP 2024

MO at -32

Market Profile Analysis dated 06th Sep 2024

Nifty Sep F: 24906 [ 25219 / 24855 ] Open Type OD (Open Drive) Volumes of 38,318 contracts Above average Initial Balance 284 points (25219 – 24935) Volumes of 1,50,065 contracts Above average Day Type Trend – 364 pts Volumes of 4,16,285 contracts Above average NF continued previous day’s probe to the downside more aggressively with […]

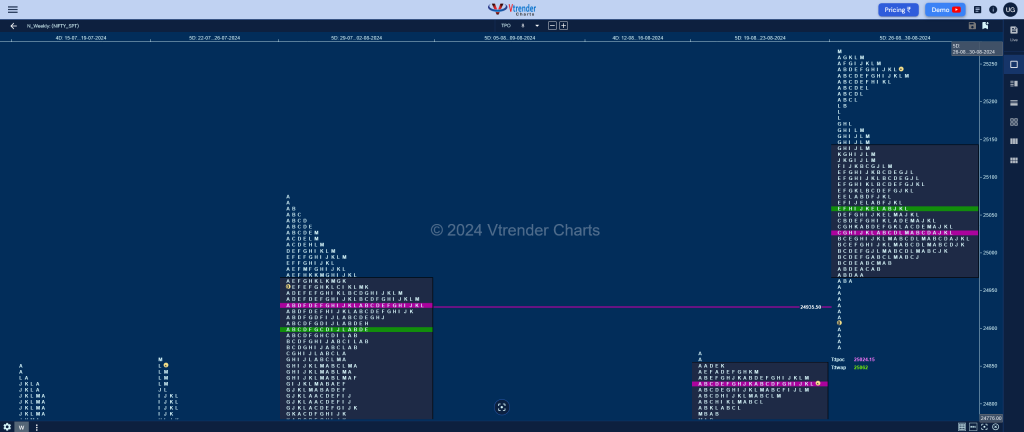

Weekly Spot Charts (02nd to 06th Sep 2024) and Market Profile Analysis

Nifty Spot: 24852 [ 25333 / 24801 ] Triple Distribution Trend (Down) Previous week’s report ended with this ‘The weekly profile was shaping up to be a composite ‘p’ shape one over the first 3 days but has turned into a Double Distribution Trend Up one with an initiative buying tail from 24964 to 24867 along […]

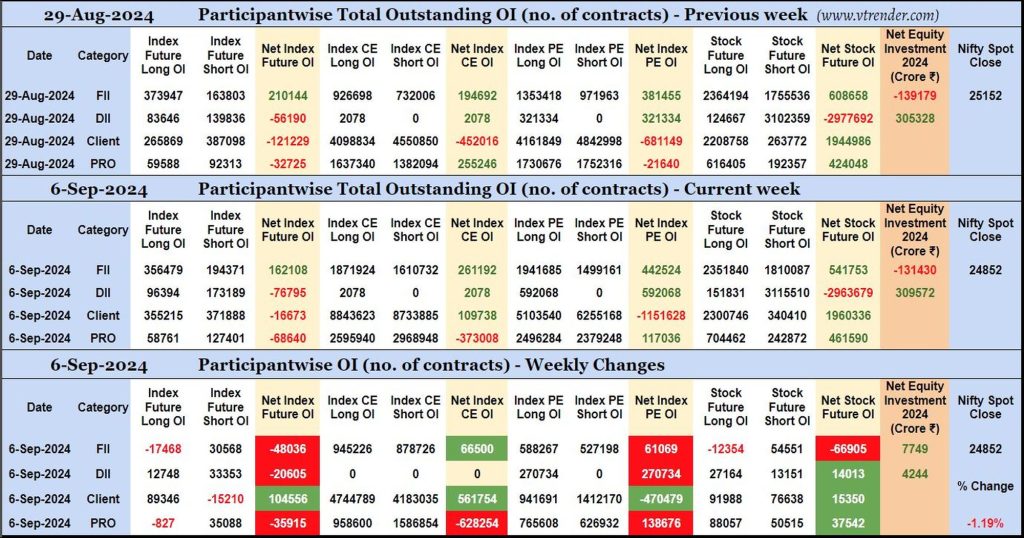

Participantwise Open Interest (Weekly changes) – 6th SEP 2024

FIIs have added 30K short Index Futures, net 66K long Index CE, net 61K long Index PE and 54K short Stocks Futures contracts this week besides liquidating 17K long Index Futures and 12K long Stocks Futures contracts.

FIIs have been net buyers in equity segment for ₹7749 crore during the week.

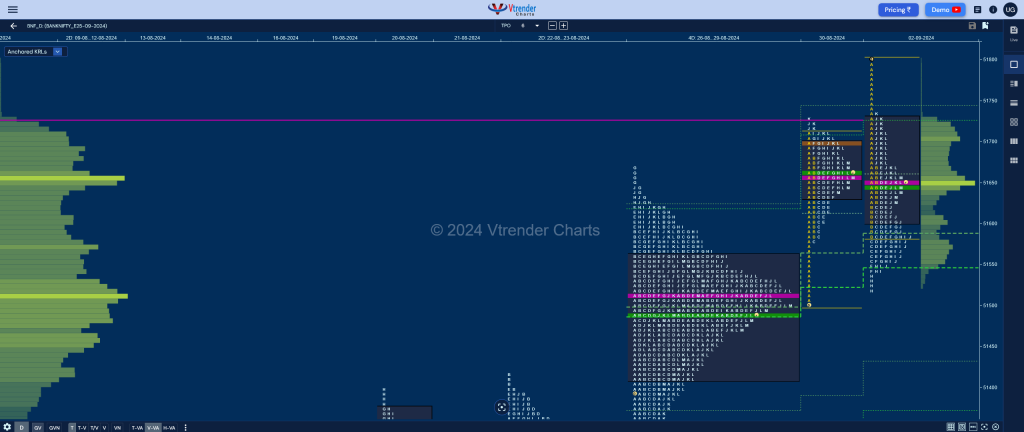

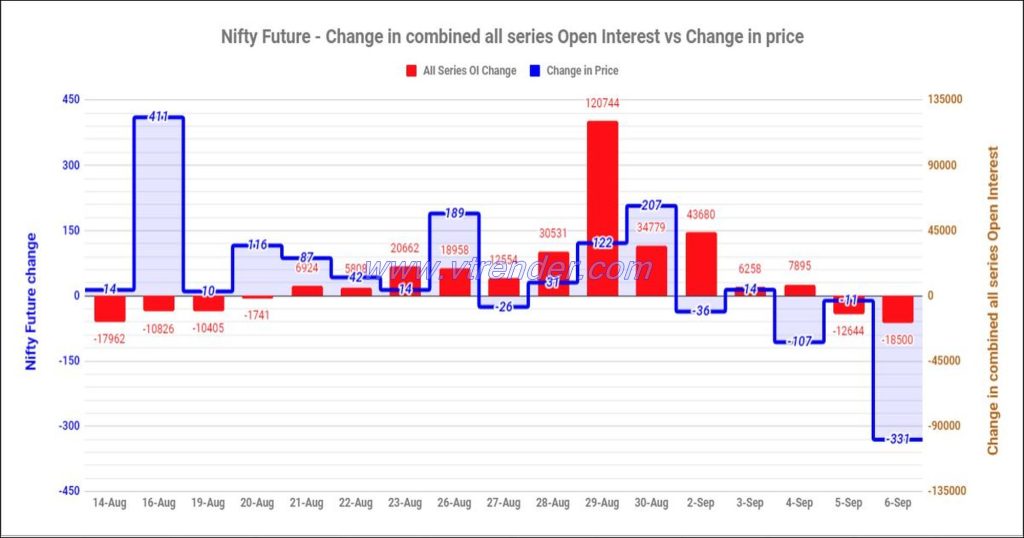

Nifty and Banknifty Futures with all series combined Open Interest – 06th SEP 2024

Nifty & Banknifty combined Open Interest across all series & change in OI